How to buy Uber stocks in 2025

Uber Technologies, or simply Uber is an American corporation with operations on all continents. It connects consumers with independent providers of ride services, and with restaurants, grocers, and other stores via its mobility and delivery divisions. Here we provide a guide on how to buy Uber stocks and what are the most relevant financial information to consider.

Uber grew at staggering rates in the years leading up to its IPO in the United States. It now registers over sixteen million daily trips and over ninety million monthly customers. It is active in almost ten thousand cities across seventy-one countries.

How to Buy UBER Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Uber Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need to Know About Uber

Let’s begin our analysis of Uber’s businesses by looking at the company’s history and strategy, as well as how it makes money and how its stock has performed in recent years.

Uber History

Uber is a relatively new company, founded in 2009 and headquartered in San Francisco, California. It was founded by Garrett Camp and Travis Kalanick under the name of Ubercab and quickly grew into one of the most famous American unicorns (i.e., privately held startups with a valuation of more than one billion dollars).

Its services expanded from ride-hailing to food and package delivery, couriers, freight transportation, and even motorized scooter rental via a partnership with Lime. It groups its operations into four divisions: mobility, delivery, freight, and advanced technologies group.

What Is Uber’s Strategy

This is a technology company that simply connects demand with supply. Its proprietary platforms connect consumers with mobility drivers of all types, such as taxis, minibuses, and motorbikes.

Despite being best known for its ride-hailing business, Uber quickly expanded into other areas such as financial partnerships and vehicle solutions. The delivery segment got a lot of attention recently because online food deliveries increased exponentially when the pandemic affected the restaurant services industry.

How Does Uber Make Money?

On May 5, 2021, Uber reported the financial highlights for the first quarter of the year. Gross bookings reached an all-time high of $19.5billion, up over 24% on a year-over-year (YoY) basis.

In a year affected by the pandemic, and with people forced to spend more time at home due to travel restrictions, Uber’s business model was strongly impacted. Therefore, the mobility division contracted by 38% in 2020 but the company compensated by double-digit growth in the freight division and triple-digit growth in the delivery division.

Uber makes money through ridesharing and carpooling, meal delivery and freight, electric bikes, and scooters. More recently, it expanded its services into urban aviation, and it also invested heavily in autonomous vehicles.

How Has Uber Performed in Recent Years?

Uber’s stock price had a pretty bumpy ride after it became public on 9 May, 2019. The company managed to survive the pandemic and the selloff that affected the international financial markets, and — like other tech companies — it bounced back strongly.

The share price reached $60 and found strong horizontal resistance at that level, with a possible triple top formation in place. This is the “technical analysis” picture for Uber stock.

Where Can You Buy Uber Stock?

The investor has various ways of getting exposure to the Uber share price.

First, investors may simply buy ordinary shares, either on cash or margin via a stock brokerage account. Buying on cash means that no money is borrowed from the broker, so you’ll only lose your initial investment if the company’s share price drops to zero. Buying on margin means borrowing some of your investment capital from the broker, so you can buy more shares with less of your money, but this means your investment can be wiped out with a more modest reversal of Uber’s share price unless you deposit more money when the broker asks for it.

Second, investors can trade contracts-for-difference (CFDs), which are derivative products that act as simple “bets” on which way the Uber share price will go. These products are usually leveraged, which means you’ll be buying on margin with all the risks that this implies.

Uber Fundamental Analysis

There is a difference between stock trading and investing.

Traders use mostly “technical analysis” over a short-term horizon, whereas investors mostly use “fundamental analysis” to look at companies’ long-term prospects.

Fundamental analysis is based on interpreting a company’s financial statements, such as the income statement, the balance sheet, and the cash flow statement. Based on the information presented in the financial statements, investors calculate various ratios and carry out complex calculations to derive to what they believe to be the intrinsic value of a company. By comparing the result with the actual market price, investors conclude that the company’s shares are overvalued, undervalued, or properly valued.

In the following sections we look at Uber’s revenue, price/earnings ratio (P/E), dividend yield, earnings-per-share (EPS), and cash flow position.

