Is it safe to buy the S&P 500 index after starting April with losses?

The S&P 500 index declined in April – is it safe to buy the market here, or is more downside possible?

April started with a correction in the major US stock market indexes. The S&P 500 index, for example, fell about 200 points in the few trading days six the new trading month started, and many investors believe that the late March move higher was nothing but a bear market rally.

Truth be said, the US stock market did nothing since the Russia-Ukraine war started. Of course, one would have expected that the rising uncertainties would have an impact on the equity markets, but investors remained pretty calm.

Therefore, we may say that the declines so far in 2022 were nothing but corrections meant to be bought. However, things may differ in Q2 2022, as suggested by the historical stock market performance.

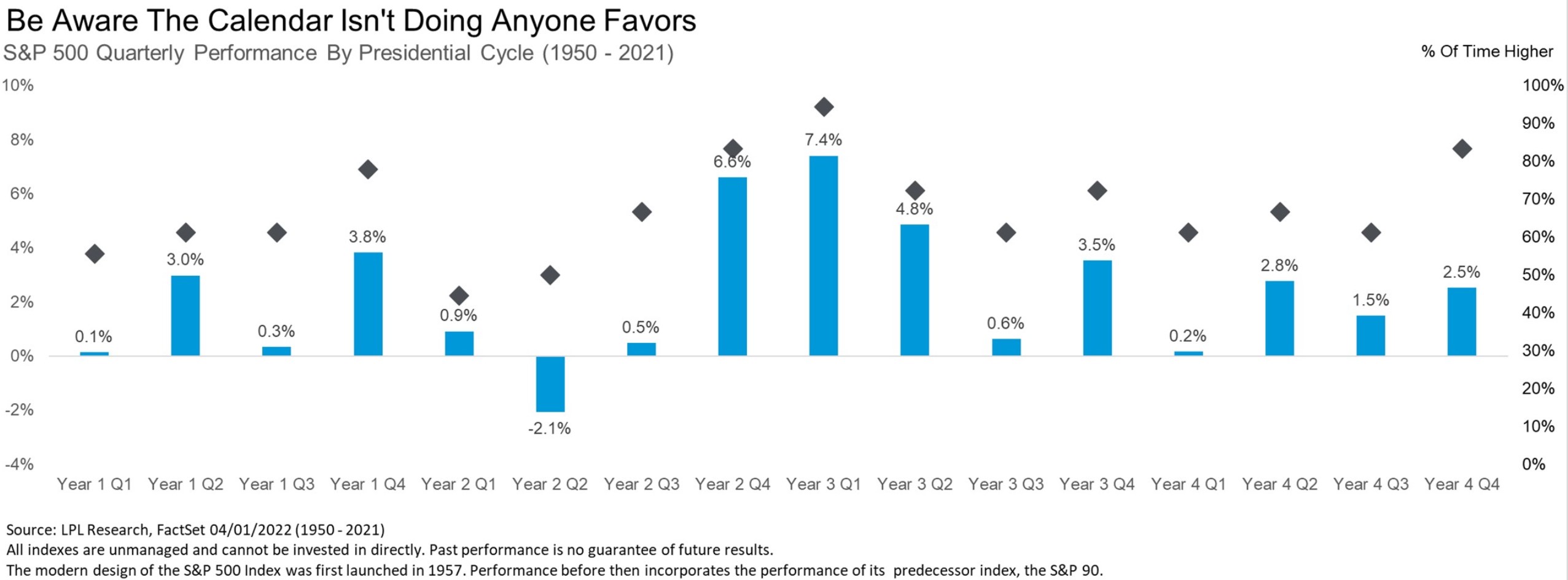

As it turns out, history tells us that the second quarter of a midterm year is tricky for stock market investors. More precisely, it is a weak quarter – and so is the upcoming one.

However, on the bright side, the next two quarters are the best ones of the four-year presidential cycle. Therefore, while Q2 and Q3 may be tricky and bring some losses, investors would most likely buy the dip yet again.

Fed prepares to further tighten financial conditions in May

The Federal Reserve has already raised the interest rate once. It ended the quantitative easing and immediately lifted the rates, but the market did not blink.

However, more and more voices from the Fed suggest that the tightening of financial conditions will continue. Moreover, it will continue at a bigger pace.

Many market participants now expect the Fed to hike 50bp in May. Moreover, to start the quantitative tightening or reducing its balance sheet.

All of these represent measures desired to combat inflation and tighten financial conditions. Stocks should have a hard time performing under such conditions, especially considering that Bill Dudley, the former head of the New York Fed, suggested that the Fed should force stocks down if it wants to regain its credibility.