Top 3 US financial services stocks to buy amid rising interest rates

The Federal Reserve of the United States started a tightening cycle last week. So what are the best US financial services stocks to buy as profit margins increase?

One of the main events in financial markets last week was the Federal Reserve of the United States' decision regarding the interest rates. The central bank raised the rates for the first time since the pandemic and vowed to increase them again at the upcoming meetings.

It is clear by now that the Fed embarked on a tightening cycle, with many voices calling for a 50bp rate hike at the next meeting. Also, multiple rate hikes further in 2022 are expected.

Financial services companies are ones to benefit from such a cycle as their profit margins increase. Here are three US financial services stocks to consider: American Express Company, Velocity Financial, and Walker & Dunlop.

American Express Company

American Express (NYSE:AXP) needs no introduction as its brand gained global recognition. It is one of the largest financial services companies in the United States and worldwide, and its stock price outperformed the market both YTD and in the past twelve months.

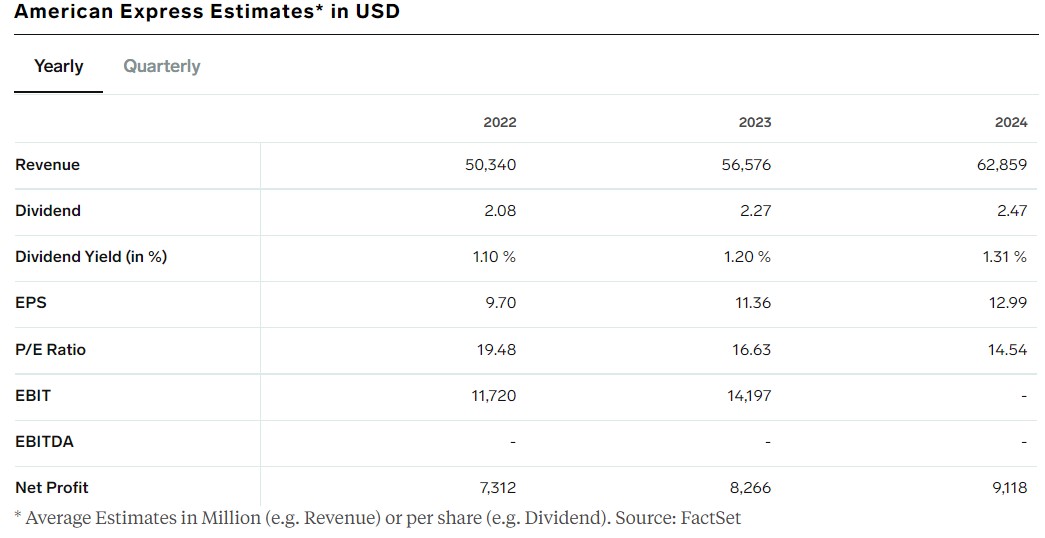

American Express pays a dividend. The forward dividend yield is 1.1%, and the dividend payout ratio is 17.22%. Also, the stock price trades at a P/E ratio of 19.48.

Velocity Financial

Velocity Financial (NYSE:VEL) is a real estate finance company from California, founded in 2004. It operated with a gross profit margin of 90.16%, higher than the sector median by 42.85%.

The annual revenue estimate for the fiscal period ending December 2022 is $106.35 million, and Velocity Financial does not pay a dividend.

Walker & Dunlop

Walker & Dunlop (NYSE:WD) operates in the thrifts and mortgage finance industry, and it was founded in 1937. The stock price gained more than 32% in the past twelve months, and Walker & Dunlop's gross profit margin for the past twelve months was higher than the sector median by 58.44%.

Walker & Dunlop is a dividend-paying company. The dividend yield is 1.79%, and the dividend payout ratio is 24.54%.