How to buy Google stocks in 2024

Google is a technology company that primarily provides digital services, such as online advertising, search engine, software, and cloud computing. It also produces hardware products such as smartphones and Chromebook computers. Google is headquartered in California, United States, and is a wholly-owned subsidiary of Alphabet Inc. At the share price of $2,872, Google has a market capitalization of $1.907 trillion at the time of writing and is ranked among the top companies in terms of market capitalization, alongside Apple, Microsoft, Amazon, and Facebook. Google owns two of the world’s most-visited websites: Google and YouTube. The company is listed on the Nasdaq exchange with the ticker symbol GOOGL.

The guide provides you with detailed information on how to buy Google stock and guides you on thoroughly analyzing the stock using different fundamental analysis metrics.

How to Buy GOOG Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in Google

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About Google

Understanding the important aspects of the business, such as its history, strategy, revenue sources, and recent performance can help you make the right investment decisions.

Google History

Stanford students Larry Page and Sergey Brin founded Google on September 4, 1998, in California, United States. The duo intended to reform the conventional search engines that ranked web pages on the basis of the number of times the search term appeared on the page. They proposed to rank web pages on relevance, which would be determined by the number and importance of the pages linking to the original website. Page and Brin named the new search engine “BackRub” but later renamed it to its present form, Google: a misspelling of the word “googol” that signifies an uncountably large number.

In 1999, the company raised $25 million funding from Kleiner Perkins and Sequoia, two major venture capital firms. Google went public on August 19, 2004, when the company sold over 19.6 million shares at $85 per share, which raised $1.67 billion and gave the company a market capitalization of $23 billion. Google made some key strategic acquisitions: it acquired the popular video streaming website YouTube in 2006 for $1.6 billion, advertising company DoubleClick in 2008 for $3.1 billion, and telecommunications company Motorola Mobility in 2012 for $12.5 billion. The company also invested in setting up 11 data centres around the world to cater to the 1 billion unique monthly visitors to its website.

Alphabet, the parent company of Google, was formed in 2015 to restructure and reorganize the company’s growing business. Google was tasked to handle the conglomerate’s internet interests and became its largest wholly-owned subsidiary. Sundar Pichai took over Google as its new CEO, replacing Larry Page who took charge as CEO of Alphabet Inc.

What Is Google’s Strategy?

Google’s business strategy includes creating useful products for its customers, ensuring secure online sessions, supporting its business partners, and contributing its share to society. During the pandemic, the company launched around 200 new initiatives and products that helped health authorities and the general public in preventing the spread of the disease. Google and Apple developed an Exposure Notification System (ENS) that enabled health authorities to manage reopenings. More than 50 countries and states used the technology, which assisted them in making appropriate decisions to contain the proliferation of the disease. Google Meet, the company’s video conferencing app, was made free of charge for use during the pandemic when businesses and the education sector switched to work-from-home and distant-learning modes.

Google ensures that its digital tools remain safe and that users’ data and privacy are secured. For example, Gmail blocks around 99.9% of spam and phishing emails, while Google Play Protect scans around 100 billion apps every day for malware or spyware.

The company supports content creators and its business partners by providing them with innovative products. For example, app developers can build their businesses thanks to the Google Play store. According to Google, more than 2.9 billion users used its productivity tools like Calendar, Google Drive, Google Docs, and Google Meet in 2020. Google estimates that it generated economic activity worth $426 billion in 2020 for more than 2 billion Americans using its advertising tools.

Google plans to invest in R&D in the areas of advertising, cloud computing, machine learning, search engine, and new products and services. As part of its expansion strategy, the company regularly invests in land and buildings for data centres, offices, and information technology assets. Strategic acquisitions, investments, and the optimal use of capital will help the company to diversify its offerings, expand its capabilities in engineering and other functional areas, and build strategic initiatives and partnerships.

How Does Google Make Money?

Google generates revenue from a variety of services, including advertising, the Android operating system, YouTube, Google Maps, Google Play, search, the Chrome web browser, smartphones, and gadgets. The company’s primary revenue source is advertising, whereas its secondary revenue comes from sales of apps, digital content, and in-app purchases. The company also sells hardware that includes smartphones and electronic gadgets. Google generates subscriptions and fees from YouTube Premium and YouTube TV.

Google Cloud charges its customers fees for using Google Cloud Platform (GCP) services and Google Workspace collaboration tools. “Other Bets” in Google’s financial reports include a combination of operating segments, and their revenues originate primarily from the sale of internet services, licensing, and R&D services.

How Has Google Performed in Recent Years?

