S&P 500: bear market rally or the start to more strength?

S&P 500 rallied last week and gained more than 6%. Was it a bear market rally or the start to more strength?

The US markets open today after the long weekend due to the Memorial Day holiday, and stock market investors eagerly await to see what comes next for the S&P 500 index. After rallying by more than 6% last week and closing at the highs, the big question is if this was only a bear market rally or is there more to come?

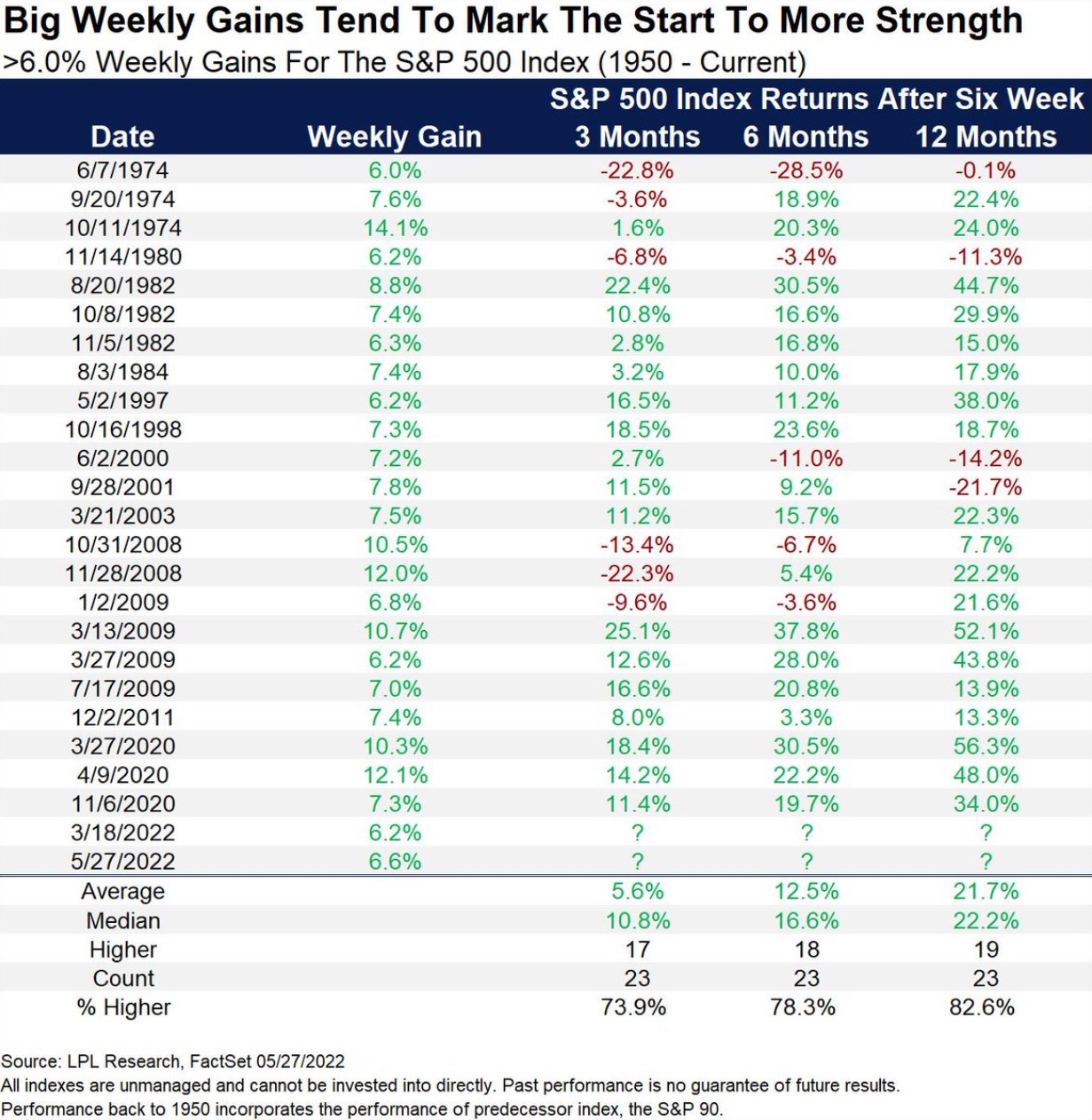

If history serves us any good, then it tells us that big weekly gains ten to market the start to more strength. With literally only two exceptions (1974 and 2008), every time when the S&P 500 index had a big weekly gain, the market rose some more in the months to come.

On average, it gained 5.6% in the next three months, 12.5% in the next six months, respectively 21.7% in the next twelve months. As such, the bias is that this is a bullish sign for stocks, despite the tightening of financial conditions in the United States.

Quantitative tightening starts tomorrow

Stocks are down for the year, and the Fed is much to blame for that. The Federal Reserve raised the interest rates and plans to raise them some more to fight inflation.

On top of that, it will begin to sell government bonds bought during the COVID-19 pandemic and in prior crises in a process called quantitative tightening. It will further add to the tightening of financial conditions and, in theory, should weigh on stocks.

But a lot of bad news is already priced in. Will the Fed keep raising rates? Yes, everyone knows that. What the market does not know yet, but will soon find out, is the quantitative tightening’s effect on stocks. The process starts tomorrow, June 1st, and is part of the Fed’s efforts to fight inflation.

To sum up, from a historical perspective, last week’s huge rally is a sign of more strength to come. Therefore, quantitative tightening should not scare investors.