How to buy BP stocks in 2025

BP is a London-headquartered company involved in the oil and energy sector. The business is transitioning towards green energy. Given the capital-intensive industry it operates in, BP had to sell its carbon-related assets to raise enough funds. Over the next years, the company plans to expand further into renewables, although most of its current income-generating activities are related to oil and gas.

The next sections introduce you to everything you need to know to buy BP stock. We will dive into a thorough fundamental analysis that can serve as the basis of your decision-making process. Thus, at the end of this article, you will be better equipped to decide if BP is the right stock for your needs, investment objectives, and capital growth strategy.

How to Buy BP Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in BP

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About BP

BP is a well-known oil company. It’s been the subject of one of the biggest corporate scandals in history and has managed to survive many changes in its history of over a century. The next sections introduce you briefly to its history, business strategy, and how it generates revenues.

BP History

BP’s history starts in the early 1900s as the Anglo-Persian Oil Company, hitting many milestones over its more than one century of existence. As an investor, however, you may want to focus on its achievements following 1998. This is when the company, then registered as the British Petroleum Company, merged with the Amoco Corporation and turned into the world’s largest oil company (BP Amoco). In 2000, BP acquired Atlantic Richfield Company and Burmah Castrol, two oil companies in the U.S. and the U.K., changing its name to BP PLC.

The company made the headlines in 2010 when the offshore drilling rig, known as Deepwater Horizon, exploded and collapsed; it was, at the time, leased by BP and under Transocean’s ownership. This caused a media scandal as 11 people lost their lives that day and nearly 5 million barrels of oil spilt into the Gulf of Mexico, making for the largest oil spill in history. The company paid more than $60 billion in fines following this event.

What Is BP’s Strategy?

Although in 1990-2003 the company invested massively in green energy under the slogan “Beyond Petroleum”, it has slowly shifted away from this field. In 2012, the company closed the solar energy unit. However, recently, BP has turned its attention back towards green electricity and energy. Most notably, it aims to invest in low-carbon energies, such as bioenergy and renewables, to achieve carbon neutrality.

BP currently has three main business activities: gas and low carbon energy, customers and products, and production and operations. Some of the main strategic activities for each of them include:

- Grow the low-carbon energy business by expanding the renewables portfolio (offshore solar and wind energy);

- Increase differentiated lubricants and fuels offerings in growing markets;

- Develop next-generation solutions, such as hydrogen and sustainable fuels;

- Improve safety and efficiency.

How Does BP Make Money?

BP is a group of associated companies and subsidiaries with a diversified stream of income. These explore, produce, transport, and distribute oil and natural gas. A large portion of revenues also comes from manufacturing plastics and chemicals, among others. Under different brands, BP also generates money via filling stations and convenience stores.

How Has BP Performed in Recent Years?

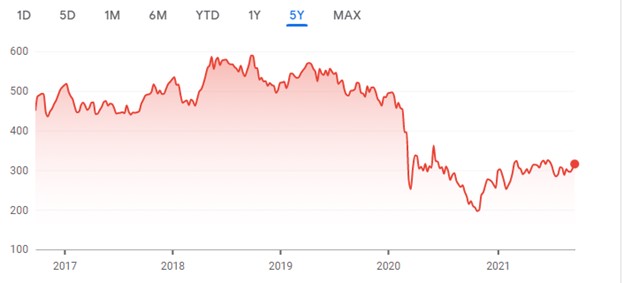

On the 28th of September 2018, the share price reached its highest level in the last five years, just shy of £5.90. Around that time, it was announced that BP secretly negotiated and paid $25.5 million to Mexico following the oil spill in 2010. Yet, after this news, the share price started to drop, remaining in a slow downtrend until the pandemic in 2020.

In 2020, the pandemic fueled investors’ concerns that the coronavirus negatively affected the oil demand, causing crude oil prices to drop by more than 20%. The oil giant suffered from this weakness in the market, reaching an all-time low price of £1.88 at the end of October 2020. This drop was mainly caused by the bearish conditions imposed by coronavirus concerns.

Source: Google Finance

Where Can You Buy BP Stock?

If you want to buy BP stock and hold it for the long term, one of the most convenient options is to register with an online stockbroker. Depending on which one you choose, you can opt for a regular trading account or a tax-efficient alternative, such as an ISA or SIPP.

