How to buy Bayer stocks in 2025

Bayer AG is a German life science and healthcare company that produces pharmaceutical drugs for treating major diseases such as cancer, heart attack, and stroke, and over-the-counter consumer health medicines for curing minor medical conditions such as wounds, pain, and digestive problems, among others.

The company is headquartered in Leverkusen, Germany and has around 385 subsidiaries operating in 83 countries. Bayer AG is the parent company of the Bayer Group and oversees the functions of the enterprise through its Board of Management. Its stock is listed on the Frankfurt Stock Exchange (FWB) under ticker BAYN, whereas the stock also trades over-the-counter (OTC) in the United States under the symbol BAYN.

The article explains why you should buy Bayer stock and provides you with important information about the company.

How to Buy BAYRY Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Bayer

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About Bayer

The following sections highlight the history of the company, discuss management’s strategy and explain how the company generates revenue. Knowing those key details can help you understand the strengths and risks associated with the company and help you make better and informed investment decisions.

Bayer History

Bayer AG was cofounded by Friedrich Bayer and Johann Friedrich Weskott in 1863 as a dyestuffs unit in Barmen, Germany. In 1881, Bayer expanded and turned into a joint-stock company. With the establishment of research center in Elberfeld, the chemical company entered the pharmaceuticals industry and developed its brand of acetylsalicylic acid - a medication that relieves pain, reduces inflammation , and controls fever - which it registered across worldwide as its trademark “Aspirin” in 1899. The drug enjoyed stellar success and became a generic name for its different brands in various countries.

In the subsequent years, Bayer expanded its operations internationally through its five foreign subsidiaries and more than a hundred sales offices and agencies worldwide. The company’s headquarters were transferred from Elberfeld to Leverkusen in 1912. The company was ranked Germany’s third-largest chemical company in 1913 after it completed its 50 years of operations.

The company suffered a significant setback during the First World War as its assets, patents, and trademarks in the U.S were confiscated. The company’s exports to foreign markets dwindled and its Russian subsidiary was impounded in 1917 during the Russian Revolution. The tough financial conditions forced Bayer to skip dividends in 1923 for the first time after 1885.

The company restarted its foreign sales activities in 1946 and expanded into the United States and Latin America. Bayer stepped into the petrochemical industry and founded Erdölchemie GmbH in Dormagen, Germany, in collaboration with Deutsche BP. In 1967, the company’s overseas site in Antwerp, Belgium started its operations. The company’s chemical and pharmaceutical business developed multiple innovative products, such as polyurethane, crop protection products, polyacrylonitrile fibre Dralon, thermoplastic Makrolon, and dyestuffs for synthetic fibre. The prominent pharmaceutical products included cardiovascular medicines, broad-spectrum antibiotics, and dermal antifungals.

In 1974, the company consolidated its position in the U.S pharmaceuticals market after it acquired Cutter Laboratories Inc. and Miles Laboratories Inc. The company also started work to build its fifth site at Brunsbüttel, Germany to further expand its production.

In 1986, Bayer acquired a key supplier of metals and ceramics, Hermann C. Starck GmbH. On its 125th foundation anniversary, the company became the first German company to get listed on the Tokyo Stock Exchange. In 1994, Bayer acquired the North American over-the-counter division of Sterling Winthrop that regained the company its brand rights to the "Bayer Aspirin" it had lost in World War I.

In March 2014, the company acquired Algeta to strengthen its oncology business. The company also acquired the consumer care business arm of the U.S-based Merck & Co. and China-based Dihon Pharmaceutical Group Co.

What Is Bayer’s Strategy?

Bayer uses the following four strategic levers that shape the business strategy of each of its business units.

- Development of innovative products and solutions using cutting-edge technologies, research, and collaborations with third parties.

- Optimize the use of business resources to achieve operational excellence.

- Ensure business sustainability in line with the United Nations’ Sustainable Development Goals and Environment targets of the Paris agreement.

- As a global leader in the health and nutrition industry, identify high-growth and profitable business opportunities.