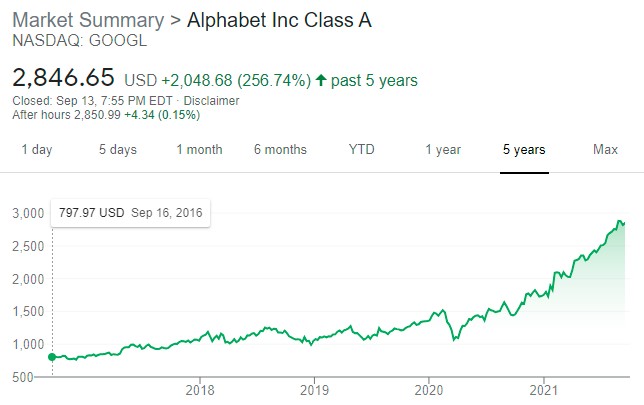

The stock of Google’s parent company, Alphabet Inc., gained around 257% between September 16, 2016, and September 13, 2021. The stock closed at its all-time high of $2,904.31 on September 1, 2021.

Source: Google Finance

Where Can You Buy Google Stock?

You can buy stock of Google’s parent company, Alphabet Inc, by opening an account with a stockbroker. Many brokers offer different types of trading accounts, including margin accounts, cash accounts, options trading accounts, individual retirement accounts, and special-purpose investment accounts.

Google Fundamental Analysis

Fundamental analysis entails evaluating a stock or company on a variety of financial metrics that give investors an idea about the stock's actual worth in relation to its market price. The common measures on which investors scrutinize a stock include revenue, earnings growth, earnings per share, price-to-earnings ratio, dividend yield, free cash flow, among others.

Google’s Revenue

Revenue is the monetary value a company generates by selling its goods or services. An increase in a company’s revenue can boost its profitability and stock price, whereas a decline in a company’s revenue can reduce its profitability and reduce its stock price. Revenue is also called “top line” and can be found on the company’s income statement.

Alphabet Inc. reported revenue of $61.88 billion in Q2 2021 against $38.29 billion in Q2 2020, which is an increase of 61.8% from the same quarter of the previous year.

Google’s Earnings-per-Share

The earnings per share figure or EPS denotes the amount of earnings attributable to each share of stock. You can calculate a company’s EPS by dividing its net profit by the average number of shares outstanding. For example, if a company’s net profit is $100 million and the average number of shares outstanding is 10 million, its EPS would be $10 per share. Earnings per share can be negative if a company is making a loss instead of profit.

Companies usually report earnings per share in two forms, with differences lying in the calculation of the average number of outstanding. The basic EPS includes only common outstanding shares in the formula, while the diluted EPS also includes convertible shares (such as warrants and employee stock options) in the calculation, which dilutes the share of profit of existing shareholders as the denominator in the formula increases.

Alphabet reported a basic EPS of $27.69 in Q2 2021 as compared to $10.21 basic EPS reported in Q2 2020— a rise of 171% from the previous year.

Google’s P/E Ratio

The price-to-earnings ratio, or P/E ratio, determines the ratio of the market price of a stock in relation to its earnings per share. In other words, it helps you calculate the multiples at which the stock is trading in comparison to its market price. For example, if a stock is trading at $20 while its EPS is $10, its P/E ratio would be 2x. This means that the stock is trading at twice the earnings it generates per share. Stocks that are trading at lower multiples of P/E can imply that they are cheap, but you should dig deeper and analyze other metrics as well before reaching any conclusion.

Google’s trailing twelve-month P/E ratio was 27.17x on June 30, 2021.

Google’s Dividend Yield

Dividends are cash payouts by the company to its shareholders from its profit. The board of directors decides whether to pay out dividends or skip them altogether, depending on their policy. Growing companies often don’t pay dividends as they want to retain and reinvest the company’s earnings to further expand the business. Investors who own shares of a company at least one business day before the ex-dividend date are eligible for any dividends declared by the company.

The dividend yield of a stock represents the total annual cash dividend paid out by the company as a percentage of its stock price. For example, if a company paid out annual dividends of $10 while the stock price is $50, its dividend yield would be 5%. Investors prefer stocks with high dividend yields as these stocks give them a higher return on their investments.

Alphabet Inc. has not paid any dividends to its shareholders to date.

Google’s Cash Flow

A cash flow statement shows the inflows and outflows of cash separated into cash flows from investing activities, operating activities, and financing activities. The ending balance of the cash flow statement shows the amount of cash & cash equivalents held by the company. Positive cash flows from operating activities mean that the company generates more cash from its operations than it spends, so the surplus can be spent on other strategic activities.

As of June 30, 2021, Alphabet Inc. had cash and cash equivalents of $17.74 billion. The company generated $25.44 billion from operating activities in Q2 2021 compared with $41.17 billion in the same quarter of the previous year.

Why Buy Google Stock?

Google is known for rolling out innovative products and services. Google Search, Android, Chrome, Google Maps, YouTube, Google Play, and other services have become a part of the lives of most people. Here are the three reasons why you should buy Google (Alphabet) stock.

