How to buy Airbus stock in the UK in 2026

Airbus is a European company active in the aerospace and defence industry. It develops and manufactures aerospace products, such as commercial jet aircraft or military helicopters. This guide tells you how to invest in Airbus stock and the steps to follow to buy airbus stock.

Airbus is the European competitor to Boeing in the commercial jet aircraft industry. The two companies are in direct competition, and the commercial jet aircraft is just one of the segments where Airbus has expertise. Its defence and space division develops and delivers products like tanker aircraft or unmanned aerial systems.

Airbus stock was recently introduced in the German Dax index. The company is one of the ten new stocks added to the European stock market index to modernise it and make it more attractive to investors.

How to Buy EADSF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Airbus

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About Airbus

Moving forward, let’s dive into Airbus’s history and business to understand how the company makes money and what the prospects are for the Airbus stock.

Airbus History

Airbus’s history started in the 1960s when the Puma helicopters performed their first flight. Since then, the company evolved into one of the leading European corporations, involved in everything flight-related.

The year 1969 was an important milestone for Airbus as it marks the official launch of the A300 program. The aim was to build commercial aircraft that could compete with American rivals, and Roger Beteille was the technical director.

Nowadays, Airbus is one of the European symbols, building commercial jet aircraft for airlines across the globe and delivering defence and security solutions to businesses and governments worldwide. The company is headquartered in Leiden, the Netherlands, and employs over 120,000 people.

What Is Airbus’s Strategy?

Airbus SE divided its activities into three segments, but the one building commercial jet aircraft is known the most by people. But, the company also runs a big business in the other two segments – Airbus helicopters and Airbus defence and space.

This last segment will matter the most in the future, as the space race has only begun. In addition, the company’s defence space systems are used for telecommunications and earth observations, among others. Airbus is also focusing on cyber security, an area of increased interest for governments in the years ahead.

How Does Airbus Make Money?

Airbus Group SE makes money by selling commercial jet aircraft to airlines operating all over the world. Besides the commercial jet aircraft business, Airbus delivers security solutions to governments and companies worldwide in cybersecurity or military defence.

How Has Airbus Performed in Recent Years?

