How to buy Aker Solutions stocks in 2025

Aker Solutions ASA is an engineering company that provides integrated solutions, products, and services to the global energy industry for the production of oil, gas, and renewable energy. The company’s services include renewable energy solutions, electrification & low-carbon solutions, and many others.

The company is headquartered in Fornebu, Norway, and operates in over 20 countries and more than 50 locations. Its stock trades on the Oslo Stock Exchange (OSE) under ticker AKSO. In the U.S, Aker’s stock trades over-the-counter under ticker AKRTF.

The article carries out the company’s fundamental analysis, provides you with detailed information about the company’s business and explains why you should buy Aker Solutions stock based on various factors.

How to Buy AKRTF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Aker Solutions

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About Aker Solutions

You need to understand the important aspects of the company, such as its history, business strategy, revenue sources, and the stock’s past performance to make informed investment decisions. The following sections contain important details about Aker Solutions.

Aker Solutions History

Aker Solutions started as a mechanical workshop near Aker River in Oslo, Norway. The workshop grew and expanded into shipbuilding and manufacturing mechanical parts for machines and equipment. With the passage of time, the company matched the pace of the industrial revolution and stepped into the mechanical and marine engineering industry.

After oil and gas reserves were discovered in the North Sea in the 1960s, the company shifted its focus to develop and modify offshore rigs for the oil and gas companies. In 1969, the company’s offshore drilling rig was used to discover the Ekofisk field, Norway’s first and the world’s largest offshore oil field of its time.

In 2002, Aker acquired an engineering and shipbuilding company Kvaerner to form a technically and financially strong business. With the acquisition, the company expanded its operations to paper and pulp, shipbuilding, and oil & gas. However, it divested its shipbuilding, paper and pulp business by 2007 to focus on the oil & gas sector.

Aker Solutions supported the challenging operations of oil & gas companies’ deepwater fields and tough reservoirs operating in the North Sea. The company attained expertise in developing subsea fields, horizontal wells, and floating production systems for oil & gas exploration companies for increased oil recovery.

In 2008, the company changed its name to Aker Solutions. In the subsequent years, the company divested and spun off some more of its businesses, including process and construction business, procurement and construction business, well-intervention business, and created a separate company by the respected name Kværner ASA. The divestment activities allowed the company to focus on field design and subsea segments.

In 2020, Aker Solutions merged with Kværner to become the leading project execution, procurement, engineering and construction (PEC) provider for global oil, gas, and renewable energy companies.

What Is Aker Solutions’ Strategy?

Long-term alliances and collaborations with customers is a central part of the company’s business strategy. To fulfil its strategic objectives, the company also establishes long-term working partnerships with its contractors and suppliers. As part of its strategy, the company signed an MoU in March with Doosan Babcock to reinforce its position in the U.K’s expanding low-carbon and renewable energy market.

The company also aims to reduce costs and build synergies by implementing a variety of measures, including rightsizing the firm’s capacity with respect to demand, reducing capital expenditures by spinning off capital intensive businesses, and deleverage the balance sheet to acceptable levels.

The company also focuses on sustainability and endorses the UN Sustainable Development Goals. For this purpose, the company aims for its renewable energy and low-carbon solutions to constitute one-third of its total revenues by 2025 and strives to increase the target further to two-thirds by 2030. The company further aims to be a net-zero emitter by 2050.

How Does Aker Solutions Make Money?

After its merger with Kværner, Aker Solutions divides its revenues into three main business segments, namely renewables and field development, electrifications, maintenance and modifications, and subsea. The renewables and field development segment provides services to the renewable energy businesses and undertakes and executes projects involving offshore wind, carbon capture, onshore facilities, traditional oil and gas platforms, marine operations, and decommissioning.

The electrifications segment provides services for electrification of oil and gas infrastructures, onshore facilities, maintenance services, modifications projects, offshore facilities asset integrity management, offside topsides maintenance, and late-life and decommissioning activities.

The subsea segment provides advanced subsea systems, products, services and low-carbon solutions; undertakes projects for subsea systems and field infrastructures, from design and engineering to fabrication and installation; and a range of life-of-field services for oil & gas production.

The company usually derives the bulk of its revenues from its operations in Norway, followed by the US, Malaysia, and Angola.

How Has Aker Solutions Performed in Recent Years?

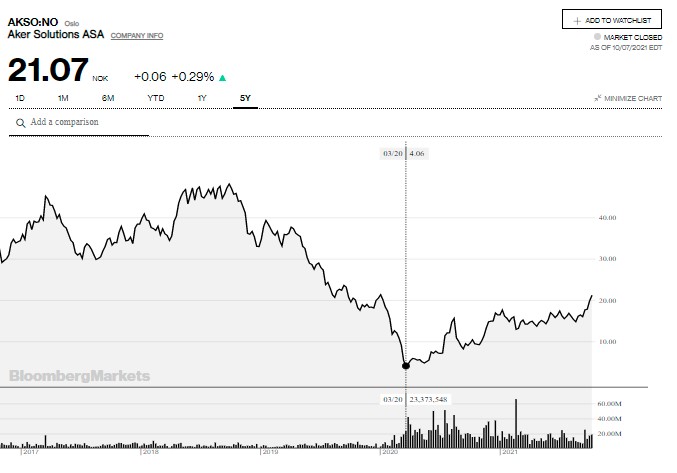

Akers Solutions stock reached its 5-year high of NOK 48.11 on 28th September 2018 but had been plummeting since then to reach the lowest point of NOK 4.06 on 20th March 2020 at the onset of the pandemic that badly reeled the oil & gas industry. However, the stock recouped some of the losses and, at the time of the writing, is trading at NOK 21.

