How to buy Ferrari stocks in 2025

This article discusses various fundamental factors why it may be an excellent decision to buy Ferrari stock and sheds light on investing in Ferrari stock. Before we dive into details, let us first describe the main facts about the Ferrari company.

Ferrari is one of the most expensive and luxurious car brands globally and is well known for its formula one team's success throughout history. The company has grown itself from a race car manufacturer to a luxury sports cars brand. The company generates more revenue from its branded merchandise than sports cars. You can find anything from watches, shoes, socks to showpieces and wallets made by Ferarri.

People are fascinated by the Ferrari brand name and its prestige, so they buy anything that is associated with it. Ferrari does not spend a single dime on advertising as their formula one team get more views in a week than they will get from advertisements. The company went public in 2016, and since then, it is has gained the attention of investors. But what makes a luxury car manufacturer worthy of your investment?

How to Buy RACE Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in Ferrari

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About Ferrari

Let’s dive into details about the history of Ferrari, the company’s strategy, how it makes money and how it has performed over the years.

Ferrari History

The Italian sports automobile manufacturing company Ferrari was founded in 1947 by Enzo Ferrari. The company manufactured its first sports car - 125 Sport with a 1.5 L V12 engine, in Maranello. With significant developments amid the production line, the firm also began working on historic Carrozzeria Scaglietti in 1951. Luckily, the company remained successful and managed to triple its public sales over the next ten years.

In the 1980s, the company went through the most challenging time amid the demise of its founder Enzo Ferrari. However, instead of succumbing to the death of its charismatic founder, Fiat Group-owned Ferrari grew into one of the world's most successful sports car manufacturers over the next two decades.

With a focus on emerging markets, including China, Japan, and the Middle East, the company endeavoured to boost its sales and increase market share since the beginning of the 21st century. The company also kept consolidating its position in UK, Germany and the US over the years. In 2015, the company became publically listed on the New York exchange (NSE: RACE). As of September 2021, the company's market capitalisation reached $54.69 Billion. All in all, Ferrari is a leading manufacturer of high-end luxury supercars today.

What Is Ferrari’s Strategy?

Its target consumers are well-known individuals and celebrities worldwide. The brand has established itself as a high-end sports vehicle manufacturer with ties to some of the world's most prestigious racing events. The brand employs a value-based positioning approach to instil pride in its owners' possession of the masterpiece.

The company is putting up significant effort to impress investors, including increasing production and expanding into new, more innovative areas. Yes, we're talking about the Purosangue SUV, which will be released in 2022.

Ferrari intends to release a slew of hybrid vehicles. The SF90 Stradale plug-in hybrid was just introduced, and the company plans to have a 60% electrified portfolio by 2022. The company is also researching other options, such as hydrogen or biofuels.

How Does Ferrari Make Money?

The company makes money primarily by selling its exotic supercars and merchandise. Its formula one team contributes to its popularity and marketing worldwide. The company’s net revenues for 2020 were €3,460 million.

How Has Ferrari Performed in Recent Years?

Ferrari’s stock price rose from its Initial Public Offering (IPO) price of $55 to its highest ever price of $230 in December 2020. After that, it has been in consolidation near $190. In just five years of its stock trading, this climb seems substantial, particularly if we see the fact that the company’s stock kept declining during the first year of trading at the stock exchange.

Source: SimplyWall

Where Can You Buy Ferrari Stock?

Unlike speculating on CFDs or margin-based day trading, buying a stock allows investors to own a share in the company. You can buy Ferrari stock with a stockbroker instead of using a trading platform.

However, modern-day brokers allow both trading and buying stock on their platforms. You can check with your bank as it might be offering a dealing desk that may help you buy stocks, too.

Ferrari Fundamental Analysis

Fundamental analysis is quite different from technical analysis, where you anticipate a stock's price movement by analysing some chart patterns or devising a strategy with a high winning probability. Fundamental analysis looks at everything that might influence the value of a company's stock, from macroeconomic variables like the state of the economy and industry circumstances to microeconomic ones like the company's management performance.

Investors make their decision based on fundamental analysis by looking at factors such as P/E ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow. Let's discuss what these terms mean and how they are responsible for Ferrari stock's performance.