Regular trading accounts allow you to place orders and build a portfolio according to your budget. Most online stockbrokers nowadays provide BP stock, along with many other assets. The requirements to open such an account depend on each broker, but they usually require low minimum deposits.

Next, you may opt for a SIPP or a self-invested personal pension if you are a UK resident. You can choose what to invest in, choosing from shares, trusts, and funds. You can redirect up to 100% of your earnings into this account, but only £40,000 will benefit from tax relief. Your investment is subject to 20% tax relief – in other words, the government helps you top up your pension account. As this is supposed to be a retirement account, you will not be able to access the funds before 55 years old, or 57 years old starting from 2028.

Finally, if you want to generate income and withdraw it at any time while benefiting from tax-free income, you can open a stocks and shares ISA if you are a UK investor with a National Insurance number. You can choose your assets, then withdraw the funds at any time without paying taxes.

BP Fundamental Analysis

Unlike technical analysis, which traders use to look for patterns in share price movements, fundamental analysis is what investors use to determine the underlying health and intrinsic value of a company. When you read about fundamental analysis, you’ll see terms such as P/E ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow. So, let’s look at what those terms mean.

Whether you plan to invest for your retirement or you have a shorter time horizon, it’s important to conduct a fundamental analysis of your chosen assets. This helps you make an educated guess about whether the company’s strategy is viable, sustainable, and what returns you may be able to generate from your investment.

BP’s Revenue

The importance of analysing a company’s revenue cannot be overstated. When the company reports revenue growth, its stock price naturally increases. This is because it boosts the company’s value, on one side; on the other side, an increase of revenue today probably means an increase of earnings in the future, too, since the company may continue its growth or reinvest the money to continue its development. As a result, revenue growth is associated with upward pressure on the stock price.

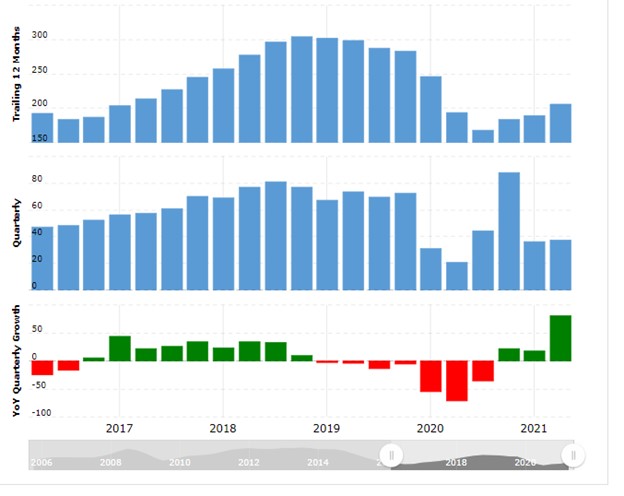

BP’s revenues can be found in its financial statements listed on its website or by accessing the stock on your stockbroker’s platform. Below, you can find a breakdown of its revenues and revenue growth. As expected, the revenue decreased from $303 billion in 2019 to only $168 billion in 2020 due to the pandemic. Based on the figure below, the revenue growth seems to recover quickly as the coronavirus concerns dissipate.

Source: Macrotrends

BP’s Earnings-per-Share

Earnings-per-share (EPS) ratio refers to how much of BP’s earnings are distributed to each investor on a per-share basis. You can find this ratio already calculated on the company’s financial statements or on your broker’s platform.

The EPS is often used by investors to understand the financial strength of a company – the higher the EPS, the more money the company has, and some of this cash is to be distributed to its shareholders, while the remaining amount (“retained earnings”) are kept for investments or other business activities. BP’s EPS in Q2 FY2020 was negative, although the company got back on track after that, beating market estimates every quarter ever since (as of this writing).

BP’s P/E Ratio

The price-to-earnings ratio tells you the price multiple and is used by investors to determine the value of a company’s shares. In simple terms, a high P/E ratio compared to its peers or industry could mean that the company is overvalued (thus, pricing is expected to correct), while a low P/E ratio means that the company is undervalued (thus, buying it now might be a great opportunity).

For example, BP’s P/E ratio is 10.24, while Chevron’s, one of its competitors, is 53.72 at the time of writing. Without taking other aspects into consideration, you may assume that BP is currently undervalued, especially since it trades significantly lower than its five-year high price. Alternatively, investors may believe that Chevron will have a high growth rate in the future, which justifies the higher P/E ratio. To have a better insight into this, you need to conduct further analysis into BP and market conditions.

