How to buy Berkshire Hathaway stocks in 2024

Berkshire Hathaway Inc won’t be familiar to many people outside of the professional investing community. But when told that this is the company through which legendary investor Warren Buffett holds most of his investments, amateur investors’ ears should prick up.

In this article, we tell you how Buffett bought this textile manufacturing company and turned it into an investment holding company. Also, how Berkshire Hathaway makes money for Buffett, and how you can get a slice of the action by buying its A or (more likely) B shares.

How to Buy BRK Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Berkshire Hathaway

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About Berkshire Hathaway

We start by stepping back into Berkshire’s history, examining its money-making investment strategy, and reviewing its recent performance as a company.

Berkshire Hathaway History

Berkshire Hathaway started out as a much different company from the one it is today. Until the 1960s this was a textile manufacturing company that could trace its roots as far back as 1839. Warren Buffett started buying Berkshire Hathaway stock in 1962 when he noticed how the stock price moved whenever the company closed one of its mills. He subsequently took full control of the company and expanded into the insurance industry and other businesses to complement the declining textiles business. The textile operations were finally shut down in 1985.

Although he’s one of the world’s richest billionaires, Buffett has asserted that he would have made a lot more money if he’d invested directly in the insurance industry rather than buying Berkshire Hathaway.

Since Warren Buffett is 91 years old (in 2021) and his long-term business partner Charlie Munger is 97, the matter of succession has been raised several times over the decades. After much deliberation (since 2010) Buffett announced in May 2021 that Greg Abel would be his successor as CEO of Berkshire Hathaway. Greg had been vice-chairman of Berkshire Hathaway’s non-insurance operations since 2018.

What is Berkshire Hathaway’s Strategy?

Since Berkshire Hathaway's investment strategy has been driven over the years by Warren Buffett’s investment approach, we should outline The Sage of Omaha’s investment philosophy.

His philosophy was strongly influenced by Benjamin Graham’s school of “value investing”. You can read Graham’s book The Intelligent Investor to learn more about this approach that looks for stocks whose prices are unjustifiably low compared with the intrinsic worth of the companies concerned.

Buffett’s interpretation of value investing is based on four tenets: Business, Management, Financial Measures, and Value:

- Business is about understanding a company’s operational philosophy, which is why Buffett eschewed new and unproven technology companies for many years, especially during the dot-com boom of the late 1990s. However, one of Berkshire Hathaway’s notable holdings now is Apple.

- Management means (among other things) determining if a company’s management maximises shareholder value by distributing profits as dividends rather than retaining them within the business, although Buffett himself retains profits within Berkshire Hathaway rather than distributing them as dividends.

- Financial Measures means calculating a company’s economic value added (EVA), which is an estimate of the company’s profits with the cost of capital (shareholders’ stakes) deducted.

- Value is concerned with calculating a company's intrinsic value by projecting its future earnings and discounting them back to today’s levels.

One more thing that Buffett likes to see in a potential investment is a “moat” around a company that makes its position unassailable by competition. Another way of saying this is to look for a high barrier to entry for new companies in the industry.

How Does Berkshire Hathaway Make Money?

Although Berkshire Hathaway has a sizable investment portfolio that earns dividend income and generates capital gains when investments are sold, the company is also an insurance company that makes money from underwriting.

How Has Berkshire Hathaway Performed in Recent Years?

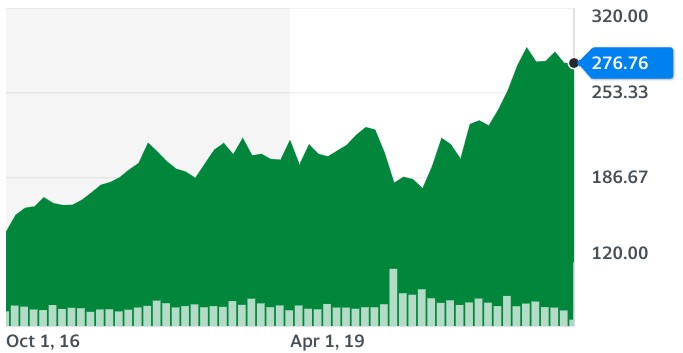

Berkshire Hathaway’s original “A” shares have enjoyed meteoric price appreciation since as far back as 1984. It’s a similar story for the “B” shares that have enjoyed a more than 13-fold increase since 1996. This is what the price chart looks like for the last five years (to September 2021):

Where Can You Buy Berkshire Hathaway Stock?

