3 stocks to watch this week as companies report their financial performance

The earnings season continues with three big names reporting their financial performance this week – Lennar, Volkswagen, and FedEx.

The week ahead is full of important economic events with the potential of moving the stock market. For example, traders and investors will closely monitor the Federal Reserve of the United States meeting and press conference on Wednesday as the central bank embarks on a tightening cycle.

Besides the Fed’s decision, attention turns to the earnings season too. This week, three big names report their financial performance from Europe: Lennar, Volkswagen, and FedEx.

Lennar

Lennar is an American homebuilder founded in 1954. It develops land and builds single-family attached and detached homes, and its EBIT margin for the past twelve months is 20.95%, higher than the sector median by 120.22%.

Investors expect EPS of $2.58 on the quarter, and the annual revenue estimate for the fiscal period ending November 2022 is $32.86 billion. Lennar has delivered better than expected or in line EPS every quarter since February 2019, and the stock price is up +64% in the past five years.

On top of the stock price appreciation, investors also received dividends. Lennar pays a quarterly dividend, and the forward dividend yield for the next twelve months is 1.73%.

Volkswagen

Volkswagen needs no introduction, as its brand has global recognition. The German automaker reports its financial performance tomorrow, March 15.

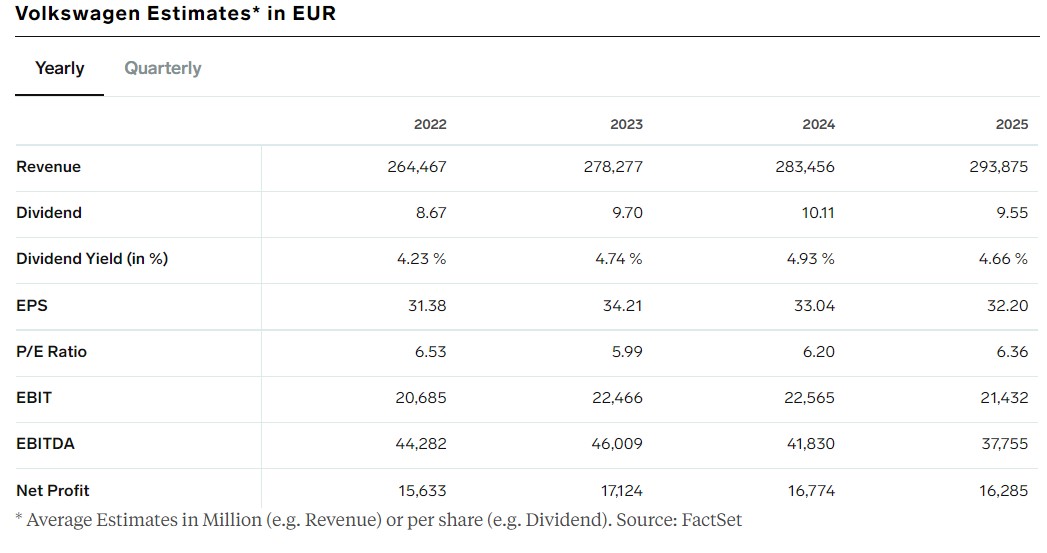

EPS are estimated to reach EUR31.38 and the stock trades at an attractive P/E ratio of 6.53 for 2022. Volkswagen pays a hefty dividend, as reflected by the 4.23% dividend yield for 2022, forecast to reach 4.66% by 2025.

FedEx

FedEx reports its quarterly earnings on Thursday, March 17, during post-market hours. Investors expect EPS of $4.65 for the quarter, and the annual revenue estimate for the fiscal period ending May 2022 is $92.92 billion.

The company operates with a gross profit margin of 27.46% and the stock price is down -17.52% YTD. At the current price level, FedEx is valued at $56.49 billion and the enterprise value reached $86.48 billion.