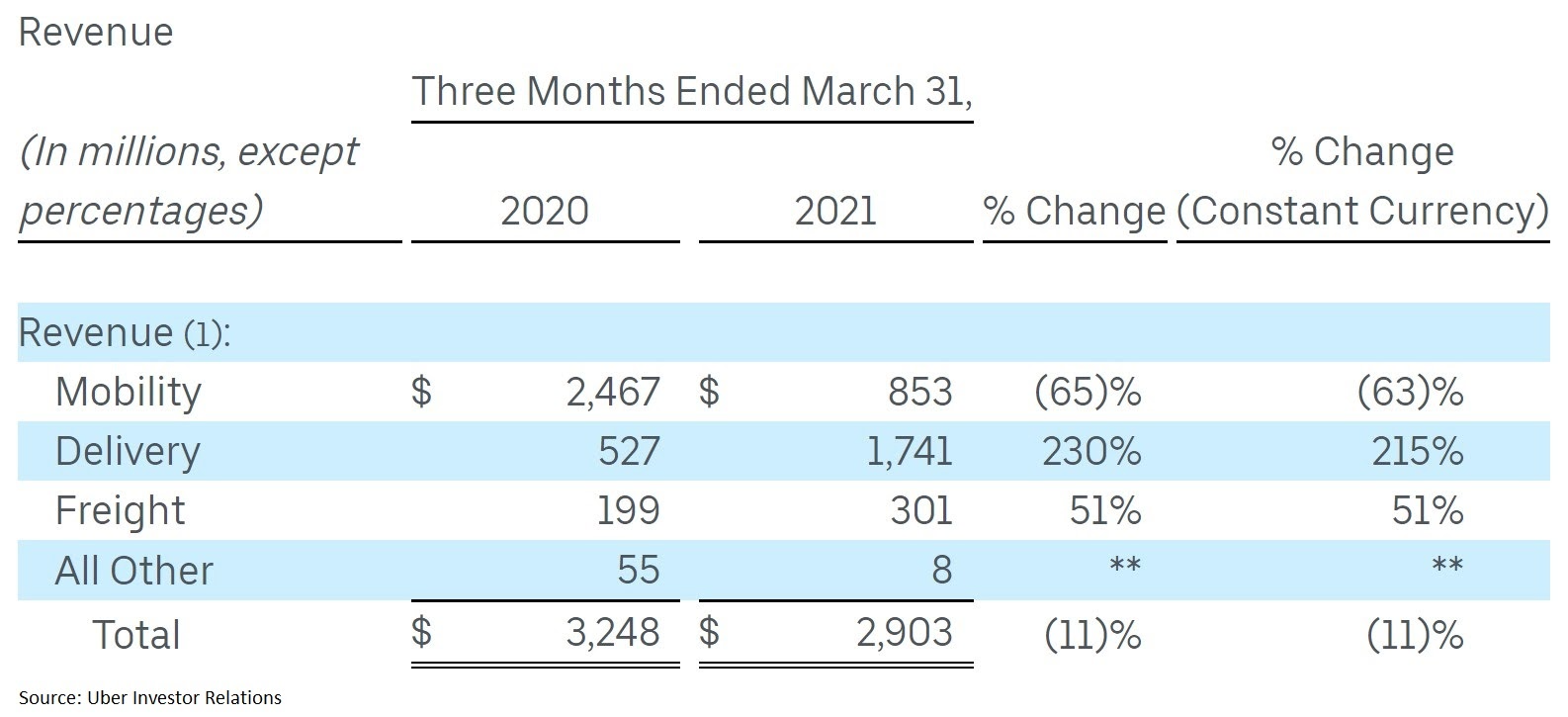

Uber’s Revenue

Uber’s business model has been affected by the pandemic. In particular, the mobility division suffered significant declines due to the lockdowns and limited mobility in most parts of the world. However, Uber’s mobility division revenue is expected to pick up in the upcoming quarters as restrictions are lifted and the vaccination campaigns prove to be effective in curbing the COVID-19 spread.

Revenue is the first line of a company’s income statement and it reflects the total value of goods and services produced or delivered by the company in a period. It is one of the most important financial metrics, and the higher the number, the better for the company and its investors.