BP’s Dividend Yield

The dividend yield is a financial ratio that measures the annual value of dividends a company pays relative to the share price of its stock. Dividend per share is the company’s total annual dividend payment, divided by the total number of shares outstanding. A company with a high dividend yield pays a substantial share of its profits in the form of dividends.

BP has been known for its generous dividend policy. The first dividend reduction occurred after the Deepwater Horizon disaster in 2010 when the company altered its dividend payments for a few quarters. Then, in 2020, BP slashed the quarterly dividend by 50%, down to a dividend yield of only 5.35% (from 10.7% previously).

The company decreased its dividend yield majorly as it shifted its focus from oil and gas production to low-carbon energy. At the time, BP reported an estimated $500 million to $5 billion per year to be spent on cleaner energy until 2030.

On the one hand, this meant less income for long-term investors. On the other hand, the company retained this capital in order to fuel its growth strategy, which could mean additional value for shareholders via capital appreciation.

In August 2020, the company officially announced that it aims to turn away from an international oil company to become an integrated energy company. Thus, dividend-seeking individuals may not find this stock a suitable choice as the company will most likely reinvest its earnings to fuel its bold promise rather than distribute them to investors.

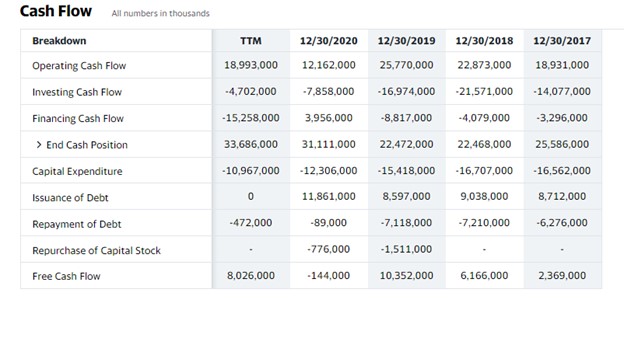

BP’s Cash Flow

BP’s cash flow and, subsequently, its financial strength have long been among the weakest in the industry. This is because of the high debt of the company, which, in 2021, was about four times higher than Chevron’s debt – whose financial position is probably the strongest in the entire industry.

BP’s capital structure was based on 45% long-term debt. To improve its position, the company has quickly sold its assets to generate more cash. It aims to achieve a goal of $25 billion in divestitures by 2025, mainly selling carbon-based assets to fuel its green energy strategy. Yet, some caution is needed – BP’s main source of income remains oil and gas, so selling too much in a short time could boost its cash flow but may strain the core revenue-generating activities.

Source: Yahoo! Finance

Why Buy BP Stocks?

Over the years, BP has reshaped itself several times. Since the Deepwater Horizon disaster, the company has managed to navigate all the ups and downs of the oil market, sold assets to improve its financial position, and took advantage of numerous opportunities.

Yet, its massive disinvestment to switch to green energy should be met with caution – it feels like a mere deja-vu, when the company invested in green energy until 2003, only to sell everything. Also, rushing into disinvesting amid oil market downturns and the coronavirus-induced crisis may seem like the company is selling low only to buy high.

Yet, there can still be a strong bullish case for BP. Here are some reasons:

- The financial position is expected to strengthen as it continues its growth strategy;

- Investments in green energy mean that the company will be less dependent on the crude oil prices, so its share price will be less correlated with this volatile market;

- Aims to increase its investments in renewable energy 20 times (compared to 2019 levels);

- BP’s stock price is well off its all-time highs and may indicate undervaluation; investors’ efforts could easily pay off in the future if BP managed to pull off its green energy strategy.

Expert Tip on Buying BP Stock

“ If you want to buy BP stock, you may want to consider when and how the company will be able to recover its pre-pandemic share price. Considering its financial position and long-term business strategy, the company may be able to bounce back in the future. This would happen only if its green energy investments pay off, considering that it is also currently selling most of its income-generating oil-related assets. The high gas and oil prices in 2021 seem like an excellent opportunity for this company to generate more cash and keep investing in alternative energy sources. ”

5 Things to Consider Before You Buy BP Stock

Betting your cash on a stock that may rise or fall is a challenging decision that cannot be taken so lightly. To help you avoid a costly mistake, we have broken several other aspects you need to know before investing in BP stock.

