How to buy Sony stocks in 2025

The Sony Group Corporation, or simply Sony, is one of the most popular brands in the world. It is one of the iconic Japanese conglomerates, now best known for its PlayStation games consoles and professional video cameras.

Besides producing and selling electronic equipment and instruments, Sony also produces, distributes, and sells video and sound products, animated motion pictures, portable game consoles, peripheral devices, semiconductors, and more.

This guide tells you how and why to buy Sony stock based on an assessment of the company’s fundamentals.

How to Buy SNE Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Sony Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need to Know About Sony

Let's start by looking at Sony's history, its sources of revenue, how its stock price has performed, and what business strategy it employs.

Sony History

Founded in 1946, Sony employs over 111,000 people across the world. It is headquartered in Tokyo, Japan, and it is one of the most emblematic companies active in the consumer discretionary sector, with a focus on consumer electronics.

The company is well-known for inventing the famous Walkman that was so popular with teenagers in the late 90s. Nowadays, the company runs a diversified business in industries such as electronic equipment instruments and devices, music, and mobile phone applications.

Sony changed its name recently into Sony Group Corporation, to better reflect its worldwide presence.

What Is Sony's Strategy?

Sony is one of the leading companies in the consumer discretionary sector, thus subject to the business cycle. Because of its worldwide presence, Sony has a competitive advantage by being active in different markets, so it benefits from the business cycle being in different phases in different parts of the world.

For example, emerging market economies may be at the peak of the business cycle while a new expansionary phase is starting in frontier economies. Sony can adapt its strategy locally while acting with a global perspective.

How Does Sony Make Money?

Sony derives its revenue from eight different sources: game and network services, music, pictures, electronic products and solutions, imaging and sensing solutions, financial services, all other, and services and elimination.

Out of these segments, the game and network services segment contributes the most to the annual revenue, and it is constantly growing. The pandemic had a positive impact on the gaming industry because people around the world were forced to spend more time indoors.

The music and pictures segments contribute about 20% to the total revenue, a little more than the financial services division. A quick look at the company's income statement reveals a balanced portfolio of income streams, with each line of business contributing to the total revenue by at least 10% (except for "all other" and "corporate and eliminate" divisions).

How Has Sony Performed in Recent Years?

Sony is listed on several stock exchanges around the world, including being listed on the New York Stock exchange in the form of American Depository Receipts (ADR). Access to American capital is key for any global corporation.

Sony’s share price barely registered the pandemic as it bounced strongly from the 2020 stock market meltdown, peaking at $120 level in February and then again in April 2020. The stock has benefited from a bullish trend comprising a series of higher highs and higher lows, and investors will continue to ride the trend (buying on the dips) until it ends.

Where Can You Buy Sony Stock?

An investor can use a stockbroker account to buy Sony stock either on margin or using a cash account.

Buying on margin requires an initial amount of money to be posted with the broker, and the rest is borrowed from the broker. The benefit is that you can buy more shares with less of your own money. The disadvantages are that you have to pay interest on the borrowed money and your losses will be amplified if the share price goes the wrong way.

Another option is to trade a contract-for-difference (CFD). CFDs follow the share price performance but don’t imply stock ownership in the same way that shares do. Some brokers offer both CFDs and Sony common shares, so it is important to know the difference.

Sony Fundamental Analysis

There are two types of stock analysis: technical and fundamental. While technical analysis involves interpreting historical market data to forecast future values, fundamental analysis means interpreting a company's underlying financial performance to derive the intrinsic value of its shares.

If the calculated intrinsic value is higher than the current market value, it means that the company's shares are undervalued, so the investor will want to buy shares (or “go long”).

If the calculated intrinsic value is lower than the current market value, the company's shares are seen as overvalued, so an investor will either sell shares, wait for a dip to buy more shares, or even “sell short” (if the broker allows).

Let’s now look at Sony's revenue, earnings-per-share (EPS), the price/earnings ratio (P/E, dividend yield, and cash flow. This will be our fundamental analysis.

Sony's Revenue

Revenue, which is the total value of the company's sales of goods and services over a period of time, is the first line on the income statement.

