Top 4 aggregates and building materials stocks to buy amid US infrastructure spending plans

US infrastructure spending plans favor investing in aggregates and building materials stocks such as Boise Cascade, Eagle Materials, GMS, and Louisiana-Pacific.

At the end of last year, the US administration announced a huge infrastructure spending plan. It will focus on funding for roads and bridges, money for transit and rail, broadband upgrade, airports, ports, and waterways upgrade – to name a few.

So what aggregates and building materials stocks to buy to make the most of US spending plans? Here are four names to consider: Boise Cascade, Eagle Materials, GMS, and Louisiana-Pacific.

Boise Cascade

Boise Cascade (NYSE:BCC) is based in Boise, Idaho. It manufactures wood products and also distributes building materials, and its stock price gained +28.31% in the past twelve months.

Boise pays a quarterly dividend and it increased it for the past four consecutive years. The company increased its YoY revenue by 44.77%, higher than the sector median by 195.28%.

Eagle Materials

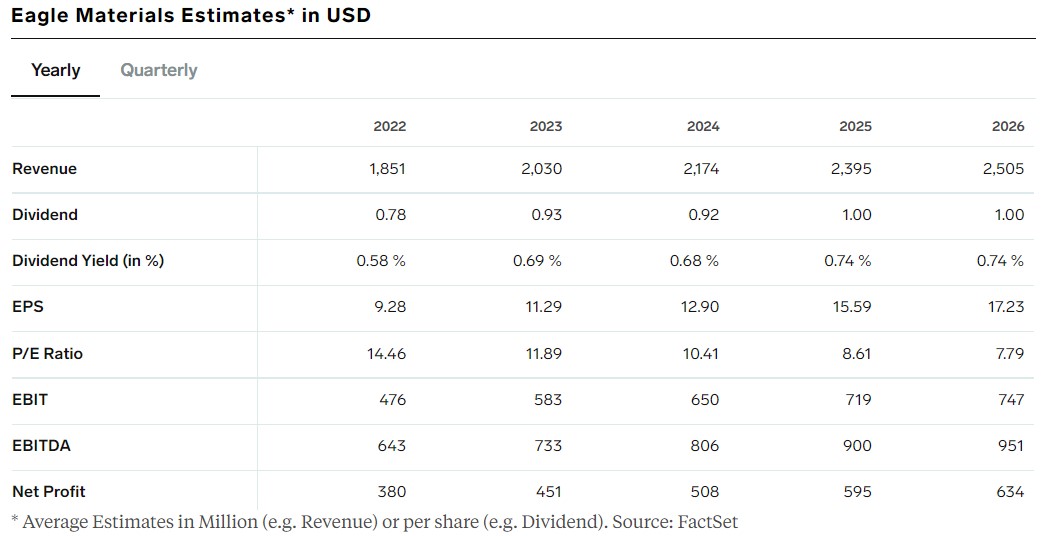

Eagle Materials (NYSE:EXP) provides heavy construction materials and light building materials. Its revenue is estimated to reach $1.851 billion in 2022 and to grow to $2.5 billion by 2026.

Just like Boise, Eagle Materials pays a dividend too. The dividend yield is 0.78% in 2022, forecast to increase to 1% by 2026.

Eagle Materials’ stock price has been upgraded by buy at Northcoast in January this year, with a price target of $193/share. Out of the 17 analysts following the stock price, 16 have issued buy ratings, and only one has a neutral rating. No analyst has a sell recommendation.

GMS

GMS (NYSE:GMS) makes wallboards and complementary building products and it is based in Tucker, Georgia. The company operated with a gross profit margin for the past 12 months of 32.11%, higher than the sector median by 10.01%.

GMS does not pay a dividend, and the stock price advanced 28.07% in the past year. YoY revenue growth exceeds the sector median by 139.83%.

Louisiana-Pacific

Louisiana-Pacific (NYSE:LPX) is based in Nashville, Tennessee, and it serves the outdoor structure market. Its gross profit margin exceeded the sector median by 50.11% in the past 12 months, and it pays a quarterly dividend; the dividend payout ratio is 4.91%, and the forward dividend yield is 1.37%.