4 reasons to buy the Dax index despite the Russia-Ukraine war

Dax index hesitates at horizontal resistance, unable to break and hold above 14,800 points. Here are a few technical and fundamental reasons supporting a bullish case.

The war in Ukraine follows the unprecedented monetary and fiscal stimulus measures triggered by the COVID-19 pandemic. As such, the supply bottlenecks generated by the pandemic were amplified by the sanctions imposed by the Western nations on Russia.

A direct consequence of both the pandemic and the war in Eastern Europe is a rise in the price of goods and services. Inflation levels differ throughout the developed world, but they nevertheless reached decades high numbers.

The stock markets in advanced economies recovered most of the ground lost since December 2021, but there is scope for more. European indexes look particularly interesting because of the low interest rates and the ECB’s position.

Out of all the European indexes, the German Dax index looks interesting for at least the following reasons:

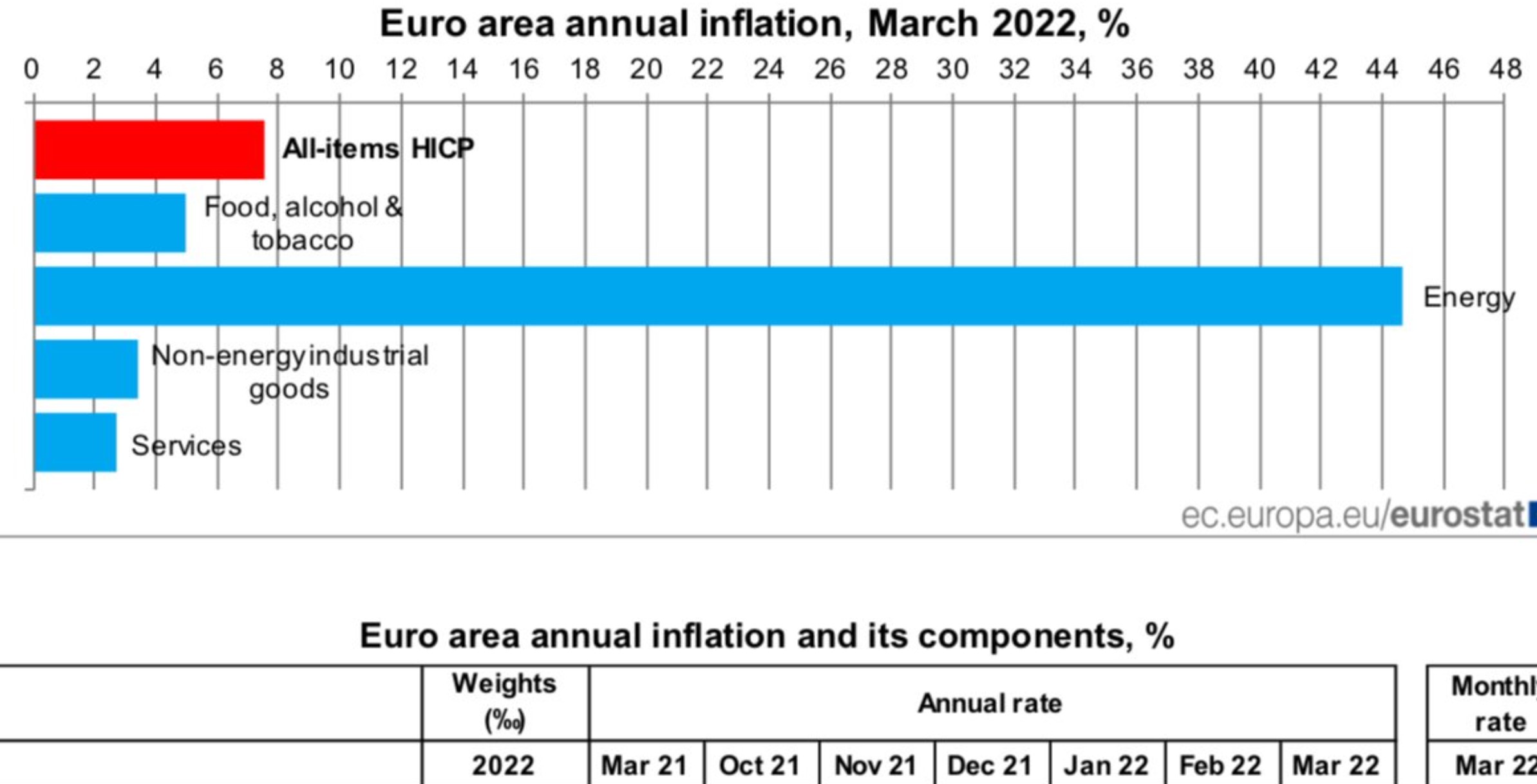

- Energy prices drive inflation in the Euro area

- The technical picture looks bullish

- ECB to keep the monetary accommodation

- There is no wage-price pressure in the Euro area

Energy prices are driving inflation in the Euro area

Inflation in Europe differs from the United States, as energy prices primarily drive it. As such, being a supply-driven context, the interest rates are likely to remain lower than in the United States. This should boost the stock market as monetary policy remains more accommodative in Europe.

Dax hesitates at horizontal resistance but the bias is bullish

Dax hesitates at 14,800 but it looks constructive. A daily close above the area should trigger a run to last year’s all-time highs.

ECB is unlikely to hike the interest rate anytime soon

The ECB is pressured to hike the rates and probably will do so, but not anytime soon. Rate hikes would not address the drivers in the Euro area inflation, and the central bank is well aware of it.

No signs of a wage-price spiral in the Euro area

Another difference between the US and the Euro area is that in Europe, there are no signs of a wage-price spiral. This is another reason why the monetary policy will remain more than accommodative, boosting the stock market.