Should you buy or sell US stocks after yesterday’s ugly session?

The US stock market had an ugly day yesterday, as seen by the Nasdaq 100 index dropping 5.1% or the S&P 500 falling precipitously. So should you buy or sell US stocks here?

US stocks bounced from their lows last Thursday and then rallied for the upcoming two sessions. Investors were relieved that the S&P 500 index avoided a bear market (i.e., a drop of more than 20% from the highs), even though the Nasdaq 100 index was already trading in the bear market territory.

Yesterday’s ugly session saw the Nasdaq 100 extending its losses. It dropped by another 5.1% for the worse day since May 5.

The index is now down 28% from its all-time highs, putting pressure on long-term investors and also tempting those with funds aside to buy the dip.

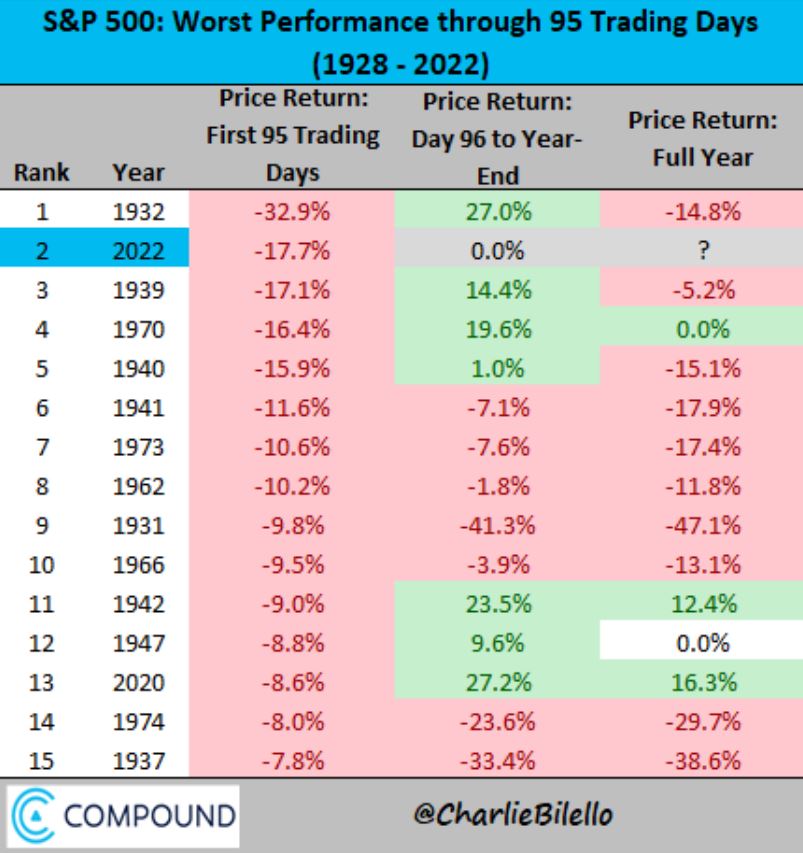

The S&P 500 performance is not that worse, but it is fast approaching the bear market territory. The index is down 17.7% in the first 95 trading days of 2022 – the 2nd worst start to a year in history.

So is it time to buy stocks after this dip? Or to sell expecting more downside? More importantly – why do stocks fall?

Fed to keep raising rates despite stocks dropping

The main reason US stocks trade in or close to a bear market is the Federal Reserve’s monetary policy. The Fed embarked in a desperate mission to bring inflation down, and it is using all its tools to do so.

Fed’s Chair, Jerome Powell, recently admitted in an interview with the Wall Street Journal that, in hindsight, the Fed should have raised the funds rate much sooner. As such, he suggests that the Fed is behind the curve, and more tightening is needed.

Currently, the market sees two more rate hikes in the upcoming two meetings, each of 50bp or even more. But the big question is if the drop in the stock markets is enough to derail the Fed from tightening?

It worked in the past, so why not work now? The answer is that inflation was not so high for more than 40 years, so the Fed won’t risk losing credibility and will do whatever it takes to bring it down.

S&P 500 is bearish while below 4,200

The technical picture also supports the bearish case. After breaking below the pivotal 4,200 the bias remains bearish for the S&P 500 index.

All in all, there is still a long way until the Feds’ June meeting. Unless the S&P 500 index bounces back above the pivotal area, the path of least resistance leads to the bear market territory.