How to buy Nike stocks in 2024

There could be no more suitable organization than Nike to bear that name of the Greek goddess of success. From a modest beginning in Oregon, Nike has grown to be a global brand with 1,026 retail stores around the world.

Nike is the world's leading supplier of athletic shoes and apparel, and a major manufacturer of sports equipment. In the last 10 years, the company has amassed $306bn in revenues, outperforming its peers by a wide margin. Nike is the world's most valuable apparel brand, with a valuation of $39.1bn.

Nike went public in 1980 and trades on the New York Stock Exchange under the ticker symbol, NKE.

This guide shows you how (and why) to buy Nike stock after taking various technical analyses and fundamental factors into consideration.

How to Buy NKE Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Nike Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need To Know About Nike

We begin by giving you a brief overview of Nike as a company, by looking at the company’s history, business models, strategy, how it generates revenue, and what its financial performance has been in the past five years. It should help you make sound investment decisions about the company's shares.

Nike History

Nike is the brainchild of Bill Bowerman, a track-and-field coach at the University of Oregon, and his former student Phil Knight. The company started as Blue Ribbon Sports in 1964, opening its first retail outlet in 1966.

Bowerman and Knight launched the Nike brand shoe in 1972, and renamed the company Nike, Inc., in 1978 following the success of the shoe. The company is the world's largest supplier of athletic shoes and apparel and a major manufacturer of sports equipment. Due to its association with success in sport, the Nike brand has become a status symbol in modern urban fashion.

The company is headquartered near Beaverton, Oregon. As of 2020, it has about 76,700 employees worldwide. Last year, Nike was valued at more than $32 billion, making it the most valuable brand among sports businesses. Nike went public in 1980 on the New York Stock Exchange under the ticker symbol NKE.

What is Nike’s Strategy?

Nike has a mass-market business model with no significant differentiation between customers. The company targets consumers who are interested in athletic footwear, apparel, and sports equipment. Nike relies on quality, innovation, and brand status to market its products to customers across different age groups and social categories.

Brick-and-mortar stores make up a bulk of the company’s sales, especially the Nike-branded stores. The company has an extensive sales network, with more than a thousand physical stores around the world.

However, due to the COVID-19 pandemic, Nike has been navigating towards e-commerce. Its e-commerce business serves more than 45 countries and is on track to account for at least 50% of sales in the coming years.

Nike is also investing more in digitally-driven sales options. It recently launched the popular SNKRS app to increase online sales. This move should trim the company’s operational cost in the long term by reducing its reliance on third-party partners and reaching younger consumers directly. Nike is already testing new live streaming formats that are already popular in Asia.

How Does Nike Make Money?

Nike makes money primarily by selling footwear via wholesalers that distribute the Nike brands across the globe. The company generated an income of $2.54 bn from a revenue of $35.53bn in 2020. Nike’s footwear segment remains the company’s most profitable, and it continues to show strong growth. The segment accounted for 66% ($23.3bn) of the company’s revenue in 2020. Nike’s apparel segment is the company’s second-largest, generating approximately $11bn in revenue worldwide. Sales from the equipment segment generated the least revenue in the company.

North America is the company’s core market. The region generated 40.7% of the company’s total revenue with gross sales of $14.48bn. Europe, Middle East & Africa is the company’s second-largest market whereas the Asia Pacific and Latin America region — which accounted for 14% of the company’s total revenue — is the smallest. Nike is supplied by about 127 footwear factories located in 15 countries, all outside the United States.

How Has Nike Performed in Recent Years?

As the chart shows, Nike shares appreciated by 223.4% in the five years to May 2021. Between mid-2016 and mid-2017, the stock underperformed, with the share price consistently hitting the resistance range of $57 to $59. However, from October 2017 when the stock broke resistance at $59.08, Nike has been on an upward trajectory, suffering only minor setbacks on the way.

In March 2020, Nike shares slipped to their lowest level in two years due to the pandemic, and the stock hit $67.45. The stock then rallied by almost 100%.

