How to buy GameStop stocks in 2025

This guide will teach you how to invest in GameStop stock and what factors to consider before staking your hard-earned money. Let us first share some quick facts about the company.

GameStop is one of the biggest video game and consumer electronics retailers in the world. The company is headquartered in Texas, United States. With more than 4,000 stores located worldwide and a team of over 12,000 employees, the company serves gaming enthusiasts all across the globe.

GameStop's major markets include U.S, Canada, New Zealand, Australia, and Europe. Besides having a chain of retail stores, the company also owns an e-commerce marketplace to facilitate consumer-to-consumer sales and a magazine that covers gaming updates. Given extraordinary gains amid the company's short-squeeze this year, GameStop pulled off massive media and public attention in 2021.

How to Buy GME Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in GameStop

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About GameStop

Let’s get to know GameStop in more detail by exploring its history, strategy, and the ways it makes money.

Gamestop’s History

In 1984, former Harvard Business School classmates James McCurry and Gary M. Kusin founded Dallas-based Babbage's software house, which became GameStop later. With the help of early investor Ross Perot, the company opened its first store in Dallas' NorthPark Center.

Initially, the company focused on Atari 2600 video game sales. However, Babbage's started selling Nintendo after 1987. Two-third of Babbage's sales consisted of video games by 1991. In the same year, the company acquired FuncoLand (video game retailer) and the Game Informer (video gaming magazine). Funco rebranded to GameStop Inc. in 1992.

By the end of 1992, the company was operating via 37 stores all across the United States. Over the next decade, the company went through multiple mergers and acquisitions and became publicly listed on New York Stock Exchange in 2002.

In 2003, the company had its best year in terms of sales and profitability. It underwent a sales turnover of $1.58 billion while profits reached 63.5 million U.S. dollars. Most impressively, GameStop made money every quarter. From there onwards, the company kept growing and lapped various successful miles up to 2017.

After the company witnessed a significant drop in its share price in 2017, it announced the closure of its 150 stores across different jurisdictions. GameStop net sales kept decreasing further, and the company bore a record-breaking loss of $673 million in 2018. Amid the COVID-19 pandemic, GameStop was forced to close its physical locations from March to May 2020. Despite the closure of all of its 3,500 stores worldwide, the company still managed to continue side sales via online portals.

What Is GameStop Strategy?

GameStop aims to become the world's largest retailer of new and used video games and PC entertainment software. Previously, the company trade model involved selling used games. For quite a long time, it worked well.

No doubt, used games generate far higher gross margins than new gaming hardware and software. However, after console gaming moved online, the company employed diverse strategies, including investment in technology, modernising fulfilment operations, and expanding the product range to include PC gaming, game tables, mobile gaming, etc.

How Does GameStop Make Money?

GameStop's prime income stream is the sales of used games. However, it does sell new games and PC software. After a slew of new gaming consoles released by the tech giants Microsoft and Sony in 2020, the company recorded a considerable increase in its sales revenue.

However, online services like Xbox Live and Steam are becoming increasingly popular. These platforms allow players to download entire game libraries from the comfort of their homes and could limit the GameStop selling potential.

How Has GameStop Performed in Recent Years?

Ever since the trend of online gaming became popular, the demand for physical gaming consoles subsided significantly. It was one of the prime reasons why GameStop suffered heart-wrenching losses over the past five years.

Consequently, GameStop’s value had been decreasing consistently up to January 2021. However, amid the short-squeeze, things changed dramatically. The GameStop stock started trading around $347 on January 25, 2021. Not to mention, it had a value of less than $19 until January 2021.

All this began when institutional investors, probably hedge fund managers, tried to take advantage of a drowning company. They started short-selling their shares in an attempt to repurchase the stock at lower prices. However, this came hard on game lovers.

In response to hedge fund managers' short selling of GameStop stock, Reddit users poured money into the company. They pushed the stock price up to $325 on January 25, 2021. The GameStop short squeeze turned excessively profitable for small investors while hedge fund managers lost billions.

Regardless of the risk, many retail investors are determined to hold on and cause the Wall Street establishments to lose as much as possible. However, the price has already started declining. If the price continued its bearish momentum, it could bring severe losses to investors keeping their stake in the company.

Where Can You Buy GameStop Stock?

