How to buy DNB stocks in 2025

Dun & Bradstreet Holdings, or simply DNB, is one of the leaders in the research and consulting services industry. It provides data, analytics, and data-driven solutions to companies worldwide, helping them to weather different phases of the business cycle and strive in any economic environment.

For 179 years, the company has helped clients solve critical business problems. DNB provides business data and analytics and also offers finance and risk solutions to its clients. This article represents a guide aimed at telling you how to buy DNB stock and what you should consider before doing so.

How to Buy DNB Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in DNB

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About DNB

Let's start by getting to know a bit more about the company's history and strategy, how it makes money and how the stock has performed in recent years.

DNB History

Dun & Bradstreet is one of the oldest companies still operating today. Its origins can be traced back to 1841 when Lewis Tappan started the company. He recognised the need for a centralised credit reporting system, and quickly the company became a reliable credit information provider to its subscribers.

Since then, the company has extended its operations worldwide. It is best known for its DUNS (Data Universal Numbering System) invented in 1963, a unique nine-digit digital fingerprint that is now required by over 90% of Fortune 500 companies and 700% of the Global 500.

Nowadays, the company employs 4,000 people worldwide and is headquartered in Short Hills, New Jersey, the United States. It has a diverse client base of approximately 137,000 customers and has business relationships with some of the most recognizable brands in the world.

What Is DNB's Strategy?

This is a business-to-business company that sells credit information to many companies around the world. It recently expanded into more than just credit information, becoming a "big data" information company.

Dun & Bradstreet Holdings has diversified its services, providing more than business data and analytics. For example, it now offers an online application enabling clients to access information in real time, helping them monitor and analyse portfolios. It also provides risk and compliance and sales and marketing solutions.

The company's data and analytics services are aimed at helping clients manage operational risk and identify new business opportunities. It joined forces with federal and state government agencies in the United States with the purpose of providing essential data and insights to support small businesses.

How Does DNB Make Money?

Dun & Bradstreet sells data and analytics to companies in order to improve their business performance. It is a leading global provider of business data. Moreover, Dun & Bradstreet helps other businesses of every size manage risk and reveal opportunities. Now, the company also offers data cloud solutions to help its customers increase revenues and lower costs.

It issues a business credit report that is valued by companies all over the world. Before doing business with another company, it is helpful to have a look at its financial strength, reliability, the likelihood of remaining in business in the next months, the debt levels, the ability to serve its debt, and so on. Dun & Bradstreet's business credit report is known for its reliability, becoming a brand in the industry.

How Has DNB Performed in Recent Years?

DNB stock is in a bearish trend as it failed at $28 in October 2020. Since then, the price action kept forming lower lows and lower highs, a series forming during bearish markets.

Where Can You Buy DNB Stock?

DNB stock can be bought in the open market through the services of any registered broker. By owning common shares in a company, investors may take part in business and management decisions by exercising their voting rights.

Another option is to trade CFDs or contracts for difference. These are instruments that track the CNB stock price and are used as an alternative to direct stock trading due to them being a cost-efficient solution when speculating. Simply put, long-term investors prefer owning the common stock, while speculators, or short-term traders, may want to use CFDs instead.

Some brokers offer their customers both stock and CFD trading. It is imperative, though, for investors to know what they are buying and selling due to differences between the two.

DNB Fundamental Analysis

Unlike technical analysis, which traders use to look for patterns in share price movements, fundamental analysis is what investors use to determine the underlying health and intrinsic value of a company. When you read about fundamental analysis, you’ll see terms such as P/E ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow. So, let’s look at what those terms mean.

This part of the article focuses on the DNB fundamental analysis. We will have a look at the company's revenue and earnings-per-share, its dividend policy and cash flow position, as well as at the price/earnings (P/E) ratio.

DNB's Revenue

Revenue is the top line in the income statement, which is one of the three major financial statements that the company reports, together with the balance sheet and the cash flow statement. Revenue represents the total value of goods and services the company sold over a period and it is an important metric for investors as it shows how and if the business grows in time.

