How to buy IBM stocks in 2024

This guide tells you about International Business Machines Corporation (IBM) stock: what the company nicknamed “Big Blue” is, how to buy its shares, and why you might want to buy them based on the company’s financial fundamentals and technical chart picture.

IBM is a much different company from the near-monopolistic provider of “mainframe” business computers that was challenged (and beaten) by Microsoft and Apple in the personal computer craze of the 1980s. It was knocked down, but not out, and this 110-year-old company is still very much alive and kicking.

How to Buy IBM Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best 3 Brokers for Investing in IBM

1. eToro

eToro is a social trading and investment platform that allows users to trade a variety of assets, including cryptocurrencies. The platform is designed to be user-friendly and intuitive, making it a good choice for those new to investing. eToro also offers some features that can be useful for more experienced investors, such as the ability to copy other traders' portfolios. You can read our full eToro review here.

Security and Privacy

eToro takes security and privacy seriously, offering features such as 2-factor verification and encrypted passwords to keep user accounts safe. The platform also offers a strict anti-money laundering policy to protect users from fraud. To prevent abuse of the platform, they have put several security features in place, such as data loss prevention and restriction of access based on IP address. When a user invests, an additional security feature blocks the transaction from being executed if the account is linked to a potentially fraudulent user. In addition, they employ top vendors, web solutions, and firewalls, constantly on the alert to block a possible cyber-attack.

They take users’ privacy of utmost importance and never share their personal information without their consent.

Fees and Features

One of the most attractive features of eToro is that it is a multi-asset platform which gives access to over 2,000 financial assets like stocks, ETFs, indices, Cryptocurrencies and many more. eToro offers users Free Insurance that would cover claims in case of insolvency or an event of misconduct. Another feature that makes this platform one of the best around is the social trading feature. You can join a community of 20 million traders all around the world and connect with like-minds to shape your trading decisions. Lastly, the CopyTrader feature allows you to use the performance of some seasoned investors to know the one to replicate.

eToro offers 0% commission when you open a long, non-leveraged position on a stock or ETF with no management fees or deposit fees. However, the platform charges an inactivity fee of $10 per month if you don’t trade for 12 months. There is also a low fixed $5 fee for withdrawals.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 (monthly) |

Pros

- Security and Privacy

- Low fees and commission

- Copytrading

- Social trading

Cons

- High inactivity fee

- Limited customer service

2. Capital.com

Capital.com offers a variety of investment products and services to its clients. These include stocks, indices, commodities, shares, crypto, and forex. Capital.com has a wide range of clients, including retail investors, institutional investors, and high-net-worth individuals. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed by several top regulatory bodies, including the FCA, CySEC, ASIC, and the FSA. This indicates that Capital.com customers are well safeguarded and that the platform adheres to strict guidelines to guarantee that consumer information is secure and hidden. In addition, Capital.com’s compliance with PCI Data Security Standards is another way it safeguards its customers’ information.

Every deposit made by retail customers is protected by the Investment Compensation fund according to regulatory guidelines.

Fees and Features

With CFD trading, customers have access to over 6,000 markets with tight spreads. Capital.com offers educational materials that can help customers to make more informed decisions. Another feature Capital.com offers is Spread betting. This gives customers access to speculate on upward and downward moves on over 3000 markets. The broker provides a tool powered by AI in its mobile trading app that offers individualized trading insights by utilizing a detection algorithm to uncover different cognitive biases.

Capital.com charges no fees on deposit, withdrawal, commission or inactivity.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Tight spreads

- 0% commission with no hidden charges

- Artificial Intelligence

- Risk management tools

- Educational materials

Cons

- Overnight fees

- Mostly restricted to CFDs

3. Skilling

Skilling is an online trading platform that offers users the ability to trade a variety of financial assets, including forex, CFDs, and cryptocurrencies. The platform is designed to be user-friendly and provides traders with all the tools and resources they need to start trading. Skilling also offers a demo account so that users can practice trading before they start trading with real money. You can read our full Skilling review here.

Security and Privacy

The security and privacy of the Skilling online trading platform are taken very seriously. All information entered into the platform is encrypted and stored securely. Only authorized personnel have access to this information. In addition, the platform uses two-factor authentication to ensure that only authorized users can access account information. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), which means customers can rest assured about the security of their assets.

Fees and Features

Skilling has four different platforms; Skilling Trader, Skilling cTrader, Skilling MetaTrader 4 and Skilling Copy. Skilling Trader is designed for traders on all levels with access to all the tools needed for trading analysis. Skilling cTrader on the other hand is designed for advanced traders with a focus on order execution and charting capabilities. MetaTrader 4 is a forex and CFDs trading platform with a very versatile and easy-to-customise interface. Skilling Copy is a copy trading platform which allows members to have access to follow or copy trading strategies of seasoned traders at a fee.