GameStop lists its shares on New York Stock Exchange. You can buy GameStop stock via a brokerage firm or financial advisor. To proceed, you need to have a live trading account opened with your broker. Not to mention, brokers also offer fractional shares for those who can't afford to buy Gamestop shares or any other stock at the par value. Alternatively, you can also seek the services of your financial advisor to help you buy GME stock. Checking the purchase facility of GME stocks with your bank is also a worthwhile option to consider.

GameStop Fundamental Analysis

Fundamental analysis is a method of estimating a security's intrinsic value after examining relevant macro and micro factors. Ranging from a state's economic well-being to a company's management performance, fundamental analysts could study anything that can affect a stock's price.

It helps you assess whether an underlying asset is undervalued or overvalued. Some variables that investors may wish to check before investing their stake in any company include revenue, price-earnings ratio, dividend yield, interest cover, earning-per-share (EPS), etc. Let’s go through each of these indicators and understand how they can offer valuable information to investors.

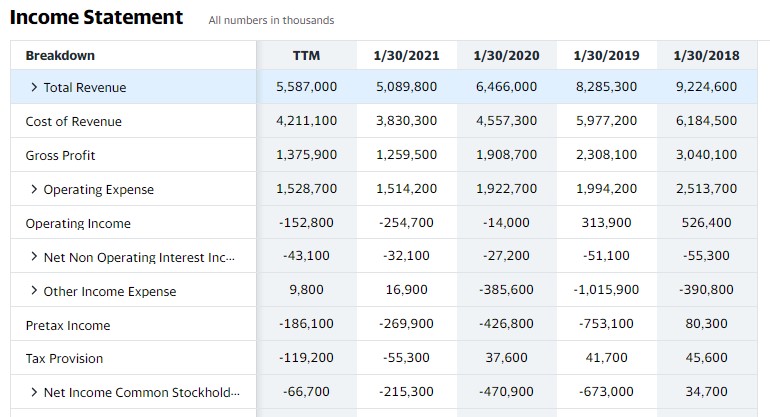

GameStop’s Revenue

Revenue is the income businesses generate from sales of their products and services. It needs to be adjusted for the relevant expenses to figure out a company's profit or loss over a given period. Typically, it is the first line that appears on a company's income statement. We deduct the cost of sales from the revenue figure to find a company's gross profit. Then, we can deduct the rest of the expenses to reach the net profit or loss. The table below reflects GameStop performance for the past years.

Source: Yahoo! Finance

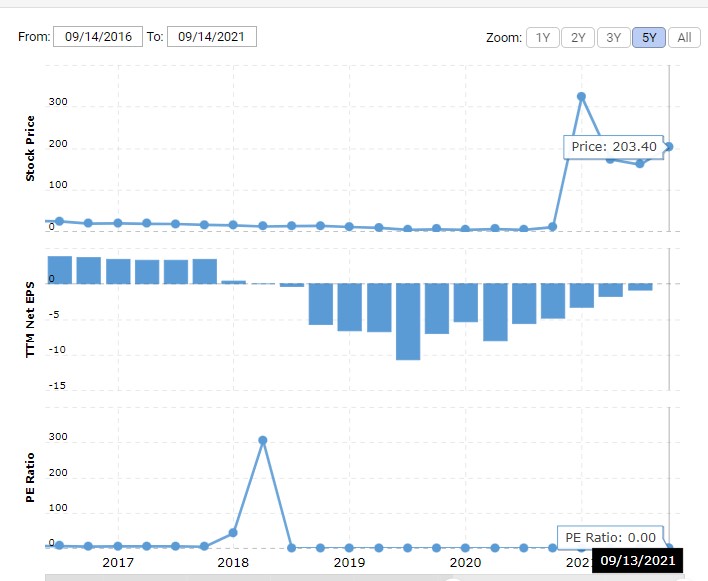

GameStop’s Earnings-Per-Share (EPS)

Earnings-per-share is an essential element to consider while estimating a company's profitability. It helps you know how much return you can expect on each share in the company. Investors can calculate the EPS by dividing a company's net earnings available to shareholders by average outstanding shares.

A company having a higher EPS value is likely to have increased stock prices. Gamestop reported $-0.85 EPS for the second quarter of the fiscal year 2021.

GameStop’s P/E Ratio

P/E ratio helps you compare a company's current share price to its earnings per share (EPS). Investors use P/E ratios to compare the relative value of a company's shares and compare a company's performance with other companies or the industry over time. If a company has a higher P/E value, it suggests overvaluation.