Dun & Bradstreet revenue has recovered from the slump in recent years and is currently on track to exceed 2020 levels. According to the company's financial reports, GAAP revenue for the second quarter of 2021 was higher by 24.4% with the same period in 2020, a trend likely to continue for the rest of the 2021 quarters. It showed positive momentum and accelerated growth as the company made progress transforming the business.

DNB's Earnings-per-Share

Earnings-per-share or EPS show how much profit was made per one single share during the course of a year. Also called the "bottom line", EPS shows the amount of profit left after the business covered all its expenses.

For 2021, Dun & Bradstreet investors expect the company to report EPS of $1.06 and then higher ones each coming year, reaching $1.45 by 2025.

DNB's P/E Ratio

The P/E ratio shows the ratio between the current market price per one share and the earnings per one share. The higher the P/E ratio, the more expensive the stock price is.

But what makes an attractive P/E ratio? The answer depends on the company's intrinsic value. Investors discount the company's future cash flows to the required rate of return in order to find out the intrinsic value. A higher P/E ratio tells that the company may be overvalued, but investors must consider the future cash flows and see what causes the P/E ratio to rise and what is the level where it signals an overvalued price.

The P/E ratio for Dun & Bradstreet is forecast at 16x in 2021 and then lowers for the years to come, dropping to 11.64 by 2025. It means that it will take 16 years for the company to earn enough money to pay back an investment at the 2021 stock market price. In contrast, if the forecast proves right, it will take only 11.64 years for the company to pay back an investment made in 2025.

DNB's Dividend Yield

Companies choose to pay a dividend to their shareholders, rewarding them for their investment and support. Dividends are deducted from the profit but not all companies choose to pay them. Dun & Bradstreet is such a company. Because of that, the dividend yield is zero as the company’s shareholders do not receive dividend payments.

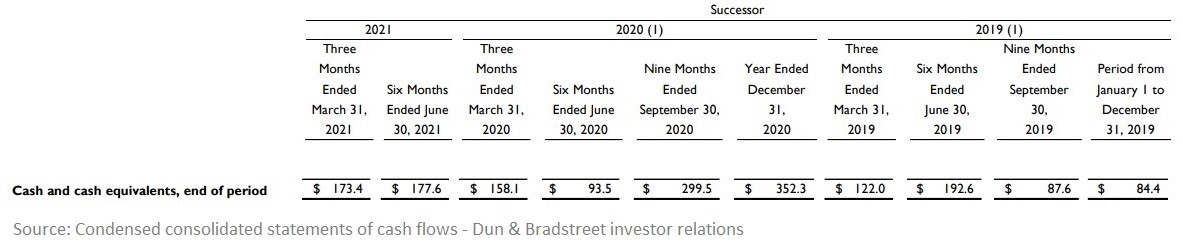

DNB's Cash Flow

The cash flow is an important fundamental metric to consider too. The free cash flow, in particular, is relevant because it shows how much money remained after the company had paid all the costs of staying in business. DNB's cash flow position has strengthened recently compared to the same period a year before.

Why Buy DNB Stocks?

Here are some reasons to consider that might make you want to buy DNB stocks:

- Impressive profitability – EBITDA for 2021 is forecast at $843 million while sales for the same period are estimated at $2.155 billion. It means one-quarter of every dollar in sales will become adjusted EBITDA profit, giving the company a solid margin by all means.

- Huge room to grow internationally– around 80% of the company's revenue comes from the U.S. market only.

- The only company to issue DUNS numbers for each business, which aids the credit reporting practice.

Expert Tip on Buying DNB Stock

“ Dun & Bradstreet is the only company that issues DUNS numbers. The company developed the proprietary system and is now a global standard. Among users, think of the United States government or the United Nations, to give some examples. When filling in numerous applications with the government, the DUNS number is required, and since Dun & Bradstreet is the only company handling them, it guarantees business continuity, thus appealing to long-term investors. ”- thomasdavid

Things to Consider Before Buying DNB Stock

Here are a few things to consider before buying DNB stock.

Understand the Company

Make sure you understand the company and the business it is in. Find out how the company earns its money and what the industry trends are. Ideally, do some research and find out projected CAGR rates for the years ahead. Also, make sure to have a close look at the company's fundamentals and how the stock price has performed recently. A general bull market does not mean that all stocks go up – some will correct, and an investor's job is to find out why.