Skilling does not charge any fee for inactivity, deposit or withdrawal. However, there are commission charges on FX pairs and Spot Metals on the Premium account type. These charges start from $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Reliable 24/5 customer support

- Over 1000 trading instruments

- Superb licensing and regulation

- Demo account

Cons

- Not enough educational materials

- High Spreads

- Service is unavailable in many countries including the US and Canada.

Everything You Need To Know About IBM

Let’s get to know IBM in terms of its long history, evolved strategy, revenue streams, and recent performance.

IBM History

IBM was founded in New York in 1911 by Charles Ranlett Flint. It was originally called the Computing-Tabulating-Recording Company (CTR) and was renamed International Business Machines by company president Thomas J. Watson in 1924. In the late 1930s, IBM's biggest customers included the US Government and even Hitler's Third Reich.

Fast-forwarding to the 1960s sees IBM involved with NASA’s space program(s), its launch of the IBM System/360 computer family, and being accused — under antitrust laws — of acting like a monopoly.

IBM’s $8 billion loss in 1993 was the biggest in American corporate history (at the time) and the company had to be turned around by RJR Nabisco's Lou Gerstner. Having lost out to companies like Microsoft and Apple in the personal computer space, IBM sold its own personal computer business to Chinese company Lenovo in 2005.

IBM has acquired several companies since 2015, and in 2020 it announced plans to split itself into two companies in late 2021.

What is IBM’s Strategy?

In its very long history, IBM has implemented many different strategies. What matters now is that the company’s focus in the future will be on high-margin cloud computing and artificial intelligence, driven by its acquisition of open-source software company Red Hat in 2019.

How Does IBM Make Money?

IBM sells a wide range of products and services in 175 countries. According to Investopedia, most revenues come from the Global Technology Services segment but the most profitable segment is Cloud & Cognitive Software.

How Has IBM Performed in Recent Years?

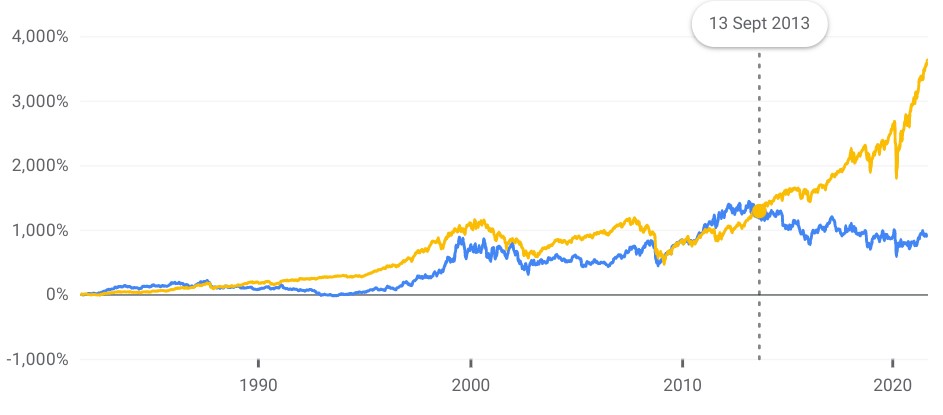

IBM’s long-term price chart shows how its share price (blue line) more or less mirrored the S&P 500 stock index (yellow line) until it started to diverge in a much different direction in 2013, massively underperforming the index for almost the decade since. This is interesting because more modern tech titans such as Apple, Amazon, and Microsoft have largely driven — and outperformed — the same S&P index over the same period.

IBM vs. S&P 500 (source: Google Finance)

Some investors would construct an investment case for IBM based on the fact that this divergence could close, and some traders would buy IBM stock long while selling the S&P index short to benefit from any convergence.

Where Can You Buy IBM Stock?

IBM is listed on the New York Stock Exchange (NYSE) and the Chicago Stock Exchange (NYSE Chicago). Its stock is also listed in other, non-US, countries such as Germany. You can buy IBM stock through a stockbroker, and some online brokers also let you bet on the direction of the IBM share price via spread bets or contracts for difference (CFDs).

IBM Fundamental Analysis

Unlike short-term traders who are more likely to use technical analysis on price chart patterns, long-term investors are more likely to employ fundamental analysis techniques to determine the financial health of a company. Here we turn our attention to fundamental analysis.

