How to buy JSW stocks in 2024

JSW Steel is one of the leading steel companies in the world and one of India’s biggest holdings. It produces, distributes, and trades iron and steel products in the form of rolls, coils, and sheets or steel doors. The company exports to over 100 countries and employs more than 13,000 people.

This article aims to present the JSW Steel company in detail, from how it is doing business to the financial performance in the last years. Also, we will have a look at what possibilities exist to buy JSW stock and how can investors build confidence before investing in JSW stocks.

How to Buy JSWSTEEL Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in JSW

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About JSW

We will start by presenting more details about the JSW Steel business, beginning with its history and strategy, and continuing with how it makes money and how JSW stock has performed in recent years.

JSW History

The company was founded in 1982 by Prakash Jindal and, currently, it is headquartered in Mumbai, India. JSW Steel has expanded its Indian steelmaking capacity rapidly, from a mere 3.8 MTPA (Million Tonnes Per Annum) in 2006 to the current 18 MTPA. By 2024-2025, the company’s output is expected to reach over 37 MTPA.

What Is JSW’s Strategy?

As an integrated manufacturer of a diverse range of products, JSW Steel has one of the lowest conversion costs in the industry. This strategy allowed JSW Steel to compete in the international arena, stealing market share from other major players.

The company’s facilities are well connected to rail, road, and port, so quick logistics helped to slash costs further. It is a pioneer in introducing leading technologies in India and invests massively to stay up-to-date with the latest developments in the industry.

Through a series of strategic acquisitions and joint ventures, JSW grew its production capacity rapidly. Nowadays, it has become one of the leading groups in the industry, with further plans to expand its production capacity.

How Does JSW Make Money?

JSW Steel makes money by selling a diverse range of steel products such as galvanized coils and corrugated sheets. It also offers light steel building solutions. It caters to diversified markets across geographies and, at the same time, it expanded its efforts to drive a sustainable business.

How Has JSW Performed in Recent Years?

JSW stock price is on a tear higher in the last years. That is particularly true in the aftermath of the COVID-19 pandemic when supply bottlenecks led to a surge in the price of raw materials and commodities. Since the 2020 lows, the JSW stock price is up more than three times and currently consolidates near the highs.

Where Can You Buy JSW Stock?

Stockbrokers typically offer the possibility to buy JSW stocks. The brokerage house acts as an intermediary and charges a small fee for its services, and by owning shares in the company an investor may participate in the management’s decisions and is entitled to received dividends.

Another option offered by brokers is a CFD or contract for difference. These contracts are financial products that track the market movements of a stock, but, by trading it, you do not own the stock. The advantage of trading a CFD rather than owning shares is that it makes short-selling easier and more cost-effective.

Some brokers offer both stocks and CFDs, so you want to make sure you are aware of the advantages and disadvantages they have.

JSW Fundamental Analysis

This part of the article deals with the company’s fundamental analysis. We will have a look at the JSW’s revenue and earnings-per-share, but also at the company’s cash flow position, the price/earnings ratio, and the dividend yield.

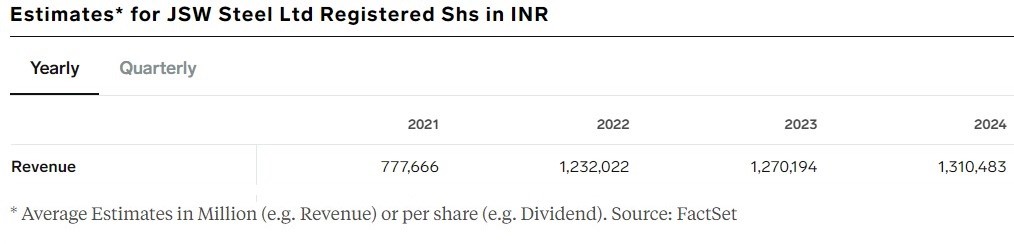

JSW’s Revenue

Revenue is the first line on a company’s income statement. The income statement reflects the company’s financial performance over a period, typically a quarter or a fiscal year.