Bayer's Crop Science business division aims to use its R&D capabilities to address several issues - such as food and water scarcity, population growth, and climate change - confronting the global food and agriculture system. The company is exploring new business areas of digital farming by digitally connecting farms using data-driven models. The division's objective is to provide healthy food to consumers at an affordable price, using sustainable and environment-friendly processes.

Bayer's Pharmaceutical business division uses a combination of data science and biology to develop innovative pharmaceutical products. To fuel long-term growth, the company focuses on key therapeutic areas that require significant R&D efforts. Acquisitions, third-party research collaborations, and in-licensing are some of the strategies that the division adopts to achieve its long-term objectives.

The company's consumer health division aims to achieve a competitive advantage and develop its business by digitising its operations, including R&D, supply chain, marketing, and sales to remove bottlenecks and improve operational efficiency.

How Does Bayer Make Money?

For financial reporting purposes, the company divides its revenue into three divisions, namely crop science, pharmaceuticals, and consumer health. In the crop science segment, herbicides, corn seed & traits, fungicides, and soybean seed & traits generated most of the revenues in the first half of 2021.

The products that comprised the bulk of revenues of the pharmaceutical segment in H1 2021 included drugs and medicines such as Xarelto (oral anticoagulant), Eylea (ophthalmology drug), and Mirena / Kyleena / Jaydess (long-term contraceptives), among many others.

In the consumer health segment, over-the-counter products related to nutrition, allergy & cold, and dermatology were the main revenue generators in H1 2021.

How Has Bayer Performed in Recent Years?

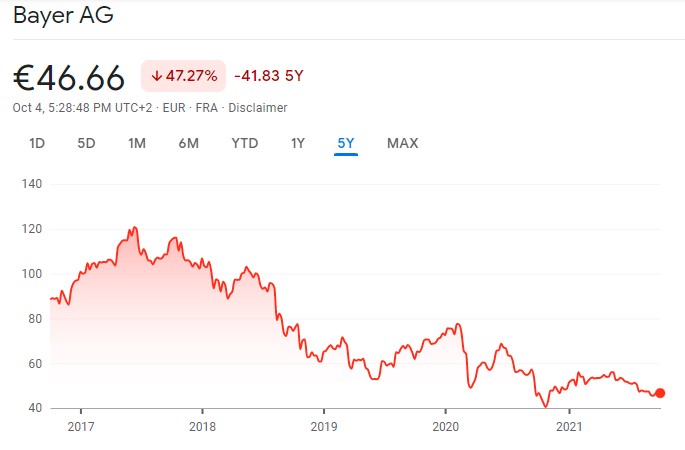

Bayer stock has lost around 47% or €42 per share since October 2016 when it was trading at €88. The stock achieved its five-year high of €120.74 on June 16, 2017, before slowly dwindling to its current levels of €46 in the subsequent years.

Source: Google Finance

Where Can You Buy Bayer Stock?

To buy Bayer stock, you need to open an equity account with a stockbroker. Most brokers offer different types of accounts, such as cash account, leveraged or margin account, CFD account, and other specialised Investment accounts. If you want to buy stocks for long-term investment, opening a cash account will serve your purpose as it allows you to buy stock using your own cash instead of the borrowed money from your broker. Leveraged accounts allow you to use borrowed money from your broker which can amplify your gains but also exposes you to a high risk of losses and overnight interest charges on the leveraged position.

Bayer Fundamental Analysis

Fundamental analysis of a company helps you determine the intrinsic or fair value of its stock in comparison to its market price, using different financial metrics such as P/E ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow. In the next sections, we will analyse the key fundamental measures of Bayer stock.

Bayer’s Revenue

Revenue represents the amount of money a company generated in a particular period by selling its products or services. Investors prefer investing in companies that register continuous revenue growth, which is a sign of strong demand for its products or services. You can view a company’s revenue on its income statement that is issued as part of financial statements covering a particular period, usually a quarter, half-year, or full year.

Bayer Group reported revenue of €10.9 billion in Q2 2021, which is an 8% increase from the same quarter of the previous year.