1. Understand the Company

Investing your funds in a company you’ve seen on social media is nothing more than a losing bet – and so is investing in a company “you’ve heard of”. To become confident in your decision, you need to understand the company by doing your due diligence. Start with the CEO – since this person is at the helm, the CEO can make or break the company’s growth plans. Check their career moves, review the business model and strategy, and consider the company by looking at the broader market and its competitive advantages.

2. Understand the Basics of Investing

You need to understand how investing is different from saving or trading. It’s recommended to familiarise yourself with all the financial terms you need to create and maintain your portfolio, such as the risk-reward trade-off, diversification, how to place orders, different types of orders, and how to use different risk management tools to increase your chances of success.

3. Carefully Choose Your Broker

Next, choosing your broker is a crucial step. There are many types of online brokers and platforms, and they are all created for different purposes. For instance, as a long-term investor, you may want to opt for a stockbroker rather than a CFD (contracts-for-difference) provider with access to BP shares. To decrease your exposure to the risky energy industry, you may want to add other asset classes to your portfolio, such as exchange-traded funds, other stocks, bonds, and even commodities. The broker’s platform should be user-friendly, not expensive, and regulated, among others, to guarantee a hassle-free investing experience in a safe environment.

4. Decide How Much You Want to Invest

If you’re reading this, you’ve probably got some savings already. Instead of waiting for inflation to swallow up your funds, you can start investing straight away. Most brokers nowadays have very low minimum deposits, allowing you to start with nearly any budget. If you have a large sum, make sure you invest a little at a time (and in different assets) to keep your risk low. For a low-budget investing account, you can start with what you have – your money will add up soon, so you can keep growing your capital.

5. Decide on a Goal for Your Investment

Time horizons are crucial in the investment world – you need to know the purpose of your investment because different objectives mean that you need money sooner or later, and you need to have access to it when this happens. For example, you may want to invest for your retirement in the next three decades or so. Alternatively, you may need to grow your capital to buy a house in the next five years. This time horizon will also help you find the right assets for your portfolio, based on their growth prospects and expected annual returns.

The Bottom Line on Buying BP Stocks

All in all, BP is an oil giant with an uncertain future. In the short term, its success will most likely depend on increasing gas and oil prices. Economic recovery after the pandemic is associated with bullish oil prices, so BP stock price may soon reach higher levels.

In the long term, however, BP’s recovery depends only on its ability to move away from oil and gas, and focus on renewable energy. Yet, there are many unknown factors that could affect its ability to transform. As of this writing, investors still seem reluctant when it comes to BP – which may explain why its share price failed to keep up with the increases in crude oil prices in 2021.

If you think BP has all it takes to overcome yet another challenge in its 100-year old history, you can easily buy its stock by registering with your chosen broker and placing an order. Alternatively, if you need more resources and information to help you find other assets worthy of your hard-earned cash, you can check out our other pages.

Frequently Asked Questions

-

Risk and return from your investments cannot be separated. A solid understanding of risk and mitigation techniques can help you understand the opportunities presented by different investment approaches. Depending on your investment strategy, you can use a broad array of risk management tools. For instance, beginners can use diversification, position-sizing, and asset allocation to reduce risk. More experienced investors may use derivatives like contracts-for-difference, options, and futures to hedge their long-term positions.

-

Long-term investors use fundamental analysis to find mispriced assets. However, fundamental analysis is much more than interpreting financial data from the company’s reports. In general, this analysis happens from a macro (i.e., economic) to micro (company-specific) perspective to find out whether BP is undervalued or overvalued. Thus, you can start by analysing as much public information as possible to better understand BP’s intrinsic value and its sustainability, projecting this information onto the general economic and political landscape.

-

BP releases dividends each quarter. You can find out the exact ex-dividend dates on BP’s official website. This is because dividends are paid only after the quarter results are released – which is also when you will find out how much the dividend is for the period.

-

Net-zero or a carbon-neutral strategy means that the company’s greenhouse gas emissions are balanced by its efforts to remove emissions over a specific period. This results in “net zero” greenhouse emissions.

-

BP used to be majorly owned by the British government until 1987. Now, it is a public company owned by both institutional and retail investors. Some examples of institutional investors include Goldman Sachs, BlackRock Investment Management, and the Vanguard Group.

-

BP is primarily listed on London Stock Exchange (LSE). Depending on your broker, you may also find it on other stock exchanges, such as Frankfurt Stock Exchange (BPE) and New York Stock Exchange (BP).