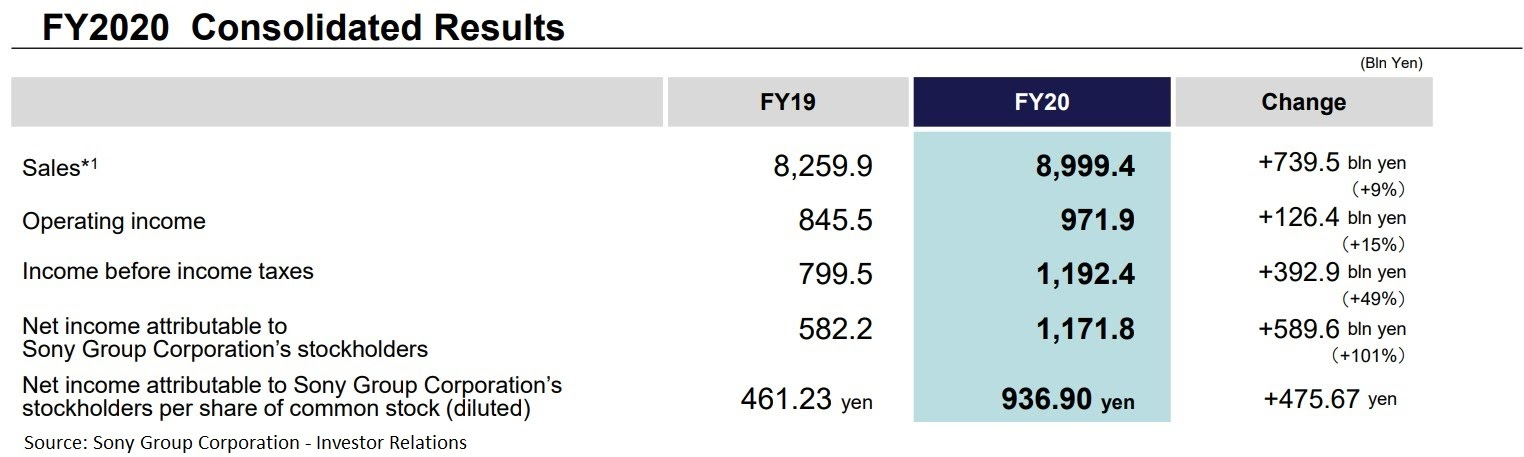

At the end of April 2021, Sony reported the full results for the fiscal year 2020. Its revenue grew by 9% compared to the previous year, and the net income attributable to Sony Group Corporation's stockholders more than doubled.

Sony's Earnings-per-Share

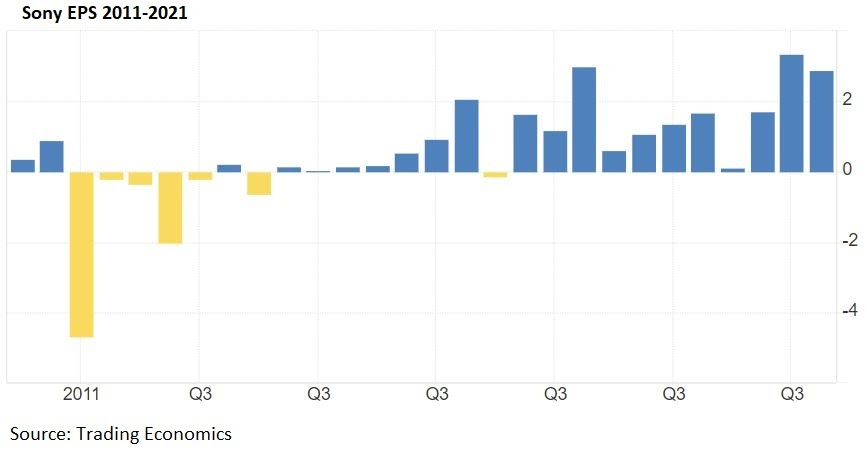

Earnings-per-share (EPS) is one of the most important metrics for evaluating a company's intrinsic value. It is calculated in “basic” and “diluted” forms and it illustrates the financial performance per share.

The basic EPS ratio deducts the preferred dividends from the net income (the bottom line on the income statement) and the result is divided by the weighted average number of the shares outstanding. The outstanding shares are the number of shares available for trading, and the number may change over a year depending on the management's policy.

For instance, if the management perceives that the market price does not reflect the intrinsic value of the company, it may decide to buy back some of the outstanding shares, thus influencing the EPS ratio as fewer shares would be available for trading.

Sony’s EPS has mostly been positive in recent years.

Sony's P/E Ratio

The price/earnings ratio (P/E) is exactly as its name implies. It is calculated by dividing the current share price by the EPS.

