Stock Market Today: Dow Plunges 643 Points as Treasury Yields Climb

Growth stocks were some of the biggest losers today as government-bond yields spiked.

Stocks sold off sharply Monday as the 10-Year Treasury Yield continued to climb. The yield on this closely watched government bond jumped 4 basis points to 3.029% – marking its first trip above the 3% threshold since late July. (A basis point is one-one hundredth of a percentage point).

Uncertainty over the Federal Reserve’s rate-hike timeline – specifically, the “how long?” and “by how much?” narratives – is spooking investors, with commentary last week from central bank officials hinting at the potential for a third straight 75 basis-point increase at the September meeting.

“Naturally, all eyes are on Jackson Hole later in the week and in particular, the appearance of Fed Chair Jerome Powell,” says Craig Erlam, senior market strategist at currency data provider OANDA. Powell is scheduled to deliver a speech at the central bank’s annual symposium in Wyoming on Friday morning. “This platform has in the past been used to make significant announcements and so every year, traders are left on the edge of their seats in case of another this time around.”

Today’s selling was broad-based, with the consumer discretionary sector (-2.7%) suffering a massive drop amid weakness in Amazon.com, Inc. (NASDAQ: AMZN, -3.6%) and Tesla Inc (NASDAQ: TSLA, -2.3%). Growth stocks in the technology (-2.8%) and communication services (-2.9%) sectors were also hit hard.

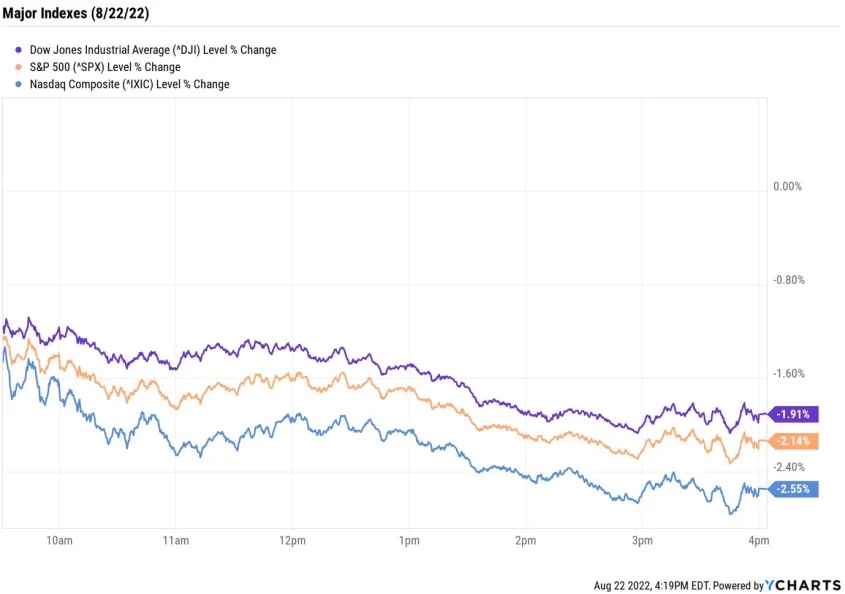

As for the major indexes, the Nasdaq Composite slid 2.6% to 12,381, the S&P 500 Index plunged 2.1% to 4,137, and the Dow Jones Industrial Average shed 1.9% to 33,063.

Other news in the stock market today:

- The small-cap Russell 2000 spiraled 2.1% to 1,915.

- U.S. crude futures slipped 0.6% to $90.23 per barrel.

- Gold futures shed 0.8% to $1,748.40 an ounce, their sixth straight drop.

- Bitcoin fell 1.4% to $21,049.05. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.).

- AMC Entertainment Holdings Inc (NYSE: AMC) plummeted 42% after fellow movie theater chain Cinemark said it could file for bankruptcy. The drop in AMC coincides with the recent selloff in fellow meme stock Bed Bath & Beyond Inc (NASDAQ: BBBY, -16.2%), which also ended sharply lower today.

- Signify Health Inc (NYSE: SGFY) was a rare splash of green in Monday’s trading, gaining 32.1%. Over the weekend, a report in The Wall Street Journal pointed to several potential bidders for the home healthcare provider, including CVS Health Corp (NYSE: CVS, -1.6%) and Amazon.com, Inc. (NASDAQ: AMZN).

Another Big Week Awaits Investors

Today’s price action shows that the dog days of summer have yet to hit the equities market, and there’s plenty on tap this week that could stoke further volatility in stocks. In addition to news from the Fed’s Jackson Hole retreat, investors will also hear the latest updates on manufacturing, housing, second-quarter GDP and inflation.

We’ll also get another batch of companies releasing their quarterly financial reports. So far this earnings season, “the equity markets have cheered overall results that were ‘better than feared’,” says Chris Haverland, global equity strategist at Wells Fargo Investment Institute. “S&P 500 Index revenue grew by more than 13%, while earnings per share (EPS) grew by nearly 8%,” Haverland says, adding that “63% of [S&P 500 components] beat sales expectations and 76% beat earnings expectations.”

Source: Stock Market Today: Dow Plunges 643 Points as Treasury Yields Climb.