How to buy Amazon stocks in 2025

Founded as an online bookstore by Jeff Bezos in 1994, Amazon has grown into one of the largest companies in the world, and undoubtedly the biggest e-commerce company, selling virtually everything from books, electronics, and toys to furniture, food, and drugs. In addition to retailing, Amazon also manufactures and sells its own products, such as the Amazon Echo and the Kindle e-reader.

But Amazon is not just about e-commerce; the company has diversified into artificial intelligence and cloud computing (with Amazon Web Services, which is the largest cloud computing service globally). Amazon also offers digital streaming services — including its own movies and TV shows — via the Amazon Prime Video platform. The music section, Amazon Music, offers access to millions of songs.

We have created this guide to show you why you might want to buy Amazon stock after taking various technical analysis and fundamental factors into consideration.

How to Buy AMZN Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Amazon Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need To Know About Amazon

Now, let’s get to know Amazon in more detail by exploring its history, strategy, the way(s) it makes money, and how it has performed in recent years.

Amazon History

Jeff Bezos founded Amazon in the garage of his rented home in Bellevue, Washington, on July 5, 1994. The company started as an online bookstore but has since grown to the biggest e-commerce company on the planet. It has also diversified into cloud computing and digital streaming services.

Bezos got the idea of building an online company after reading a report about the future of the internet in the early 1990s, which projected annual web commerce growth at 2,300%. Out of all products that could be sold online, he settled for books due to the global demand for literature, the low unit price, and the vast number of titles available in print. Bezos' parents offered seed capital of almost $250,000 for the start-up, making them the company’s first investors.

In 1997, Amazon went public and was listed on the Nasdaq stock exchange. Between 1998 and 2004, Amazon offered convenient shopping and other services to customers. In 2005, the company launched its cloud computing unit, Amazon AWS, and the crowdsourcing area with Amazon Mechanical Turk. In 2011, it began offering streaming services including Amazon Music and Amazon Video. In late 2020, Amazon announced that it would create an online pharmacy and it hinted at plans to acquire jets for its delivery business. Amazon has also acquired food delivery companies, such as Deliveroo and Selz. At the time of writing, Amazon has a workforce of 1.3m employees.

What is Amazon’s Strategy?

Amazon’s strategy has transitioned from the online bookstore it once was to an e-commerce giant that offers a marketplace for companies to sell their products. It has also spread its wings to other areas like logistics, consumer technology, cloud computing, and — most recently — digital streaming.

Core to the strategy is offering consumers easy access to everything they need to live comfortably in our technology-driven world. Amazon’s business model is to use all available technology to vertically integrate everything it needs to serve consumers by acquiring various delivery services. Amazon uses the cost-cutting benefits of its subscription-based services (Amazon Prime membership) to attract more customers and make them shop more frequently.

Whether it’s online retailing, cloud computing, or digital streaming services, Amazon primarily serves consumers in the online space. However, it is also experimenting with Amazon Go physical grocery stores that will be manned by robots. The robot kiosks will operate without cashiers or checkout lines and may also feature delivery drones for home deliveries.

How Does Amazon Make Money?

Amazon generates its revenue from online stores, physical stores, third-party seller services, subscription services, and Amazon Web Services (AWS). Retailing remains the company’s primary revenue source, with online and physical stores accounting for a good portion of its revenue. This includes revenue from third-party retailers, whom Amazon allows to sell their products on its platform and charges them a commission on sales. Products sold through third-party retailers are often less common items with a higher purchase price. By using third-party retailers, Amazon can avoid having a higher inventory turnover and diluting its profits by holding goods for long.

Amazon’s subscription-based model, the Amazon Prime service, also contributes to its revenue. Subscribing to an Amazon Prime account by paying a fixed amount per annum offers customers free two-day or same-day shipping on eligible items. The subscription also allows customers to stream most Amazon media and entertainment content. Kindle, which allows subscribers to read books online, is another subscription model that generates revenue for the company.