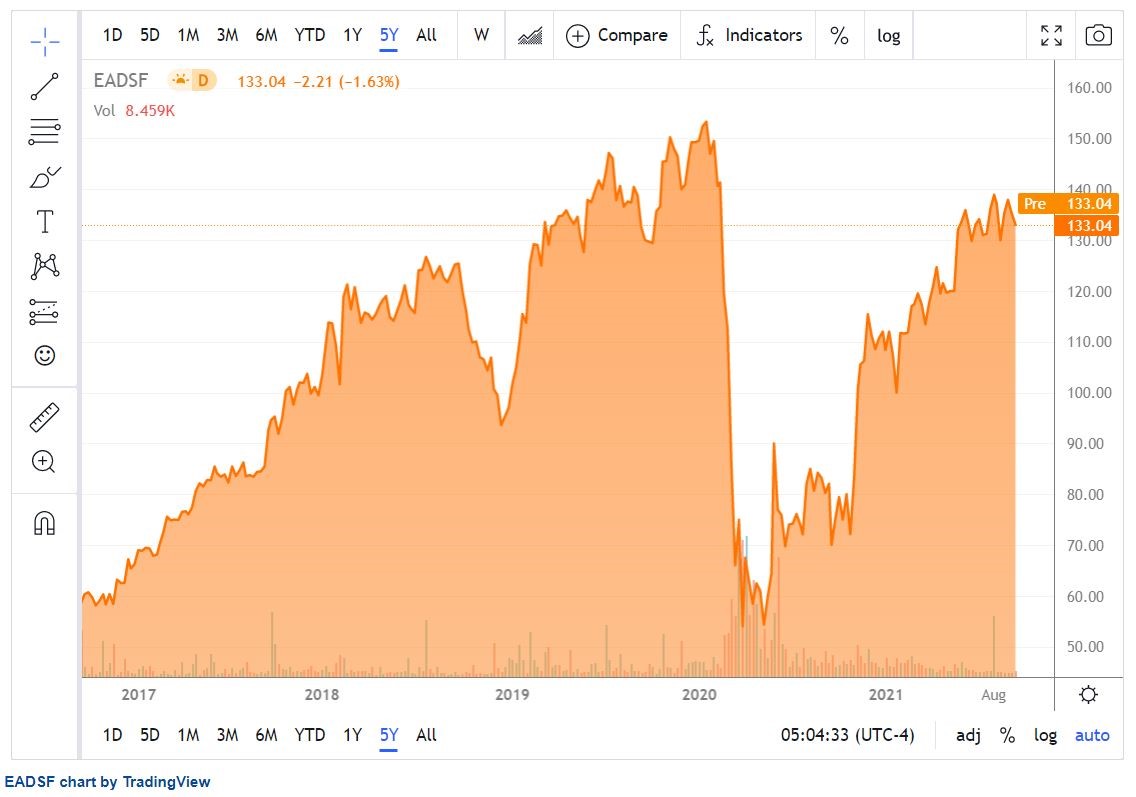

Airbus stock price made an all-time high just before the COVID-19 pandemic started in 2020. Since then, it fell with the general stock market but recovered most of the declines in the meantime. However, it is yet to challenge the all-time highs set at $150.

Where Can You Buy Airbus Stock?

When buying shares in a company, you are investing and owning a part of its business. As a shareholder, you have the right to receive dividends if the company chooses to pay them and have a voice in major decisions.

A stockbroker account is needed to buy stocks, and regular stock trading is different from trading CFDs or contracts-for-difference. In the first case, you own a piece of the company, while in the second case, you speculate on the price movement of the company’s share price by trading a product that tracks the price action. Some brokers offer both possibilities – buying stocks in a company and speculating on the future price movement via a CFD.

Airbus Fundamental Analysis

Fundamental analysis is critical in valuing a company’s share price, like Airbus shares. It refers to analysing the company’s financial performance, and investors use various metrics to compare different stocks before deciding to buy one. This article will focus on Airbus’s revenue, earnings-per-share, the price/earnings ratio, the dividend yield, and the cash flow position.

Airbus’s Revenue

Revenues show how much a company makes from the sales of its products and services. It is not a metric of profitability, though.

Airbus makes about $62 billion in revenue in a fiscal year. For example, the estimates for the fiscal period ending December 2021 are €52.94 billion. Moreover, for the fiscal period ending December 2022, Airbus’s revenues are expected to rise close to €59.44 billion and reach €73.47 billion by 2025.

Airbus’s Earnings-per-Share

A company’s earnings-per-share or EPS shows its profitability per one single share. EPS is presented at the bottom of the income statement. For this reason, it is also called the bottom line.

The higher the EPS, the better for shareholders as it shows rising profitability. In the case of Airbus, EPS are expected to reach €3.77 in 2021 and are forecasted to grow to €7.76 in 2024.

Airbus’s P/E Ratio

The price/earnings ratio, or simply the P/E ratio, is one metric used to compare companies. Ideally, the comparison is made between companies in the same industries and sectors.

The ratio reveals how much investors are willing to pay for every euro the company makes in profit. In other words, it is calculated as the price per one share divided by the earnings per one share. Hence, the name – price/earnings ratio.

A higher P/E ratio suggests that the company is overvalued. A helpful analysis is to compare the P/E ratio of one company to the sector median to see how it deviates from it.

The P/E ratio for Airbus stock is 29.82 and is projected to decline to 14.17 by the end of 2025. In other words, investors are willing to pay €29.82 for every euro that Airbus makes in profit in 2021.

Airbus’s Dividend Yield

Dividends reward shareholders for their investments. Not all companies choose to pay a dividend, though, and not all investors want to own stocks that pay a dividend.

Amazon, for example, is one company that has not paid a dividend since its creation. Yet, it is one of the stocks that performed the most in the last several years. Therefore, investors willing to buy Amazon shares focused more on the potential growth perspectives than on dividends.

Airbus used to pay a dividend, but it suspended the payment in 2020. The COVID-19 pandemic led to big troubles for the airline industry and Airbus’s business model suffered in consequence. However, it does not mean that the company will not pay a dividend in the future.