Because it starts the income statement, the revenue is also called the “top line”. Effectively, it represents how much the company sold over the period or the total sales made during the period.

JSW Steel estimates for the FY 2021 are INR777,666 million, or about $10 billion, and expected to grow in the years ahead, reaching INR1,310,483 million by 2024.

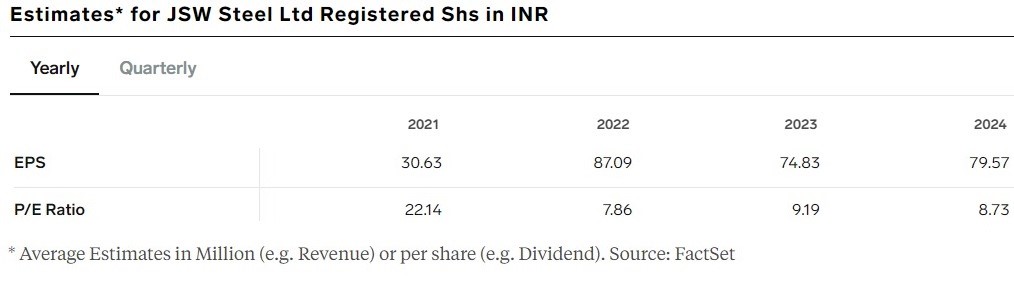

JSW’s Earnings-per-Share

If the revenue is the top line on the income statement, the earnings-per-share or EPS are to be found at the bottom of the income statement. This financial metric shows the company’s profitability per one single share, and the higher the number, the better for the company and its shareholders.

EPS are presented as basic or diluted. JSW Steel EPS estimates for 2021 are INR 30.63, expected to more than double by 2022 and settle at 79.57 by 2024.

JSW’s P/E Ratio

The price/earnings ratio or simply the P/E ratio is another important metric used by investors in the process of valuing a company’s stock price. As an investor, you would want to see a small P/E ratio, but for all the good reasons.

For example, the P/E ratio is calculated by dividing the current stock market price by the earnings-per/share. So, it is the price of one share divided by the profit per one share. If the P/E ratio is super high, the stock price is not attractive to investors because it shows how many years it takes an investor to recover the investment.

JSW Steel’s P/E ratio in 2021 is estimated at 22.14, expected to decline significantly in the years ahead, settling at 8.73 by 2024.

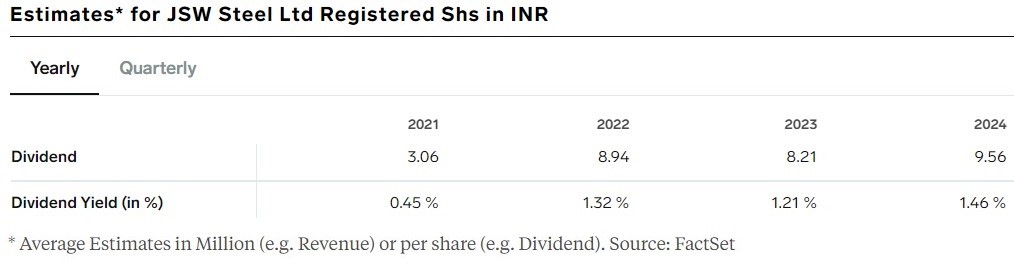

JSW’s Dividend Yield

Not all companies choose to pay a dividend, but those that do so are attractive to dividend-seeking investors. Some investors like to own shares in a dividend-paying company because they can reinvest the dividends and thus increase the income compounding rate.

One of the metrics used to analyze the dividend is the dividend yield, which shows the size of the dividend paid compared to the company’s price. JSW Steel’s dividend yield is estimated at 0.45% in 2021, expecting to increase to 1.46% by 2024.