On financial websites such as Yahoo! Finance you’ll see Berkshire Hathaway shares listed separately as BRK-A and BRK-B. Since the price of its Class A shares had become too expensive for many investors to buy, in 1996 the company was forced to issue a new class of shares (Class B) priced at one-thirtieth of the Class A stock. A subsequent stock split made the Class B shares even more affordable.

Although both classes of shares are listed on the New York Stock Exchange (NYSE), you’ll be buying the “B” shares via a broker as a retail investor. Some brokers let you buy fractional shares, and some brokers let you speculate on the Berkshire Hathaway share price without buying shares at all - by taking leverage spread bets or contracts-for-difference (CFDs) instead.

Berkshire Hathaway Fundamental Analysis

Warren Buffett is famous for performing fundamental analysis of the companies he buys via Berkshire Hathaway. Therefore, it’s only right for us to perform a fundamental analysis of Berkshire Hathaway itself before you buy its stock.

Berkshire Hathaway’s Revenue

Let’s start with the revenue that is shown on the “top line” of the company’s income statement:

You can see that the revenue figure fell between 2019 and 2020, probably because of the coronavirus crisis market crash, but that the trailing-twelve-months (TTM) figure to September 2021 recovered as a result of the subsequent bull market bounceback.

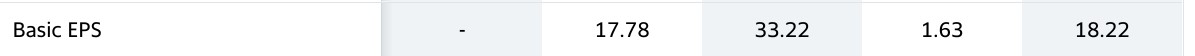

Berkshire Hathaway’s Earnings-per-Share

Deducting a company’s costs from its revenue leads to its earnings, also known as profits. Since you don’t own the whole of Berkshire Hathaway, what you’ll actually want to know is your share of those earnings; i.e., the earnings per share (EPS). Berkshire’s EPS has been more variable than its revenue in recent years:

The TTM EPS to June 2021 was a massive $67,628.

Berkshire Hathaway’s P/E Ratio

The EPS is still not what we really want to know, because a stock’s attractiveness depends on the share price you have to pay for its earnings stream. Therefore, we want to know this stock’s price-earnings ratio (P/E), calculated as the price of its shares divided by the earnings-per-share.

At the time of writing, Berkshire Hathaway’s P/E is about 6, which means you pay $6 for every $1 worth of annual earnings. Put another way, it would take the company only six years to earn enough money to pay back your investment.

A lower P/E is regarded as more attractive than a higher P/E, and this is close to the company’s ten-year low P/E of 5.83 compared with its ten-year high of 129.98. So, on this measure, it could be a good time to buy Berkshire Hathaway stock (as of September 2021).

Berkshire Hathaway’s Dividend Yield

Some companies distribute some of their earnings to shareholders in the form of dividends.

Dividend yield is a measure of the income that investors can expect to receive from a stockholding. Expressed as a percentage, it allows investors to compare the income from a stock with the interest that would be received by holding investment funds in a bank deposit account instead.

Despite Warren Buffett being a big fan of dividends and the compounded returns that can be built by reinvesting them, Berkshire Hathaway doesn’t pay dividends. Buffett’s argument might be that he can reinvest the company’s earnings within the company more effectively than you could if you received dividends, and he’s probably right.