- Google’s strategy of building new digital and hardware products, and improving the existing ones, has made the company one of the world’s largest and most valuable companies. Amidst the 2020 coronavirus pandemic, the company introduced 200 new products and features that helped the people in various ways. The fact that Google’s products have been adopted globally speaks volumes about the potential of the company, which should be a good reason to include the stock in your portfolio.

- Google regularly invests in research & development activities and acquires innovative businesses that can contribute to its long-term success and augment its expertise across different domains.

- Google’s stock has produced explosive returns since its inception due to its continuous earnings and revenue growth. The best part is that the company is still growing as it is aggressively investing in AI and machine learning that has many ground-breaking applications.

Expert Tip on Buying Google Stock

“ Alphabet stock has been climbing high since its inception. Any dips in the stock price can provide you with a buying opportunity. You can also consider applying the dollar-cost averaging technique by buying the stock in small amounts irrespective of its price, which minimizes the impact of volatility on your purchase and might lower your average cost of holding the stock. While the stock doesn’t pay dividends, you can hold it for the long term to earn capital gains through stock appreciation. ”

5 Things to Consider Before You Buy Google Stock

To become a better investor or trader, you should consider the following 5 things before investing in any stock.

1. Understand the Company

Investing blindly in a stock just to jump on the bandwagon is not prudent investing. You should understand the company thoroughly to know the underlying risks and potential rewards of owning its stock. The more you become familiar with the company’s operations, the higher will be your chances of making accurate decisions on buying and selling its stock at the right times. The best way to study the company’s business model is to study the annual report and keep yourself updated by following the industry news. You can study the company’s financials and compare them with its peers in the industry to determine whether the stock is appropriately valued on the market.

2. Understand the Basics of Investing

You should understand the basic principles of long-term investing as well as short-term trading. Try to build a well-diversified portfolio of different stocks that will spread your investment risk across different companies. In other words, you should refrain from putting all your money in a single stock that can expose you to high risk if the outcome doesn’t go your way. If you are into short-term trading, you should risk only a small portion (1% or 2%) of your account on a single trade. You should always employ risk mitigation techniques and place stop loss on each of your trades to protect your capital.

3. Carefully Choose Your Broker

You should always choose a broker that gives you access to a robust trading platform with mobile trading features. Also, choose a broker that charges low commissions or spreads, allows you to trade a wide range of financial assets, and supports popular deposit and withdrawal methods. Opening your account with a regulated broker will safeguard you from getting defrauded. So, you should review a broker and compare its services with the other ones to choose the best one among them.

4. Decide How Much You Want to Invest

Before investing or trading, you should determine how much to invest. If you invest a large amount of money without mitigating the risk of losing your capital, you could find yourself in trouble. One of the basics of investing is that you should open smaller positions and limit the use of leverage because even a small movement can wipe away your account if you open large or leveraged trades.

5. Decide on a Goal for Your Investment

Your investment goal will determine the type of investment strategy you adopt to achieve that goal. If your investment goal is to beat the popular benchmark, such as the S&P 500 index, you might have to assume higher risk and pick stocks that can generate higher returns. There is always a risk-return trade-off. So, if an investor sets a goal of acquiring high returns, they will have to assume higher risk, and vice versa.

The Bottom Line on Buying Google Stocks

Tech giant Google continues to impress investors with its above-average financial results, and it impresses customers with its interesting products and services. In Q2 2021, Google’s ad revenue jumped by 69% YoY to reach $35.8 billion while YouTube’s ad revenue increased by 84% YoY to reach $7 billion. Also, Google Cloud registered 50% growth that helped slash its cloud business operating losses. The company is making investments in its new ventures: Waymo (a self-driving technology company), Verily (a life sciences company), and Calico (a healthcare research company). The company has plenty of growth prospects, and investors are upbeat about its stock.

If you want to invest in the stock of Google’s parent company, Alphabet, you can open an equity account with a stockbroker. This is an easy process that requires filling out an online form and uploading your identity documents. Most brokers will open your account within three business days after verifying your credentials. After your account is successfully created, you can fund it using any of the popular deposit methods, such as Paypal, credit or debit cards, and wire transfers.

If you want to learn about other exciting stocks, check out the companion pages to this one or click here.

Frequently Asked Questions

-

Google’s parent company, Alphabet Inc., is listed on the Nasdaq exchange with the ticker symbol GOOGL.

-

Google primarily earns revenue from Google search ads and YouTube ads.

-

Google has not paid out any dividends since its inception, but it has generated significant returns for its shareholders through stock price appreciation.

-

The United States accounted for 47% of Alphabet’s total Q2 2021 revenue, while Europe, the Middle East, and Africa accounted for 30% of the company’s Q2 2021 revenue.

-

Alphabet, the parent company of Google, was formed in 2015 to restructure and reorganize the company’s growing business.

-

The Initial Public Offering of Google took place on August 19, 2004, when the company sold over 19.6 million shares at $85 per share, which raised it $1.67 billion and gave the company a market capitalization of $23 billion.