The dividend yield shows how much the dividend payments amount in the current stock price. Because Airbus does not pay a dividend, its dividend yield is zero.

Airbus’s Cash Flow

Cash flow is an essential part of any business. A company may be profitable, but it needs to forecast future cash flows to run its day-to-day operations. A strong cash position is desired, but too much cash sitting idle is not a positive for business because of the missed investment opportunity.

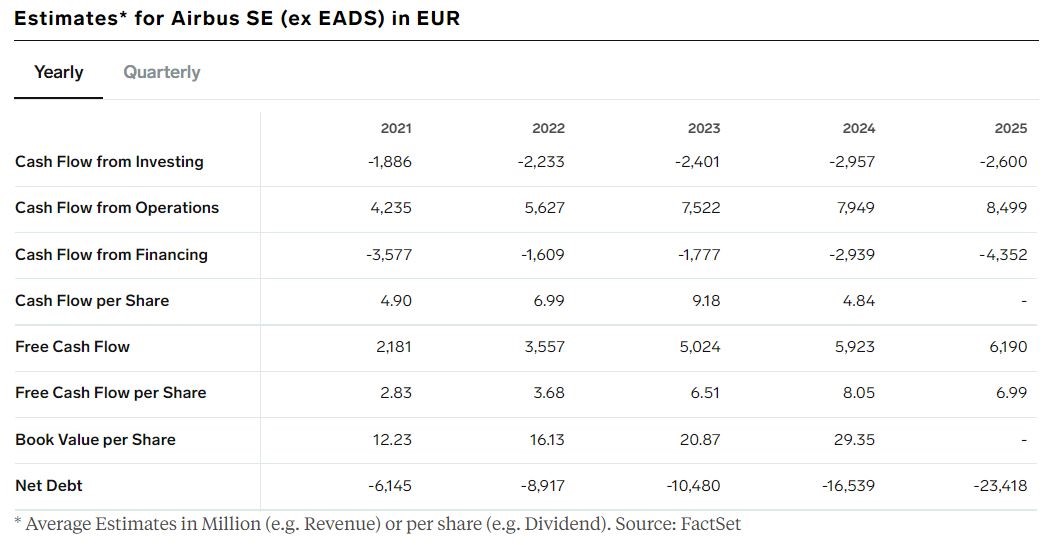

Airbus has a strong cash position, and the free cash flow is projected to rise from the current €2,181 to €6,190 by the end of 2025. The free cash flow is the amount of money left after running its operations, and it is usually used to expand the business into new areas or markets. The higher the free cash flow position, the better.

Why Buy Airbus Stocks?

Airbus is a crucial European company having a strategic position in the international context. Airbus is the European answer to American aircraft engineering, and it emerged as one of the leading companies on the old continent.

Here are three reasons worth considering in favour of Airbus stock:

- Strong financial position – the company’s earnings are projected to rise close to 50% in the next five years.

- Airbus is a dividend-paying company that stopped the dividend payment because of the COVD-19 economic disruptions. However, it has a long dividend payment history, and investors expect it to be resumed once the pandemic is over.

- The airline industry, as well as the defence and security industry, are promising in the years ahead.

Expert Tip on Buying Airbus Stock

“ Airbus’s business was disrupted severely by the COVID-19 economic recessions. The airline industry was one of the most affected, but effective vaccines offer a new perspective. Investors bought the stock market dip influenced by the easy monetary and fiscal conditions, and they bought some more in November 2020 when the results of the COVID-19 vaccine were made public. In other words, as the world sees the light at the end of the tunnel, the pandemic impact on Airbus’s business will dissipate, and growth may resume. ”- thomasdavid

5 Things to Consider Before Buying Airbus Stock

Before buying shares in any company, one needs to do some due diligence to understand the business better and plan the investment. Here are some things to consider before buying Airbus stock.

Understand the Company

The first and utmost important thing is to understand its business and interpret its financial position correctly. Some investors like a company’s brand or product, which is compelling enough to invest in the financial asset. However, the fundamental analysis offers a better perspective of how the company performed in the past and, more important, provides an educated guess about how it might perform in the future.