Understand the Basics of Investing

Not all investors have economic studies, but knowing some basic concepts from the investing world does help. One of them is to diversify your portfolio to spread the risk across different businesses, sectors, and financial assets. The challenge in this risk management effort is to find the right diversification degree, as too much diversification affects the account's growth rate. Also, consider all the costs related to trading, such as the orders' execution costs, the funding costs, and so on.

Carefully Choose Your Broker

The broker is your partner in the investing journey. Therefore, it should care about your investing activity and always be there to support it. Unfortunately, not all brokers run a regulated business, and this is where the investor steps in and does their own diligence to find out if the broker is trustworthy or not, if it is regulated or not, what the customers' reviews say about the business and others.

Decide How Much You Want to Invest

The next step in the investment process is to decide how much to invest. It is not wise to invest all the funds in a portfolio in one single company. Instead, consider splitting the amount on various investments. Also, some traders use a dollar-cost-averaging technique, where they invest in the same company but at different price levels. Finally, some other traders invest only a certain percentage of the portfolio in any given stock.

Decide on a Goal for Your Investment

What is the purpose of your investment? Some investors save money to invest for the long-term, in the hope of using the funds after retirement. Some other investors like the quick price action that often characterises the stock market, and thus prefer to speculate on the rise and fall of certain stock market sectors. Regardless of the goal for your investment, it is best to know beforehand and to plan accordingly.

The Bottom Line on Buying DNB Stocks

Dun & Bradstreet is one of the oldest companies around and it is doing most of its business in the United States. However, it expands globally and therefore there is a lot of room for growth. DNB stocks are attractive because the company is the only one issuing DUNS numbers, required for businesses around the world. Therefore, the business's longevity is guaranteed. Moreover, DNB stocks are attractive because of impressive profitability.

If you are ready to invest, the next step is to choose a broker that offers DNB stocks and search its database for the company's ticker. Once found, make sure to shortlist it, eventually moving it to the wish list or favourites to find it easily once you make your decision. Finally, decide on the amount to invest and place an order – either at the current market prices or at future levels, by using the numerous pending orders that any stockbroker offers to its clients.

If still hesitating, there is no rush. Take your time to read some more about investing, and start with simple, basic concepts. Most of these concepts can be found by browsing the educational materials on our website.

Frequently Asked Questions

-

DUNS stands for Data Universal Numbering System and was established in 1963. The number is used to identify more than 420 million public and private businesses worldwide and Dun & Bradstreet updates this vast network of businesses that its clients use every day so that they can make informed business decisions. The number is recommended and even required by commercial, trade, and public sector organisations.

-

Not all companies choose to pay a dividend to their shareholders. Various reasons may lie behind such a decision, and it does not mean that the company is not worth your investment. For example, Amazon is not a dividend-paying company, and yet it is one of the largest companies in the world, a success story of our times. Some companies choose to retain their earnings and use them for growth, rather than pay dividends to shareholders.

-

Dun & Bradstreet raised $1.7 billion at $22 per share from public shareholders during its IPO in the summer of 2020. Originally, it intended to sell 65.75 million shares for between $19-$21, but the company ended up selling 78.3 million shares at $22 per share.

-

This is a comprehensive report valued by businesses around the world. It contains company information, such as operational data, bankruptcies, public filings, etc. It also shows the likelihood of a company going out of business in the next year or the probability of facing financial stress over the months ahead. Finally, a Dun & Bradstreet business credit report averages a company's financial strength.

-

To start with, creditors. Before approving credit, it is wise to check the solvency of a company and a Dun & Bradstreet business credit report comes in handy. Another group is made of companies that want to demonstrate their good payment history. Other companies search for funding and having a Dun & Bradstreet business credit report can improve their odds.

-

Some parts of it are offered by the company for free, such as the DUNS number, which is delivered for free within 30 business days. However, if you need it faster, it comes at the cost of $229. Monthly alerts on credit scores also cost nothing, but the company charges on its CreditBuilder Plus and CreditBuilder Premium services.