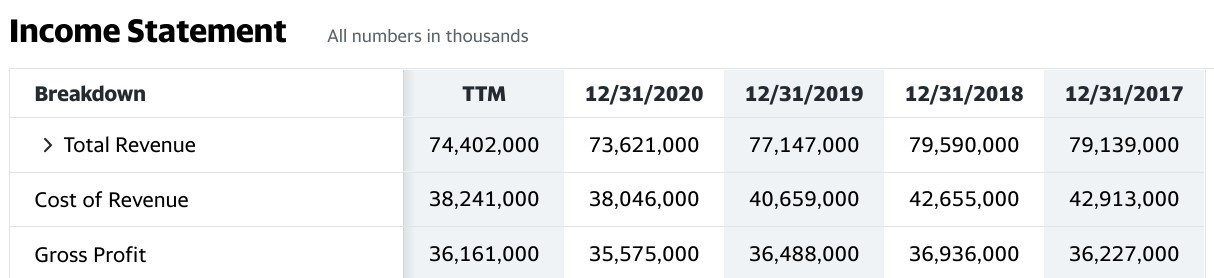

IBM’s Revenue

Revenues (i.e., the amount of money a company brings in from sales) will typically appear as the top line of the company’s income statement. You can also find this information on financial websites. The direct costs of producing and distributing the products that earn the revenue are deducted to arrive at the gross profit.

IBM’s revenue for the four years to 2020, plus the trailing twelve months (TTM) revenue, look like this:

Source: Yahoo! Finance

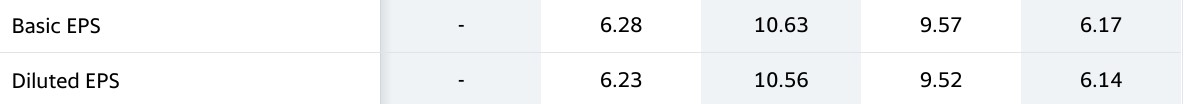

IBM’s Earnings-per-Share

Once all the company’s costs have been deducted (including overheads) you arrive at the company’s earnings, which typically appear as the bottom line of the income statement. Divide this net profit by the number of common shares outstanding to calculate the earnings per share (EPS). Again, EPS figures are published, so you don’t have to calculate them:

Source: Yahoo! Finance

IBM’s P/E Ratio

Now, divide the company’s share price by the earnings-per-share to produce the price-earnings ratio (P/E) that tells investors how many years it would take the company to generate enough earnings to pay back their shareholdings. A lower P/E means that you paid a lower price for higher earnings, which is a good thing.

IBM’s P/E ratio at the time of writing is 23.36, which (for comparison) is much lower than Tesla’s 397.47 because Tesla is a “growth stock” that is expected to grow its earnings much faster than IBM in the future to justify its relatively high share price.

IBM’s Dividend Yield

A company’s management can choose to pay out a proportion of the annual earnings to shareholders in the form of dividends. The “dividend yield” is the amount of the annual dividend payments divided by the share price, expressed as a percentage.

At the time of writing, IBM’s 4.78% dividend yield is quite attractive compared with the amount of interest you’d receive by depositing your funds in a bank account instead of investing in IBM stock. However, owning stocks is riskier than putting money in a bank account.

Not all companies pay dividends, so you have to rely on share price appreciation, and therefore sell your stockholding to make a profit. Dividend-paying stocks like IBM provide some profit income while you hold the stock, with the possibility of price appreciation on top.

IBM’s Cash Flow

A final fundamental measure that investors might consider is a company’s cash flow, particularly the “free cash flow” figure. A positive cash flow shows that a company's liquid assets are increasing, which means it is more likely to pay its way and even return money to shareholders. The same set of financial statements, which can be found on the company’s website (in the “investor relations” section) or on financial websites, will include the cash flow figures.

IBM’s free cash flow increased between 2017 and 2020.

Why Buy IBM Stocks?

With its well-known brand name and long history, IBM has some of the characteristics of the kind of stalwart stock that legendary investor Warren Buffett would buy, the only problem being that he sold his IBM shares about three years ago (in 2018) to concentrate on Apple stock instead. However, a forward dividend yield of about 4.8% at the time of writing, and a history of paying similar-size dividends, makes IBM stock look attractive compared with the much lower interest income you’d receive if you deposited your funds into a bank account instead of investing in IBM.

Expert Tip on Buying IBM Stock

“ Unlike Apple, Tesla, or other tech stocks, IBM is unlikely to change the world with disruptive technology any time soon, so this stalwart stock should probably be bought to hold based on its dividend distributions. ”

5 Things to Consider Before You Buy IBM Stock

There are at least five things you should consider before buying IBM stock or any other company stock.

1. Understand the Company

If you’ve read any of the books written by seasoned and successful investor Peter Lynch, you’ll know that he suggests investing in companies you use yourself. If a company is popular with you, your friends, and your family, it may well be popular with other customers. However, a company you like does not automatically make a good investment, as owners of shares in their favourite football (soccer) club stocks can attest. So, take inspiration from this idea, but don’t take it too far.

