How to buy Boeing stock in the UK in 2026

The Boeing Company, or simply Boeing, is one of the largest aircraft producers in the world. It operates through four divisions: Boeing Capital; Defense, Space and Security; Commercial Airplanes; and Global Services. For retail traders intending to buy Boeing stock, the company is best known for its commercial airlines business that took a big hit during the COVID-19 pandemic. It is also a competitor to Airbus.

Founded in 1916, this iconic American corporation employs over 141 thousand people. It belongs to the industrials sector: a cyclical sector that reflects the ups and downs seen in the business cycle.

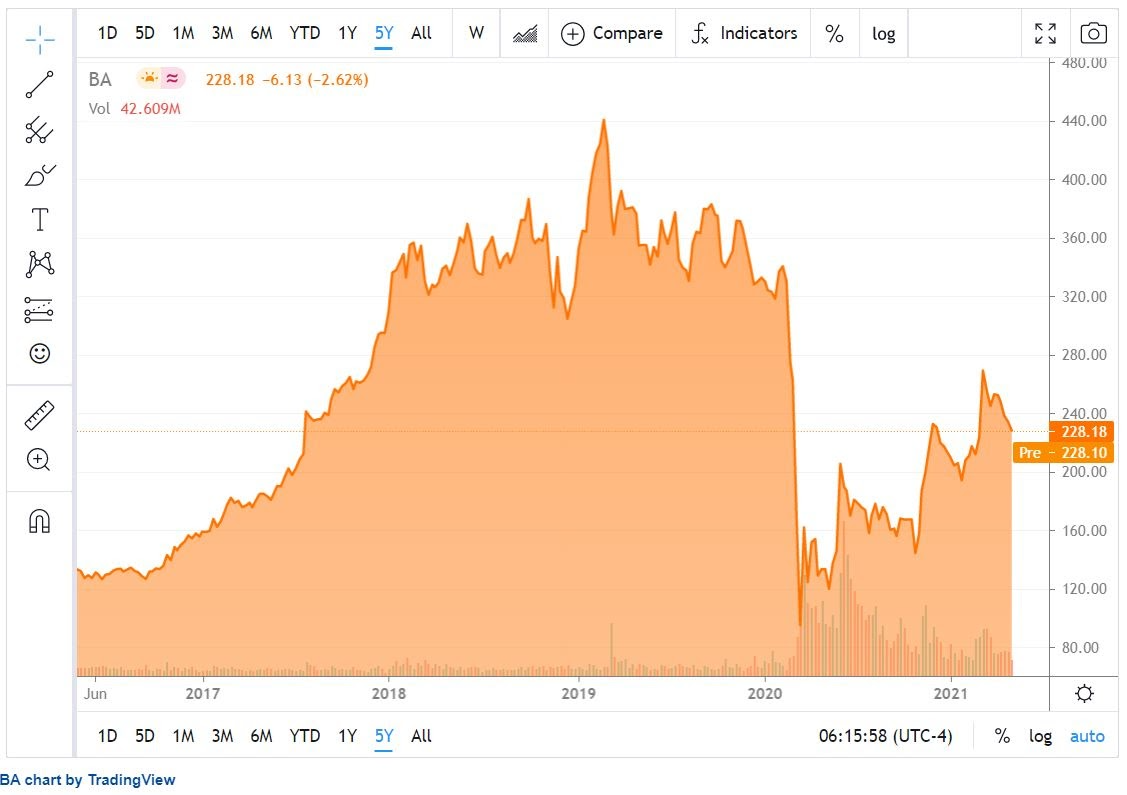

In the years prior to the pandemic, Boeing suffered from negative publicity due to its 737 Max aircraft’s technical issues. It haunts the company to this day, yet Boeing shares have recovered from the 2020 lows and are up over 81% in the twelve months to May 2021.

How to Buy BOE Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Boeing Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need to Know About Boeing

Before digging into Boeing's financial fundamentals, let’s have a look at the company’s strategy and history, how it makes its profits, and what opportunities lie ahead.