At the time of writing, Sony’s share price sits at $98. If we use the most recent EPS of $2.88, we arrive at a P/E of 34.02. This means that investors are willing to pay $34.02 for every $1 of the company's profits.

While our calculated P/E may seem unreasonable to many individual investors, we should keep in mind that other investors have a forward-looking attitude. The basis for valuing a company's share price comes from correctly interpreting the present value of its future cash flows. If investors believe that the company can increase its profitability in the future, then the present value of those future cash flows is reflected in the market price.

Sony's Dividend Yield

Dividend yield is another useful measure used by investors to decide if it’s worth investing in a company. Dividend-paying companies are favored by many investors, as the extra income generated by dividends is often reinvested in buying more company's shares. Therefore, over the long term, the total returns increase significantly.

Not all companies choose to pay their shareholders a share of the annual profits as a dividend, but Sony has a long history of paying dividends.

Sony’s most recent dividend (at the time of writing) is $0.27/share and its average dividend yield for the past four years of 0.53%. The yield is calculated by dividing the dividend per share by the market price per share, and the higher the yield, the more attractive the company is to investors.

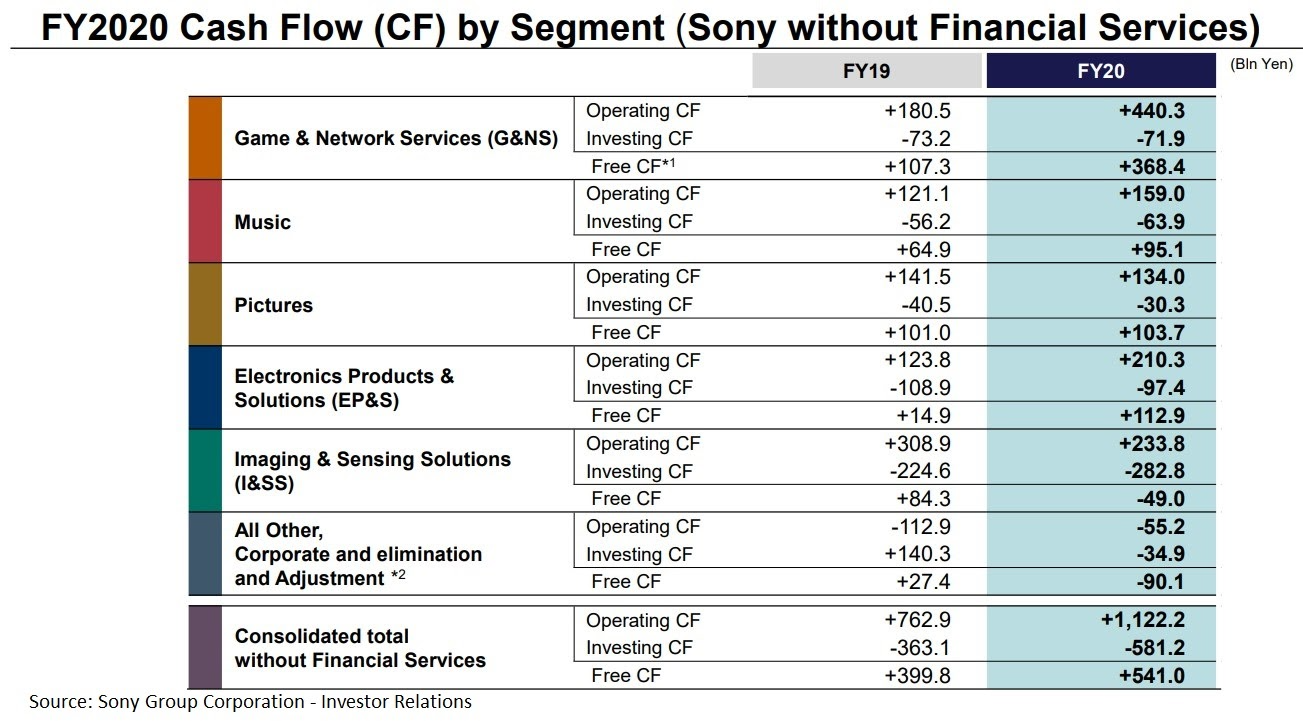

Sony's Cash Flow

Cash flow shows the liquidity position of the company.