In the three months ended 31 March 2020, Uber’s revenue declined by 11%, mostly on the back of a $600 million accrual made for the resolution of some historical claims in the United Kingdom. The delivery and freight divisions grew by 230% and 51% respectively when compared to the same period in 2020.

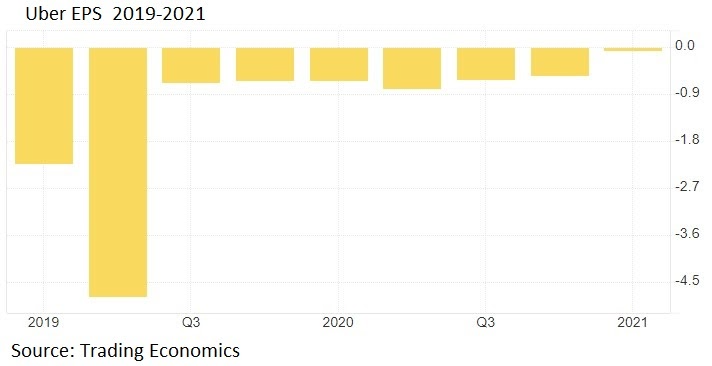

Uber’s Earnings-per-Share

EPS is another important financial metric that shows how much the company earned per single share. The ratio is derived from the net income “bottom line” of the income statement.

From the net income, investors deduct the preferred dividends, if any exist. The result is then divided by the weighted average number of the shares outstanding over the reported period. If there are no changes in the number of shares outstanding during the period, then the same number used in the previous period is used again. That is how the basic EPS is calculated, but equally important is the diluted EPS.

The diluted number shows the earnings-per-share if the convertible debt (if any) is converted. Thus, the diluted EPS number is typically lower than the basic EPS.

Uber has surprised investors with better than expected EPS, especially in the last reported quarter. The strong performance shows how the company came back with the improved economic performance, and it reflects the gradual lifting of the pandemic restrictions.

Yet, Uber reported a net loss of $(108) million for the last quarter and an adjusted “earnings before interest, taxes, depreciation, and amortization” (EBITDA) of $(359) million. Despite the loss, investors were pleasantly surprised by the increase in EPS and the narrowing EBITDA.

Uber’s P/E Ratio

At the time of writing, Uber is trading at $47.31/share. Because the company lost money in the previous quarter (and the quarters before that), the P/E ratio can’t be calculated because the denominator would be negative. Put simply, the P/E ratio is meaningless for an unprofitable company.

Uber’s Dividend Yield

Uber does not pay a dividend. In its relatively short history, it has had a difficult time turning to profitability, so that is the first aim. In time, depending on the management’s strategy, Uber may pay a dividend, but that should come only after some years of constant profitability. Therefore, the dividend yield has no relevance for a company that is yet to pay one.

