Nikkei 225 forecast amid Bank of Japan’s yield curve control measures

The Bank of Japan’s yield curve control measures led to a collapse of the Japanese yen. How did the measures impact the stock market, and what to expect next from the Nikkei 225 index?

One of the biggest stories in financial markets in 2022 has been the Japanese yen’s collapse. The yen’s rapid decline comes as a result of the Bank of Japan fighting against the rise in the 10-year JGB (i.e., Japanese Government Bonds) as part of its yield curve control measures.

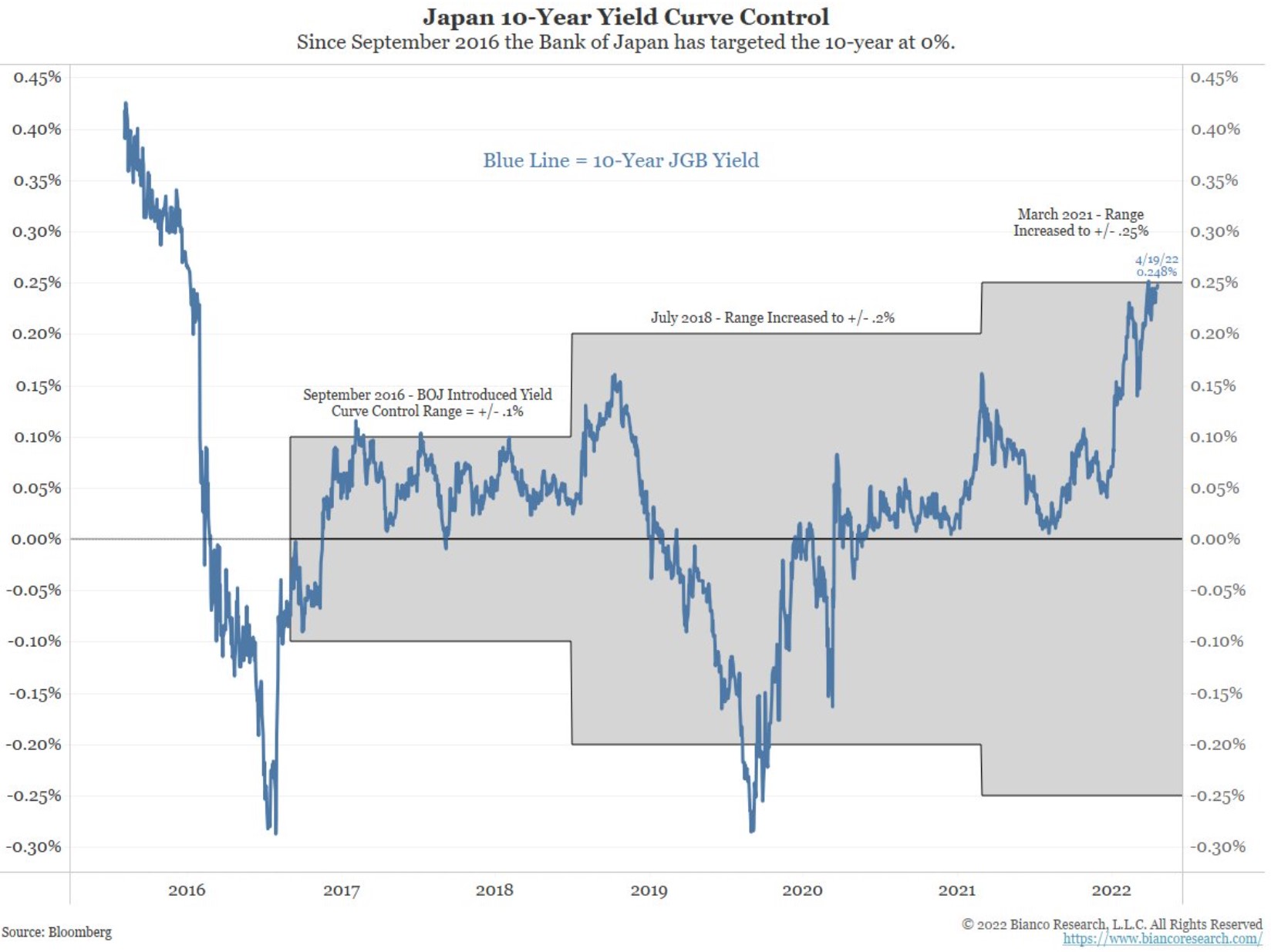

The central bank introduced the yield curve control measures in September 2016. Under the program, the bank vowed to keep the yield in a range of +/-0.1%.

The range was increased twice so far – first, in 2018, at +/- 0.2%, and second, this year, at +/- 0.25%. But the yields do not fall and keep pressuring the top of the band.

Despite the Bank of Japan buying unlimited amounts of JGBs, it can’t, at least so far, push the yields down. As a side note, the price of a bond and its yield have an inverse correlation, so the yields should decline the more bonds the bank buys. Only they don’t, while the Japanese yen cratered.

Nikkei 225 is under pressure as the 10-year JGB yield has been pushing up

Conventional wisdom tells us that when a central bank buys bonds, it is effectively engaging in quantitative easing. Based on everything we know about quantitative easing in all the years that major central banks used the tool, it should boost the stock market.

It did so in Japan too. But since 2021, while the 10-year JGB pushed against the top of the band, Nikkei 225 dropped.

It formed a double top pattern just above 30,000 points and had a hard time bouncing. The chart above shows the importance of the 24,000 pivotal area, as it offered stiff resistance during 2018-2020, and thus, it should offer support on a decline there.

To sum up, if the Bank of Japan’s efforts are not enough to push the 10-year JGB away from the top of the band, the bank may be forced to increase the range yet again. Therefore, Nikkei 225 would have a hard time making a new high should the yields stay above 0%.