The aim is to find a balance between the cash needed for running the day-to-day operations and the cash to be invested in short and long-term securities. Keeping all the cash in a bank account is not always lucrative so treasury departments in large corporations choose to invest the extra cash in short-term marketable securities that are liquid enough to be considered cash equivalents.

Sony has a strong cash position, with the free cash flow position for the consolidated businesses (excluding the financial services sector) increasing from 399.8 billion yen in FY19 to 541 billion yen in FY20.

Why Buy Sony Stocks?

While some of the fundamental financial metrics may show that Sony’s share price is expensive, here are some reasons why you might want to buy Sony stocks:

- It is a global corporation and a trusted brand

- The gaming industry has strong compound annual growth rates (CAGR) for the years ahead

- It provides exposure to the Japanese corporate world

- Global diversification benefits from business cycles’ fluctuations

Expert Tip on Buying Sony Stock

“ The unprecedented COVID-19 pandemic brought economic recession to all parts of the world at the same time but Sony fared well due to its gaming division. This is the division to watch while economies come out of lockdown. ”- thomasdavid

5 Things to Consider Before You Buy Sony Stock

Investing in a company's shares should come at the end of a due diligence process. Before investing in Sony shares, there are at least five things to consider.

1. Understand the Company

A thorough understanding of the company's business is mandatory. Look for long- and short-term trends in the industries the company derives most of its revenues from, which are many and varied in Sony’s case.

2. Understand the Basics of Investing

Investing means putting financial resources to work by building a portfolio of various assets. Portfolio management is a complex field, and risks always exist. Some risks can be diversified away by adding uncorrelated assets to a portfolio. Some risks can be managed using stockbroker pending order types such as stop orders to limit a loss or lock in a profit.

3. Carefully Choose Your Broker

A critical step in the investing process is choosing your broker. Several things must be considered, such as regulation, commissions and fees, markets to trade, the trading platform, and available research. The best broker might not be the one with the lowest fees because other factors weigh in an investor's decision to choose a broker. Think of the broker as the trader's partner during the investing journey.

4. Decide How Much You Want to Invest

The first step in the investment journey is to fund your trading account with only surplus funds that you won’t need for a while. After funding your account, you need to decide how to split the funds between different assets/markets— to obtain diversification benefits and to spread the risk as efficiently as possible. Some traders invest a certain percentage of their account in any new position, some prefer to add only to winning positions, and others use a dollar-cost-averaging technique. As a rule of thumb, never invest money you cannot afford to lose, because not all risks can be diversified away.

5. Decide On a Goal for Your Investment

A proper goal considers both the time horizon for an investment and the financial performance. Some investors are in it for the regular dividend income and because they like a company's business and beliefs. Some investors are driven solely by financial performance. Other investors simply want to own a piece of a business that keeps its real value and acts as a store of value against inflation.

The Bottom Line on Buying Sony Stocks

Sony is a company with a great brand name, with diverse activities in growing industries. By holding shares of Sony, investors gain exposure to a global corporation that doesn’t depend on any single market.

If you’re ready to invest: find the right broker, fund your account, and place your trades.

If you’re not ready yet: study financial and technical analysis to find the estimated value of Sony's shares.

Frequently Asked Questions

-

While a P/E ratio of 34.02 may look high, some companies trade at even higher multiples. Investors should compare Sony’s P/E with its competitors and with the median for the sector. P/E is also just one fundamental measure among many.

-

Any company can go bankrupt, and while Sony may be in no more imminent danger than any other company, it’s always a good idea to diversify your investments across different stocks in different sectors.

-

Diversification cannot protect a portfolio from wide-ranging systemic risks such as the COVID-19 pandemic that caused all markets to decline at the same time. Consider investing in uncorrelated assets, which could even include commodities such as gold.

-

Technical analysis uses historical price data to predict future market moves, and it is more suitable for short-term trading than long-term investing. Some investors do use technical analysis to interpret continuation patterns in a rising market and to time their additional purchases. However, fundamental analysis is the preferred method for investing in the stock market.

-

The cash cow of Sony's activities is the gaming division. Because of the restrictions caused by the COVID-19 pandemic, people spent more time indoors, so Sony stocks acted just like the rest of the tech sector: at first declining then bouncing back strongly.

-

Most likely. Sony has a long dividend-paying history stretching back to the 1980s, and it didn’t stop paying dividends during the pandemic. It is fair to assume that the management will reward shareholders' trust by maintaining its dividend-paying policy.