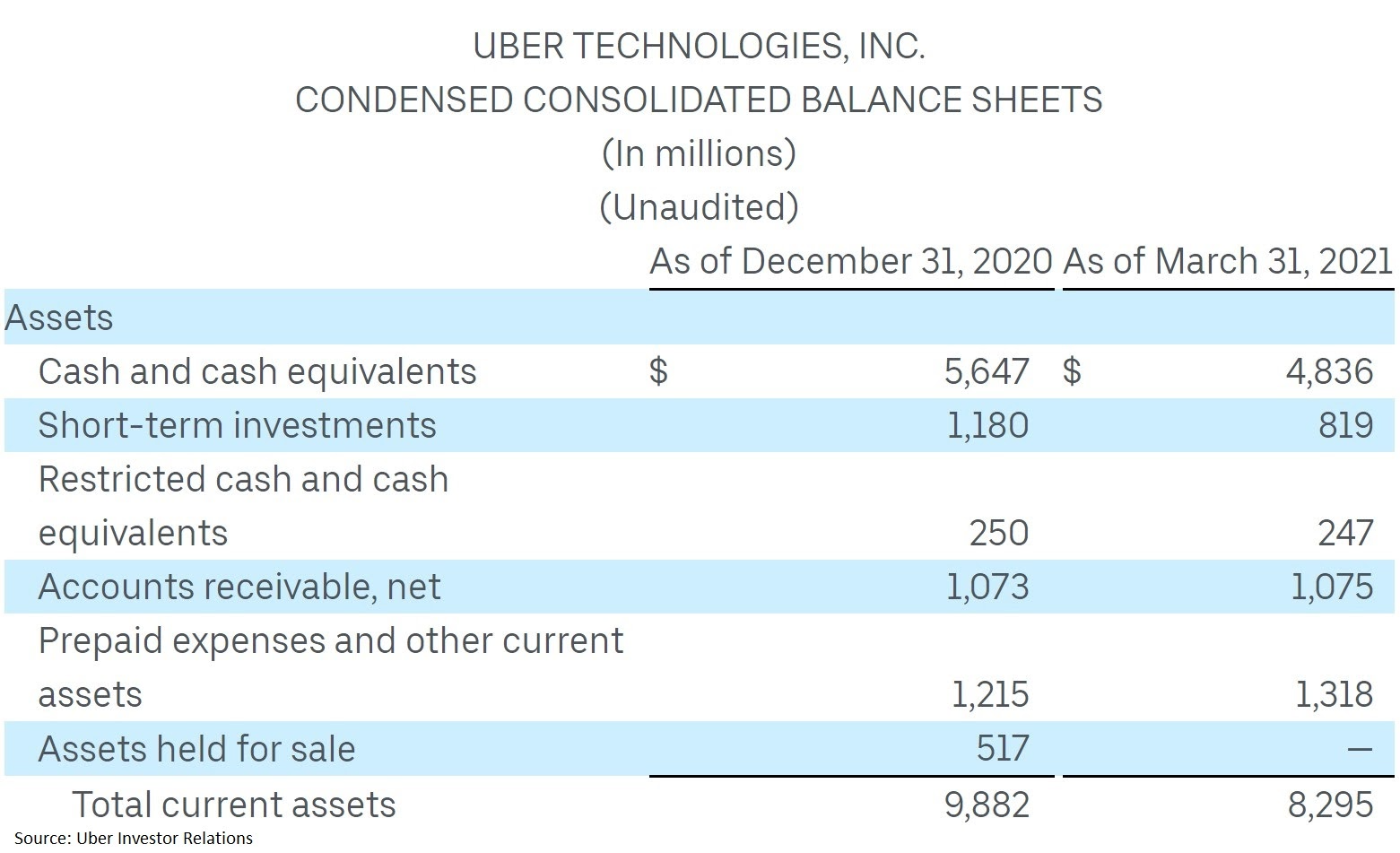

Uber’s Cash Flow

Uber’s cash position worsened in the most recent quarter (at the time of writing) but it remains solid. The cash and cash equivalents declined to $4.83 billion from $5.64 billion in the previous three months. The short-term investments and restricted cash and cash equivalents declined as well.

A strong cash position shows a liquid company able to meet its short-term debt. From this point of view, Uber’s cash position is strong and the prospects are promising in light of the economies recovering from the COVID-19 pandemic.

Why Buy Uber Stocks?

Uber’s mobility division was hit by the pandemic, but a strong comeback is expected. The company did an excellent job of balancing the revenues with the expansion of the delivery division, as the growth potential here is likely to outpace the other two divisions’ growth rate.

Merchants on the delivery platform exceeded seven hundred thousand, with new names such as COFFEE.KAN from Japan or Grupo Hunan from Mexico. Also, non-food merchant additions expand the delivery division and present a strong potential moving forward.

Here is a summary of the reasons to consider buying Uber stocks:

- It is a global brand with a global reputation

- Great growth potential for the delivery division

- Strong comeback expected from its mobility division

Expert Tip on Buying Uber Stock

“ Although Uber’s price action at the time of writing suggested a short-term triple top formation at the $60 level, technical traders are well aware of the saying that “triple tops rarely hold”. In such cases, it’s usually better to buy on strength by waiting for the price to break upwards. ”- thomasdavid

5 Things to Consider Before You Buy Uber Stock

At the minimum, investors should consider the following before investing in Uber stock.