Boeing History

Boeing has existed for almost a century and it was initially named the Boeing Airplane Company. It changed its name after fifty years of existence to better reflect the new activities it became engaged in: defense, space and security, and Boeing Capital.

Its rivalry with Airbus is well-known among investors. Boeing and Airbus compete directly, and their rivalry in getting the bigger number of annual orders is a benchmark for the overall global economy. For example, during the COVID-19 pandemic, the news that Ryanair ordered several Boeing planes was viewed as the bottom of the business cycle.

Boeing’s diversified business helped its stock price recover after the safety concerns related to the 737 Max planes.

What Is Boeing’s Strategy?

As already mentioned, Boeing is an industrial company that competes in four different areas. In addition to its huge business with US government defense projects, it also offers financial services and manages financial exposure via finance leases under the Boeing Capital part of its business. Like any cyclical company, Boeing is strongly dependent on the economic cycle, and periods of economic recession weigh on its profitability.

How Does Boeing Make Money?

Boeing is mostly known for its Commercial Airplane division that provides fleet support services, commercial jet aircraft, and cargo services. But this is not the only segment that contributes to the company’s financial performance.

The company runs a huge business in the defense and security sector, being involved in the production of unmanned military aircraft, surveillance and intelligence systems, just to name a few.

Boeing had a hard time during the COVID-19 pandemic as the commercial airline industry came to a sudden halt. At the time of writing, it is yet to recover: operating 25% below its pre-pandemic level, which affects the bottom line of Boeing’s income statement.

How Has Boeing Performed in Recent Years?

Despite the 737 Max problems, Boeing’s share price peaked at more than $440/share one year before the pandemic. Then the pandemic hit, and the rest is history.

Unlike other sectors that benefited from the pandemic, such as the technology sector, the commercial airline sector was one of the hardest sectors. While the dip in the equity market was abrupt for all sectors, the recovery was uneven. For instance, many companies recovered quickly to exceed pre-pandemic levels, while BA stock only recovered half its lost share price.

Where Can You Buy Boeing Stock?

Investors can gain exposure to Boeing stock in various ways. The easiest way is to buy Boeing stock directly using an account offered by a stockbroker. Some online brokers let you trade fractional shares or put up less of your own money by participating in margin trading, but the latter significantly amplifies your losses as well as your gains.

Directly owning Boeing stocks has more benefits than (for example) trading the stock via “contracts for difference” (CFDs). A CFD only allows a trader to speculate on the underlying asset’s movements without the additional benefits of owning the actual stock (e.g., discounted products or the chance to vote at company meetings).

Boeing Fundamental Analysis

Traders and investors use various techniques to value a company. While technical analysis is mostly used for speculating on financial assets movements, fundamental analysis is used to find a company’s intrinsic value (hence what its share price should really be).

The market price always reflects the present value of the company’s future cash flows. Many models exist to discount those future cash flows to find out the correct present value, and, at the end of the process, investors have an idea about the company’s intrinsic value.

If the market price is above the calculated intrinsic value, the shares are overvalued. The investor has the option of “selling short” (betting on a falling price) by borrowing from the broker, or simply sitting tight if the investor follows a long-only strategy when running the portfolio.

If, on the other hand, the market price is below the calculated intrinsic value, the shares are deemed as undervalued. Hence, the investor will look to gain exposure by “going long” in either a cash or margin account.

Now let’s look at Boeing’s revenue, earnings-per-share (EPS), price/earnings ratio (P/E), dividend yield, and cash flow.

Boeing’s Revenue

Revenue refers to the total sales of goods and services over a specific period. This is an important aspect of interpreting financial statements: the income statement (where the revenue position belongs) shows the financial performance of a company, whereas the balance sheet only shows the financial position at a given point in time, typically at the end of the fiscal year.