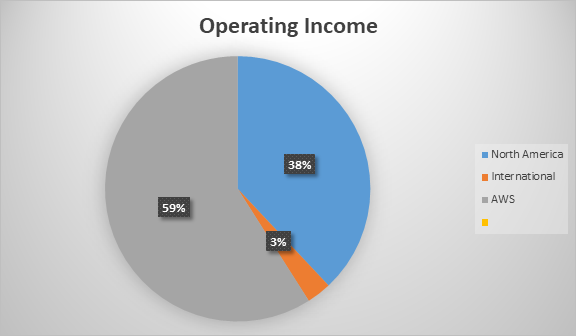

The cloud computing unit, Amazon Web Service (AWS), is another major source of revenue. AWS currently controls about a third of the global cloud market, which is nearly twice as much as its next closest competitor: Microsoft. While it does not contribute the most revenue to Amazon, AWS is by far the highest contributor to the operating income. The company sees AWS as a powerful growth catalyst that will continuously bring in new customers with increasing enterprise adoption.

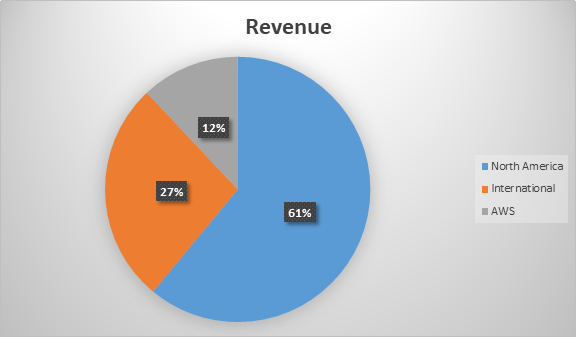

In its financial reports, Amazon divides its business into three segments: North America, International, and AWS. The North American and International segments refer to geographical breakdowns of Amazon's retail business. So, those two segments describe revenue and operating income from retail sales, subscription services, and exports from North America and the rest of the world.

For example, in the 2020 Financial Year, ended Dec. 31, 2020, North America accounted for $236.3 billion in revenue, which is an increase of 38.4% from FY 2019 and represents about 61% of the company's net revenue for the year. The International segment accounted for $104.4 billion in revenue, which represents 27% of the total net revenue, while the AWS segment generated revenue of $45.4 billion, which represents about 12% of total net revenue.

In terms of the operating income in the 2020 FY, the North America segment generated $8.7 billion, comprising about 38% of the total operating income for all segments. The International segment reported an operating income of $717 million, which accounts for only about 3% of the total operating income for all segments. Interestingly, the AWS segment brought in $13.5 billion, which represents 59% of the total operating income for all segments.

How Has Amazon Performed in Recent Years?

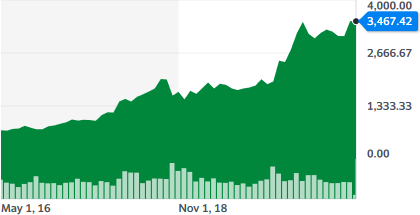

Amazon has grown steadily over the years, and this has manifested in the stock price climbing steadily for five years: from $671.41 in the first week of May 2016 to $3467.42 by the end of the last week of April 2021. This 400%+ price appreciation means that someone who invested $10,000 in Amazon five years previously would be sitting on more than $41,000 of profit.

Source: Yahoo! Finance

Where Can You Buy Amazon Stock?

Amazon trades on the Nasdaq exchange under the ticker symbol AMZN, so you can only buy Amazon stock via a broker that lets you buy US shares. This can either be a US-based broker or any of the major International brokers that have access to all major stock exchanges around the world.

Note that buying Amazon shares from an exchange-registered stockbroker (which gives you part ownership in the company) is different from simply placing a bet on the direction of the Amazon share price via any of those OTC online spread betting or CFD brokers.

Another way of investing in Amazon shares is through the direct stock purchase plan (DSPP) that Amazon launched in 2019. To do so, you have to open an account with Computershare.

Amazon Fundamental Analysis

Fundamental analysis is a method of evaluating an asset to know its true value, so you can project how the company may perform in the future.

Unlike technical analysis, which involves using specific patterns in share price movements to forecast future price movements, fundamental analysis is a process of determining the health and intrinsic value of the underlying company. When performing fundamental analysis of a stock, you’re interested in certain factors or ratios that show how well the company is performing. Some of those factors include the company’s management and goodwill, which are not measurable, as well as P/E ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow, which are measurable.

Next, we’ll look at those measurable ratios to see how you can use them in your analysis.

Amazon’s Revenue

A company’s revenue, also known as gross sales, refers to the total amount of money generated by the sale of goods or services offered by the company. When analyzing a company’s quarterly or yearly report, the revenue is usually the first thing you see at the top of the income statement (which is why it’s sometimes called “top line”). You can get the report from the company’s website, but some stockbrokers also include the link on their websites.