As the economy reopens and vaccination numbers continue to tick upwards, stocks such as Nike should benefit from consumer spending driven by stimulus, high savings level, and pent-up consumer demand. The share price is expected to trend higher till the end of 2021 year given its impressive results from the first quarter.

Where Can You Buy Nike Stock?

There are a few ways to purchase Nike stocks.

You can decide to purchase the shares through a broker or go down the Direct Stock Purchase Plan (DSPP) route instead, both of which give you part ownership of the company and make you eligible for dividends.

Nike’s DSPP has initial set-up fees of at least $10 and requires an initial investment of $500. You also have the option of setting up an ongoing automatic investment of at least $50. You are allowed to lower your automatic investment amount after you reach the $500 threshold.

You can also trade the derivatives on Nike stocks. Derivatives are financial securities that derive their value from an underlying asset (Nike in this case). For example, you can trade Nike CFDs via any of the online CFD brokers that offer them. However, CFDs do not give you any ownership claim.

Nike Fundamental Analysis

Fundamental analysis is a method of evaluating an asset to know its true value. It is a means of ascertaining the intrinsic value of a security (i.e., a stock). Fundamental analysis takes a holistic look at the stock because it considers all factors that can affect the stock’s value. Fundamental analysis aims to compare the stock’s market price with its intrinsic value to determine if it is undervalued or overvalued.

Fundamental analysis includes macroeconomic factors, such as the state of the economy and industry conditions, and microeconomic factors, like the effectiveness of the company's management. Analysts look at the overall economic condition and the strength of the specific industry before concentrating on individual company performance to arrive at a fair market value for the stock.

Analysts use certain metrics to conduct fundamental analysis of a stock. Those metrics include P/E ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow.

Nike’s Revenue

In 2020, Nike’s global revenue amounted to about 37.4 billion US dollars. North America remains the company's biggest market, accounting for 39% of the revenue generated within that period. The footwear segment is the most profitable unit in Nike. Footwear generated $23.3bn for the company compared with $10.9bn for apparel. Revenue generated from the sale of equipment was about $1.28bn.

The impressive results posted in 2020 continued into the next fiscal year, and Nike had an impressive Q1 2021. The company reported a net income of $1.45 billion. Total sales rose to $10.36 billion from $10.1 billion a year earlier, though the figure fell short of analysts’ expectation of $11.02 billion.

Nike’s direct-to-consumer business grew 20% year over year, to $4 billion. Online sales grew by 59%. The company said it booked over $1 billion in sales online in North America for the first time.

Source: Yahoo! Finance

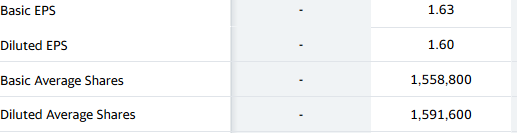

Nike’s Earnings-per-Share

Earnings-per-share (EPS) helps financial analysts and investors weigh a company’s financial strength. It is considered to be one of the most important variables in determining the value of the stock.

Many investors still look to EPS as a gauge of a company's profitability. EPS is calculated by dividing the company's profit by the total number of outstanding shares of its common stock. A higher EPS means a company is profitable enough to pay out more money to its shareholders. Investors who don’t want to calculate the ratio by themselves can find it on financial websites like Yahoo! Finance and major brokers’ websites.

For the 2020 fiscal year, Nike’s basic EPS was $1.63 per share, while the diluted figure was $1.60 per share.

Source: Yahoo! Finance

Nike’s P/E Ratio

The price-to-earnings ratio (P/E) is another metric widely used by fundamental analysts and investors to determine the value of a stock as compared to the company's earnings.

The P/E shows what the market is willing to pay today for a stock based on its earnings. A high P/E could mean that a stock's price is high relative to earnings and is possibly overvalued. It indicates that investors are expecting higher earnings growth in the future, so they are willing to pay a higher share price today. Conversely, a low P/E might indicate that the current stock price is low relative to earnings and is possibly undervalued.