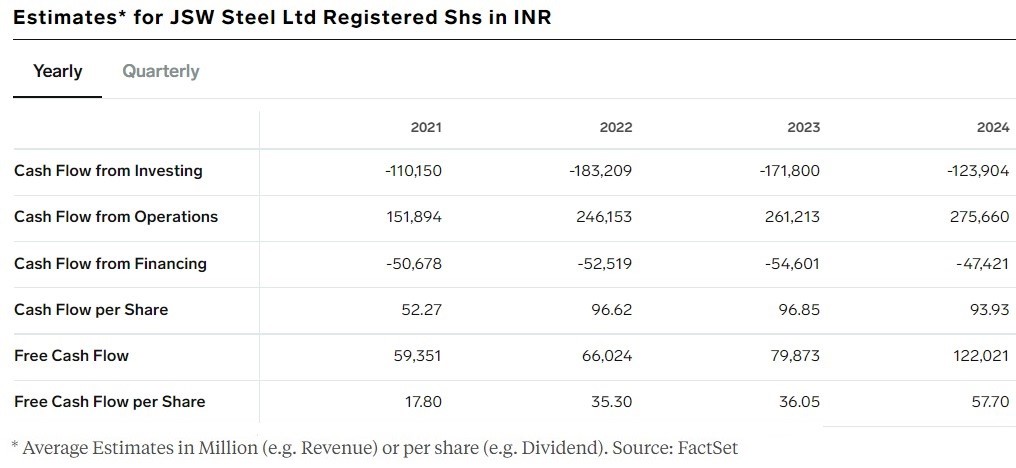

JSW’s Cash Flow

A company’s cash flow position is another relevant financial metric to interpret. The cash flow statement shows the cash flow detailed in areas such as investing, operations, and financing. Too much cash sitting idle is not desirable because of the opportunity cost, so each big company invests the extra cash via its treasury department in short-term securities designed to serve short-term liquidity needs. Long-term bonds are designed to finance the company’s liquidity needs in the long run.

Out of all, the free cash flow is, perhaps, the one to consider as it shows what is left after the company has covered all its costs of doing business. JSW Steel has a strong free cash flow position, one that is expected to double by 2024.

Why Buy JSW Stocks?

Commodities and raw materials are in great demand in the aftermath of the COVID-19 pandemic. Commodity prices increased significantly and shortages drive them even higher. The monetary and fiscal stimulus around the globe has led to the shortest economic recession in history, as the global economy recovered quickly. As such, strong growth lies ahead, with governments from advanced, emerging, or frontier markets laying down massive infrastructure investing plans.

Here are a few things that might make you buy JSW stocks:

- Huge infrastructure spending plans worldwide.

- Steel is 100% recyclable.

- Commodity prices are in a bullish trend in the aftermath of the COVID-19 pandemic.

- India’s economy on track to reach $5 trillion by 2024.

Expert Tip on Buying JSW Stock

“ Strong domestic demand suggests that JSW Steel will have room to increase production capacity, thus increase its profitability. In addition, the Indian economy is expected to grow rapidly in the years ahead and huge infrastructure plans have been laid out. JSW Steel stands to benefit from all these and the new investment projects announced around the world signal solid demand in the years ahead. ”- thomasdavid

5 Things to Consider Before Buying JSW Stock

Here are five things you might want to consider before buying JSW stocks with confidence.

Understand the Company

It all begins with having a clear understanding of the company’s business. Look at industry trends, the company’s product range, how it has performed recently, the challenges ahead, or how its financial position is. Make sure you know how the company earns its money and what might happen to come in the way of management’s plans. For that, a look at the management forward guidance is important, because it lays down the road for the years ahead.

Understand the Basics of Investing

Investing is not as easy as buying and forgetting. Some knowledge of investing terms is required and helps investors. Start with basic terminologies such as financial products and the role of a brokerage house, and move on to basic fundamental analysis. After that, try your hand at risk management strategies that help investors mitigate the risk of losing the funds.

Carefully Choose Your Broker

The broker is a crucial part of the investment process and a financial entity must regulate it. The financial authority requires that the broker complies with the local regulations and it is all to the customers’ benefit. Don’t be shy to check with the regulator the status of the broker’s license as the broker is your partner in the investing journey.

