Should you buy Meta stocks after better than expected Q1 2022 EPS?

Facebook’s parent company, Meta Platforms, surged yesterday following the Q1 2022 earnings call. The company reported much better than expected EPS.

2022 brought the sharpest decline in Meta Platform’s stock history, sparking questions regarding the viability of its business model focused on the metaverse. But it all faded away as yesterday, following the quarterly earnings, Meta’s stock surged by more than 17%.

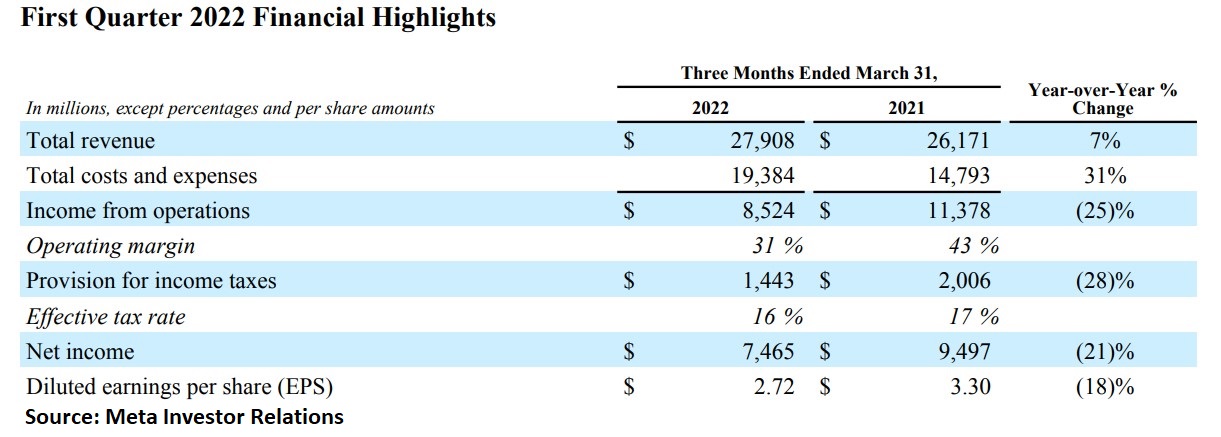

A quick look at the main details of yesterday’s Q1 2022 financial performance shows us that the results are not as impressive as the stock market move may imply. For instance, total revenue did increase, but the increase in total costs and expenses was much higher – 31% vs. 7%.

Also, income for operations declined by -25%, and even net income dropped by -21%. So why did Meta’s stock price surge after the quarterly earnings?

Why did Meta’s stock Price surge following the quarterly earnings reléase?

One of the reasons why the stock outperformed is connected to the rise in daily active users. The company added about three million new users, higher than the market expected.

Also, the market expected EPS of $2.56, and the company reported $2.72 on the quarter.

How did the stock perform this year?

Meta’s stock price is down sharply this year despite yesterday’s surge. It lost about -40% YTD, as investors did not like the increase in expenses and the one-way bet the company takes on the metaverse.

However, yesterday’s results and market reaction might be a turning point for Meta. In a time when the tech sector is under pressure, the surge gives hope to investors that bought the 2022 tech market dip.

What do analysts say about Meta’s stock price?

Analysts are mostly bullish. Out of the 97 analysts covering the company, 80 have issued buy ratings, and 14 have neutral ones. Only 3 analysts have issued a sell recommendation.

Most recently, Evercore and Capital Depesche maintained their buy rating, with a price target of $325, respectively $330/share.