Top 3 reasons to invest in the stock market

There is always a reason to scare investors and drive them to pull money out of the stock market. Yet, staying invested for the long term has proven to be the right decision.

People’s attitude towards investing has always been challenged. Only in the last few years a pandemic and a war in Eastern Europe have scared investors away from the stock market.

But investing is a long-term commitment, or at least it should be. The problem is that most retail investors have short-term expectations and tend to pull their funds away, which, at least by looking at what happened in the last three decades, turned out to be a mistake. So here are three reasons to invest in the stock market in the long term:

- Investing in UK stocks in the last 33 years would have yielded 5.9% annually

- Stock market shocks do not scare investors away

- Inflation and low interest rates erode the value of money

5.9% annual growth rate for 33 years investing in UK stocks

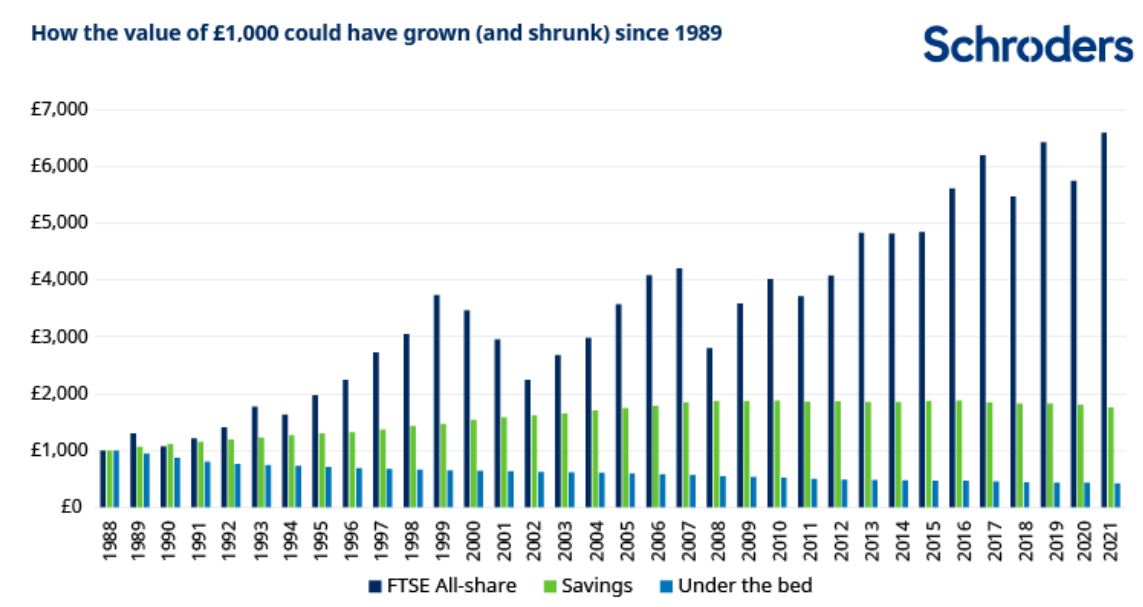

A study by Schroders shows that one thousand pounds invested in the UK stock market 33 years ago would have yielded 5.9% annual growth rate. By buying the FTSE All-Share index in 1989 and reinvesting the income, one thousand pounds would now be worth GBP 6,600.

Stock market shocks do not scare investors away

Recent years have shown us that stock market shocks do not scare investors away that easily. Sure enough, the initial shock of a recession leads to many selling their shares, but there is always someone else ready to buy the dip.

The most recent example comes from the COVID-19 pandemic. Even with the prospect of the global economy shutting down, many investors had faith and bought the stock market dip in what turned out to be the shortest bear market on record.

Inflation and low interest rates erode the value of money

The same study mentioned earlier shows that keeping the money “under the mattress” for the same period would have ended with a -2.6% annual growth rate. More precisely, inflation would have eaten more than half of the value of one thousand pounds in a little over more than three decades.