Unfortunately, not all brokers are regulated, and regulation brings trust. Besides regulation, you might want to invest with a broker that offers negative balance protection, has small bid-ask spreads, and segregates its customers’ funds from the funds needed to operate.

Decide How Much You Want to Invest

It is never wise to invest money you cannot afford to lose. Also, instead of investing everything in one business, think of spreading the investment over different industries and sectors, in order to reduce the risk of losing money. Ideally, try to add only uncorrelated assets to a portfolio and always have a decent cash position available so as to take advantage of opportunities that might arise.

Decide on a Goal for Your Investment

One of the first questions to ask yourself before starting the investment process is why you want to invest in the first place? Not everyone has the same goal for their investments, and therefore it is essential to know why are you doing it.

In some cases, investors prefer only dividend-paying stocks in order to build a future cash-flow stream for retirement. In some other cases, investors prefer to invest in a company simply because they enjoy the company’s products or services. Or, some other investors use the stock market as a vehicle of saving for retirement.

Depending on the goal for the investment, different strategies are more suitable than others. For example, a buy and hold strategy works fine for investing for retirement, but some investors prefer to speculate on the short-term market movements.

The Bottom Line on Buying JSW Stocks

JSW Steel is one of the fastest-growing conglomerates in India. It manufactures and sells steel products both on the domestic and international markets. It is constantly investing in new products and is committed to investing in meeting the global energy goals by continually reducing its carbon footprint. The company sells its products in more than one hundred countries in the world and it pays a dividend. With a strong free cash flow position, it stands to benefit from the domestic market growth and the JSW stock price has tripled since the COVID-19 pandemic lows.

If you are ready to invest, feel free to choose your broker from the list provided in this article and search for the company’s symbol. You may want to shortlist the name so as to have it at hand for later use. Next, you must decide how to invest – at the market price or using a pending order. If you trade at the market price, the broker will fill your order at the best current market price.

On the other hand, if you want to buy only at a certain level, the broker gives you the tools to do so. For this, a pending buy stop order may be used to buy from higher levels, and a pending buy limit order to buy from lower levels. Why would anyone want to buy from higher levels? The answer is that to avoid consolidation and trade from a higher level means that a breakout might already happen.

If you are not yet confident to invest, feel free to check the other educational resources on our website. Also, make sure to check the Internet on additional material regarding investing and when ready, check the broker’s offering and the company’s stock. Ideally, you may want to start investing using a demo account, because this way, you’ll learn a lot about the conditions offered by the broker and the way financial markets function.

Frequently Asked Questions

-

India’s economy is on the verge of becoming a $5 trillion economy by 2024. Investments in infrastructure are expected in the years ahead, as the country prepares to invest over $1.4 trillion by 2024, in projects like doubling the length of highways. Most recently, the government announced a steel production target of 300 MTPA by 2031. Hence, JSW Steel stands to benefit from all the local developments.

-

The company’s product range is extremely diverse. Think of TMT bars used in construction and infrastructure or special alloy steel used in the automotive sector. Moreover, JSW invests in new products, trying to capture niche markets such as advanced high-strength steel for automobiles.

-

Challenges exist and some of them are independent of the management’s decisions. For example, a slowing global economy is one risk that may affect the company’s financial performance. Trade protectionism, slowing domestic consumption, or raw material availability are other examples.

-

JSW Steel raised $750 million in December 2020 through an offshore bond of half a billion following by a tap issue of $250 million. It is rated AA- with a positive outlook at ICRA, BB- with a positive outlook at Fitch, and Ba2 with a positive outlook at Moody’s.

-

To meet global energy and climate goals, the steel industry must cut emissions by at least 60% by 2050. Steel will be more popular than other materials, because of being affordable to use in multiple applications and is infinitely recyclable. JSW is prioritizing the making of stronger, responsible, and greener steel.

-

India, Japan, the United States, and China, are the major top steel-producing countries in the world. China, in particular, holds the largest share, but it is also an importer of steel products. The largest steel consumption for the years ahead is expected to come from China and India.