How to buy Microsoft stocks in 2024

Rising to prominence in the late 1970s and early 1980s, Microsoft's software became the industry standard for PCs. This gave Microsoft (ticker symbol: MSFT) a crucial first-mover advantage that it has capitalised on ever since. The huge licensing fees and erstwhile monopoly for Microsoft Office propelled the company to great heights.

Though Microsoft may not be the ground-breaking tech titan it once was, the company is far from obsolete and continues to remain relevant. Microsoft has earned plaudits for its successful pivot away from desktop computing into new and exciting avenues of growth like cloud computing, remote work apps, and video games.

This guide highlights the reasons you could consider buying Microsoft stock. It takes into account the fundamental factors and technical analysis which make this stock a good buy.

How to Buy MSFT Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Microsoft Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need To Know About Microsoft

Here, we drill beneath the surface and get to know Microsoft as a company, exploring its history, strategy, how it makes money, and how it has performed in recent years.

Microsoft History

In January 1975, computer geek Paul Allen read an article in Popular Electronics magazine about the Altair 8800 microcomputer. He showed it to Bill Gates, his childhood friend and fellow computer geek. Both friends had been writing computer programs and even skipped high school classes to work in their school's computer room.

Gates was a pre-law student at Harvard, despite pressure from Allen to leave Harvard so they could work together full time on their projects. After reading the article, Gates called MITS, makers of the Altair, and offered his and Allen's services to write a version of the new BASIC programming language for the Altair.

After eight weeks, Allen and Gates demonstrated their program to MITS, which agreed to distribute and market the product under the name Altair BASIC. The deal inspired Gates and Allen to form their own software company called Microsoft, which Allen derived from the words microcomputer and software.

Thanks to Microsoft Windows (its best-selling product to date), Microsoft captured over 90% market share of the world's personal computers by the 1990s. Microsoft has been able to leverage its success, expanding into other areas such as cloud computing services, server software, internet services, video games, and PC hardware and accessories.

What is Microsoft’s Strategy?

Microsoft's business strategy is to build a broad product portfolio in four key areas: cloud computing, personal computing, office services, and productivity/business. The company also uses mergers and acquisitions to increase its capabilities, product range, and value offering. Some of Microsoft’s notable acquisitions are LinkedIn, Skype, and Nokia. Any acquisition Microsoft makes, and any new product it launches, is with an eye on the future.

Microsoft's business strategy places a great emphasis on the cloud segment of the business. The company is focused on growing its cloud computing services after missing out on the opportunities presented by new technology such as video conferencing and internet calls. Latching on to the growing cloud computing trend, Microsoft’s Azure cloud business has reinvented the company and has significantly boosted its revenue. Depending on the product or market, Microsoft also uses a low-cost model to boost market penetration. For example, Microsoft Teams is offered as a package in the Office Suite, to stimulate demand and get more market share from competitors such as Slack and Zoom.

How Does Microsoft Make Money?

Microsoft makes money from the sale of computing devices, cloud systems and services, software, and other products to consumers and businesses. The company breaks down its revenue into three key segments: Intelligence Cloud, Productivity and Business Process, and More Personal Computing.

In its 2020 financial year, Microsoft Corporation reported a net income of over $44.28bn from a revenue of $143.02bn. The company's Intelligent Cloud segment is the largest source of profit as well as the fastest-growing. The segment comprises all of Microsoft's public, private, and hybrid server products as well as cloud services for businesses. These include Microsoft Azure, Windows Server, GitHub, Enterprise Services, and more. The segment generated $48.3bn in revenue in 2020 from servicing high-profile clients such as eBay, Boeing, Samsung, and BMW.

Microsoft's Productivity and Business Processes segment includes a portfolio of products designed to enhance corporate productivity, communication, and information services. One of its major products is the Microsoft Office software suite. This segment generated $46.4bn in revenue for the 2020 fiscal year.

The More Personal Computing segment consists of products and services aimed at putting customers at the center of the experience. These include the Windows operating system, Surface devices, and gaming products. This segment generated $48.24bn for the 2020 fiscal year.

How Has Microsoft Performed in Recent Years?

In the five years to 2021, Microsoft shares have appreciated by 393.4%. The stock had a bullish run from June 2016 to September 2018, when it increased by 123% from $51.17 to $114.37. However, by December 2018, the stock had trimmed its gains by 11% before rallying by 67% till March 2020, when it declined by 7% due to the pandemic. Microsoft experienced its steepest decline in two years when it slipped by 10.2% between August and October in 2020.

As of the time of this writing, Microsoft’s all-time high price is $263.19 and it has traded more or less flat since hitting this height.

Microsoft has sidestepped the selloff of some other big tech stocks. The company is also not involved in any antitrust filings, so it’s largely free from negative press. As the company continues to expand its cloud computing business and increase research on augmented reality, shares are expected to trend higher, driven by its impressive financial results.

Where Can You Buy Microsoft Stock?

Microsoft does not have a direct share purchase program, but there are two other ways to invest in Microsoft stocks.

