Should you buy Airbnb stocks ahead of the 2021 full-year earnings call?

Airbnb investors get ready for the full-year financial performance release scheduled for Tuesday, February 15, during post-market hours. The market expects EPS of $0.04 on the quarter.

Airbnb is set to announce its Q4 and full-year 2021 results tomorrow. Headquartered in San Francisco, California, Airbnb employs over 5,000 people, and its financial performance was severely affected by the COVID-19 pandemic.

Travel restrictions and lockdowns impacted Airbnb’s revenues initially, but in time consumers appreciated the business model as offering more privacy than the classic hotel industry. For Q4 2021, investors expect EPS of $0.04, following $1.22 in the previous quarter. If Airbnb delivers, this would be the second consecutive quarter with positive earnings.

Perhaps more important than the actual earnings will be management’s forward guidance. The industry is changing just like consumer behavior did, and the new guidance might easily move the stock price.

How did Airbnb stock price perform lately?

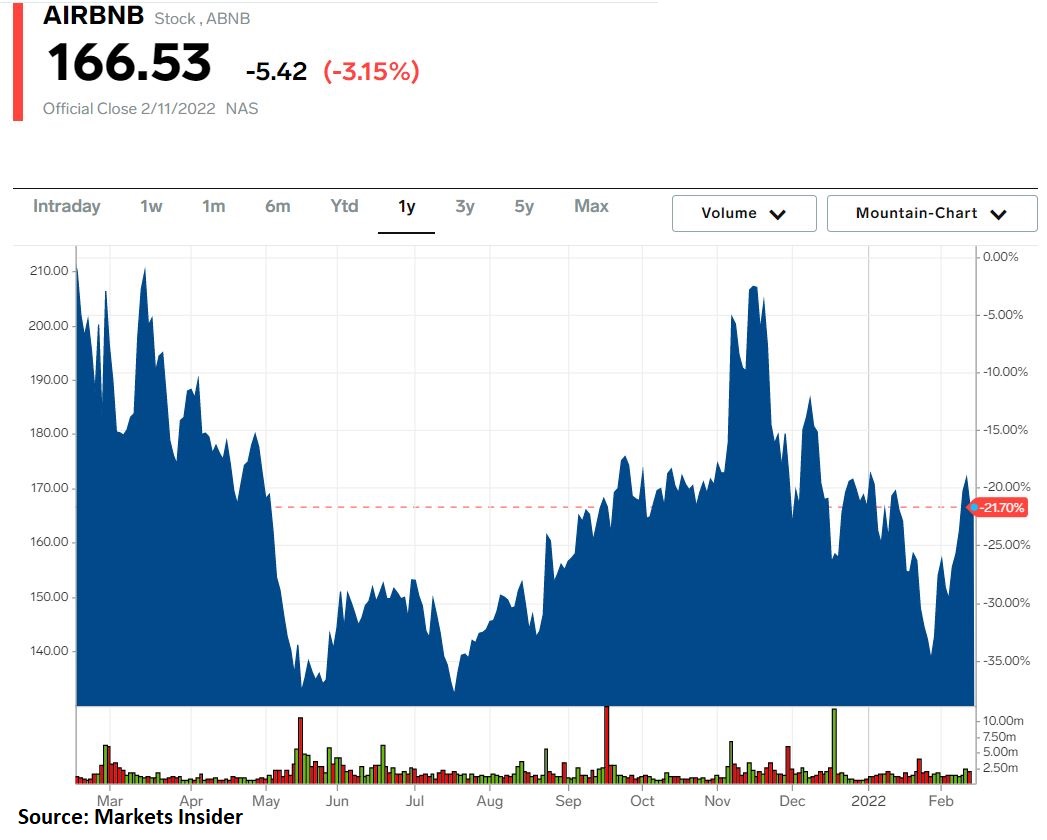

The stock price has been down more than 20% in the last twelve months. This is a company that does not pay a dividend and, since its IPO a couple of years ago, it topped at $200/share.

Airbnb operates with a gross profit margin of 79.88%, higher than the sector median by 123.14%, and its revenue growth YoY is also much higher than the sector median – 46.7% vs. 22.10%.

What do analysts say about the Airbnb stock price?

Analysts are mostly bullish on the Airbnb stock price. Out of the 58 analysts covering the stock, 31 have issued buy ratings, and 26 have neutral ones. Only one analyst has a sell recommendation.

One week ago, Airbnb was downgraded to hold at BTIG Research. On the other hand, Morgan Stanley maintained its buy rating for the Airbnb stock price with a price target of $160.

How about valuations?

Airbnb has a market capitalization of $104.28 billion and an enterprise value of $98.79 billion at the current stock market price. The price/sales ratio for the last twelve months is much higher than the sector median (17.07 vs. 1.06), and the stock trades at a P/E ratio of 165.24.

In other words, investors are willing to pay a hefty price to own the stock.