2. Understand the Basics of Investing

If you like the look of a company to invest in, it is also important to be able to analyse it from a fundamental financial perspective. For example, IBM stock is attractive as a dividend-paying stock regardless of whether you use the company’s products or services. In addition to dividend yield, you should make yourself familiar with the other fundamental measures (such as the P/E ratio) discussed earlier. Also, don’t discount the value of technical analysis — or chart reading — to help refine the timing of your stock purchases. Put simply, learn about the basics of investing.

3. Carefully Choose Your Broker

Having identified a stock to buy based on its products or services, and then backing up your investment hypothesis with technical or fundamental analysis, you then need to put your plan into action by buying shares via a broker.

Brokers are not all the same, which is why we suggest some of the best ones for you to try. We look for low fees, good customer service, and above all, regulation status. A regulated broker could offer you negative balance protection (so you can’t lose more money than you ever deposited) and protection from default up to a certain level. For example, the Financial Services Compensation Scheme (FSCS) provided by the UK’s Financial Conduct Authority (FCA) could protect your funds up to £85,000 per financial institution.

4. Decide How Much You Want to Invest

One of the most important aspects of investing is money management, which — in simple terms — means making sure that you don’t go broke. Periods of drawdown, when the value of your investments falls before hopefully heading higher, are inevitable. Even if you think that your investment decisions will be proved right in the long run, it’s well known that “the markets can remain irrational longer than you can remain solvent”. It is therefore important that you never need to cash in your investments at exactly the wrong time simply because you desperately need the money.

In short, never invest money that you might need in the short term to pay your rent, your kids’ college fees, or something else. Another way of saying this is “never invest money that you can’t afford to lose” but beware that this can become a self-fulfilling prophecy: if you can afford to lose a lot of money, you probably will, because you’ll be less careful.

Once you’ve decided how much you can genuinely afford to invest, the next step is to invest it wisely. This means diversifying your risk across many stocks and other assets rather than “betting the farm” on any single stock that could go bust. Alternatively, you can diversify over time by investing a small amount each month in an index fund.

5. Decide on a Goal for Your Investment

Picking up on the previous point about how much you want to invest, you should think about what you’re investing for. Are you looking to tie up your funds for a long time to pay for your children’s university education or your retirement, and would it therefore be a good idea (in the UK) to invest via a tax-efficient account such as an Individual Savings Account (ISA) or Self-Invested Personal Pension (SIPP)? This might not be a good idea if you’ll need to get your money back sooner, or if you’re looking for some speculative “quick wins” rather than steady income from dividends. Short-term speculation could be better suited to a broker’s spread betting or CFD trading account.

The Bottom Line on Buying IBM Stocks

In this guide, we first told you about IBM as a company: its history, its business model, how it makes money, and how it has performed in recent years. We then turned our attention to looking at IBM as a potential stock purchase, based on financial fundamentals such as the dividend yield. We concluded by discussing some of the other things you should consider before investing; particularly, how much you can afford to invest.

For an investor who is still hesitant - and there’s nothing wrong with that - we provide additional educational materials including guides on our website. After telling you how to buy other stocks, we’ll tie up a few loose ends by answering some frequently asked questions.

Frequently Asked Questions

-

IBM is listed on two US stock exchanges: the New York Stock Exchange (NYSE) and the Chicago Stock Exchange (NYSE Chicago). You will also find IBM shares listed on other stock exchanges such as Germany’s Börse Frankfurt.

-

IBM shares have paid dividends for many decades, at least as far back as 1962. This stock has a bank account-beating dividend yield.

-

One way to stop your investment in IBM stock from getting wiped out (however unlikely this may seem) is to diversify across several stocks and other assets rather than investing all your money in IBM shares.

-

You can apply technical analysis techniques — i.e., chart reading — to any stock, but such techniques may be better for speculators looking to benefit from big price moves of momentum stocks such as Tesla. A stalwart stock like IBM is better bought based on fundamental analysis.

-

When IBM developed its first personal computer (the IBM PC) in 1980, the company signed a non-exclusive contract for startup software company Microsoft to develop the MS-DOS operating system that would run on IBM’s hardware. Although the “open architecture” hardware was copied by other manufacturers who produced IBM-compatible PCs, all of those PCs ran Microsoft’s operating system. Thus, Microsoft made money while IBM lost market share.

-

Throughout the 1980s and beyond, IBM was nicknamed “Big Blue”-- maybe because of the blue tint of its monitors, or maybe because of its deep blue company logo. IBM embraced the nickname and even named its chess-playing computer “Deep Blue”.