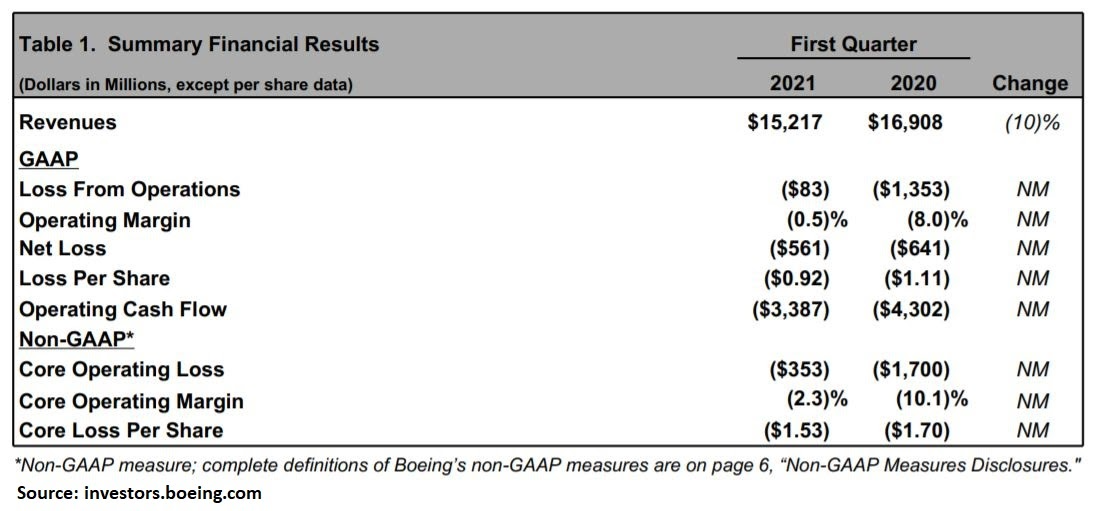

In sharp contrast to net income, which is known as the bottom line, revenues are the top line of the income statement. According to the last quarterly earnings, Boeing’s revenue declined 10% to $15.2 billion in Q1 2021 when compared to the same period in 2020.

Boeing’s Earnings-per-Share

Earnings-per-Share or EPS is a profitability ratio based on net income, which is the bottom line on the income statement, net of preferred dividends, and adjusted by the weighted average number of shares outstanding.

In the course of a year, a company may issue new shares, may repurchase them back, or may split the share price. All these actions would affect the weighted average number of shares outstanding. Also, if some embed options exist — such as warrants or convertible shares — these will affect the number of shares. For this reason, investors calculate not only the basic EPS but also the diluted EPS. The difference between the two is that the diluted EPS shows what the EPS would be if the convertible debt was actually converted.

The higher the EPS number, the better for the company. At the time of writing, Boeing’s EPS has declined dramatically in the previous four quarters, mostly due to the total collapse of the airline industry. Although the EPS posted by Boeing in the last quarter is abysmal, keep in mind that investors price a share based on the future value of its cash flow.

Boeing’s P/E Ratio

The price-to-earnings ratio (P/E) simply shows the value of the company’s shares divided by the EPS. At the time of writing, one share of Boeing is priced at $239.57, but we can’t calculate the P/E ratio because the company lost money in the previous quarters (thus making the denominator negative).

In general terms: the higher the P/E ratio, the more likely that the company’s share price is overvalued.

Boeing’s Dividend Yield

As the name suggests, dividend yield is a financial ratio that reflects the annual dividend (your share of the company’s profits) divided by the share price. To many investors, dividend-paying companies are a must in a portfolio because of the opportunity to reinvest the proceeds. The higher the ratio, the more attractive the company is to dividend-seeking investors.

The longer the dividend-paying history, the more attractive the company for dividend-seeking investors. However, not all companies pay a dividend, and some of those that do are doing so to attract investors in a declining industry.

Boeing does not currently pay a dividend, even though it used to. Most likely, it will start paying a dividend again as the company fights back following the pandemic-led collapse.

