Best energy ETFs to buy amid attractive P/E ratios: XLE, XOP, and VDE

Energy ETFs trade at a fair valuation while paying hefty dividends as energy prices keep pushing higher. So what are the best energy ETFs to buy?

The spectacular rise in oil prices led to many investors turning their attention to the energy sector. An alternative to directly buying shares in an oil company, energy ETFs provide diversification within the industry and trade at appealing valuations.

So what are the best energy ETFs to buy amid attractive valuations? Here are three to consider:

- Energy Select Sector SPDR Fund (XLE)

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP)

Energy Select Sector SPDR Fund (XLE)

XLE is one of the most liquid energy ETFs that offers exposure to the US energy industry. With an annual dividend yield of 3.75% and a P/E ratio of 16.64, XLE is an interesting option for those looking to get exposure to the energy sector while not investing directly in one particular company’s stocks.

XLE’s main holdings are Exxon Mobil Corporation and Chevron Corporation. The two companies account for 43.97% of the ETFs holdings, and other notable holdings are in EOG Resources (4.87%), ConocoPhillips (4.5%), and Schlumberger NV (4.33%).

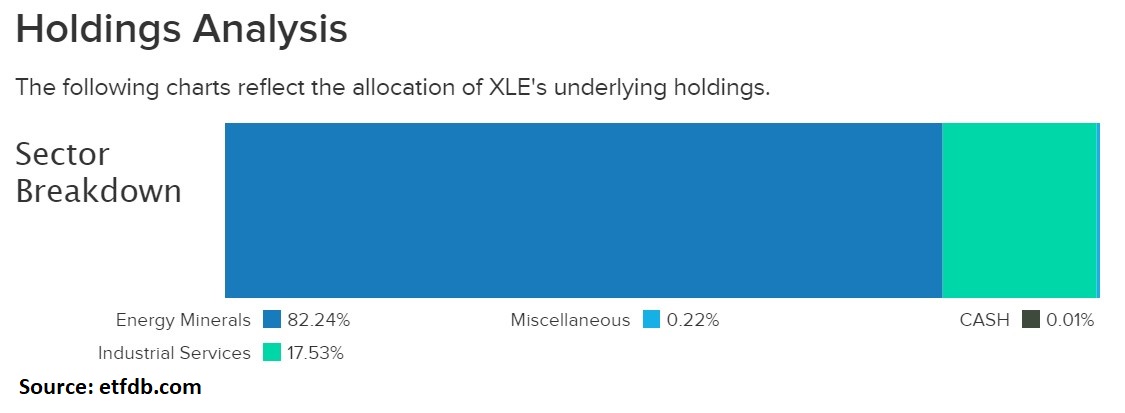

The main sectors where XLE’s underlying holdings are allocated are energy minerals and industrial services.

SPDR S&P Oil & Gas Exploration & Production ETF (XOP)

XOP focuses on the exploration and production sub-sector, thus being an interesting option for those looking to get exposure to companies involved in discovering and exploring new oil and gas deposits.

The main holdings are Southwestern Energy Company (2.96%), EQT Corporation (2.91%), Antero Resources Corporation (2.55%), and Hess Corporation (2.44%).

XOP trades at a P/E ratio of 13.25, and the annual dividend yield is 1.26%.

Vanguard Energy ETF (VDE)

Unlike XOP, VDE holdings are concentrated in a few stocks, such as Exxon Mobil (20.51%) or Chevron (17.09%). VDE trades at a higher P/E ratio than the other two ETFs presented in this article (34.8), but its annual dividend yield is much higher too, at 3.52%.

VDE’s YTD return is +42.71%.