The easiest method to find out the P/E ratio of GameStop or any other company is to divide the market price of the company's stock by its earnings-per-share (EPS). Not to mention, companies recording losses over time make it impossible to calculate the PE ratio. With negative EPS for the past few years, GameStop has been underperforming.

Source: MacroTrends

GameStop Dividend Yield

A dividend yield refers to the annual payment a company pays to its shareholders expressed as a percentage of the current price of a company's share. For instance, if an organisation opts to pay $0.01 as an annual dividend and its share price is $1, then its dividend yield is 1%.

Companies employ different policies concerning dividend payments, such as annual, bi-annual or quarterly disbursement of profits to shareholders. Despite generating higher profits, a company can lose the interest of investors if it chooses to pay no dividends at all. However, the importance of a dividend yield may also vary from client to client. Some clients prefer to receive consistent dividend payments, whereas others might be happy with consolidated returns.

Generally, you can expect lower dividend rates from developing companies as compared to the established ones. Not to mention, companies with high dividend yields are not always the best choice to consider.

As far as the dividend yield of GameStop is concerned, it stopped paying dividends. The company paid $0.3 million as cash dividends for the fiscal year 2020 last time. However, the company revoked dividend payments subsequently to reduce the company's debt and increase financial stability.

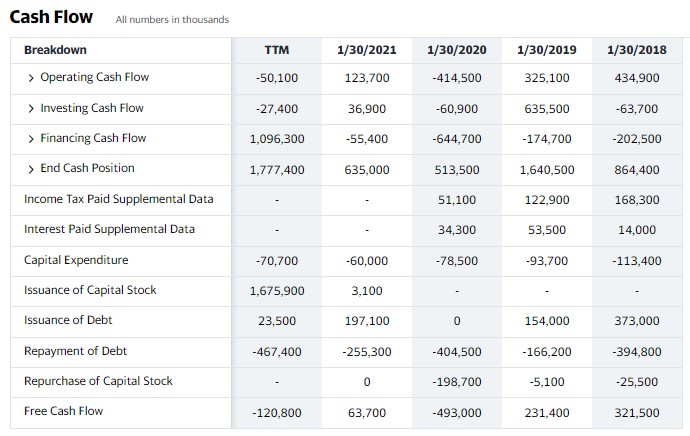

GameStop Cash Flows

A cash flow statement is a summary of cash transactions of a company. Irrespective of the profit or loss element, it includes all the cash inflows and outflows over the given period. A cash flow statement helps investors assess the liquidity of a company.

A corporation should be sufficiently liquid to meet its debt obligations (overdrafts, short-term loans) and pay operating expenses (rent, salaries, tax payments). After satisfying all the immediate obligations, a business is left with free cash flows.

Investors are usually interested in free cash flows since companies use them to pay dividends or invest in other profit-generating activities. Checking the cash flow statement of a business before buying its stock is crucial. GameStop free cash flow seems to have declined over the years. However, the company did well compared to the last year.

Source: Yahoo! Finance

Why Buy GameStop Stocks?

While the general public and institutions hold 44.5% and 37% of the GameStop stock respectively, 18.5% company's shares are held by the company's management. It is one of the main reasons why you should consider buying GameStop stock. Essentially, the company's management would try its best to get the share price higher. However, GME share price could have already been exhausted amid its short squeeze initiated in January 2021. Not to mention, the company has also halted dividend payments after 2020.

GameStop will be putting sincere efforts to extend its digital presence. After appointing Ryan Cohen (co-founder of Chewy) as GameStop chairman, the company seems to have started reaping fruits by recording a 25% increase in its sales this year.

Undoubtedly, strong leadership bringing massive e-commerce exposure to the table can certainly help the company make a strong comeback. According to experts, GameStop has the right potential to become one of the leading gaming portals in the e-commerce industry. However, before investing your money in the company, you should do your own due diligence.

Expert Tip on Buying GameStop's Stock

“ GameStop turned into one of the most popular meme stocks on the market. Due to high volatility, it’s recommended that you do your own research and invest in this stock only if you are convinced that it has what it takes to beat market competition and keep growing in the future. ”

5 Things to Consider Before You Buy GameStop Stock

1. Understand the Company

Developing an understanding of the company can help you decide whether it is worth your investment or not. Spare enough time and research the company well. Consider both technical and fundamental aspects of your prospective company before making a final decision, such as the type of the company, the geo-location, the business model, past performance, profit-earning potential, and others.

