Tales of a humbled investor, as DraftKings plunges 20% on earnings miss

Act I – March 2021

The date is 12th March 2021. It’s ten months since I bought stock in DraftKings ($DKNG), the US fantasy sports and betting company. I spring out of bed and open the portfolio app on my phone. To my delight, I’m greeted with the three most glorious words: all time high. DraftKings is trading at $74 and I’m up 3.4X from my original purchase at $22. I pull up a calculator, deciding to massage my ego a bit. What is a 3.4X return across ten months on an annualised basis? The calculator spews out 429%. That American guy Warren Buffett is famous for what, a 20% annualised return? Wow – i'm looking at 429%! I feel very clever. Maybe I can retire by the time I’m 30. Life is good.

The approximate timeline from my purchase ($22) to that March morning ($74), via MyStocksPortfolio

The approximate timeline from my purchase ($22) to that March morning ($74), via MyStocksPortfolio

Act II – Present Day

Present day. As I write this, DraftKings is trading at $17.52, down 76% from those March 2021 highs. How much profit did I take? Nothing, zero, nada, 0.

Like I did with the gains, I could also annualise the fall in percentage terms, but I’d be afraid my calculator would break. The stock market has a way of humbling you. $DKNG is a prime example of that.

And…the approximate fall from those delirious highs, to where we sit today ($17.52)

And…the approximate fall from those delirious highs, to where we sit today ($17.52)

The Thesis

-

Legalised Gambling

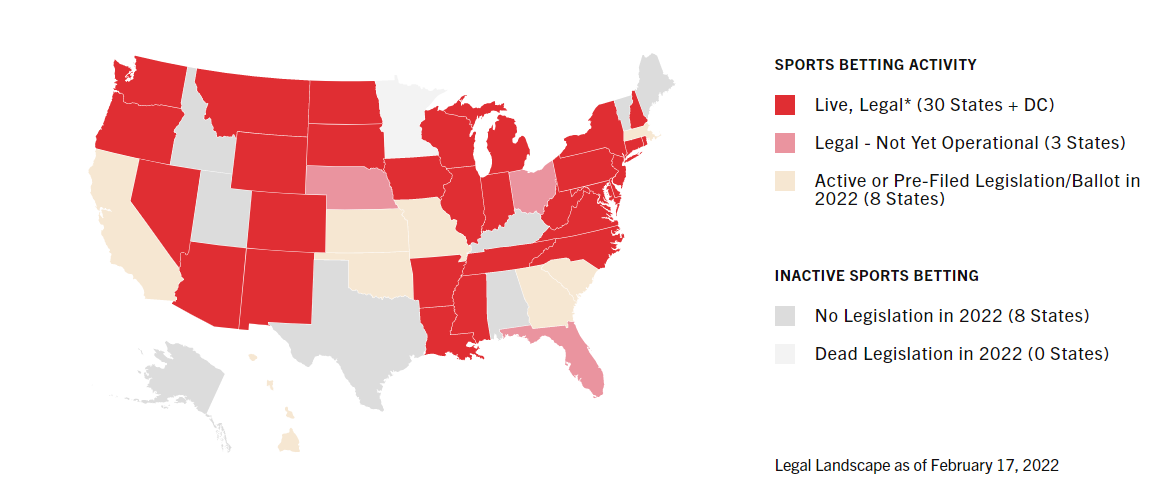

The thesis was simple. The most prominent reasoning was the swiftly-evolving gambling sector in the US. I thought there was simply too much potential tax revenue to be earned through the regulation of online gambling, which was largely illegal in the States. It’s a country which loves sports, betting and fantasy football – all of which DraftKings do. There were bills in the pipeline, with states eager to increase revenues amid the pandemic. Looking back now, I did get this part correct. States did begin to legalise gambling, and the DraftKings share price rocketed accordingly.

The betting landscape in America is a lot more open now that it was a couple years ago, via Americangaming.org

2. International Expansion

Secondly, DraftKings were primed to expand internationally, with Europe the most touted destination, where a whole new market would open up. I thought that its flagship product, daily fantasy sports (DFS), was perfect for Europe – and one that largely had never been seen on the continent before. DFS, to explain it briefly, is a game whereby you pick a fantasy team for one slate of games only (say, for example, the 3PM Premier League fixtures) and pay money to enter it into competitions. You could pay $20 to enter a tournament of up to 200,000 players, with the winner banking a million dollars (the much advertised “Milliy Maker”), or you could pay $5 to enter a fifty-person tournament where the top 25 double their money. The options are endless – you can even play private tournaments with your friends.