Understand the Basics of Investing

Risk or money management is another factor to consider. A sound money management system focuses on diversification across industries, order execution, and discounting a company’s future cash flows to find the intrinsic value of its stock price. In other words, make sure to understand the basics of investing before deciding to buy a stock.

Carefully Choose Your Broker

Not all brokers are the same. They try to differentiate their business offering via reduced spreads and commissions, an improved trading platform offering outstanding technical analysis tools, or fast execution. Depending on your investing style, one broker may be more suitable than another.

Decide How Much You Want to Invest

The next step in the investing process is to decide how much you want to invest. It is not wise to put all your eggs in the same basket, as diversification is key to successful long-term trading. Moreover, the price action may take quite some time to consolidate, and investors typically lack discipline and patience. Some investors choose to invest a certain percentage of their portfolio in one particular stock and always keep cash at hand for upcoming opportunities.

Decide on a Goal for Your Investment

Find out what drives you to the investment world and adjust the portfolio accordingly. For example, if long-term investing is your thing, make sure to change the portfolio’s composition and structure according to the time horizon for the investment. Or, if you want to speculate on the short-term movement of a company’s stock, you need to consider commissions paid to the broker and how they affect the bottom line.

The Bottom Line on Buying Airbus Stocks

Airbus SE is one of the most emblematic European companies that saw its business model severely disrupted by the COVID-19 pandemic. However, the stock price recovered most of the pandemic-led declines as the airline industry resumed its activity.

Airbus suspended its dividend payment during the pandemic, but it has a long history of paying one. In other words, the likelihood is that it will resume paying a dividend when the financial position strengthens.

Airbus sits on a solid free cash flow position forecast to more than double in five years. It shows the resilience of its business and how the other segments helped the company weather the economic recession triggered by the pandemic.

If you are ready to invest in Airbus stock now, the next step is to open a trading account with a stockbroker. If not, you may want to use a demo account and practice some more before dedicating real funds to a trading account.

Frequently Asked Questions

-

Not if you use orders to protect the investment. Traders may limit the potential loss by placing a stop-loss order. In other words, that is the level where the bullish case ends or the price level where it makes no sense for the trader to remain invested. The key is to set the stop-loss order close enough to the current price so as not to suffer significant losses but far enough to avoid being stopped by a minor price correction. Therefore, it is vital to find a level that invalidates the bullish scenario and where the bullish investment case does not make sense anymore.

-

When the COVID-19 pandemic hit, the company’s business model was disrupted. The commercial jet industry was severely affected as airlines shut down their operations. As a result, Airbus focused on the other business segments until the airline industry reopened gradually. However, until then, it chose to stop paying a dividend due to the highly uncertain future.

-

It depends on the management’s plan and the consequences of the pandemic on Airbus business model. On the one hand, if history offers us any guidance, the company will likely return to its dividend-paying policy in the period ahead, as the financial position strengthens. But, on the other hand, there is no guarantee that the management will choose to do so, even as the financial situation improves.

-

Research and development are critical for a company like Airbus. The three segments it operates in require extensive research in new technologies, products, services, and the company’s financial statements reflect it. Airbus’s research and development expenditures are forecast at €2.9 billion in 2021 and set to rise to €3.24 billion by the end of 2025.

-

It may or may not. The first stock market’s reaction during the COVID-19 pandemic was a sharp sell-off. However, as it became clear that the pandemic would trigger extensive lockdowns worldwide, investors looked for opportunities. Tech companies rallied from their lows and made new all-time highs, but not all stocks performed the same. The future performance depends on the company and the market conditions.

-

Airbus is mainly known for its commercial jet business and less known for its other businesses, such as its operations in the defence and security industry. As such, when airlines around the world were forced to ground their fleet, orders for new planes were frozen too. After all, the pandemic brought an unprecedented situation, and investors did not react well.

Moreover, some iconic Wall Street investors (i.e., Warren Buffett) announced that they sold all their participation in the airline industry, sending a negative signal to the market. However, some other investors decided that the industry’s fundamentals would improve eventually, and they took advantage of the low stock market price.