Get exposure to the virtual world with these 4 stocks

COVID-19 was an accelerator for the metaverse vision. Here are 4 stocks to buy to be on the front line if the metaverse is taking off: Matterport, Galaxy Digital, Synaptics, and Micron Technology.

The tech sector is under pressure in 2022, as reflected by the Nasdaq 100 index, down a few thousand points from its all-time highs. Meta Platforms, Facebook’s parent company, made headlines, as it dropped over 25% in one single session after delivering disappointing results.

One of the reasons why investors sold Meta was that investments in the metaverse increased, while revenues did not keep up. Speaking of metaverse, opinions are split as to what it is and if it is useful or not?

Companies like Meta bet heavily on metaverse, considering it at the initial stages of mass adoption – just like the Internet was in the 90s. If Meta is right or not, it remains to be seen, but those wanting to get exposure to the virtual world may consider these four stocks: Matterport, Galaxy Digital, Synaptics, and Micron Technology.

Matterport

Matterport (NASDAQ:MTTR) is a spatial data company from Sunnyvale, California. It made headlines when it partnered with Meta Platforms AI research division and now analysts forecast that it can grow revenues by some 50% in 2022 alone.

Galaxy Digital

Galaxy Digital (TSX:GLXY) is a crypto financial services firm that invested heavily in the metaverse, in things such as NFTs (Non-Fungible Tokens) and Sandbox (a metaverse platform enabled by blockchain).

Synaptics

Synaptics Incorporated (NASDAQ:SYNA) is an IT company from San Jose, California. It makes powerful display-driver chips useful when accessing the metaverse. In other words, this is a bet on a company delivering products for the metaverse’s infrastructure.

The stock price is up 65.75% in the last 12 months, despite correcting more than -25% YTD.

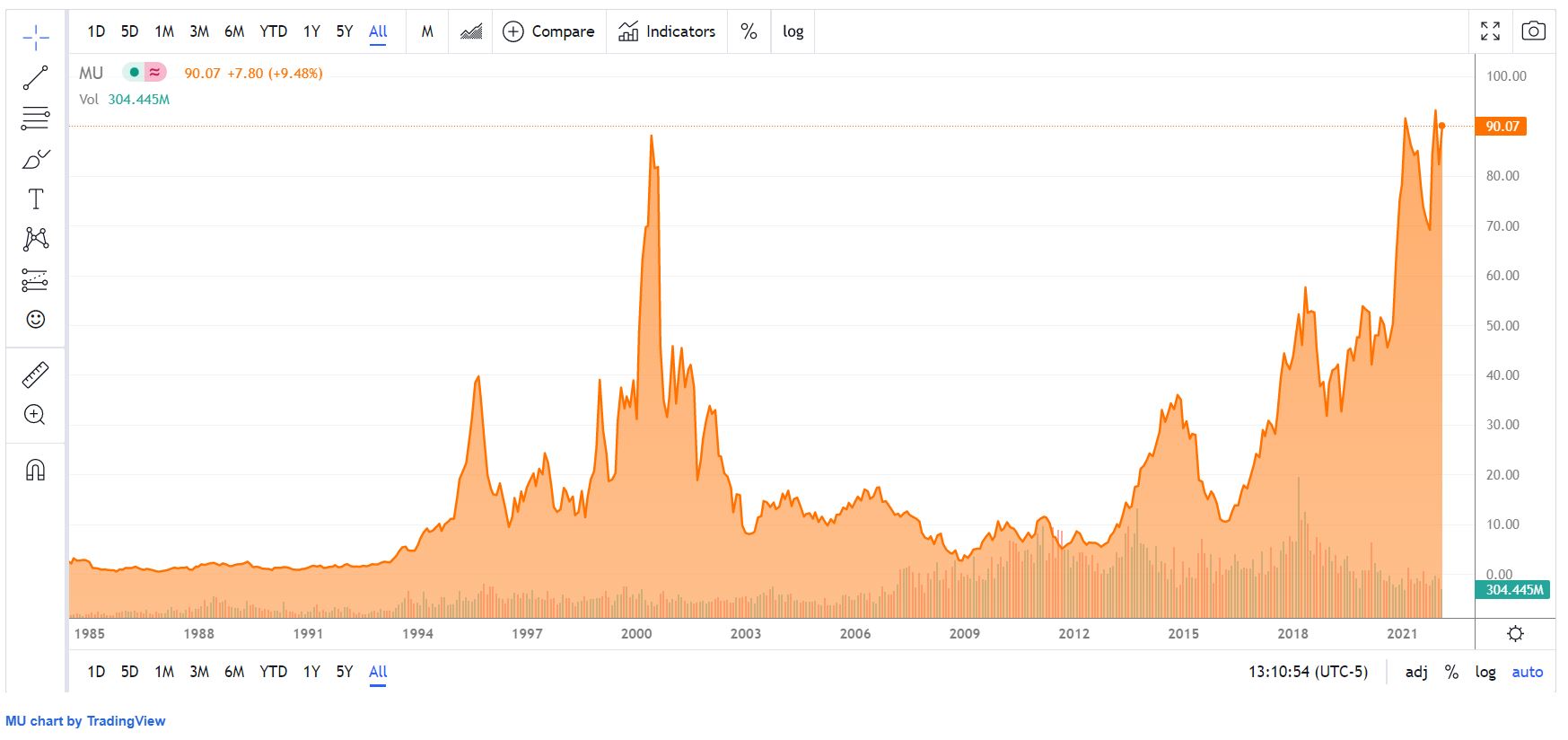

Micron Technology

Micron Technology (NASDAQ:MU) is another company specialized in products needed to build the metaverse’s infrastructure, such as data centers or headsets. It also pays a dividend and the stock price is almost flat YTD and in the last twelve months. However, it trades close to its all-time highs after rallying in the last three years.