It differs from conventional fantasy sports in Europe (shout out to Mo Salah who I am giving the triple captaincy to this weekend – don’t let me down, my friend) in that it is not season long; the entertainment is over the course of one day or weekend, with the winner promptly decided and paid. Sitting down for an afternoon to watch football but don’t want to commit to 38 weeks of managing a fantasy team? It’s perfect. It combines the entertainment of conventional gambling with the “skill” of fantasy sports, as well as the personal satisfaction.

This may be cool, but I came fourth out of sixteen friends in my fantasy football league last year

This may be cool, but I came fourth out of sixteen friends in my fantasy football league last year

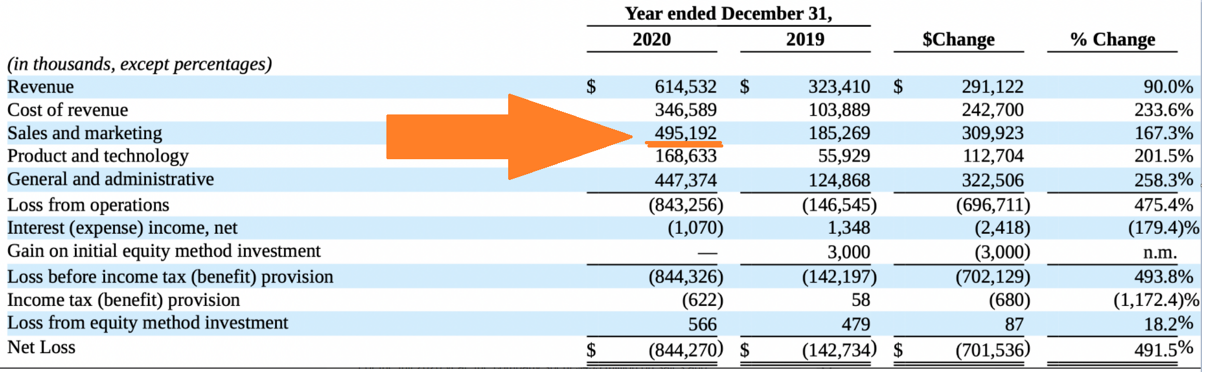

3. Marketing

Aggressive is the only word here. As gambling laws became more relaxed in the US, DraftKings went all-in. Spending a colossal $495 million on marketing in 2020, DraftKings voraciously pursued the potential new customers that opened up as gambling regulations loosened state-by-state. The DraftKings brand was plastered all over American sports broadcasts, podcasts and YouTube channels. Michael Jordan joined as a “special advisor to the board” (the share price promptly jumped 10%). And I was on board with the strategy, seeing it as an ambitious but logical approach.