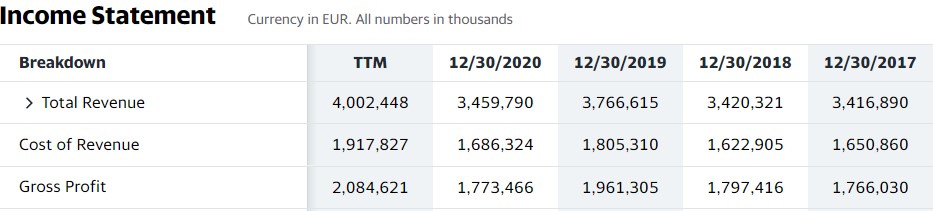

Ferrari’s Revenue

The company's revenue is the total amount of money received from sales in a specific period, say a year. After cutting the sales costs involved, we get gross earnings or profit. The company's gross earnings or profit is the biggest most important factor investors look into. Here is a table showing Ferrari's annual earnings over the past years:

Source: Yahoo! Finance

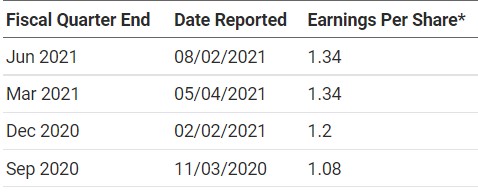

Ferrari’s Earnings-per-Share

The net profit is divided by the number of common shares outstanding to calculate earnings per share (EPS). EPS is a frequently used statistic for assessing corporate value since it shows how much money a business generates for each share of its stock. Investors will pay more for a company's shares if they believe its earnings are higher than its share price. Therefore, a higher EPS implies better value. Ferrari EPS for the quarter ending June 30, 2021, was $1.34.

Source: NASDAQ

Ferrari’s P/E Ratio

The price-to-earnings (P/E) ratio compares the share price to the earnings per share of a company or simply its share price divided by EPS. A high P/E ratio might indicate that a company's stock is overpriced or that investors anticipate strong future growth rates. According to MacroTrends, Ferrari’s P/E ratio is 43.83, which means investors are willing to pay $43.83 for every dollar the company earns.

Ferrari’s Dividend Yield

The dividend yield is the amount of money a firm pays shareholders for owning a share of its stock divided by its current stock price, expressed as a percentage. Dividends are most likely to be paid by mature firms. The dividend yield is 2% if a firm pays out annual dividends of $0.1 per share and the current share price is $5.

You can find a company’s dividend yield and other fundamental factors on your stockbroker’s website, the company’s official website, or financial websites like Investopedia, Yahoo! Finance, MacroTrends, or MarketScreener. You can also compare the dividend paid with the interest rate a bank will pay for the same amount of deposit to decide if you want to put your money in the bank.

Ferrari’s dividend yield is 0.47% at the time of writing.

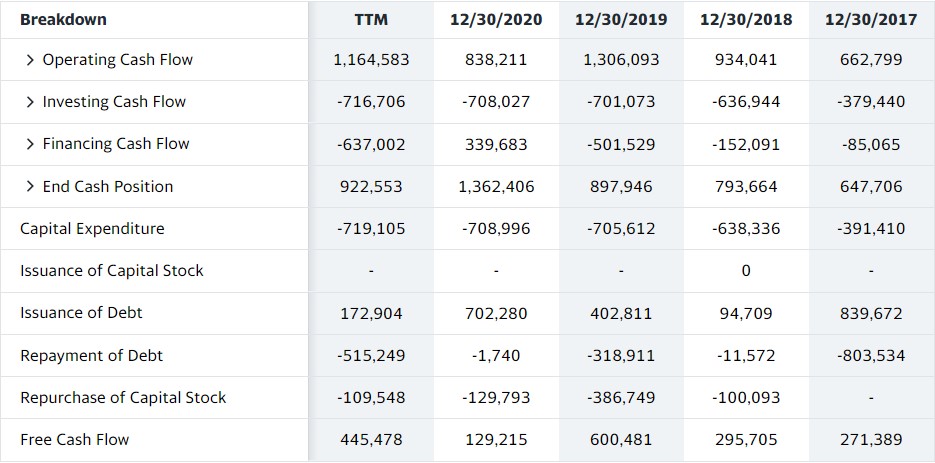

Ferrari’s Cash Flow

Cash flows are the inflows and outflows of funds into and out of a company and are generally divided into three categories: operations, investment, and financing. All cash generated by a company's core business activity is included in the operating cash flow. Yet, the figure that attracts most investors’ attention is known as the free cash flow, which excludes all the costs, such as issuance of debt, stock, and other payments made by the firm.

Source: Yahoo! Finance

Why Buy Ferrari Stocks?

Investors seeking to expand their portfolios should think about a company's future before purchasing its stock. Ferrari's earnings are anticipated to rise by 70% over the next several years, signalling a bright future ahead. This should result in more stable cash flows, which will increase the value of the company's stock. More factors are favourable for this anticipation, such as:

- Ferrari’s interest in Hybrid SUVs to increase its earnings looks promising.

- Ferrari’s interest in electric cars will revolutionise the whole supercars industry.

- By increasing wealth in the world, the demand for hypercars is increasing.

Expert Tip on Buying Ferrari Stock

“ If you check Ferrari’s share price chart, you will find it pretty much volatile with up and downswings. So, if you’re interested in buying RACE, you better be buying it with limit orders on lows in an uptrend. This is an important risk management tool that can help you automate some of your trading tasks, so you can rest assured that your position remains profitable. However, keep in mind that, in times of volatility, slippage can occur. ”- willfenton

5 Things to Consider Before You Buy Ferrari Stock

There are five things you should consider before buying Ferrari stock or any other company stock.