You can purchase Microsoft shares through a stockbroker, which makes you a shareholder in the company, and eligible for dividends, and (potentially) able to vote on company matters.

Alternatively, you can trade Microsoft futures and CFDs. These derivatives do not give you ownership; you are merely seeking to profit from the stock price movements.

Microsoft Fundamental Analysis

Fundamental analysis is a method of evaluating an asset to know its true value, also referred to as the intrinsic value. In the case of a stock, it helps you know the value of the company behind the stock and to project how the company may perform in the future. It is different from technical analysis, which is the study of specific patterns in share price movements to forecast future price movements.

With fundamental analysis, investors try to determine the health and intrinsic value of the underlying company by studying certain financial metrics. Some of those factors include the company’s management and goodwill, which are not measurable. But here, we will focus on the measurable financial ratios such as the P/E ratio, revenue, earnings-per-share, dividend yield, and cash flow, in detail.

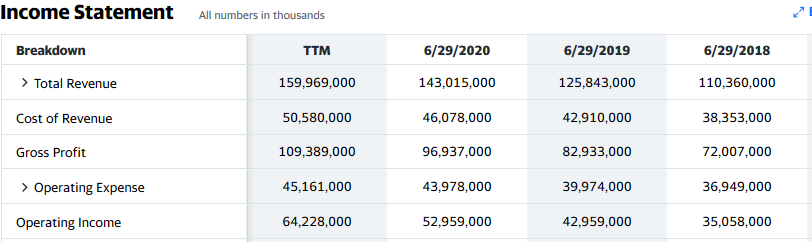

Microsoft’s Revenue

A company’s revenue refers to the total amount of money generated from goods or services within a specified accounting period. This is also referred to as gross sales.

Revenue is recorded in the income statement, and it is often the first item presented in the statement, which is why it is called the “top line”. You can get the information from the company's website, your broker’s website, or financial websites such as Yahoo! Finance, Market Watch, and CNBC.

In the 2020 fiscal year, Microsoft made a total revenue of $143bn, which was a 13.6% increase from the 2019 financial year. Microsoft has increased its revenue by 136% in the last 10 years.

Source: Yahoo! Finance

Microsoft’s Earnings-per-Share

Earnings are the company’s profit during the period under review after all costs and taxes have been deducted from the revenues. Earnings per share (EPS) is obtained by dividing the company's earnings by the total number of outstanding shares of its common stock.

Earnings-per-share (EPS) is used by financial analysts and investors to weigh the financial strength of a company, and it serves as an indicator of a company's profitability. Value investors and fundamental analysts consider EPS to be one of the most important variables in determining the value of a stock.

Microsoft’s 2020 annual EPS was $5.82, a 13.83% increase from the 2019 number. The higher the EPS, the more profitable the business. You can calculate the EPS yourself, but it is often provided on financial websites such as Yahoo! Finance. EPS is used to calculate the P/E ratio, which we will discuss next.

Microsoft’s P/E Ratio

The price-to-earnings ratio (P/E) is another financial ratio used by fundamental analysts to assess the value of a stock. The P/E ratio shows what investors are willing to pay today for a stock based on its past or future earnings.

A high P/E could mean that a stock's price is high relative to earnings and possibly overvalued. It indicates that investors are expecting higher earnings growth in the future, so they are willing to pay a higher share price today. On the flip side, a low P/E might indicate that the current stock price is low relative to earnings and possibly undervalued.

Growth stocks usually have a high P/E because the company is reinvesting profits to grow the company and investors are expecting higher future returns from those investments. This contrasts with value stocks that have a lower P/E ratio because they are often undervalued. Microsoft's P/E ratio can be calculated by dividing the stock price by the annual EPS. This gives 34.40 at the time of writing, which is fair for a tech company.

Microsoft’s Dividend Yield

The dividend yield (expressed as a percentage) is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It is calculated by dividing the dividend per share by the price per share. Thus, dividend yield and stock price are inversely related; when the share price rises, dividend yield falls, and vice versa.

Growth companies often don’t pay dividends whereas established companies do tend to pay dividends. If you're looking for dividend income, the dividend yield is an important metric you can use to assess the worth of the dividends.

As of the time of this writing, Microsoft’s dividend yield is 0.90%.

Microsoft’s Cash Flow

In finance, the term cash flow is used to describe the amount of cash and cash equivalents that a company generates or consumes in a given period. It shows the increase or decrease in the amount of money a company has.

A company’s cash flow is reported in its cash flow statement and shows how the company generates cash to pay its debt obligations and fund its operating expenses. It enables investors to understand how a company's operations are running, where its money is coming from, and how money is being spent. Combining it with the income statement and balance sheet, investors can determine the financial health of the company.

According to its 2020 fiscal report, Microsoft had a free cash flow of $53.7bn.

Why Buy Microsoft Stocks?

Microsoft has constantly reinvented itself, showing strong resilience and adaptation to the fast-paced nature of the tech industry. Starting as a PC maker, this tech giant has been able to branch into other areas such as cloud computing and remote work software.

