How to buy PayPal stocks in 2024

Hardly anyone will not have heard of international online payments processor PayPal, since you’ve probably used it to pay for an eBay purchase in the past. But did you know, for example, that Tesla and SpaceX CEO Elon Musk was an early investor? Put simply, do you know enough about this company to make an informed decision about buying its stock via a stockbroker?

In this article, we present a brief history of PayPal, its business model, and its performance, so that — if you choose to — you can buy PayPal stock with confidence. And we increase your confidence by also covering some of the essential investment basics.

How to Buy PYPL Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Best Reviewed Brokers to Buy PayPal Stocks

1. eToro

eToro is one of the most prominent social investment networks, with a mission to improve investors' knowledge and activity regarding finance. Since its inception in 2007, eToro has become the premier investment platform for novice and experienced traders, with a user base of over 17 million. You can read our full eToro review here.

Security and Privacy

When choosing an investment platform, security is among the biggest factors to consider. Since eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), you can be assured that your funds and personal details are secure. Furthermore, eToro SSL encrypts all submissions to safeguard against hackers trying to intercept confidential information. Finally, the platform has two-factor authentication (2FA) to ensure the users’ accounts are safe.

Fees & Features

Both inexperienced and seasoned investors can take advantage of eToro's extensive library of cutting-edge trading methods. For instance, beginners in trading can take advantage of CopyTrading available on eToro as it allows them to mimic the actions of more experienced traders. Those with trading experience will be glad to find that eToro provides access to many markets, such as stocks, currencies, and cryptocurrency, all from one platform. Also, eToro is a commission-free service. However, the platform charges a monthly fee of £10 for inactivity to promote active trades on the platform.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

| Deposit Fee | £0 |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com, which originated in 2016, is an excellent multi-asset broker. With over 5 million users, it has established itself as a low-cost platform with low overnight fees, tight spreads, and 0% commission. You can read our full Capital.com review here.

Security and Privacy

Capital.com is an FCA, CySEC, ASIC, and NBRB-licensed corporation dedicated to providing the most effective trading experience in the world. It shows that users' data is secured and hidden on Capital.com, since the site follows stringent criteria to achieve this goal. Capital.com takes client data security seriously, and one way it does this is by complying with the PCI Data Security Standards.

Fees & Features

Capital.com offers a wide variety of no-cost brokerage services. Its financial policies are transparent. Any fees you incur will be made clear before you pay them. Capital.com's principal costs come from spread charges, which are often low compared to competitors. The broker's mobile trading app features an AI-powered tool that gives clients personalized trading information by employing a detection algorithm. In addition, Capital.com's multilingual customers can get in touch with a representative via email, phone, or live chat.

| Fee Type | Fee Amount |

| Deposit Fee | £0 |

| Commission Fee | 0% |

| Inactivity Fee | £0 |

| Withdrawal Fee | £0 |

Pros

- Efficient email and chat support

- MetaTrader integration

- Commission-free trading

Cons

- Majorly restricted to CFDs

3. Skilling

Skilling is a multi-asset broker with significant growth. The broker offers excellent trading conditions regarding platform features and products available to experienced traders. Skilling now provides Forex, CFD, Stock, and cryptocurrency trading six years after its inception to individual investors. You can read our full Skilling review here.

Security and Privacy

When looking for a broker like Skilling, it is essential to check the broker's regulatory standing. Skilling is administered by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). In addition, the money that traders deposit into their Skilling accounts is held in a completely independent financial institution. For maximum safety, Skilling only uses top-tier financial institutions for this purpose. Tier 1 capital is the industry benchmark for measuring a bank's soundness.

Fees & Features

Skilling does not charge commissions for trading equities, indices, or cryptocurrencies. The platform charges Spreads which vary based on the share, but are typically very reasonable. Skilling offers two distinct account options for FX and metals CFD trading. The Standard Skill account has significantly larger spreads but no commissions. The Premium account charges commissions on spot metal and FX CFD trades for decreased spreads. Additionally, Skilling provides a demo account, mobile applications, and a trade assistant.

| Fee Type | Fee Amount |

| Commission Fee | £0 |

| Withdrawal Fee | Varies |

| Inactivity Fee | £0 |

| Deposit Fee | £0 |

Pros

- Great platform choice

- Demo accounts

Cons

- High Spreads

- Service is unavailable in many countries, including the US and Canada.

Everything You Need to Know About PayPal

To properly understand PayPal, you need to know its history, business strategy, revenue streams, and recent performance.

PayPal History

A software security company called Confinity was established in 1998 by Peter Thiel, Luke Nosek, and Max Levchin. Since the original business model didn’t succeed, the company refocused on the PayPal electronic payments system that was launched in 1999. Confinity merged with Elon Musk’s X.com financial services company, which subsequently ceased its own internet banking operations to focus on PayPal. The combined company was renamed PayPal in 2001 and was publicly listed in 2002 with the ticker symbol PYPL.

PayPal was bought by eBay in 2002 and it became the default payment method for eBay purchases. In 2015, it was spun out as a separate publicly traded company: PayPal Holdings. It was announced by eBay that PayPal would no longer be presented as the preferred payment method after its ongoing agreement ended in 2020.

Since 2015, PayPal has acquired digital money transfer company Xoom and Swedish payment processor iZettle.

What is PayPal’s Strategy?

PayPal's strategy has evolved in three phases, as described by former eBay CEO Meg Whitman:

- In Phase 1, the company concentrated on raising revenues from eBay auction buyers (who didn’t have to divulge credit card details to sellers) and sellers (who wouldn’t otherwise qualify to take credit card payments).

- In Phase 2, PayPal tried to make money by earning interest on funds deposited in its accounts, but then it refocused on making money from service charges to business customers.