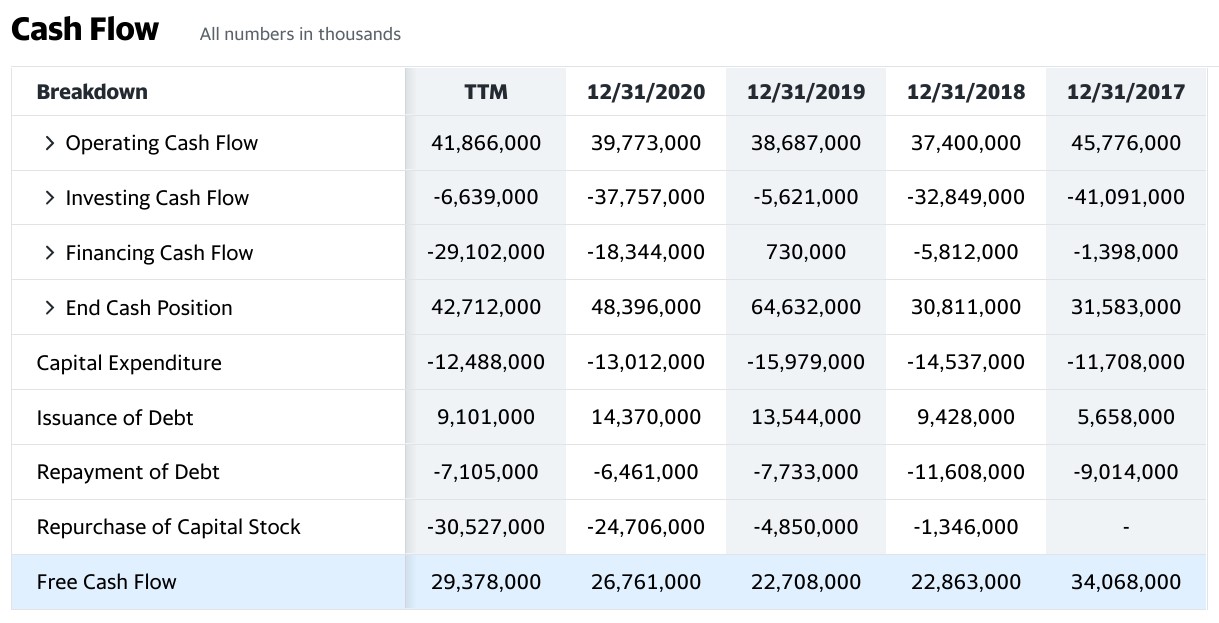

Berkshire Hathaway’s Cash Flow

The final fundamental metric to consider is a company’s cash flow, specifically its free cash flow figure that represents the money that the company has left over — after paying all the costs of staying in business — to fund further investment or pay down debts or (not in this case) distribute to investors as dividends.

After falling between 2017 and 2018, you can see how Berkshire Hathaway’s free cash flow has since been increasing:

Why Buy Berkshire Hathaway Stocks?

Most investors would love to emulate Warren Buffett’s success by implementing his investment philosophy, but do you actually think you can beat him or even match him? You’ve no doubt heard the phrase, “If you can’t beat them, join them”, and you can join Buffett by investing in his Berkshire Hathaway investment holding company.

Expert Tip on Buying Berkshire Hathaway Stock

“ Berkshire Hathaway had to issue a new class of “B” shares when its “A” shares became too expensive for many investors to buy, so you should be looking at the B shares (BRK-B) as a retail investor. This said, some of the newer online brokers allow you to buy fractional shares in companies whose shares would otherwise be too expensive. ”

5 Things to Consider Before You Buy Berkshire Hathaway Stock

There are at least five things you should consider before buying Berkshire Hathaway stock or any other company stock.

1. Understand the Company

As explained earlier, some of Warren Buffett’s key tenets are around understanding the company you’re investing in, in terms of its business, management, financial measures, and value.

2. Understand the Basics of Investing

Understanding the companies you invest in is just one aspect of investing. You also need to understand some of the basic investing principles such as money management (making sure you stay solvent) and diversification (spreading your risk across several stocks and other uncorrelated assets). Also, understanding how to use various order types such as “limit orders” that ensure you don’t pay more for shares than you think is reasonable.