Source: Bloomberg Markets

Where Can You Buy Aker Solutions Stock?

You can buy Aker Solutions stock by opening a stock or equity account with a stockbroker. You can open different types of accounts, including cash account, margin or leveraged account, CFD account, and specialized investment account. Some brokers also provide value-added services, such as the services of a trading advisor, on different types of accounts. You should check your broker's website to determine which types of accounts and features it offers.

Aker Solutions Fundamental Analysis

The fundamental analysis of stock includes calculating different financial metrics of a company using figures from its financial statements and its stock's price. The metrics provide valuable information to prospective investors about the stock, and most investors use them to determine the stock's fair value in relation to its market price. The commonly used fundamental measures include the P/E ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow.

Aker Solutions' Revenue

Revenue determines the amount of money a company receives from the sales of its products or services in a period. Companies implement different strategies to increase their revenues, which can potentially earn them higher profits. Investors prefer those companies that consistently report growth in their revenues as it signifies the acceptability and popularity of the company's product or service among its customers.

You can find the revenue figure on the income statement issued as part of the financial statements issued by the company. In 1H 2021, the company reported a revenue of NOK 13.5 billion.

Aker Solutions' Earnings-per-Share

The earnings-per-share or EPS denotes the earnings or net profit available for each outstanding common stock or share. It is calculated by dividing the net profit less preferred stockholders' dividends, if any, by the average number of common stock outstanding during a period. For example, if a company has a net profit of $100 million while the average number of shares outstanding during the period were $10 million, its EPS would be $10.

In 1H 2021, the company reported EPS of NOK 0.18.

Aker Solutions' P/E Ratio

The price-to-earnings ratio or P/E ratio of a stock measures the stock's price in relation to its earnings per share. Investors use this metric to calculate the earnings multiple at which a stock is trading on the market. For example, if a stock's market price is $100 while its EPS is $10, its P/E ratio would be 10x. The P/E ratio of 10 means that the stock is trading at 10 times its EPS.

The P/E ratio is commonly calculated on a trailing 12-month basis, which means that the EPS of the past 12 months is used for calculating the metric. You should also note that the P/E ratio of stock changes daily with the movement in stock price.

The company’s half-year P/E ratio at its current price is 116x.

Aker Solutions' Dividend Yield

The cash distributions from the company's profit to its shareholders are called dividends. The board of directors have the authority to declare dividends as and when they deem fit keeping in view the company's dividend policy. In case dividends are announced, those shareholders that hold the stock before the ex-dividend date are eligible to receive dividends.

Investors also evaluate a stock's dividend yield, which determines the cash dividends a company paid out per share in the last 12 months as a percentage of its current stock price. For example, if a company paid dividends of $10 per share in the past 12 months and the stock's current market price is $100 per share, its dividend yield would be 10%. The stock's dividend yield of 10% means that the stock paid out 10% of its current price per share as dividends in the past 12 months.

Aker Solutions paid out non-cash dividends (or share dividends) to its shareholders in 2020. Each shareholder received one share each in Aker Carbon Capture and Aker Offshore Wind against one share of Aker Solutions. The payout gave an equivalent value of NOK 3.17 per share to shareholders.

Aker Solutions' Cash Flow

The free cash flow of a company is the amount of cash left after deducting capital expenditures from its operating cash flows. A healthy free cash flow figure means that the company generates sufficient cash from its operations to not only finance its capital expenditures, but also dividend, interest payments, and other business expansion projects.

The cash & cash equivalents figure on the cash flow statement represents the amount of cash the company had at the time of the preparation of the statement. As of 30th June 2020, the company’s cash flow from operations stood at NOK 259 million.

Why Buy Aker Solutions Stock?

Aker stock has transformed into a specialised solutions provider to energy companies and offers state-of-the-art technologies to its customers. Here are some of the reasons why you should consider buying Aker Solutions stock.

- The company has strong financial standing as its net cash position at the end of Q2 2021 was NOK 0.8 billion, which shows that the company can handle capital-intensive projects and helps to deleverage its balance sheet.

- The company has a strong order intake and order backlog for its business segments, with a steady flow of revenues in the coming years.

- The company provides cash dividends or bonus shares as dividends that can increase your overall returns.

