How to buy Disney stocks in 2025

The Walt Disney Company, which is known simply as Disney, is a multinational mass media and entertainment conglomerate. The company is headquartered in California, but together with its subsidiaries, has offices and operations around the world.

Disney offers a wide range of services, including media networks through the Disney, ABC, ESPN, Freeform, FX, and National Geographic brands; studio entertainment via the Walt Disney Pictures, Twentieth Century Studios, and Marvel brands; and theme parks and resorts around the world, including the Walt Disney World Resort in Florida, Disneyland Resort in California, Hong Kong Disneyland Resort, and Disneyland Paris.

Disney is listed on the New York Stock Exchange (NYSE) and has been a component of the Dow Jones Industrial Average since 1991. This guide tells you how to invest in Disney stock and why you might wish to do so, taking various fundamental analysis factors into account.

How to Buy DIS Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Disney

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need to Know About Disney

Now, let’s get to know Disney in more detail by exploring its history, strategy, how it makes money, and how it has performed in recent years.

Disney History

On October 16, 1923, two brothers (Walt and Roy Disney) founded the Disney Brothers Cartoon Studio, which also operated under the names “The Walt Disney Studio” and “Walt Disney Productions”. Walt Disney died of complications relating to lung cancer on December 15, 1966, marking the end of an era for the company.

Meanwhile, the company went public on November 12, 1957, listing on the New York Stock Exchange at a share price of US$13.88. In 1986, the company officially changed its name to The Walt Disney Company. Since the 1980s, Disney has made several acquisitions, including that of 21st Century Fox in 2019.

What Is Disney’s Strategy?

Disney started as a cartoon studio and took its time to establish itself as a leader in the American animation industry before diversifying into other aspects of entertainment and mass media, such as live-action film production, television networks, and theme parks. The company operates an entertainment and mass media conglomerate, offering an array of services under several brands that can be grouped into the following segments:

- The Studio Entertainment segment, which produces and distributes motion pictures, includes the brands Walt Disney Pictures, Twentieth Century Studios, and Marvel.

- The Media Networks segment operates the Disney, ABC, ESPN, Freeform, FX, and National Geographic brands, as well as several domestic television stations.

- The company’s Parks, Experiences, and Products segment operates theme parks and resorts around the world, including the Walt Disney World Resort in Florida, Disneyland Resort in California, Hong Kong Disneyland Resort, and Disneyland Paris.

- Finally, the Direct-To-Consumer & International segment operates digital content streaming services, offering direct-to-consumer video streaming via Disney+ (with over 94 million paid subscribers as of September 2021), ESPN+, and Hulu. It also operates branded apps and websites, such as Disney Movie Club and Disney Digital Network.

How Does Disney Make Money?

Disney is a highly diversified company that makes money from multiple businesses categorized into the aforementioned segments.

Owing to the coronavirus pandemic, most of Disney's theme parks and resorts were still closed during Q1 of its 2021 fiscal year, which ended January 2, 2021. Therefore, the Media Networks segment generated the most revenue and profits. In that Q1 report, the company’s revenue fell 22.2% compared to a similar quarter the previous year, while net income fell 99.2%.

The Media Networks segment accounted for 47% of the total revenue; the Parks, Experiences, and Products segment accounted for 22%; the Direct-To-Consumer segment accounted for 21%; while the Studio Entertainment segment accounted for about 10%.

How Has Disney Performed in Recent Years?

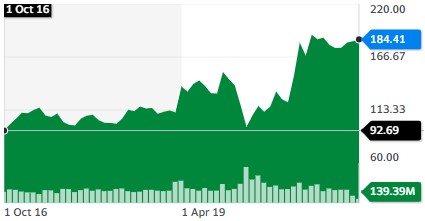

Disney’s share price has gradually grown over the last five years, doubling from about $90 in September 2016 to over $180 in September 2021. Along with most other stocks, it crashed in March 2020 but then rebounded to an all-time high price of $203 in March 2021.

Disney 5-Year Price Chart (source: Yahoo! Finance)

While the stock has more than recovered from the pandemic-induced market crash, the company is still struggling from the effects of the pandemic, with some segments of the company yet to operate at their optimal levels due to regulatory restrictions.

Where Can You Buy Disney Stock?

When you buy Disney stock from a stockbroker registered with the New York Stock Exchange (NYSE), you get part ownership of the company. This is different from simply speculating on the company’s share price by placing a CFD trade or spread bet, although some brokers let you do both: buy shares or place leveraged bets.

Many stockbrokers offer just the standard dealing accounts, but UK-based stockbrokers also offer “shares ISA” and SIPP accounts, which are tax-efficient. Your bank may well have a share dealing arm through which you can buy Disney shares.