The company is using its dominant position to make acquisitions in areas that should increase its market penetration and reduce competition. Some of the company’s notable acquisitions are LinkedIn, GitHub, and Skype. Microsoft is venturing into new areas such as virtual reality and the company has also spent considerable time and effort creating the potential business use cases for the HoloLens VR headset.

Some of the main reasons why you should buy Microsoft shares are:

- Microsoft has the fastest-growing cloud computing business

- The company has a growing gaming business through string sales of Xbox console

- Microsoft regularly pays dividends

Expert Tip on Buying Microsoft Stock

“ Microsoft’s share price seems to have grown without suffering any significant dips, so — in a sense — any time is a good time to buy Microsoft stock. By using a “limit order” to buy shares, you can be sure not to pay more for them than you want to. ”- willfenton

5 Things to Consider Before You Buy Microsoft Stock

Here are five things to consider before buying Microsoft stock.

1. Understand the Company

Legendary investor Warren Buffet advocates building a circle of competence when investing. This means investing in areas that you are knowledgeable about. However, being familiar with a company should not stop you from doing a fundamental analysis to be sure of the company’s financial health before investing. Yes, you might be using a lot of Microsoft’s products and services but study the company’s fundamentals first to be sure the stock is worthy of your hard-earned money.

2. Understand the Basics of Investing

Understanding the stock market is essential to making informed trading decisions. You need to know the basics of investing and how the market works. Before attempting to invest in Microsoft, you need to learn about things like risk management, money management, diversification, as well as how to read financial reports and perform technical analysis. While risk management, money management, and diversification help you to manage risks, technical and fundamental analysis helps you to invest in the right stock and at the right time.

3. Carefully Choose Your Broker

There are many factors to consider when choosing a broker, including your investment objectives, capital, and even place of residence. Ensure you choose a stockbroker that is registered with the financial services regulator in your country of residence and that you can get some form of protection from any financial compensation scheme in your country. Apart from regulation status, you should also consider trading commissions and the trading tools offered by the broker before making a choice. While some charge commissions on transactions, others offer commission-free trading accounts. Some brokers require a minimum amount before you can set up a brokerage account with them.

4. Decide How Much You Want to Invest

It is necessary to determine the percentage of your capital you want to allocate to this one stock. There are a variety of ways you can arrive at this. You can invest a percentage of your portfolio, with the general rule of thumb being to invest more than 2% of your portfolio in any single stock. You can also invest a specified amount in the stock or make monthly investments which can be accumulated over years, which is known as dollar-cost-averaging. The key is never to invest any amount you cannot afford to lose.

5. Decide on a Goal for Your Investment

There should be a clear goal for your investment: Why are you investing in this particular stock? Is it to hold for the long term or trade in the short term? Are you buying the shares because you like the company or have noticed mispricing in the stock that you want to take advantage of? These are the sort of questions you need to answer before investing in a stock.

Perhaps, you want to buy the stock as part of your retirement or to fund your child's college education. It is always appropriate to clarify the reason why you are investing in a particular stock and have a strategy regarding when to buy and when to sell. This will enable you to quieten the noise in the market and stick to your initial plans.

The Bottom Line on Buying Microsoft Stocks

Microsoft falls into the category of stocks that you don’t just trade but want to buy and own because the company has been a leader in the tech industry for a long time. Since its establishment in the mid-70s, the company has constantly reinvented itself and launched new products to reach new markets. Though the company looked like a tech laggard at one point, it has shown its ability to bounce back with innovative products.

To invest in Microsoft shares right now, all you need is to sign up for a stockbroker’s stock trading account, fund your account, select Microsoft from the categorized list of stocks, and place a market order or limit order to buy the stock.

If you’re not ready to invest right now, continue to educate yourself by reading our other guides like How the Stock Market Works, The Difference Between Fundamental and Technical Analysis, Market Psychology and a lot more on Buy Stocks. You may also practice “paper trading” using a stockbroker’s demo account to familiarize yourself with the broker’s platform and tools.

Frequently Asked Questions

-

Microsoft could be a very good stock to buy. As technology becomes increasingly important in our daily lives, companies such as Microsoft will remain relevant and profitable.

-

Microsoft shares are primarily listed on America’s Nasdaq exchange. However, the stock also trades on other stock exchanges around the world, including the London Stock Exchange, Xetra, Argentinian BYMA, and Moscow Exchange (MOEX).

-

You can purchase Microsoft shares via any stockbroker that has access to the Nasdaq exchange or any other stock exchange where Microsoft is traded. Most international brokers have access to various stock exchanges around the world.

-

Yes, Microsoft has consistently paid dividends since 2003, and it paid its very first dividend in 1986. At the time of writing, Microsoft’s dividend yield is 0.90%.

-

In the five years to 2021, Microsoft shares have appreciated by 393.4%. So, if you had invested $1000 in Microsoft shares around May 2016, you would have realized $3,933 in profits.

-

When you buy the stock, don’t forget to place a stop-loss order that will get you out of the market if the trade goes against you by a certain amount. But be careful not to set the stop loss too close to your entry level nor too far from it. More importantly, only buy the stock with an amount you can afford to lose.