4 large cap stocks to buy ahead of their quarterly earnings

The week ahead is full of large cap stocks reporting their financial performance for the last quarter. Here are four names to watch: Target, Snowflake, Kroger, and Salesforce.

The conflict in Ukraine may have stolen all the headlines recently, but investors should also pay attention to the ongoing earnings season. Many large cap companies report their quarterly earnings this week, such as Target, Snowflake, Kroger, and Salesforce.

A large cap stock, also known as a big cap, is a stock that has a market capitalization bigger than $10 billion. Market capitalization is calculated by multiplying the price/share with the number of outstanding shares.

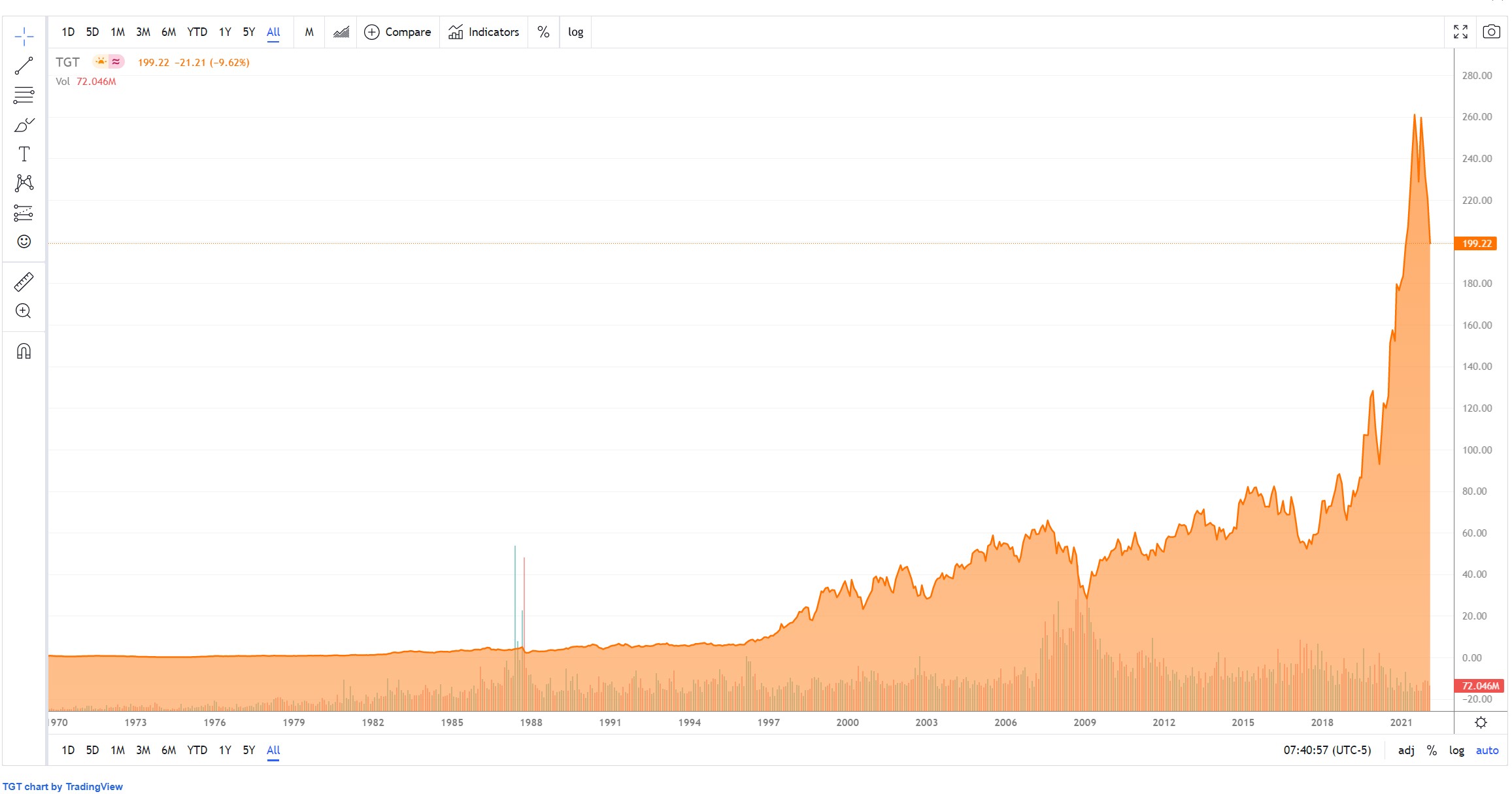

Target

Target (NYSE:TGT) presents its quarterly earnings on Wednesday, March 1. Investors expect EPS of $2.85 on the quarter, and the company delivered better than expected EPS for the past 12 consecutive quarters.

Target is one of the longest dividend-paying companies in the United States. It grew its annual dividend for the past 53 years, and the forward dividend yield is 1.81%. The stock price is down -13.92% YTD.

Snowflake

Snowflake (NYSE:SNOW) is an American IT company providing cloud-based data platforms. It reports the financial performance for the past quarter on March 2, and investors expect EPS of $0.3 on the quarter. If it delivers as expected, this would be the second consecutive positive quarter for Snowflake.

The company operates with a gross profit margin for the past twelve months of 60.32% and is valued at $82.52 billion at the current market price.

Kroger

Kroger (NYSE:KR) is one of the oldest US retailers, and it reports its quarterly earnings on March 3. Investors expect EPS of $0.73 on the quarter, and the annual revenue estimate for the fiscal period ending January 2023 is $139.57 billion.

Kroger’s stock price is up +43.35% in the past twelve months.

Salesforce

Salesforce (NYSE:CRM) reports its quarterly earnings on March 1, at 02:00 PM PT. Investors expect EPS of $0.75 on the quarter, in line with the same period last year.

Salesforce is an American IT company developing cloud computing solutions and providing customer relationship management software worldwide. It operates with a gross profit margin of 72.02% in the last twelve months, and the stock price is down -18.12% this year.