Disney Fundamental Analysis

Unlike technical analysis, which involves using historical price movements, patterns, or technical indicators to predict how a share price might move in the future, fundamental analysis is used by investors to determine the underlying health and intrinsic value of a company.

When performing a fundamental analysis of a stock, investors consider many financial factors. Some of them — such as corporate management and goodwill — are not measurable. In this guide, we will focus on measurable financial metrics, such as the company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow.

Disney’s Revenue

A company’s revenue is the amount of money it generates from selling its products or services before the costs of sales and other expenses are subtracted. Since revenues are typically reported at the top of the income statement, it’s often referred to as the top line.

Investors love companies that achieve year-on-year revenue growth. However, Disney’s revenue for its 2020 fiscal year, which ended Sept. 29, 2020, fell by 6.0% when compared to the 2019 fiscal year because of the effects of the coronavirus pandemic.

Source: Yahoo! Finance

Disney’s Earnings-per-Share

A company’s earnings are the profits it earns after all costs of doing business have been subtracted from the revenue for the accounting period. However, you should be more interested in earnings per share (EPS) since this reflects your proportion of shares in the company.

Disney’s EPS can be calculated by dividing the company’s total earnings by the total number of outstanding shares of its common stock. However, you don’t need to calculate this yourself since you can get the figure from your stockbroker’s website or any of the major financial websites. Disney’s EPS for the 2020 fiscal year was -$0.2, but this was better than analysts had predicted.

Source: Yahoo! Finance

Disney’s P/E Ratio

The price-earnings (P/E) ratio of any company is a financial metric that compares the company’s share price to its earnings-per-share. You calculate it by dividing the company’s current share price by its EPS. Since Disney’s EPS is negative (because it made a loss in its 2020 fiscal year) we cannot calculate the P/E ratio even though we know the share price.

Generally, a very high P/E ratio indicates that the stock may be overvalued, while a low ratio may indicate that the stock is undervalued. But this is not always the case, as investors may be anticipating futures earnings in pricing the shares, which is why you need PEG (growth-adjusted P/E value). In this case, we can’t calculate the PEG because we couldn’t calculate the P/E ratio.

Disney’s Dividend Yield

Dividends are payments a company makes to its shareholders as a reward for investing in the company. These payments may come quarterly, semi-annually, or annually. A company’s share price tends to rise when a company declares dividends because investors want to get their names in the company’s record for the dividends. However, after the ex-dividend date, the stock falls because those buying the stock at that time are not entitled to the dividends.

The dividend yield is a company’s total annual dividends expressed as a percentage of its share price. For example, a company that pays out a total dividend of $1 for the year when its share price is $40 would have a dividend yield of 2.5%. Be sure to compare the yield with the prevailing interest rate to know whether investing in the stock is worth more than keeping your money in the bank.

The dividend yield of a stock can be seen on your stockbroker’s website or any of the major financial websites. While Disney has been paying dividends for over 40 years, it suspended its semi-annual dividends for the 2020 fiscal year due to the impact of the COVID-19 pandemic.

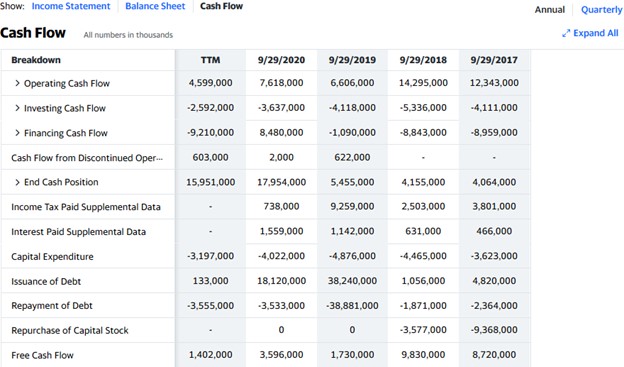

Disney’s Cash Flow

Disney’s cash flow statement is a record of how cash and cash equivalents are generated and expended by the company. The cash flow statement can be seen beside the other financial statements in the financials section of the company’s information on your broker’s website or financial websites like Yahoo Finance.

What you should be looking for in the cash flow statement is the free cash flow, which shows the amount of cash or its equivalents the company has left after taking care of major expenses, such as the mortgage, equipment, and other bills. Companies use their free cash to pay dividends, pay down debts, or fund expansion.

As you can see from Disney’s cash flow statement below, the company had about $3.6 billion in free cash at the end of September 2020.

Source: Yahoo! Finance

Why Buy Disney Stocks?

The coronavirus pandemic had — and continues to have — a devastating effect on Disney’s theme park businesses, and this has affected the company’s revenue and earnings. Despite recovering from the pandemic-induced crash in 2020, Disney stock has struggled since March 2021. However, the company is known for its long history and record of resilience.

