How to buy Frontline stocks in 2024

Frontline is a Bermuda-based company operating in the oil, gas storage and transportation industry. Besides operating oil and product tankers, Frontline also charters, purchases, and sells vessels. The COVID-19 pandemic led to massive disruptions in the demand for oil as the world economy entered recession.

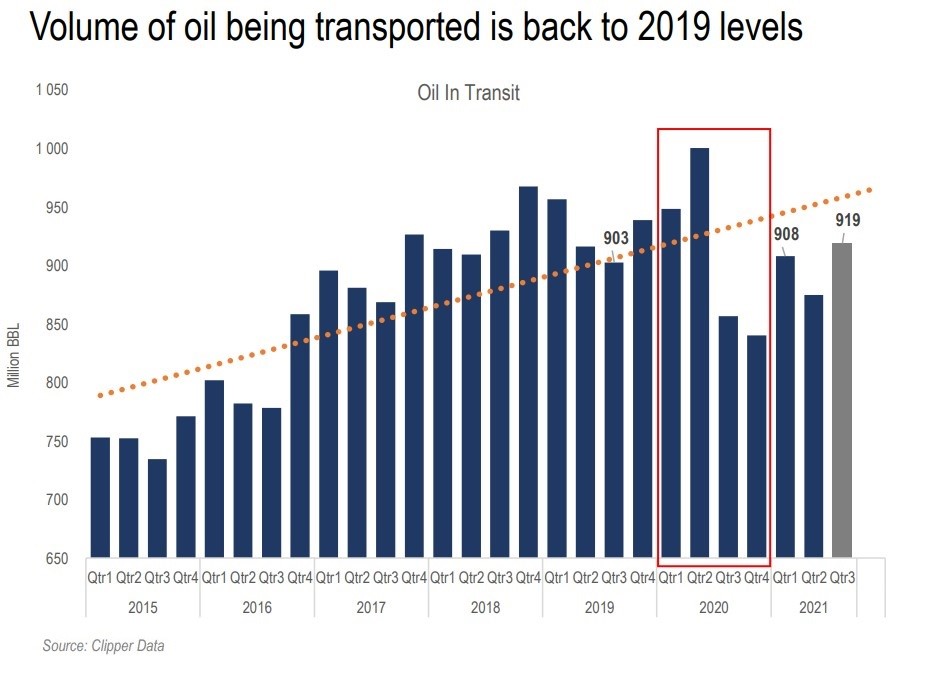

The oil-shipping industry suffered directly as oil inventories piled up as demand fell drastically. Many oil-shipping companies did not survive, but Frontline did, and as of December 2020, it operates a fleet of 68 vessels. As the world economies recover from the pandemic slump, oil demand is back, and so is the volume of oil being transported.

This article is a guide on buying Frontline stock to ride the global economic recovery and benefit from the U-turn in the energy markets. We will look at fundamental analysis and other factors specific to the company and industry, so you have everything at hand to buy Frontline stock with confidence.

How to Buy FRO Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in Frontline

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About Frontline

We will start with an analysis of the company's history and how it makes money, its strategy, and how the Frontline stock price has performed in recent years.

Frontline History

Frontline was founded in 1985 in Sweden, and in 1996 the Hemen Holding Limited became the majority shareholder. Hemen is indirectly controlled by John Fredriksen and supported the decision to change the headquarters from Sweden to Bermuda in 1997. The company's shares started trading on the New York Stock Exchange in August 2001, and since then, it has returned significant dividends to shareholders.

In the meantime, the company's fleet increased significantly. Frontline engages in the transportation of crude oil and its related refined petroleum products and operates in the spot and time charter markets.

What Is Frontline's Strategy?

Frontline looks at charter opportunities and tries to optimise them as best as it can. The company tries to have fixed charter income coverage for the fleet, and if it does not manage to do so for the entire fleet, it tries to trade the balance of the fleet on the spot market.

The size of the fleet is important in the tanker industry, which is highly cyclical. It helps negotiate terms with clients and charterers and allows the company to obtain competitive terms from suppliers or shipbuilders.

Frontline strives to achieve competitive operation costs through the high utilisation of its vessels. Favourable financing conditions are critical for the company's financial performance, too, as well as the outsourcing of technical management and crewing.

How Does Frontline Make Money?

Frontline transports oil and refined products. Its customers are major oil companies as well as oil trading companies.