Growth stocks like technology companies usually have a high P/E because investors are expecting higher future returns. This is unlike value stocks that have a lower P/E ratio because investors are not willing to pay a higher share price today for future earnings.

Nike’s P/E ratio at the time of writing is 83.42, calculated by dividing its price by its earnings-per-share (133.47/1.63 = 83.42). This implies that investors are willing to pay $83.42 for every $1 Nike earns per annum. In other words, they are willing to wait for more than 83 years to recoup their investment if the company continues earning at that rate.

Nike’s Dividend Yield

The dividend yield (expressed as a percentage) is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Also referred to as dividend-price ratio (when expressed in ratio), the dividend yield is calculated by dividing the dividend-per-share by the price per share. It can then be multiplied by 100 to get the percentage yield.

Dividend yields are inversely related to the stock price. When the price of a stock rises, its dividend yield falls and vice versa. This is why the dividend yield of beaten-down stocks often looks unusually high.

New companies that are small and growing quickly pay a lower dividend than mature companies in the same sectors. Established companies that are not growing very quickly pay the highest dividend yields. Consumer non-cyclical companies that sell staple items or utilities are examples of entire sectors that pay the highest average yield.

Nike paid an annual dividend of $1.10 per share for the 2020 fiscal year, so the dividend yield would be calculated as (1.1/133.47) x 100 = 0.82%.

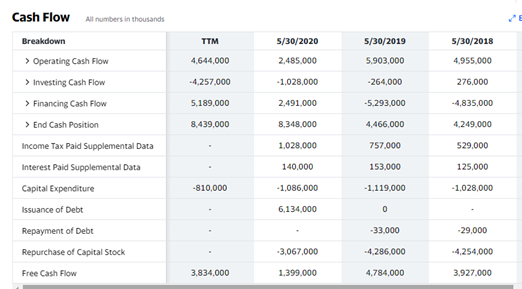

Nike’s Cash Flow

Cash flow is the increase or decrease in the amount of money a company has. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given period. The cash flow statement measures how well a company manages its cash position; in other words, how well the company generates cash to pay its debt obligations and fund its operating expenses.

The cash flow statement allows investors to understand how a company's operations are running, where its money is coming from, and how money is being spent. According to its 2020 fiscal report, Nike had a free cash flow of $3.83bn as shown in the image below.

Source: Yahoo! Finance

Why Buy Nike Stocks?

After a gloomy 2020, which saw sales plunge by 40% in the second quarter, Nike has seen an uptick in sales. Boosted by the COVID-19 vaccine and reopening of the economy, Nike is one of the retail stocks that should benefit from increased summer spending. The company is also leveraging its online platform to further push sales, thereby accommodating the change in shopping patterns brought about by the pandemic. Here are some reasons why you should buy Nike shares

- Nike is part of the reopening play in the stock market

- It is a trusted brand with an impressive business model and extensive product portfolio

- It is the market leader in sports apparel and footwear

- It regularly pays dividends

- It should see a boost in sales as sporting events return

Expert Tip on Buying Nike Stock

“ Sports is making a comeback this year, with major sporting events such as the NFL and NBA already in season and the Olympics scheduled for August. Also, there is a lot of pent-up consumer demand driven by a very high savings level. Therefore, it could be a good time to buy and hold a Nike position while accumulating more shares on the dips. ”- willfenton

5 Things to Consider Before You Buy Nike Stock

Before you make an investment decision, there are certain things you should take into account. Here are five of them.

1. Understand the Company

Understanding the company entails knowing its business, how it generates revenues, and who its competitors are. You can also understand a business by looking at its management and what ideology it embraces.

Legendary investor Peter Lynch was a strong advocate of investing in companies you know; he believed that you can form reasonable expectations about a company’s future by familiarizing yourself thoroughly with it. Warren Buffett is also known to use this approach; his “circle of competence” concept encourages investors to focus on areas they knew best.