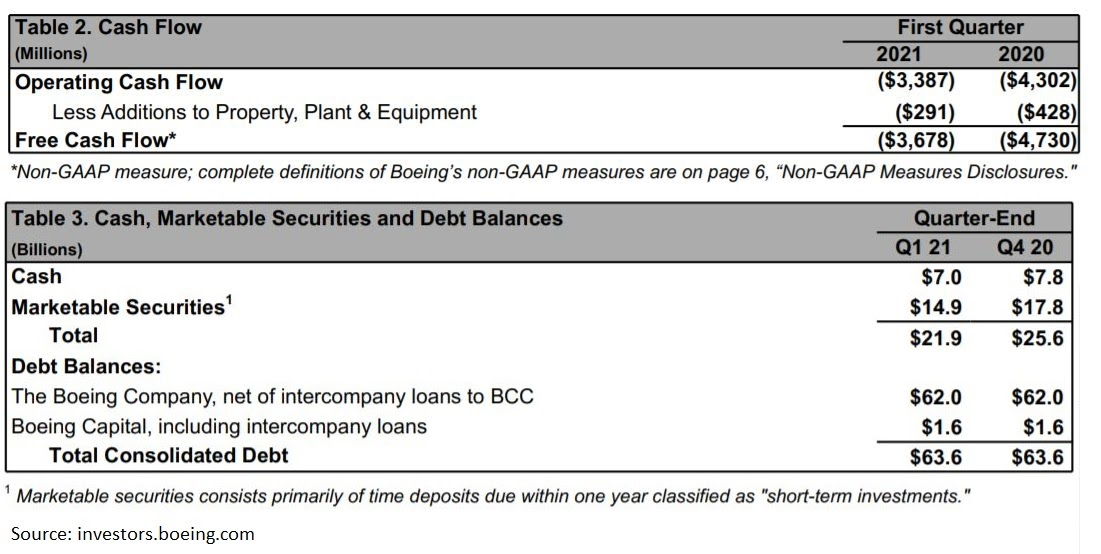

Boeing’s Cash Flow

The cash flow statement reveals the cash available to the company, and this is grouped into three categories: cash flow from operations, investing, and financing activities. Out of the three, the cash flow from operations — also known as CFO or operating cash flow — is the most important one because it reveals how much cash the company generates from its day-to-day operations.

A strong cash position is desirable because it suggests a viable business. Also, assets that can be quickly converted to cash, such as marketable securities, are desirable too.

Why Buy Boeing Stocks?

Boeing is one of the market leaders in the aviation industry, but it also generates a big chunk of its revenue from other sources. Some years ago, the idea was to diversify away from the main commercial airplane manufacturing industry by entering adjacent lines of businesses in the defense and security sectors.

Unfortunately, the pandemic affected most of Boeing's customers; i.e., commercial airlines. Because of the pandemic and the “force majeure” clauses, commercial airlines were advantaged in their contractual obligations with the airplane manufacturers.

The pandemic hit the airline industry so hard that many names were bailed out by governments. The most amazing example comes from one of the leaders in the commercial airline industry: Lufthansa AG, a German carrier that had to be bailed out by the German government.

Yet, air travel is here to stay. Here are some reasons to buy Boeing stocks despite its poor financial position weakened by the pandemic:

- A leading commercial airplane manufacturer, with a diversified business

- Promising growth trends for the commercial airline industry once the pandemic ends

- New management

- Orders started to build up again as the pandemic eases

Expert Tip on Buying Boeing Stock

“ Boeing is active in a cyclical industry and is affected during periods of economic contraction. Now that the business cycle has passed the trough, and the economy has started growing again as seen in the first quarter of the year, cyclical companies such as Boeing will have an easier time improving their financial results. ”- thomasdavid

5 Things to Consider Before You Buy Boeing Stock

Investing in a company usually comes at the end of a due diligence process that covers at least the following points: fully understanding the company’s business, establishing an investment thesis, assessing the financial intermediary, deciding on the capital to be invested, and determining an investment objective.

1. Understand the Company

Investors are attracted to a company for various reasons, which may be personal (i.e., they use and like the company’s products or services) or to do with core values (e.g., the company invests in clean energy). A dividend-paying company may appeal more to some investors, while others focus on growth rather than dividends. Warren Buffett’s Berkshire Hathaway is well known as one of the most successful companies in the world, yet it doesn’t pay dividends.