It operates VLCCs (Very Large Crude Carriers) in the crude oil tanker market, among other types of carriers, such as Suezmax, Aframax, or LR2. Frontline operates in a highly fragmented and competitive market, formed of two main types of operators – major oil company fleets and independent ship-owner fleets.

How Has Frontline Performed in Recent Years?

The Frontline stock price fluctuated wildly in the last five years, reaching as high as $13 and as low as $4. The COVID-19 pandemic and the subsequent decline in the price of oil into negative territory led to the tanker market coming to a halt.

The share price more than halved in the months following April 2020, but the 2018 lows in the $4 area held. Those willing to buy Frontline stock in the midst of the 2020 pandemic saw the share price increase significantly since then.

Where Can You Buy Frontline Stock?

You can buy Frontline stock by using the services of a stockbroker. Investing in a company's stock is like owning a little piece of it, participating both in the good and bad times. Most of the companies pay a dividend, and, as a shareholder, you are entitled to receive one if the management decides to reward its shareholders by sharing the profits. Also, owning the shares of a company gives you the right to participate in the management decisions, participate at annual meetings, and vote.

If you aim for short term profits and believe that the company's stock price will decline, CFDs or contracts for difference are more suitable, due to the ease of going short. CFDs are instruments that track the movements in the underlying asset (i.e., the company's stock price) and some brokers offer both CFDs and ordinary shares to their customers. Therefore, make sure you know if both are available and trade them accordingly.

Frontline Fundamental Analysis

The next part of the article is dedicated to the company's fundamental analysis. Traders use fundamental analysis to find out if the stock price is overvalued or not, and if it is reflecting the company's intrinsic value. We will have a look at Frontline's revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow position.

Frontline's Revenue

Revenue is the first line in the income statement and shows the amount of money the company makes from the selling of its goods and services. Rising revenues shows the company's ability to expand its product range, or to reach more customers via expanding in other markets. Declining revenues shows a shrinking market share, increased competition, or simply a business model unable to grow anymore.

Revenues may be affected by exogenous factors, independent of the company's actions. The tankers industry is one such industry where developments in the price of oil lead to wide fluctuations in the reported revenue.

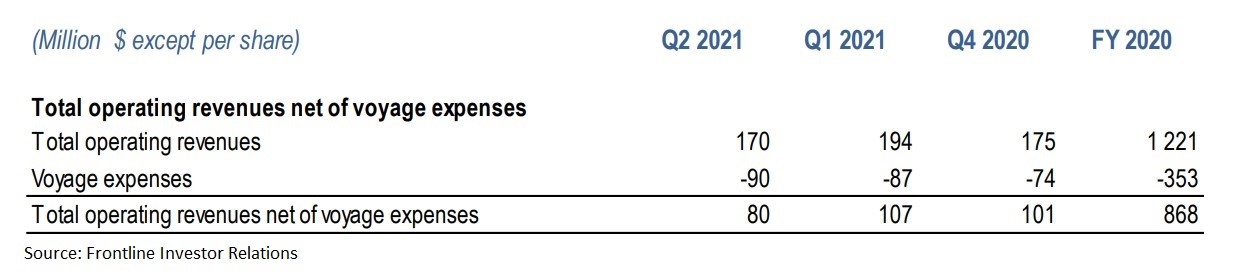

Frontline earned $1.221 billion in total operating revenues in 2020 and $364 million during the first two quarters of 2021. As the oil price recovered from the 2020 lows, the tankers industry is expected to recover as well, thus revenues to improve in the quarters and years ahead.

Frontline's Earnings-per-Share

Earnings-per-share or EPS is another fundamental metric that investors look at. It shows the company's profitability per one single share, if any, and the higher the number, the better.

EPS is presented in two forms – basic and diluted. Basic EPS is calculated by deducting preferred dividends from the net income and then dividing the outcome by the weighted average number of outstanding shares in the fiscal period.

