2 reasons to buy US stocks despite the ugly price action

US stocks are on track for one of the worse years in history. With 6.5 months to go this year, is it safe to buy stocks here in the hope of a rebound?

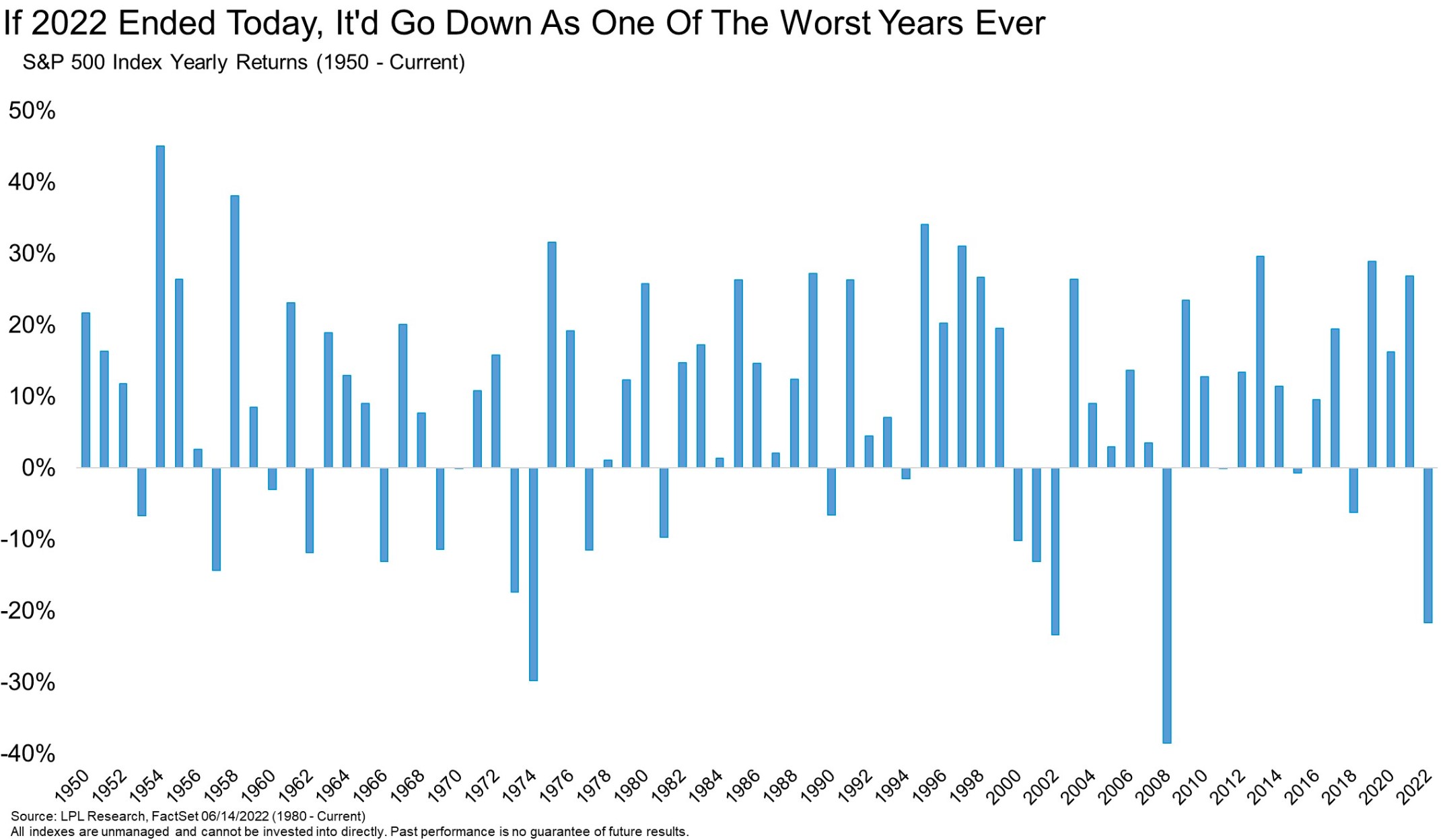

As central banks have started a global tightening race, equity markets are under pressure. In the United States, the largest equity market in the world, the S&P 500 is on track to deliver one of the worse returns ever.

Down over 20% YTD, the S&P 500 finished the year with such performance only three times in the past. This year could be the fourth, but we are not there yet. After all, there are still 6.5 months ahead of us until the end of the trading year, so one should not rule out a bounce.

So here are two reasons why stocks look attractive down here:

- A lot of bad news is priced in already

- The technical analysis reveals a falling wedge pattern

A lot of bad news is priced in already

As mentioned above, only three years since 1950 delivered a worse result than -20% for the S&P 500. If one is looking for an explanation for why stocks underdelivered so far in the trading year, plenty of reasons are there.

For instance, rampant inflation led to the Fed tightening financial conditions. The Fed has three key policy tools: forward guidance, interest rates, and the balance sheet.

It is now using all three at once in its fight against inflation. And in the same direction – tightening. Hence, stocks had a hard time advancing.

So why would stocks turn around now that the Fed prepares to hike some more over the summer? One explanation is that a lot of bad news is already priced in.

A recent Bank of America Global Fund Manager Survey revealed that optimism about global growth is at an all-time low. It is even lower than it was during the last two crises (i.e., the COVID-19 pandemic and the Great Financial Crisis of 2008-2009). Therefore, a lot of bad news might already be priced in.

Possible falling wedge pattern hints at a reversal

A falling wedge pattern is visible on the daily chart. While bearish while inside the wedge, the price action might suddenly change if the market climbs back above 4,000.

At that level, the upper edge of the pattern would be broken, and traders would likely push the market towards the pivotal 4,200 area. A close above invalidates the bearish scenario and puts bulls back in control.