3 reasons to buy US stocks

US stocks tumbled after the Federal Reserve hiked the interest rate by 50bp this week. So is there any reason to buy stocks here?

On Wednesday, the Federal Reserve of the United States raised the interest rate by 50bp. A highly anticipated move, it was met with a stock market rally.

Somehow the market participants viewed the Fed’s decision as dovish relative to what was already priced in. Because the Fed announced a softer path to quantitative tightening, the market rallied on the day of the rate hike announcement.

But the rally did not last long. US stocks ended the week sharply lower when compared to where they closed on the day the Fed hiked, triggering worries that the weakness may continue in the weeks ahead.

While there are plenty of reasons to be bearish, here are some contrarian ones:

- Nasdaq 100 is at support

- “Markets In Turmoil” – a contrarian indicator with a perfect track record

- Valuations improved

Nasdaq 100 meets support

The technology sector was perhaps the most affected one this year. After ending 2021 at the highs, the Nasdaq 100 index dropped several thousand points.

In now met support in the 12,700 area, and a bounce above 14,000 would bring bulls back in control. In other words, while above 12,000 Nasdaq 100 remains bullish, and a move above 14,000 would trigger more strength.

CNBC ran its famous “Markets In Turmoil” headline

When stocks fall sharply, panic dominates. Investors sell their holdings on fears of more downside, and financial media runs doomsday headlines.

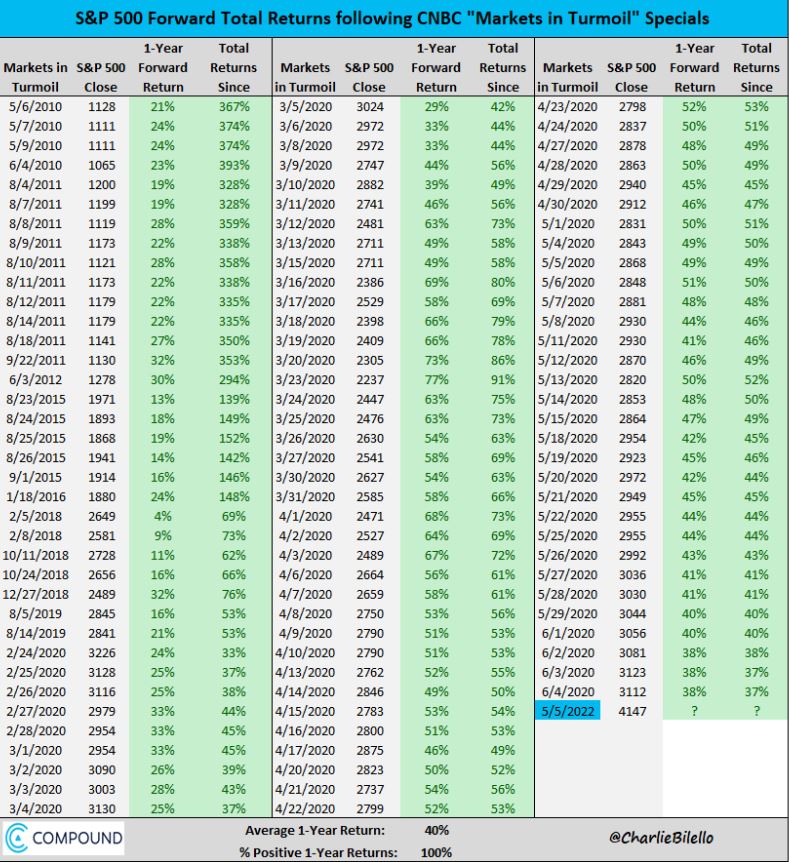

Such a headline is the now-famous “Markets In Turmoil” from CNBC. The financial television ran it on May 5, one day after the Federal Reserve delivered its FOMC Statement, at a time when the stock market reversed gains made in the aftermath of the Fed’s decision.

Only this is the perfect contrarian indicator.

Every time this headline ran on CNBC in the last 12 years, it was followed by a sharp stock market reversal. As such, the average 1-year return is 40%, and the percentage of 1-year returns is 100%.

In other words – this is the contrarian indicator with a perfect track record.

Valuations improved

During the COVID-19 pandemic, the stock market bounced from the initial dip and rose to record highs. The tech sector led other sectors, and valuations reached sky-high levels.

As such, the current correction offers better valuations for long-term investors. For instance, Microsoft is now a company generating $8.45/share in FCF (free cash flow) and has a growing revenue of 20%. In comparison, in 2019, revenues grew by only 15%, and Microsoft had $4.34/share trailing FCF.

To sum up, while the 2022 selloff might have scared many investors, such corrections are not unusual, and improved valuations may tempt those willing to buy the dip.