2. Understand the Basics of Investing

Trading the stock market is a little more challenging than other, less risky assets, such as bonds. Chances are high for newbies to get lost or become overwhelmed. Always have a well-planned trading strategy in hand. Do not forget to employ different risk and money management tools. Invest less and keep your investment well diversified. Avoid investing more than 5% of your funds in a single stock.

3. Carefully Choose Your Broker

The market is full of legit and scam stockbrokers. Therefore, let us mention some crucial points to help you expedite your search.

First of all, check the regulation status of your broker. Regulations ensure brokers keep clients’ investments segregated and maintain enough liquidity. Some regulated brokers even allow clients to claim compensation against their financial losses if a company becomes insolvent. For example, regulated brokers in the US and UK offer indemnity insurance to their clients under registration with FDIC and FSCS, respectively.

Secondly, check the trading cost with your prospective broker. The fee to buy and sell shares should be feasible. You can also compare the fee charges of your prospective broker with other competitors available around. Choose the one that comes with a low trading cost and does not employ any hidden charges.

You might also wish to confirm what trading platforms and risk management tools your prospective broker offers. Opening a demo account with your broker can help you test the user-friendliness of the broker's trading platform and the user-friendliness of available trading tools.

Do not forget to check the level of customer support services of your potential brokerage firm. A reputable broker remains on its toes to serve its clients round the clock.

4. Decide How Much You Want to Invest

It is best to determine your risk tolerance level well in advance. It will prevent you from investing too much in a single stock. Remember, keeping all of your eggs in the same basket is nothing but a foolish mistake. Sensibly divide your investment into equal amounts and build a portfolio of multiple stocks. For example, if you have $10,000 available to invest, split it into small chunks and buy five different stocks worth $2,000 each instead of investing all of it in GameStop.

5. Decide on a Goal for Your Investment

Finally, think well before buying the GameStop stock or vesting your stake in any other company. Identify the reasons for your investment and decide on a goal. For instance, retirement plans need you to opt for long-term investment. You receive yearly, bi-annually or quarterly dividend payments along with an opportunity to increase your wealth with price appreciation of your stock over the years. Alternatively, if you want quick profits, day trading might suit you better. Remember, do not invest the money you can't afford to lose.

The Bottom Line on Buying GameStop Stocks

A long-time favourite of many gamers, GameStop has been endeavouring hard to adapt to changing market conditions. To transform the business from retail stores sales to a thriving e-commerce company, GameStop has hired two ex-Amazon executives, Mike Recupero as its new CFO and Matt Furlong as the GameStop's CEO.

According to many industry experts, the stock price of GameStop might witness a drop coming back to its original position in the future. Not to mention, multiple predictions also suggest that the company's share price will rise once again amid the ongoing developments in the company business model and organisational structure. Chances are there that the company will start lapping successive miles soon.

If you think you're ready to proceed, buying GameStop stock is pretty straightforward. Just find a reliable broker listing GameStop stock and open a live trading account with it. Fund your account and place your trade.

However, if you're still unsure whether it's the right time to buy GameStop stock, you can wait for some time until the share price of the company drops. Buying GameStop shares at a low price and anticipating growth in its value over time can also be a good move. All in all, the choice is yours.

Frequently Asked Questions

-

Yes, nearly all major brokerage firms have GME stock listed on their offerings. However, amid the stock's excessive volatility, some brokerage firms allow only a limited volume of GME trading.

-

GameStop shares are listed on the New York Exchange (NYSE) under the ticker GME.

-

Until 2020, GameStop had been consistent with paying dividends. However, it has halt dividend disbursement for an unspecified period.

-

Yes, the GameStop split occurred on March 19, 2007. It was a 2:1 split. In other words, for every GME share owned before the split, the shareholder now owned two. Amid the shares split, the market capitalisation remains the same, but the price per share decreases.

-

It depends upon your expected investment tenure. Technical analysis is helpful when you wish to invest on a short-term basis. On the other hand, fundamental analysis allows you to have a broader picture of the stock’s position and aids in making long-term investment decisions.

-

While opening your position, do not forget to set stop-loss order. Although there is always a risk of slippage in case of high volatility, limit orders can help you manage your risk much better.