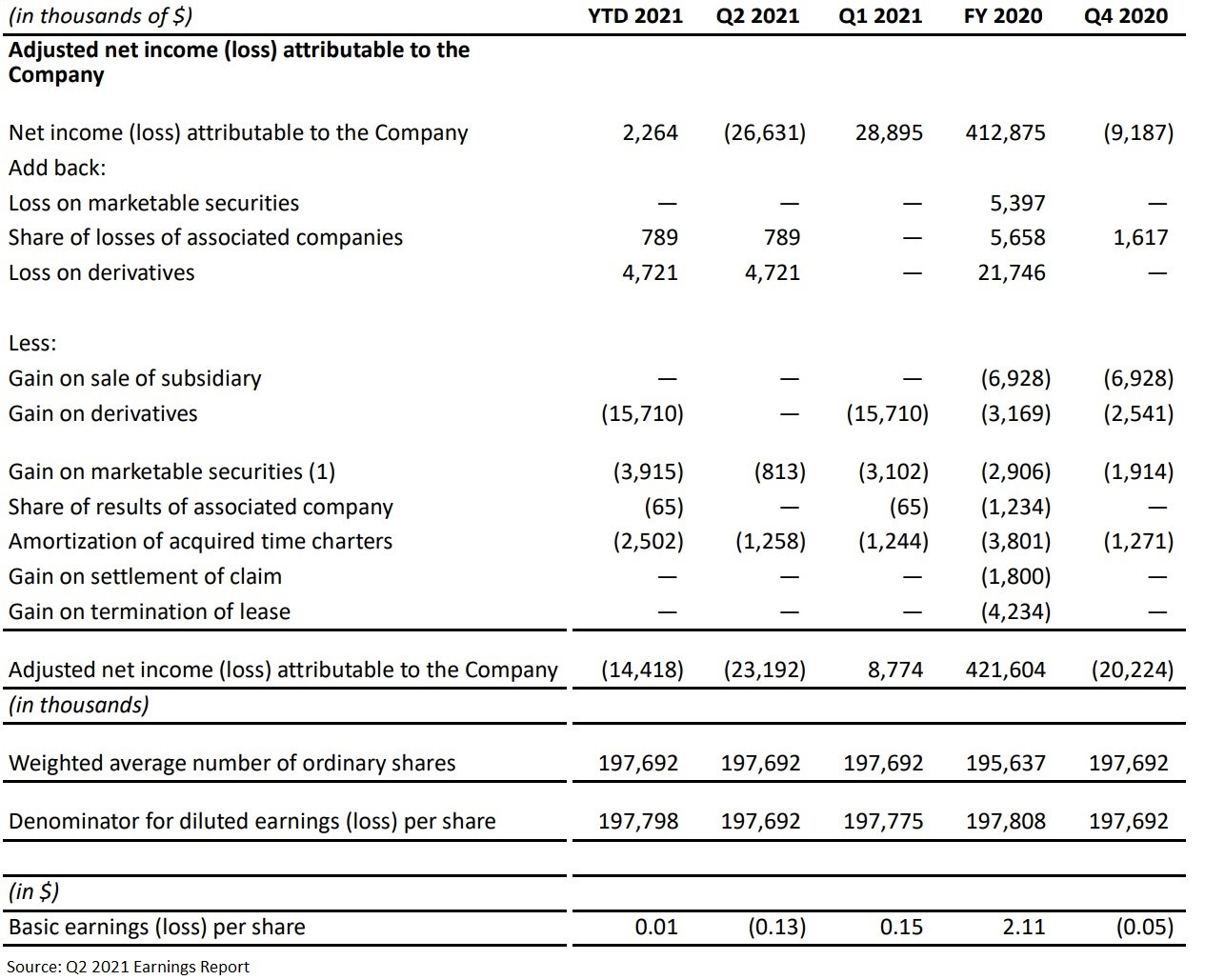

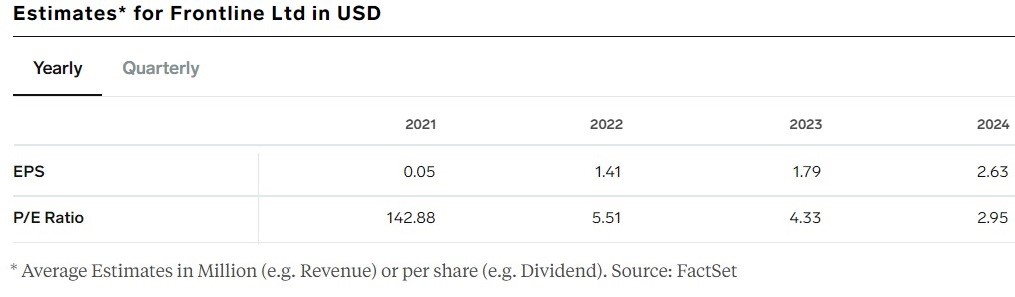

Frontline reported EPS of $2.11 for the fiscal year 2020, but then it struggled in 2021 to find its way to profitability. For the second quarter of the fiscal year 2021, Frontline reported a loss of -$0.13 per share.