1. Understand the Company

Uber has revolutionized the urban transportation industry and has disrupted well-established businesses (e.g., old-school taxi companies). For that, it has endured local restrictions and bans from local authorities in many cities and countries, yet somehow it has survived and thrived.

Higher growth rates are needed for the company to find its way to profitability, but this is understood by investors when companies become public to raise capital for expansion. Even if a business losses money presently, it may become profitable sooner than expected and even exceed investors’ expectations.

2. Understand the Basics of Investing

An investing background surely helps before buying stocks, but not all traders have this background, so education is important. The basics of investing focus on risk and money management, portfolio construction strategies, diversification strategies, and understanding of how orders are executed.

3. Carefully Choose Your Broker

The broker is the middleman or intermediary in the investing process, connecting buyers and sellers of stocks. The broker strives to match the buyers and sellers by offering the best possible execution, and by fairly representing the trader’s interests. A good broker is regulated, offers segregated accounts, focuses on customer service, and charges fair fees and commissions.

4. Decide How Much You Want to Invest

The stock market is full of temptations. At any point in time, the trader may be tempted to go “all in” on a trade or economic development, but investing requires a long-term horizon and strategy. For this reason, investors need discipline, and the best way to achieve it is to have a plan and execute it properly. Some investors keep part of their account in cash, to be deployed when profitable opportunities present themselves. Some investors divide their investment funds into equal parts, and they allocate each part to only one stock.

5. Decide on a Goal for Your Investment

Investors have different rationales for putting their funds into the market. One of the most common reasons is to build a pension fund for retirement. Another reason is for investors simply to put money to work when interest rates mean that there is nothing to be gained from depositing the money in a bank account instead. Whatever your reason for investing, having a goal for your investment is a healthy habit.

The Bottom Line on Buying Uber Stocks

Although Uber has not yet made a profit, it is on its way to doing so. The triple-digit rise in the delivery division points to a promising future. Moreover, Uber sits on a healthy cash position, and further growth in its operations should lead to profitability.

For an investor wanting to buy Uber stock based on the present value of its future cash flows, the first thing to do is to open a trading account with the preferred broker. Next, fund it. Finally, pull the trigger and place an order.

For an investor who is still hesitant — and there’s nothing wrong with that — we provide additional educational materials including guides like How the Stock Market Works, The Difference Between Fundamental and Technical Analysis, Market Psychology and a lot more on Buy Stocks. Learning is a lifelong endeavour and it is particularly important when money is on the line.

Frequently Asked Questions

-

Uber was on track to profitability before the COVID-19 pandemic hit. Its IPO in 2019 was one of the highlights of the year and one of the most expected IPOs in a while. But the pandemic triggered heavy losses in the mobility division due to mobility restrictions all over the world. However, what Uber lost in the mobility division, it gained in the delivery division. The key to turning a profit comes from Uber's ability to maintain the growth rates in the delivery division, to recover the mobility division’s growth trends, and to expand into new markets. Uber faces tough legislative conditions in some parts of the world, which could impact the bottom line.

-

At the time of writing, investors are still willing to pay more than $47-per-share for a company that is losing money in the present but has strong growth potential for the future. If the present value of the future cash flows indicates an intrinsic value bigger than the Uber stock price, then future profitability is just a matter of time.

-

Uber shares declined from the $60 level after three attempts to move higher. In technical analysis, such a level is called resistance, and a “triple top” is said to form when the price fails to break through three consecutive times at the resistance level. However, as long as Uber keeps the series of higher highs and higher lows typical for bullish markets, investors will look to buy the dip.

-

One way is through diversification, by buying several other stocks in addition to Uber. A more advanced way to protect against a share price decline is to buy protection and hedge against the risk using a “put option” as insurance, but this is only for advanced investors.

-

Yes. Uber shares are liquid enough that investors rarely (if ever) have trouble exiting from an Uber investment. You can even leave the broker to do the work of exiting your investment, by setting a limit order to sell your investment if it reaches your target level.

-

Uber is listed on the New York Stock Exchange under the ticker UBER and is part of the Nasdaq100 index, a tech index that tracks the largest tech corporations in the United States.