Bayer’s Earnings-per-Share

Earnings per share or EPS determines the amount of earnings or net profit available for each outstanding share. The metric is calculated by dividing the net profit by the average number of shares outstanding during a period. For example, if a company reported a net profit of $100 million and has 10 million shares outstanding, its earnings per share would be $10 ($100 million/10 million shares). If a company reports a net loss, its EPS would be negative or alternatively would be read as loss per share.

Bayers reported a €2.38 loss per share in Q2 2021.

Bayer’s P/E Ratio

The price-to-earnings or P/E ratio of a stock denotes its earnings or price multiple. In other words, the P/E ratio determines the price multiples of a stock in relation to the earnings available for each share. For example, if a stock trading at $50 has an EPS of $5, its P/E ratio would be 10x ($50/$5). The P/E ratio of 10x means that the stock is trading at a price multiple of 10 in comparison to its EPS of $5.

Stocks with high P/E ratios mean that they are trading at high earnings multiples and may be overvalued, which warrants further investigation on your part. P/E ratio is usually calculated on a trailing 12-month basis, which means that the earnings per share or EPS of the previous 12 months are taken into account while calculating the ratio. The P/E ratio of a stock changes daily with the change in the market price of the stock.

As of the 10th October 2021, Bayer has a negative TTM P/E ratio of 17x, as it had a trailing 12-month loss of -2.73 per share in comparison with its current market price of €46 per share.

Bayer’s Dividend Yield

Dividends are cash distributions by a company to its shareholders from its profit. Dividends are declared by the board of directors of the company as and when they deem fit in accordance with the dividend policy of the company. Only those investors who acquire the shares before the ex-dividend date are eligible for dividends declared by the company.

Dividend yield determines the amount of annual dividends per share expressed as a percentage of the stock’s market price. The dividend yield is calculated by dividing the annual dividends per share by the stock’s market price. For example, if a stock paid out $10 as dividends annually and its current market price is $100, the dividend yield of the stock would be 10% ($10/$100)x100.

Bayer has traditionally paid dividends to its shareholders every year. From 2017 through 2019, the company paid out €2.80 annually as dividends. In FY 2020, the company paid €2.00 in dividends per share. As of 10th October 2021, the dividend yield of Bayer’s stock turned out to be 4.28%.

Bayer’s Cash Flow

The free cash flow of a company shows the amount of cash left after deducting capital expenditures and interest paid from operating cash flows. High free cash flow means that the company generates ample cash to not only fund its operations and capital expenditures but also pay dividends to its shareholders.

Cash & cash equivalents are recorded on the cash flow statement and represent the cash reserves a company holds at the time of the preparation of the statement. In Q2 2021, Bayer reported free cash flows of €1,152 million.

Why Buy Bayer Stocks?

Bayer has a rich history spanning over 150 years. The company has spread its operations to most parts of the world and has regularly produced innovative pharmaceutical, consumer health, and crop improvement products. Here are some of the reasons why you should consider buying Bayer stock:

- Bayer pays regular dividends to its shareholders and has a healthy dividend yield of around 4.5%, which makes it a decent choice for dividend investors.

- The company posted a strong Q2 2021 result with double-digit currency and portfolio-adjusted growth in group sales and a healthy free cash flow of €1.2 billion in Q2 2021 shows the financial strength of the company.

- The company made strategic acquisitions and has ample products in its pipeline that can contribute to its future revenues.

Expert Tip on Buying Bayer Stock

“ Bayer stock lost around 45% over the past five years (2016-2021), which might prompt you to stay away from the stock. However, the attractive point of the stock is its decent dividend yield. To benefit from the dividend yield and, at the same time, save yourself from the downside, you can have a small exposure to the stock initially and gradually increase your holding. This will ensure that you don’t miss out on the dividend payments and don’t overexpose yourself to the downfall in the stock. If the market sentiments or small-term triggers favour the stock, you can then increase your position. ”

5 Things to Consider Before You Buy Bayer Stock

Before buying Bayer stock, you need to consider the following five tips that will help you make the right investment decisions at the right time, which can increase your chances of earning a higher return without taking unnecessary risk.