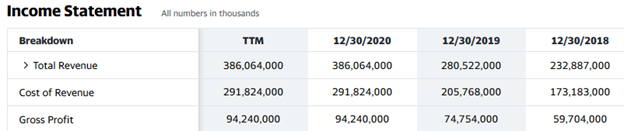

Revenue growth — when the current revenue is higher than that of the corresponding period in the preceding year — is a good thing for the company’s stock. Amazon’s revenue for the 2020 financial year that ended Dec. 31, 2020, grew by 37.6% to $386.1 billion compared to $280.5 billion in the 2019 financial year.

Source: Yahoo! Finance

Amazon’s Earnings-per-Share

In the financial analysis of a company, earnings are the profit the company has made during the period under review after all costs and taxes have been deducted from the revenues. As the revenue is called the “top line”, you might call earnings the “bottom line”.

As a shareholder, the total earnings are not that important because you don’t own the whole company. What is more useful is earning per share (EPS), which is an important financial ratio that shows how profitable the company was during the period under review.

Amazon’s EPS is calculated by dividing its net income by its total number of outstanding common shares. The higher the EPS, the more profitable the business. While you can calculate the EPS yourself, it is often provided on various financial websites, such as Yahoo! Finance where (at the time of writing) it is given as 14.09 for Amazon.

EPS is used to calculate another ratio, the P/E ratio, which we will discuss next.

Amazon’s P/E Ratio

The price-earnings (P/E) ratio is a financial ratio that measures a company’s current share price relative to its earnings per share. It is calculated by dividing the current price of the company’s stock by its earnings per share.

In general, a high P/E suggests that investors are expecting higher earnings growth in the future, so they are willing to pay a higher share price today. However, beyond a certain level, it could mean that the company is overvalued. Historically, the average P/E for the S&P 500 Index, which is often used as the benchmark, has ranged from 13 to 15.

To calculate Amazon’s P/E ratio, you simply divide the current share price by the EPS. Taking the 2020 financial year as an example, the calculation at the time of writing would be 3467.42/14.09 = 246.10. This means that investors were willing to pay $246.10 for every $1 Amazon earns per annum. In other words, it would take Amazon more than 246 years to earn enough money to pay back your investment.

Amazon’s P/E ratio can be said to be on the high side, which could mean that the company is overvalued. But the P/E doesn’t factor in the company’s earnings growth rate. So, the PEG ratio, which measures the relationship between the P/E ratio and earnings growth, provides a more complete story than the P/E alone.

Amazon’s Dividend Yield

Dividends are payments the company makes to its shareholders as their share of the company’s earnings. They are a portion of the company’s profits shared among its shareholders.

Dividend-paying companies typically declare dividends twice a year, and such information can be found on major financial websites or your stockbroker’s website.

Dividend yield compares a company’s dividend payments (for the year) to its stock price. If the company pays out $1 in annual dividends and the current share price is $20, then the dividend yield would be 1/20, expressed in percentage to get 5%.

Many investors like stocks with good dividend yields because they hold their stocks for a long time, and they want to be sure that the money they are making from holding a stock is better than the interest rates they would have received for depositing that money with a bank. Traders, on the other hand, hold a stock for a short time and are more interested in making money through short-term price fluctuations rather than dividends.

Despite making high earnings per share, Amazon has not started paying dividends to its shareholders. Instead, the company plows back its earnings into the business, which is one of the reasons for the stock’s huge capital appreciation.

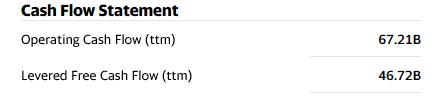

Amazon’s Cash Flow

Cash flow refers to the net amount of cash or its equivalents that move in and out of a business. Cash that comes into the business is called cash inflows and those that move out of the business are called cash outflows.

For a company to be in good health, it must be generating positive cash flows, which means that the cash inflows must be greater than cash outflows. As with many other companies in good financial health, Amazon maintains a positive cash flow.

Source: Yahoo! Finance

Why Buy Amazon Stocks?

Amazon’s business strategy will continue to be profitable because its products and services are essential to day-to-day life. From shopping, to online to streaming, to cloud computing, people will always need Amazon services. And Amazon is constantly trying to create more value for its customers.