Frontline's P/E Ratio

The price/earnings ratio or P/E ratio shows how much investors are willing to pay for $1 in annual profits that the company earns. Effectively, it is calculated by dividing the current stock market price by the EPS and the higher the number, the more unattractive the company is. Put differently, the P/E ratio shows how many years the investors will recover their money if the company's annual profits remain unchanged.

Frontline's poor performance during the COVID-19 pandemic sent the P/E ratio through the roof. It is estimated that for 2021 the P/E ratio will be 142.88, but then expected to "normalise" in the years ahead, reaching 2.95 by 2024.

Frontline's Dividend Yield

Frontline used to pay a dividend to its shareholders, but it does not do so anymore. Once again, the developments in the oil market during the pandemic have severely impacted the company's profitability and thus management decided to stop paying a dividend.

Given the long history of paying a dividend, the policy will likely return in the future, once the tankers industry stabilises. Because Frontline does not pay a dividend as of this writing, we cannot calculate its dividend yield.

Frontline's Cash Flow

A company's cash flow position tells much about its ability to meet short and long-term liquidity and solvency issues. The higher the cash flow position, the better, but cash sitting idle without being invested brings opportunity costs. As such, companies with excess cash flow invest it in various financial instruments, such as marketable securities or long-term bonds.

A company's cash flow statement shows the cash flow from investing, operations, and financing, but one important metric investors like to focus on is the free cash flow. This is the amount of money that remains after the company covers all the costs of staying in business.

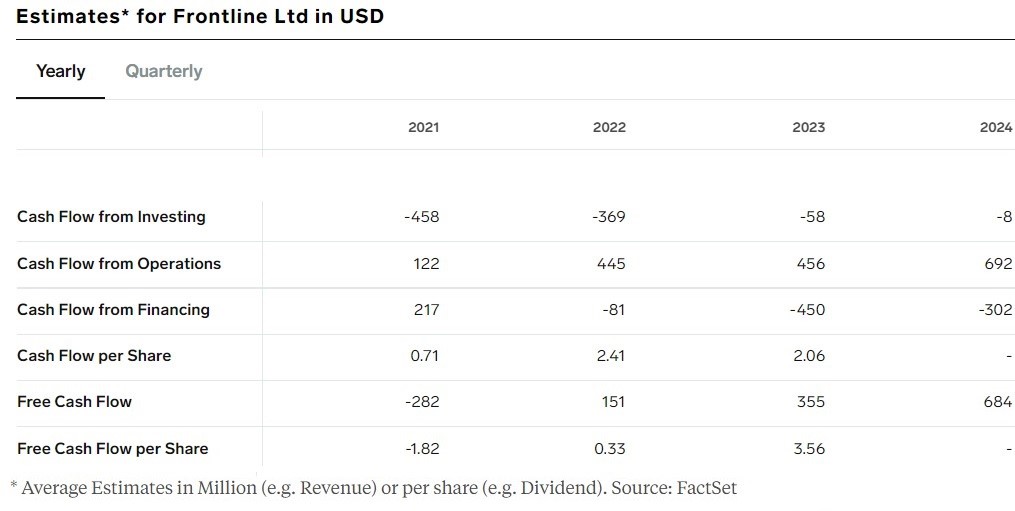

Frontline's free cash flow position is forecast to improve in the years ahead and to reach $684 million by 2024.

Why Buy Frontline Stocks?

Here are a few reasons to consider that might convince you to buy Frontline stocks with confidence.

- Large and modern fleet, with many VLCCs. VLCCs are capable of passing through the Suez Canal in Egypt;

- Strong demand for oil as the world economies recover after the COVID-19 shock;

- Improvements in the global economic outlook;

- Transported oil is back to 2019 levels.

Expert Tip on Buying Frontline Stock

“ Frontline is turning its fleet around and investing heavily in ECO-type VLCCs. It entered into an agreement in June 2021 to buy two latest-generation ECO-type VLLCs built in 2019 and the HHI shipyard in South Korea. Scheduled for delivery during the fourth quarter of 2021, the two VLCCs will contribute to the company's profitability as they are attractive options for customers forced to turn "green" on ESG concerns. ”- thomasdavid

Things to Consider Before Buying Frontline Stock

Before investing, you might want to consider the following.