2. Understand the Basics of Investing

Make sure you understand the 101 of investing. Investing is mostly about managing risk but not eliminating it (because you can’t). Diversification is one risk-reduction strategy.

3. Carefully Choose Your Broker

The broker is your partner in the investing process. Low fees and commissions are not all that matters, and most investors choose their brokers on other criteria such as reputation or regulation. The broker’s trading platform is also important because successful diversification depends on the broker making various asset classes available to buy.

4. Decide How Much You Want to Invest

This is a controversial point to consider because it depends on what type of investor you are: risk-averse, risk-seeker, or risk-neutral. Typically, financial market participants are risk-averse, yet temptations exist everywhere.

Margin accounts enable traders to buy more stock than the cash in their account allows them to. In this case, buying on margin has an additional cost (the interest on the money borrowed from the broker) and increased downside risk. During bearish markets, investors can receive margin calls from their brokers, which means their positions will be closed if they don’t deposit more cash.

5. Decide on a Goal for Your Investment

The investing process starts with the planning step. When planning, the investor must consider the target or goal for the investment. Things to consider are whether the investment is supposed to deliver diversification benefits, how long you are willing to remain invested, what is the required rate of return, and what is the maximum risk you are willing to take. There is a saying that says, “If you fail to plan, you plan to fail!”

The Bottom Line on Buying Boeing Stocks

Boeing is a leading company in its industry and is one of the Dow Jones Industrial Average components.

As the economy rebounds from the lows, so do cyclical companies such as Boeing. In the first quarter of the year, the US Gross Domestic Product (GDP) grew by over 6%, suggesting the worst of the economic contraction is over. Boeing and other cyclical companies should benefit from the new expansionary phase in the business cycle.

While not a dividend-paying company at this time, Boeing does have a dividend history. It is fair to assume that the “good habit” of paying dividends will follow after the pandemic ends.

If you’re ready to invest, you can follow the simple three-step process of choosing a broker, finding the stock to invest in, and placing an order.

If you’re not sure about the overall investing process, you can learn more by reading our guides before deploying your funds into investments.

Frequently Asked Questions

-

No. Boeing had strong fundamentals before the pandemic hit the world. The company took an indirect hit from the air travel shutdown as investors pulled funds out of those stocks in particular. As that trend reverses, and world economies open up, the airline industry is ready to rise again.

-

Most likely. Up to 2020, Boeing had a long history of paying dividends and it stopped doing so because of the pandemic. It makes no sense to declare a dividend when the industry is on the verge of collapse, but as soon as the industry recovers, so will Boeing's financial performance. Hence, it is only fair to assume that the plan is to revert to being a dividend-paying company as soon as it is viable to do so.

-

Valuing a company in search of the intrinsic value of its shares is solely a fundamental analysis concept. Investors look at the company’s financials and use different models to discount the future value of its cash flows. In a market that is semi-strong efficient, not even fundamental analysis can lead to abnormal returns over long periods of time. However, as the markets proved time and again, they are not that efficient, so finding the right stock to buy requires a mix of both technical and fundamental analysis.

-

To buy: Buying shares is betting on the price to rise. Effectively the investor takes a long interest in the company’s shares. The good part is that the downside is limited, or bounded, to zero. For this reason, many investing strategies of famous hedge funds are long-only strategies, thus avoiding unnecessary exposure when shorting a stock. When shorting: the investor borrows the shares from the broker, but if the market squeezes higher, the downside is unbounded or unlimited, leading to potentially huge losses. A recent example is GameStop, which triggered billions of losses for short-selling hedge funds.

-

Yes, Boeing is not profitable now. But the shares still trade above $200 each and this tells much about investors’ perspective about future earnings. Remember that it is the present value of the future cash flows that matter the most when valuing a company.

-

This is as simple as investing in any other market. Pending orders are known for being the right tools to deploy effective money management. As such, all you have to do is to set the level that would signal the exit from the investment, and place a stop-loss order at that level. When and if the market reaches that level, the broker automatically gets you out of an uncomfortable position.