However well you think you understand a company, be sure to study the fundamentals before you invest.

2. Understand the Basics of Investing

The world of investing offers a seemingly endless number of assets and opportunities. As such, it is easy to get lost in the euphoria of investing. But investing goes beyond buying an asset and waiting for its value to rise.

Understanding the basics of investing is similar to learning a new language. The good news is that once mastered, you will have a better understanding of how to invest your money.

There are a lot of factors that make a good investment strategy. Risk management, investment portfolio diversification, fundamental analysis, and technical analysis are some of the basics you need to know before investing.

3. Carefully Choose Your Broker

Your broker should be an organization with the capacity to meet your investment objective and preserve your capital. If you choose the wrong broker, it could affect the growth of your portfolio. Generally, things you should look out for in a broker include security, regulation by relevant authorities, access to exchanges, and payment options.

You may decide to go for a free brokerage or paid brokerage. If you are a small retail investor, a free brokerage would suit your needs since you won't incur huge transaction costs. However, if you have huge capital, it may be better to seek the services of a professional broker that offers investment advice.

4. Decide How Much You Want to Invest

There are a variety of ways to decide how much you want to invest in a particular stock.

You can invest as a percentage of your portfolio, with the general rule of thumb being not to invest more than 2% of your portfolio in any single stock. You can also invest a specified amount in the stock; e.g., $1000 worth of Nike stock. Alternatively, you can decide to enter the market at intervals such as during corrections and dips, or by averaging up or down on the cost of the share over time.

The key is never to invest any amount you cannot afford to lose.

5. Decide on a Goal for Your Investment

Your investment goal helps to clarify your aim of investing in a particular stock.

Why are you investing in this particular stock? Is it to hold for the long term or the short term? Are you buying the shares because you like the company or have noticed an opportunity in the stock that you want to take advantage of? These are the sorts of questions you need to answer before investing in a stock.

Maybe you’re buying the stock for your retirement or to fund your child's college education. It is always appropriate to clarify the reason why you are investing in a particular stock because this helps you to sit tight and stick with your initial plans despite the day-to-day noise in the market.

The Bottom Line on Buying Nike Stocks

In summary, Nike is a global company that continues to dominate the sportswear market. It controlled 27.4% of the sports footwear and apparel market in 2019, and the company continues to innovate and improve the quality of its products. Nike has been profitable and has consistently increased its dividends payouts for a decade despite a recession and a global pandemic.

To invest in Nike shares right now, all you need is to sign up for a stockbroker’s stock trading account, fund your brokerage account, select Nike from its categorized list of stocks, and place a market order or a limit order to buy the stock. Or, invest via the Nike Direct Shares Purchase Program (DSPP).

If you find yourself not ready to invest right now, you can continue to study the company and read our other educational materials.

Frequently Asked Questions

-

Nike is primarily listed on the New York Stock Exchange (NYSE). However, the stock also trades on the London Stock Exchange and Deutsche Börse Xetra. So, the stock can be bought from any of those exchanges.

-

You can buy Nike shares from any broker that has access to the NYSE or any of its acceptable partners in your country. If you like, you can also use Nike’s DSPP option.

-

Nike is a very good company. Its shares have returned over 230% in the last five years (at the time of writing) and the company is adapting to the world of e-shopping.

-

Yes, Nike pays dividends. For the 2020 FY, the company paid dividends of $1.10 per share. It has grown its dividend for 10 consecutive years, increasing its dividend by an average of 10.93% each year. By estimation, Nike pays out 59.46% of its earnings out as a dividend.

-

Yes, Nike is a profitable company. In 2020, the company generated an income of $2.54 bn from a revenue of $35.53 bn, despite the pandemic.

-

Technical analysis may be beneficial before buying, to fine-tune the timing of your purchase. However, you must do a fundamental analysis first to be sure that the company is in good financial health. Fundamental analysis tells you whether a company is good for investment, while technical analysis tells you the right time to hit the buy button.