3. Carefully Choose Your Broker

To buy shares, you need a stockbroker, but they’re not all the same. Choose a well-known broker that has good customer reviews and is regulated in your jurisdiction (so that you get some financial protection against the broker going bust).

4. Decide How Much You Want to Invest

If you’ve received a windfall such as an unexpected inheritance, you might be tempted to put all the money into Berkshire Hathaway stock. But beware that this single stock — however sound it may seem — would not provide you with a diversified portfolio. In fact, the company’s holdings are not very diversified. Consider investing only a proportion of your available funds in the company, with the rest of your funds invested in other companies and uncorrelated assets such as gold.

If you have a regular monthly amount to invest, this will allow you to practice “dollar cost averaging”, which means buying tranches of shares at different share prices to reduce the danger of making a single share purchase at a too-high price.

Whatever you do, don’t invest money from the long term that you might need to take back for something else in the short term. And never (ever!) borrow money that needs to be paid back soon in order to make investments that won’t pay off until far into the future.

5. Decide on a Goal for Your Investment

What kind of investor or trader do you want to be? If you’re looking to make a lot of money in a little time through day trading, buying Berkshire Hathaway shares is probably not right for you. If you’re looking to emulate Warren Buffett’s success by buying shares and potentially holding them forever, then why not try to piggy-back his success by buying and holding the shares of his own company?

The Bottom Line on Buying Berkshire Hathaway Stocks

Berkshire Hathaway is legendary investor Warren Buffett’s investment holding company. For many investors, this alone would be reason enough to buy its shares and thus benefit from a slice of Buffett’s success.

In this article, we’ve explored Berkshire Hathaway’s history from humble beginnings as a textile mill. We’ve looked at how the company invests and makes money, and we’ve explored its financials from the same “fundamental” perspective that Buffett himself might use when assessing a potential investment.

This is not the only guide of its kind. If you’re not ready to buy Berkshire Hathaway stock, you might instead be interested in one of the other companies we’ve covered on our website. Look around to find the investments that take your fancy.

Frequently Asked Questions

-

Berkshire Hathaway is listed on the New York Stock Exchange (NYSE) under two ticker symbols: BRK-A for the expensive Class A shares, and BRK-B for the more affordable Class B shares.

-

Although Warren Buffett is a big fan of investing in companies that pay dividends, his own holding company doesn’t do so and never has. Here’s one way to look at it: Buffett believes that he can invest the dividends from companies better than they can reinvest their profits within their businesses (so he likes to receive dividends). And he thinks he can reinvest profits back into his own business better than you could reinvest the dividends you’d receive (so Berkshire Hathaway doesn’t pay dividends).

-

As a nonagenarian, Warren Buffett isn’t getting any younger, nor is his business partner Charlie Munger, but plans to replace Buffet as CEO of Berkshire Hathaway are in place. In May 2021 it was announced that Vice Chairman Greg Abel will take the reins when required, with Vice Chairman Ajit Jain on standby.

-

As of September 2021, Apple stock accounts for more than 40% of the company's holdings, with Bank of America accounting for more than 14% and American express accounting for about 8.5%. One of Buffett's most famous stock holdings, The Coca-Cola Company, accounts for more than 7% of Berkshire’s portfolio. The outsize Apple holding makes the Berkshire portfolio less diversified than you might have thought, but we can afford Buffett this luxury since he seems to know what he’s doing.

-

Warren Buffett counts ConocoPhillips, U.S. Air, and Dexter Shoes among his investment mistakes for various reasons ranging from "buying at the wrong price" to "investing in a company without a sustainable competitive advantage". Dumping Disney stock (twice) is also considered to have cost him a lot of money. Even the Oracle of Omaha doesn’t know everything about investing.

-

Technical analysis (i.e., interpreting price chart patterns) can be used as a complement to fundamental analysis when assessing any stock purchase. However, this would go against the spirit of Warren Buffett’s own approach when deciding which stocks to invest in.