1. Understand the Company

Before you invest in any stock, you need to know about its history, performance and its reputation among other investors. If you’re a seasoned trader, you will probably know the best methodology of stock picking. However, if you are new to investing in stocks, you can always do a bit of research on your own around the fundamental factors discussed in previous sections.

2. Understand the Basics of Investing

Learn the basics of investing, and then before buying shares of a stock, ask yourself these questions:

- Risk management: Either you will buy and hold or have thought about getting out at a certain point when things go wrong. This is where stop-loss orders can help you protect your position.

- Money management: What is the maximum percentage of your capital you are willing to risk when buying a stock? You should also ensure you do not tie up too much of your hard-earned cash in only one position.

- Diversified portfolio: How are you going to diversify your portfolio to make it profitable overall? What stocks are you looking at, what looks more favourable than others, what will be your risk on each stock according to its potential?

- Can you rely on demo trading: You can try demo trading to understand the mechanics of order placing or strategy building, along with how to use the trading platform.

3. Carefully Choose Your Broker

Once you decide to become an investor in the stock market, here are few pointers to make sure before choosing a broker:

- Regulation and capital protection: The stockbroker should be regulated by the financial services regulator in your country or not. So, you don’t lose your investment if the broker goes bust. For example, in the UK, the country’s financial services compensation scheme (FSCS) protects you as an investor.

- Costs and customer service: Check the cost of buying and selling shares with that broker. Check the response time of customer service and whether they resolve your queries or not.

- Access apps and offerings: You need to ensure that the broker provides a good trading platform for PC, tablet, or mobile. The broker should offer the stocks that you are looking to buy.

- Technical aspects of trading: Ensure your stockbroker provides price charts for free and allows advanced orders like stop, limit, trailing stop, and take profit.

4. Decide How Much You Want to Invest

Have you ever heard of “never put all your eggs in one basket”? You should never invest all your money in one stock at once. You can diversify your risk among different potential winning stocks. If you have only one stock to buy at a time, don’t buy it all at once.

Say buy £5,000 worth of shares first. If the price goes against you, find a new entry at a bouncing point and then buy £5,000 again to average your buy price. After that, wait and watch what the market does. Remember, hope is not a strategy and you should always know your way out.

5. Decide on a Goal for Your Investment

Before investing in the stock market, make a goal. It can be a side hustle where you put your extra money as an investment for short term gains. Or you can be a serious long term investor with 5+ years of plan in mind.

Age can be an important factor in terms of experience. If you are young and a newbie to investing in stocks, then our suggestion is to invest a small portion of your wealth to gain experience. As you gain experience over time, you can increase your investment in stocks.

The Bottom Line on Buying Ferrari Stocks

Ferrari is a giant in the supercars industry. It produces some of the fastest and expensive cars in the world. With its innovative ideas for the future, it moves towards mid-range hybrid and electric cars to diversify its product portfolio. It looks promising from an investor’s perspective.

So, if you have decided to invest, then signup with a stockbroker that meets the criteria discussed in the previous section. Find Ferrari stock and buy it at your discretion, if you feel confident.

Test your strategy and skill on paper trading or a demo account if you are still in the learning phase.

Frequently Asked Questions

-

Ferrari stock is listed on NYSE with a ticker Ferrari NV and NASDAQ with a ticker RACE. It is also listed with a ticker Ferrari N.V. on the Borsa Italiana stock exchange in Milan. The only real difference is that the former lets you invest at the US dollar price. In contrast, the latter lets you invest at the euro price (which should differ only due to the exchange rate).

-

Ferrari stock is a popular choice among long-term traders and active traders. Due to its volatility, it can be suitable for scalping, day trading or swing trading.

-

To take care of your risk, you can place a stop-loss order near a price you feel comfortable with based on your risk appetite. If the share price falls below that point, you get out of the trade, taking a small loss. In some cases, when there are sudden market crashes, you could face slippage where your stop-loss order is not fulfilled, so keep it in mind as well while building your strategy.

-

There is an order type called take-profit order. If you buy Ferrari shares now and the price starts rising, you can place a take-profit order before your target, and it will automatically sell your shares with profit when the price reaches there. This may also mean that you could have gained more if the share price keeps rising after your take-profit level.

-

This depends on your strategy, time period, and your objectives. Technical analysis is usually employed by short-term traders who want to identify the right entry and exit price points. If you prefer a buy-and-hold strategy, short-term price swings will not have much relevance, so fundamental analysis is a better approach to identify whether Ferrari can live up to your expectations.

-

A stock split is a business activity in which a company's current shares are divided into numerous shares. Essentially, corporations opt to split their shares to decrease the trading price of their stock to a level that is acceptable to the majority of investors while also increasing the liquidity of the stock. However, Ferrari’s stock has no split history.