1. Understand the Company

Understanding the company includes knowing the company’s business model, strategy, competitive environment, risks, strengths, weaknesses, business opportunities, fundamentals, macro environment, and many others. In other words, you must know the internal and external factors that can influence the stock’s price so that you can proactively trade the stock accordingly to profit from the opportunities.

2. Understand the Basics of Investing

Before buying any stock, you must employ the basic principles of investing. One of the pillars of investing is to create a diversified portfolio containing different uncorrelated assets, which will spread your investment risk across different assets and lower your portfolio risk. If you are into short-term trading, you should always employ risk management techniques and use stop-loss to limit your downside risk on a trade.

3. Carefully Choose Your Broker

Among the countless number of brokers available, you need to be patient and look out for the one that offers the best services. At the minimum, your broker should provide you with the following essential features:

- Access to an advanced trading platform that can be used across all the devices irrespective of the operating system.

- Access to a variety of asset classes.

- Low commissions and spreads.

- Registered with and regulated by the local and foreign regulatory authorities so that you get your money back in case of brokers’ default.

- Provides a range of technical analysis tools.

- Provides convenient deposit and withdrawal methods.

4. Decide How Much You Want to Invest

While buying a stock, you should refrain from putting all your money in that single stock. You will find plenty of more investment opportunities as well, so the prudent way to invest your money is not to invest all your money at once. Many investors employ the dollar-cost-averaging strategy to lower their cost of buying stocks. If you want intraday or short-term trading, you need to calculate your trade size so that your risk per price movement is manageable. Ideally, you should not risk more than 1% or 2% of your account balance on each of your trades.

5. Decide on a Goal for Your Investment

You must set a reasonable goal before devising an investment strategy to achieve it. Your investment strategy depends on your investment goal. For example, if you are in your 20s or early 30s and want to save for your retirement, you can employ an aggressive investment strategy and invest a higher portion of your portfolio in stocks. In contrast, if you are nearing your retirement, you would want to protect your accumulated capital while earning some returns, which requires a conservative investment strategy by focusing on fixed-income securities (i.e., bonds) instead of stocks.

The Bottom Line on Buying Bayer Stocks

Bayer is one of the leading pharmaceutical companies in the world in terms of revenue. The company has been in the industry for over 150 years, has produced countless successful products, and expanded globally. Also, the company pays out regular dividends to its shareholders, which makes the stock worth holding for the long-term.

If you want to buy Bayer stock, you need to open your account with a broker. Most brokers allow you to open your account online - you need to fill out an online form and upload your identification documents, such as your ID card and proof of residence. Your account will be created after the broker successfully verified your documents. You can fund your account using any of the popular deposit and withdrawal methods, such as Paypal, debit card, credit card, and wire transfer.

If you want to discover other exciting stocks, you can check other guides on our website. We have analysed hundreds of interesting stocks that can potentially provide you with high returns.

Frequently Asked Questions

-

Bayer stock is suitable for long-term investment as it regularly provides dividends to its shareholders with a healthy dividend yield of 4.5% approximately at the time of the writing. Although the stock is significantly down from its five-year high, the stock can potentially give returns if you buy it near the bottom.

-

You need to closely follow the company-specific and industry developments to determine the short-term triggers that can influence its stock. You may also use price charts and technical analysis tools to exploit short-term movements.

-

Bayer stock trades on the Frankfurt Stock Exchange under the ticker BAYN and on the over-the-counter exchange in the U.S under the ticker BAYRY.

-

The company is exposed to a number of risks, including competition from other players in the crop science market, research & development investments not materialising into marketable products, regulatory issues, and pending litigation such as Glyphosate lawsuits.

-

The company expects the sales of the seeds and crop protection division to grow by 2%, the pharmaceutical division by 5%, and the consumer health division by 2% in 2021. With the rebound in the global economy post-pandemic, the company is focusing on emerging markets, along with the U.S market which will drive the most of its growth in 2021.

-

The crop science division of Bayer contributed the most to Bayer’s revenue in Q2 2021 as it registered €5.02 billion in sales.