DraftKings, Inc

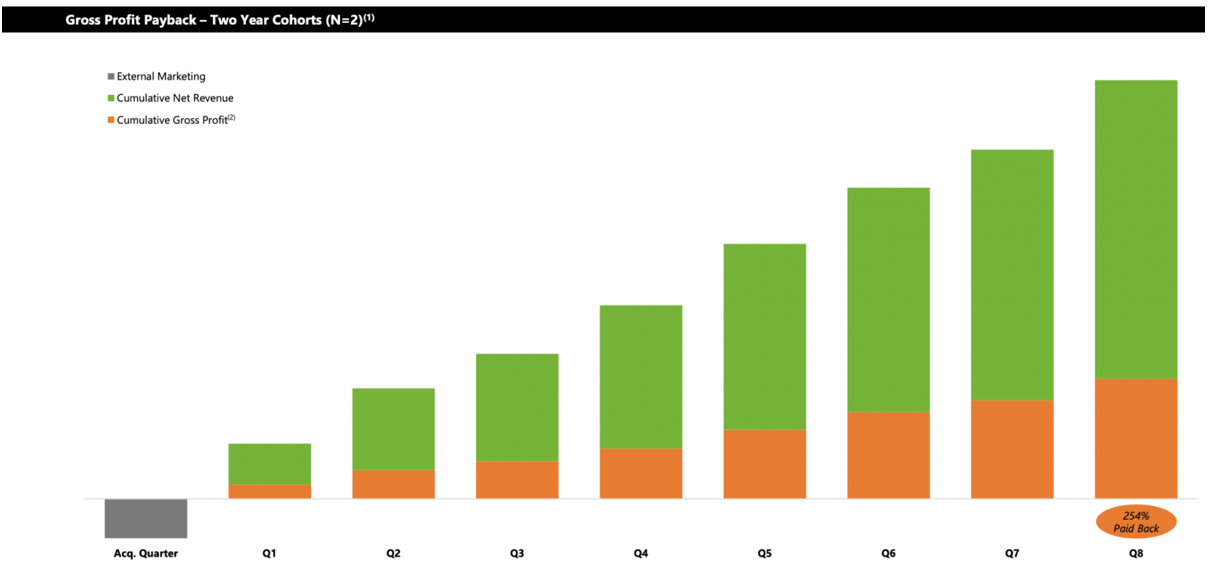

Hypothesising that new customers would be “sticky”, the logic behind the marketing spend was that it would be repaid quickly, as the graph from their 2020 financial statements below shows ever-so-tantalisingly. So the next year, DraftKings doubled their marketing spend, from the above $495 million in 2020 to nearly $1 billion in 2021.

DraftKings, Inc (via SeekingAlpha)

The Problems

They were staring me right in the face, but I chose to ignore them.

1. Path to Profit

So, yep. DraftKings is not profitable. Its a problem, admittedly, when a company doesn’t make money (see: the Tesla naysayers), but one that the young, "Robinhood" investors are repeatedly choosing to overlook – who needs to make a profit in today’s world, anyway? I chose to think the losses were temporary, for the reasons outlined above. In truth, I still think a path exists here (the company guided in earnings today that the fourth quarter of 2023 is when they expect to reach the promised land).

A net loss of $844 million in 2020 was followed by a $1.5 billion loss in 2021. Note, however, that this includes stock compensation which many tech companies exclude. Indeed, the practice of liberally adjusting EBITDA makes it unclear and hardly inspires confidence. But what matters in the short term is guidance vs reality, and this morning’s earnings call projected 2022 losses of $825 to $925 million, which are worryingly wide of the consensus forecast of $572 million, causing a 20% plunge as investors fled the stock.

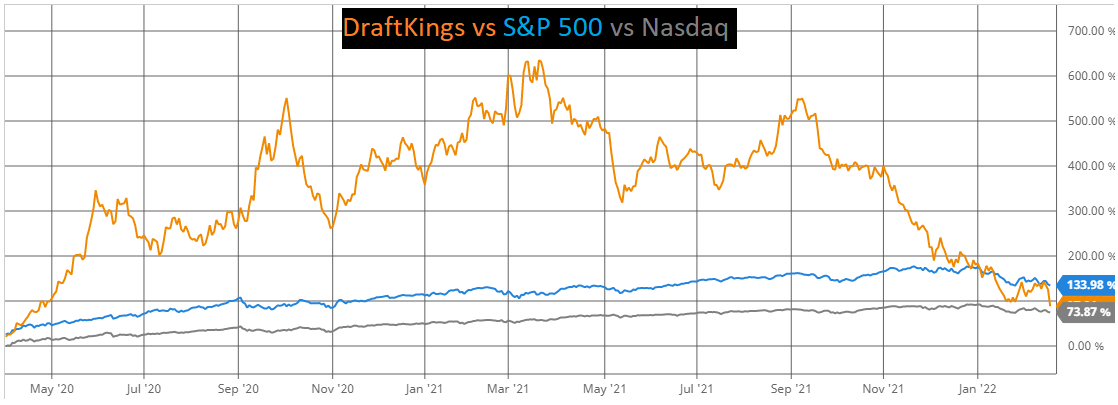

2. SPAC/Tech Hysteria

Going public in April 2020 via SPAC, DraftKings symbolises the hysteria of the early pandemic, when companies were going public via reverse-mergers more often than lockdowns were being announced. The macro climate then preceded to create the perfect storm for DraftKings, as the tech sector as a whole exploded amid the money printing and stay-at-home narratives of the early days of COVID.

This continued throughout 2020 and into early 2021, when Gamestop and AMC highlighted the craziness in the markets, with Elon Musk giving traders heart attacks every time he clicked “send tweet”. But what rockets up so violently must trickle slowly back down, and the tech sector has been hurting since– Nasdaq is down 14% YTD and the Fed has turned hawkish to allay fears of an overheating economy.