So, Amazon stock still has room for growth compared to other stocks, and here’s why:

- Amazon is not resting on its impressive growth over the years, it is constantly trying to create more value for its customers — the new robot kiosk is an example

- The Amazon brand is trusted globally

- The company has been recording earnings growth in the past, always beating analysts’ expectation

Expert Tip on Buying Amazon Stock

“ At the time of writing, Amazon shares are trading at around $3467.42 per share. So, if you don’t have huge investment capital, it could be a good idea to buy the stock via brokers and platforms that offer fractional shares. ”- willfenton

5 Things to Consider Before You Buy Amazon Stock

Before you buy Amazon stock, here are five things you must do:

1. Understand the Company

Before you put your money on any company, you must understand the company: what it does and how it makes money. If possible, let it be a company whose products you already use. However, being familiar with a company should not stop you from doing a fundamental analysis to be sure of the company’s financial health before investing.

2. Understand the Basics of Investing

Before attempting to invest in Amazon, you need to learn the basics of investing. You should learn stuff like risk management, money management, and diversification. While risk management and money management enable you to control how much you can lose if anything goes wrong, diversification offers you a way to spread your risk across several stocks.

3. Carefully Choose Your Broker

Be sure to choose a broker that is registered with the financial services regulator in your country of residence so you can be sure that they cannot easily run away with your money and that you can get some form of protection from any financial compensation scheme in your country. Apart from regulation status, you should also consider trading commissions and the trading tools offered by the broker before making a choice.

4. Decide How Much You Want to Invest

One important rule in investing is to never invest more than you can afford to lose. Also, do not invest with borrowed money no matter how well you think a stock will perform: Leverage — which means investing with borrowed money — is a double-edged sword.

When you have saved up your capital, you should determine the percentage of that capital you will allocate to one stock and how you want to invest the money. It may be preferable to scale in gradually and practice dollar-cost-averaging. Whichever method you chose, ensure to diversify your portfolio across different stocks and even different asset classes to avoid systemic risks.

5. Decide on a Goal for Your Investment

Finally, you must consider your investment goal: why are you investing and how long do you intend to hold your investment? It could be to build your pension fund for retirement. But then, what is your investment strategy? You should know when to sell: it could be at a specific time in the future or when the company’s fundamentals no longer look good, or you may even want to hold the stock indefinitely. Whatever is the case, write down your investment goal and plan.

The Bottom Line on Buying Amazon Stocks

In summary, Amazon is an e-commerce powerhouse that is leveraging technology to make shopping a lot easier while providing online access to entertainment and web services. You can buy Amazon stock through a stockbroker or via Amazon DSPP.

To invest in Amazon shares right now, all you need is to sign up for a stockbroker’s stock trading account, fund your account, select Amazon from its categorized list of stocks, and place a market order or a limit order to buy the stock.

If you’re not yet ready to invest right now, continue to educate yourself by reading our other guides like How the Stock Market Works, The Difference Between Fundamental and Technical Analysis, Market Psychology and a lot more on Buy Stocks. You can also practice “paper trading” using a stockbroker’s demo account to familiarize yourself with the broker’s platform and tools.

Frequently Asked Questions

-

Amazon's explosive growth in its early years came at the expense of profitability; it lost money during its first 17 quarters as a public company. The company recorded its first profit of just 1 cent per share in Q4 2001, but fast forward to the end of 2020, Amazon's gross profit stood at more than $94 billion, with its net profit standing at more than $21 billion!

-

Although Amazon has been consistently profitable in the last few years, the company has never paid any cash dividends to its common shareholders. Amazon prefers to plow back its earnings to pursue growth. That policy might not change in the foreseeable future.

-

The first rule is to only buy the stock with a specified percentage of your investing capital that you can afford to lose. Another thing you can do is to place a stop-loss order that would get you out of the market if the trade makes a certain amount of loss. But you should neither set the stop loss too close to your entry price nor too far from it.

-

Yes, you can also do technical analysis before buying Amazon shares, provided your fundamental analysis shows that the company is in good financial health. While fundamental analysis tells you whether a company is good for investment, technical analysis can tell you the right time to press the buy button.

-

At Amazon’s current share price of $3,467.42, you can’t even buy one share of stock with $1000 of investment capital. However, you can still invest your $1,000 in Amazon by using a brokerage platform such as Robinhood that allows fraction shares trading.

-

Amazon is primarily listed on the Nasdaq stock exchange, but the stock also trades on the London stock exchange and the EURONEXT exchange. Depending on where your broker is based, you can buy the stock from any of those exchanges.