Best 4 US mid-cap stocks to buy for portfolio diversification

Mid-cap stocks offer diversification benefits to a portfolio dedicated to large-cap stocks only. So what are the best mid-cap stocks to buy?

Mid-cap stocks are often viewed are promising companies in the middle of their growth phase. For this reason, investors often favor mid-cap stocks instead of large-cap ones. Also, mid-cap stocks offer diversification benefits to a portfolio by balancing growth and stability.

So here are four US mid-cap stocks to buy for portfolio diversification: Palo Alto Networks, Pioneer Natural Resources, Datadog, and Corteva.

Palo Alto Networks

Palo Alto Networks (NASDAQ:PANW) is an IT company from Santa Clara, California. The stock price outperformed the market in the past twelve months and YTD, rising by +86.66% in the past twelve months.

Pioneer Natural Resources

Pioneer Natural Resources (NYSE:PXD) operates in the oil and gas exploration and production industry. It is based in Irvin, Texas, and was founded in 1997.

With the price of oil trading comfortably above $100/barrel, oil companies’ profit margins are expected to improve. This was also true in the past twelve months, as the price of oil rallied from trading below zero in 2020 to above $100 in 2022.

The stock price delivered +36.35% YTD.

Datadog

Datadog (NASDAQ:DDOG) is an IT company from New York, founded in 2010. The stock price gained more than 70% in the last twelve months and the company operates with a gross profit margin of 77.26%, higher than the sector median by 57.23%.

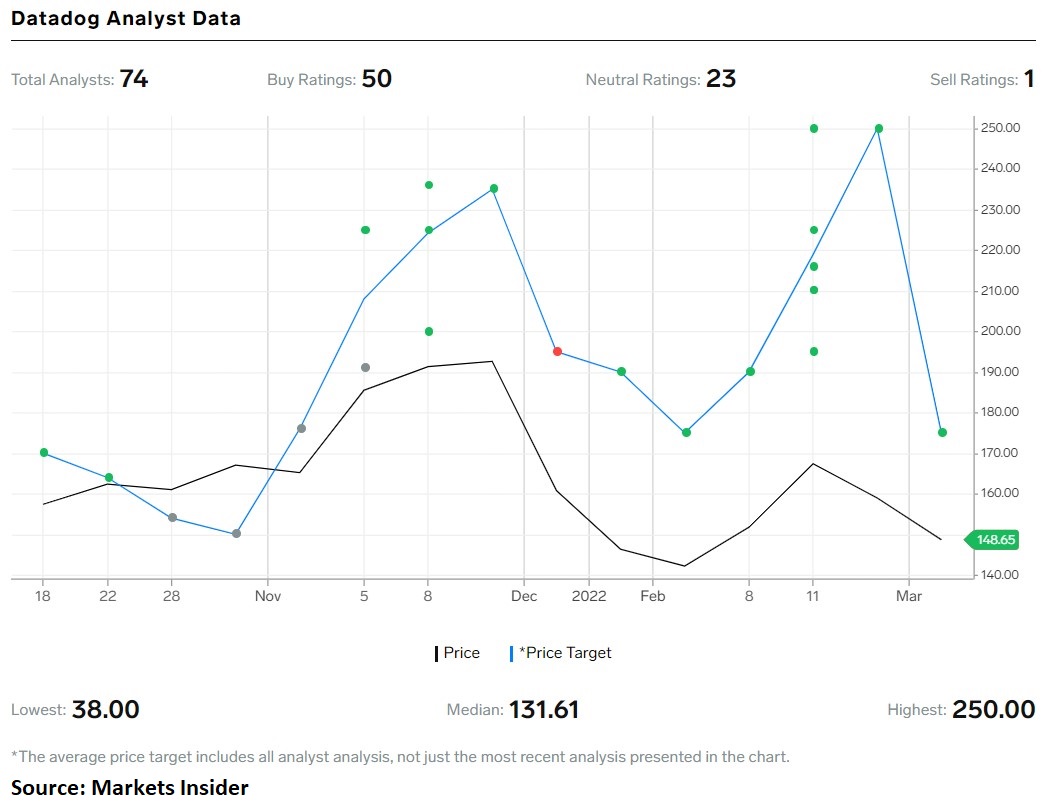

As a tech company, it provides services to the cloud industry and most analysts have a buy recommendation for Datadog’s stock price. Out of the 74 analysts covering the stock, only 1 analyst has a sell recommendation. Moreover, 50 have a buy recommendation and the rest a neutral one.

Corteva

Corteva (NYSE:CTVA) operates in the fertilizers and agricultural chemicals industry and the rise in food prices as well as in fertilizers prices should improve the company’s operating margins. Corteva’s gross profit margin for the past twelve months is already above the sector median by about 38.38%.

Corteva’s stock price has outperformed the market YTD, delivering a positive return of 22.41%.