The rollercoaster ride, plotted against the S&P 500 and Nasdaq Via BarChart.com

Lessons

1. Profit Taking

Most importantly, the saga has been a lesson in profit taking. The bloated marketing budget, red profit numbers and wild swings of the stock should have been a warning to at least take some profit off the table and rebalance, once it was approaching a 4X from the initial investment. Diversification is a simple mantra that everyone knows, but it’s easier said than done. When every headline you read is kids in sweatpants making 100X returns on memecoins and stock options, hitting that sell button on a rocketing stock is a real test of willpower.

2. Halo Effect

It’s also a sobering example of the Halo Effect – when an investor’s opinion of a stock is biased due to positive experiences in using it. I’m a big fantasy sports guy and I have been an arbitrage trader on betting exchanges for many years, so I’m very familiar with the betting industry. Further, American sports are a passion of mine and I absolutely love playing DraftKings. Looking back, I let this affinity for the product cloud my judgement. It factored into my refusal to sell any of my holdings, but stock picking is often about placing your personal biases to one side.

DraftKings CEO Jason Robins was defiant in December when the stock plummeted to $13B. At least he owns a Bored Ape NFT, which should cheer him up (floor price currently 86 ETH = $241K)

What Now?

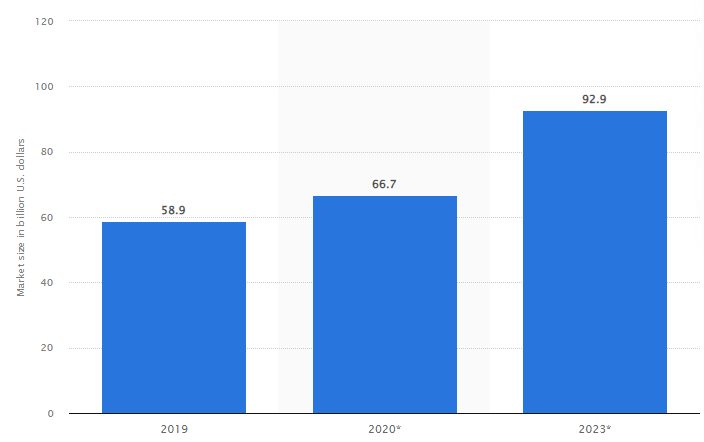

Well, I’m sticking to my guns. Sure, the news is grim everywhere you look – missing earnings, profits worsening, prominent short investors publicising large positions – not to mention the macro developments recently (Ukrainian tension, Fed tapering etc). But I believe we are at the point where DraftKings is too cheap. It remains a leading name in the betting industry in America; an industry where trust and brand value will hold immense value.

It’s also an industry which is still in its nascent stage and very much on the up. A market cap of $7.3 billion is a nice entry point for a leading stock in such a promising sector. However, it remains a high beta stock (5Y Monthly is at 2.01) so bear that in mind with allocation. But with the 20% crater today meaning it’s trading 76% off highs, the punishment doesn’t fit the crime.

The online gambling industry is forecast to hit $92 billion by 2023 via Statista

Then again, maybe I’m just stubborn. I love sports, numbers and playing fantasy. In assessing an individual stock, however, that’s not really helpful. As discussed above, if anything it’s a disadvantage. Additionally, given I’m 18% underwater on my additional investment, maybe there’s now some loss aversion bias; maybe I’m being influenced by the memories of that wonderful March morning when the stock was plodding along buoyantly at $74.

It reminds me of going to Manchester as a proud Newcastle fan in 2015. Against all odds, Newcastle took the lead in the first half, silencing the City stadium. For twenty-five minutes, 1-0 up against the best team in the league, I lived the dream. Life – like it was in May 2020 with that DraftKings all time high – was good. But then City scored six goals in twenty minutes (five via Sergio Aguero, who I incidentally removed from my fantasy team out of loyalty). Newcastle lost 6-1 and, to make matters worse, they ended the season by getting relegated.

But for those twenty-five minutes at 1-0 up, it was glorious. If only I could have cashed in my “fan” ticket then, sailed off into the sunset and never watched football again. Obviously, things don’t work that way. But for DraftKings, after the upward explosion and all the warning signs, I could have rebalanced. I could have taken profits. So let that questionably tangential anecdote serve as a lesson.

But that’s in the past, and all that matters is going forward – whether to buy or sell. So with DraftKings at $17.52, as a disgruntled underwater investor, in sickness and health, till death do us part, do I hold?

I do.