Understand the Company

It all starts with a good understanding of the company, how it makes money and what is its financial position. As an investor, you might want to check industry trends, the forecast for the years ahead, the forward guidance provided by the management, and so on. The more you know about the company, the more confident you are to invest.

Understand the Basics of Investing

Investing requires some knowledge of basic concepts, such as how to place an order with your broker, what types of orders are available to use, or how to apply money management rules for better diversification of your investment portfolio.

Carefully Choose Your Broker

The brokerage industry grew exponentially as more and more investors tried their hand in financial markets. Stiff competition led to improved practices, but not all brokerage houses are the same. Due diligence is needed before choosing a broker, and, as an investor, you might want to invest with a regulated broker, one that offers negative balance protection, has solid customer reviews, and segregates customers funds from the funds needed to operate the business.

Decide How Much You Want to Invest

This is a crucial aspect of investing. The funny thing is that human nature plays tricks on us all – everyone wants to get rich quickly, and no one is willing to patiently wait for it to happen. As such, bad decisions turn out to be catastrophic for the investing account, such as betting all your funds on one single company.

Instead, think of diversifying the investment and spreading the risk throughout different companies, sectors, and industries. One of the best practices here is to invest a certain percentage of the trading account in any one company and always have a cash position to take advantage of opportunities in the market.

Decide on a Goal for Your Investment

What do you want from your investment? You might want to invest for retirement, and then a buy and hold strategy would be the right choice. Also, think of investing in dividend-paying companies to achieve that goal easily, due to the increased compounding rate from reinvesting the dividends. Regardless of the reason to invest, make sure you define your goal, make a plan, and stick to it.

The Bottom Line on Buying Frontline Stocks

Frontline is a world leader in the seaborne transportation of crude oil and petroleum refined products. It operates one of the most modern fleets in the tankers industry, made of 68 vessels consisting of VLCCs, Suezmax tankers, as well as LR2/Aframax tankers.

Investors feeling confident enough to buy Frontline stocks may do so by using the services of a brokerage house from the list presented in this article. Simply look for the company, place your order, and monitor or manage your portfolio.

Investors that still hesitate may want to dedicate more time to research the company or to learn more about investing. If that is the case, feel free to check our educational materials on our website and also use other sources to build the confidence needed to invest in financial markets.

Frequently Asked Questions

-

Many risks exist. Frontline transports crude oil and refined products, so there is the risk of developing other ways of moving oil and oil products, such as new pipelines in the Arabian Gulf or West Africa. Other risks are political ones, or the risk of an armed conflict in the Arabian Gulf or West Africa, affecting oil from the two oil-producing regions. Frontline had a tough time during the pandemic as demand for oil dropped drastically, but the subsequent recovery builds strong momentum and investors may want to buy Frontline stocks.

-

There are international conventions that impose liability for pollution in international waters. Because of that, tankers' operators need to upgrade their fleet constantly or else pay higher insurance costs. The Bunker Convention requires owners of ships over 1,000 gross tons to have insurance for pollution damage.

-

Frontline operates a modern fleet. The oldest ships were built in 2004 (i.e, two VLCCs) and the majority of the other ships were built after 2015. As of December 31, 2020, Frontline operates 68 vessels, out of which it owns 60 (15 VLCCs, 27 Suezmax tankers, 18 LR2/Aframax tankers).

-

To start with, vessel operating expenses are critical to the company's profitability. These are direct costs associated with running a vessel and include repairs and maintenance, insurance, or lubricating oils, to name a few. Other factors are typical for any company, such as depreciation, impairment losses on goodwill, or gains and losses on derivatives.

-

A rise in global oil consumption would benefit Frontline. It means that there is more oil to be moved and it means business for Frontline. Another thing to consider is the OPEC+ policy, as it may affect tanker rates as customers may decide to move more or less oil depending on OPEC+ decisions. Ultimately, the price of oil – higher oil prices are beneficial to Frontline.

-

The best way to do so is to use an adequate money management system in your investing operations. Effectively, it refers to finding the level which invalidates your bullish scenario for the Frontline stocks and then setting a stop-loss order at the level. The broker will automatically get you out of your position if the market price reaches it.