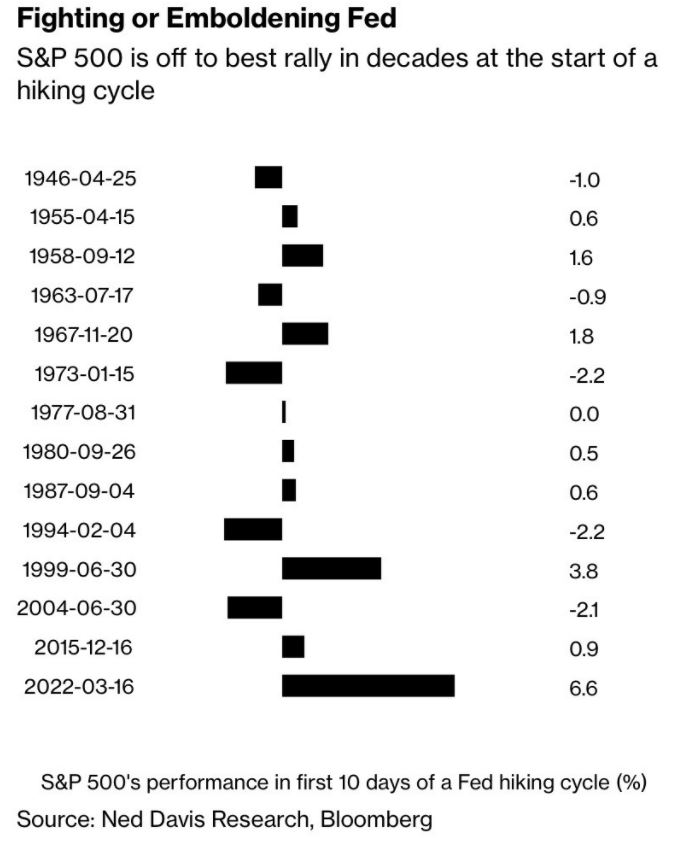

S&P 500 gained 6% since the Fed raised rates: is it time to sell?

S&P 500 rallied since the Fed raised the federal funds rate. As the Fed prepares to frontload rates, is it time to sell the index?

Following the first interest rate hike in what seems to be the start of a tightening cycle, the Fed’s Chair, Jerome Powell, did not reject the idea of delivering a 50bp hike at the Fed’s next meeting. Frontloading rates is something that the Fed would probably do in 2022, and yet the stock market keeps performing.

Triple bottom pattern points to more upside potential

The market formed a triple bottom pattern in the 4,100-4,200 area before bouncing, thus suggesting a bottom might be in place. The next level of interest is 4,600, and a daily close above the pivotal area points to further upside for the S&P 500 index.

4,600 might also act as the triple bottom’s neckline. If that is the case, the measured move is calculated by taking the distance from the triple bottom to the neckline and projecting it to the upside from the neckline. It suggests that the S&P 500 index can easily move another 500 points higher.

End of month flows and the NFP

This is a big week for the stock market for at least two reasons. First, on Thursday, the end of the month flows guarantee an increase in volatility. Thursday is the last trading day of the month, and the rally may prompt some investors to book some profits ahead of April.

Second, this is the Non-Farm Payrolls week. Every first Friday of a new month, investors monitor the NFP as an indicator of the US jobs market and of what the Fed might do next.

The Fed is hawkish and wants more rate hikes, but it remains data-dependent. Because job creation is part of the Fed’s mandate, the market react strongly to any deviations from the forecast.

All in all, the S&P 500 index remains bid despite higher inflation, higher rates, or war in Europe. Investors keep buying the dip, and a new attempt at the all-time highs should not be discarded.