Here are three reasons to buy Disney stock:

- Despite the scare of the Delta variant of COVID-19, economies continue to open up, so Disney is expected to optimize its business.

- Disney has started offering streaming services (Disney+), and the number of paid subscribers has already grown to 103.6 million (as of April 3, 2021) in about 18 months of operation.

- Disney has an expansive mentality and is always eager to grow and diversify via acquisitions and creating new businesses.

Expert Tip on Buying Disney Stock

“ While Disney stock may have a long-term growth prospect, the stock has always been cyclical over the short term. So, when trading this stock, you may want to wait for the low point in the cycle to buy at the dip. If you are a momentum investor, however, you may want to look for a local breakout. ”- willfenton

5 Things to Consider Before You Buy Disney Stock

Here are five things to consider before you buy Disney stock:

1. Understand the Company

Before you put your money into Disney stock or any other company, you need to study the company to know how it makes money and its business strategy. It is not enough for it to be a company you are familiar with or are using its products or services, as suggested by Peter Lynch. You must perform a fundamental analysis to be sure of the company’s financial health before investing.

2. Understand the Basics of Investing

You need to learn the basics of investing before attempting to invest in Disney or any other stock. Ensure you understand what risk management, money management, and diversification are and how to use them to protect your capital. Risk and money management techniques enable you to limit how much you will lose if something goes wrong, and diversification is a technique to spread your risk across several stocks.

3. Carefully Choose Your Broker

While there are many brokers you can use, make sure you choose a broker that is registered with the financial services regulator in your country of residence. This offers the comfort that the broker cannot easily disappear with your money. Also, you can get some form of protection from any financial compensation scheme in your country. Other factors to consider before choosing a broker are trading commissions, trading platforms and tools, the number of assets offered, payment methods, and the promptness of the customer support team.

4. Decide How Much You Want to Invest

Determine the percentage of your capital you will allocate to one stock and how you want to invest the money. When you’ve done that, you may want to scale in gradually (dollar-cost-averaging), instead of investing all the money at once. No matter how good an opportunity looks, do not invest with borrowed funds and never invest more than you can afford to lose. One more thing: ensure you diversify your portfolio across different stocks and even different asset classes to avoid systemic risks.

5. Decide on a Goal for Your Investment

Last but not least, consider your investment goal. You need to know why you are investing and how long you intend to hold your investment. Whether you’re investing to build your pension fund for retirement or save for your kid’s college education, you should know when to sell. Decide whether it would be at a specific time in the future or when the company’s fundamentals no longer look good. You may also hold the stock indefinitely and sell as you need.

The Bottom Line on Buying Disney Stocks

Disney is a multinational mass media and entertainment company with a highly diversified business portfolio. You can buy the stock through a stockbroker and benefit from its expansive business outlook.

If you’re ready to invest in Disney shares right now, sign up for a stockbroker’s stock trading account and fund it. Then, select Disney from the broker’s categorized list of stocks and place an order to buy the stock.

If you’re not yet ready to invest, keep educating yourself by reading our other guides on our website until you are ready. In addition, practice “paper trading” using a stockbroker’s demo account to familiarize yourself with the broker’s platform and tools.

Frequently Asked Questions

-

Disney has a long history of making profits. It was a profitable business before the coronavirus pandemic emerged and significantly interrupted some of Disney’s business segments. Although the company made a loss in its 2020 fiscal year, quarterly reports for the 2021 fiscal year show that it has already started making profits.

-

We can’t put a date on when Disney will start paying cash dividends again. However, judging from its over 40 years of paying regular dividends, it makes sense to believe that it would start again once its business improves and recovers from the pandemic impact.

-

First, only invest with an amount you can afford to lose, to protect your emotional capital. As for your trading capital, commit only a small fraction of your capital to each trade. Also, set a stop loss to get you out of the market if your trade goes against you. One more thing, build a diversified portfolio such that when any of them is down, other stocks are making enough profits to offset the losses.

-

Yes, you can day trade Disney shares because the stock has enough liquidity and makes some reasonable intraday movements, which are what day traders look for. However, owing to the US pattern day trading rule, you may need to maintain a $25,000 minimum balance to trade more than three times in five consecutive trading days. You can bypass this rule by trading the stocks options or CFD (if permitted in your country).

-

Yes! While you may use fundamental analysis to know that the company is in good financial health, you need technical analysis to know the right time to buy the stock and when to sell. Some technical analysis methods you can use include chart patterns, indicators, and Elliott Wave analysis.

-

Yes, the profits you make from trading Disney or any other stock are subject to capital gains taxes, unless you are using a tax-exempt account such as the IRA in the US and ISA in the UK. For shares sold in less than 1 year, you will be taxed at your ordinary tax rate.