Expert Tip on Buying Aker Solutions Stock

“ Aker Solutions stock lost roughly 44% over the past five years (between October 2016 and 2021). However, the stock produced fourfold gains since it dropped to its lowest levels of NOK 4.03 at the onset of the pandemic. The best tip for buying Aker Solutions stock in such a scenario is to either trade the short-term company or industry-specific triggers or buy the stock on dips if you have a long-term investment horizon. This will ensure that you limit your downside risk while reaping the upside returns in the short term. ”

5 Things to Consider Before You Buy Aker Solutions Stock

Investing gurus recommend some common tips that can help you along your investment journey. By applying the following five time-tested tips, you can lower your risk and earn higher returns while avoiding the mistakes that sometimes even professional investors make.

1. Understand the Company

Understanding the company means knowing its business model, competitive environment, fundamentals, factors that can drive its stock, among other aspects of the business. Knowing the critical aspects of the company's business allows you to make better investment decisions as you would be able to foresee the impact of the different factors on the stock price.

2. Understand the Basics of Investing

If you follow the basic principles of investing while buying any stock, you can perform better than most of the investors who disregard or don't know about them. For example, if you are into long-term investing, you should create a diversified portfolio, which means that you should not put all your money in a single stock or asset but spread it across different stocks to reduce your investment risk. Similarly, if you perform intraday or short-term trading, you should employ risk management strategies by using stop-loss in each of your trades to protect your capital and limit your downside risk.

3. Carefully Choose Your Broker

Your trading performance also depends on the type of stockbroker you choose, which means that you should carefully evaluate different brokers to select the best one that suits your trading or investment style. While each broker offers different features, you should look for the following features in a broker to have the best trading or investment experience. Your broker should:

- Provide you with access to an advanced online trading platform that works on all operating platforms and devices, including smartphones.

- Be registered with and regulated by a local regulatory authority to safeguard your money in the event of broker default.

- Charge low trading commissions, fees, and spreads.

- Allow you to trade different types of financial securities.

- Gives you an option to open a demo account to get yourself familiar with the trading platform and test trading strategies.

- Provide easy and popular deposit and withdrawal methods.

4. Decide How Much You Want to Invest

Wealth managers and investing experts advocate strategically allocating your money to different assets or stocks. If you believe that a stock will rise in the near future, you can include it in your portfolio and allocate a larger portion of your money to buy the stock. However, you should not invest all your money in that stock, which can overexpose you to that company - and your gain or loss will depend on the performance of a single stock. A prudent strategy is to build a portfolio of different stocks with slightly larger allocations to the stocks that you believe will rise, which will reduce your risk.

5. Decide on a Goal for Your Investment

An investment goal is necessary to devise a strategy to achieve it. In other words, your investment goal will determine the type of investment strategy you adopt. For example, if your investment goal is to achieve higher returns than the stock market index, you'll have to adopt an aggressive strategy and take a higher risk that might also cost you money. However, if your investment goal is to generate moderate returns, you can achieve it by investing in low-risk assets or low-risk investing strategies. There is always a risk-return trade-off in the investing world: you'll have to take on a higher risk to generate higher returns and vice versa.

The Bottom Line on Buying Aker Solutions Stocks

Aker Solutions is one of the largest companies in Norway in terms of revenue and is one of the leading solutions providers to energy companies. The firm has strong financials with a solid backlog of upcoming projects that can promise a steady flow of revenues in the future as well. The firm is continuously making new strategic acquisitions that help it acquire new technologies and further develop its business.

If you want to invest in Aker Solutions stock, you need to open an equity or stock account with a stockbroker. You can open your account by filling out an online form and upload your identity documents, such as the proof of residence, and your ID card. After your documents are successfully verified, your account will be created. You can then fund your account using any of the popular deposit methods.

If you want to explore more interesting stocks, you can browse our website for in-depth coverage of hundreds of stocks. You can view all the information about the stock in one place, which can greatly save you time and help you make an informed investment decision.

Frequently Asked Questions

-

Aker Solutions is a financially and technically sound company and is one of the leading solutions providers to energy firms. The firm has long-term collaborations with its partners and customers and has a strong order intake and backlog, which shows that the company’s solutions are highly valued by its customers. This can materialise into higher revenues and profitability for the company and higher total returns for its shareholders.

-

Aker Solutions stock can move in response to a variety of factors, including company and firm-specific factors such as mergers and acquisitions, award of future contracts, oil & gas commodity prices, and others.

-

Given the five-year negative returns generated by the stock, you can consider trading the stock using market-moving triggers or technical analysis using price charts or technical indicators.

-

You can analyse various fundamental metrics of Aker Solutions stock, such as the P/E ratio and PEG ratio, and compare the metrics with its peers to have an idea about the fair value of its stock.

-

Demand that can impact the market activity of oil firms; dependence on the award of energy contracts, local rules and regulations; shifting from conventional high-carbon to renewable energy sources that require companies to transform their operations and incur high costs.

-

The recent rise in oil & gas prices have increased the activity level of oil & gas firms, which has benefitted the firm. Also, governments worldwide are incentivising energy companies to invest in renewables, which is transforming the energy sector - and Aker Solutions is the firm that can directly benefit from the increased demand for renewables-related solutions.