- In Phase 3, the company created its Merchant Services business unit to provide payment solutions outside of eBay.

How Does PayPal Make Money?

PayPal makes money mainly by charging merchants fees of up to 2.9% (plus $0.30) for selling items. The other way it makes money is by earning interest on money sitting in customers’ accounts.

How Has PayPal Performed in Recent Years?

We’ll present PayPal’s performance as a business when we perform a fundamental analysis in subsequent sections. Meanwhile, let’s look at how the stock has performed from a technical perspective, which means looking at its price chart.

By 2021, PayPal’s share price was more than eight times higher than at the time of the company’s IPO in 2015:

PayPal price chart (source: Yahoo! Finance)

The uptrend will have pleased early investors, and savvy traders could have benefited from a degree of volatility along the way. Both types of market participants may be able to benefit in the future.

Where Can You Buy PayPal Stock?

PayPal stock can be bought via any stockbroker that lets you buy stocks that are listed on the Nasdaq exchange. Many online brokers also allow you to speculate on the rising or falling PayPal share price by placing long or short leveraged spreads bets or taking contract-for-difference (CFD) trades. There may be some restrictions such as not being allowed access to CFDs in the United States.

PayPal Fundamental Analysis

Fundamental analysis is fundamental to assessing a company’s value — how much it’s worth — for investment purposes. If a company’s intrinsic value is greater than its current market capitalization, you should buy it. This is the approach taken by legendary “value investors” like Warren Buffett.

Let’s perform a rudimentary analysis of PayPal stock, to see if it’s worth paying today’s share price for a stake in the company. The principles are more important than the actual amounts in this analysis because the numbers will not be the same by the time you read this.

PayPal’s Revenue

We’ve already indicated how PayPal makes money. How much money it makes — before costs have been deducted to arrive at profits — is the company’s “revenue” figure that might also be referred as its “top line” because it typically appears as the top line of the company’s income statement.

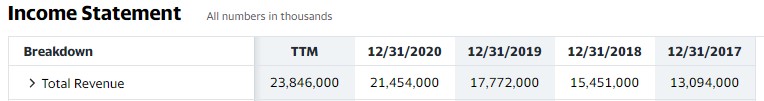

PayPal’s top line revenue for the four years to 2020, and its trailing-twelve-months (TTM) revenue at the time of writing, is as follows. You can see that the company’s revenue has increased every year.

Source: Yahoo! Finance

PayPal’s Earnings-per-Share

What’s the bottom line when buying PayPal stock? Literally, the bottom line of a company’s income statement is its “earnings” figure that may also be referred to as its net profit. You’ll be interested in PayPal’s profits, of course, but you’ll be more interested in your share of the profits than the total profit amount. This is why you’ll want to know the earnings per share (EPS), which is calculated as the total earnings divided by the number of shares outstanding.

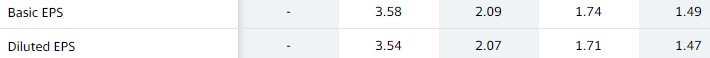

You don’t have to calculate the EPS yourself since it is available via many online sources. PayPal’s EPS figure for the four years from 2017 (on the right) to 2020 (on the left) are as follows. Encouragingly, the EPS has been increasing.

Source: Yahoo! Finance

PayPal’s P/E Ratio

As an investor, you pay for your share of a company’s earnings by buying shares. What is important, then, is the price you pay for the earnings stream. This can be expressed as the price-earnings (P/E) ratio that is calculated as the share price divided by the earnings per share.

At the time of writing, PayPal’s trailing-twelve-months (TTM) P/E is 69.03, which means that it would take the company 69 years to earn enough money to pay back your investment. This sounds high, and it is, but it’s not as high as some stocks such as Tesla, which has a P/E of 399 at the time of writing. On this measure, at the time of writing, PayPal stock is five times better value than Tesla stock.

Although stocks with lower P/E ratios are considered more attractive than stocks with higher ratios, the higher ratios may be justified if a company’s earnings are expected to increase exponentially in the future.

PayPal’s Dividend Yield

A company’s earnings can benefit investors in two ways: they can be ploughed back into the business to increase its value (and share price) or they can be distributed to shareholders in the form of dividends, or both. As a growth stock, PayPal has never paid dividends, so its dividend yield doesn’t matter.

PayPal’s Cash Flow

If PayPal ever did pay dividends, it would do so from its free cash flow, which is also the money that the company has available to pay for expansion or pay down its debts. At $4.9 billion, PayPal’s 2020 free cash flow was much higher than its $1.8 billion figure from 2017.

Why Buy PayPal Stocks?

From a technical perspective, PayPal is an attractive stock if you believe that “the trend is your friend”. You can consider attaching a protective stop order to your investment in case the trend ends, but beware that this stock’s volatility could cause you to get stopped out of your investment on a temporary fall for no good reason.

For a fundamental perspective, PayPal has enjoyed rising revenues and rising earnings-per-share for several years. Although these factors are attractive to investors, keep in mind that all earnings are ploughed back into the business, so you won’t get any dividend income from this stock.

Expert Tip on Buying PayPal Stock

“ Although the PayPal share price has been in a multi-year uptrend since its 2015 IPO, it has been subject to volatility of up to 20% (or more). This gives investors opportunities to buy on the dips as well as providing speculative traders with short-term shorting opportunities. ”

5 Things to Consider Before You Buy PayPal Stock

Deciding to invest in PayPal stock is not only about understanding the company, which is our first point that follows. It’s also about understanding the basics of investing, choosing your stockbroker wisely, determining how much you want to invest, and deciding how long you want to invest.

1. Understand the Company

If you’re ever used PayPal and as an individual or business buyer or seller of eBay items, or to transact some international business, you’ll have some idea about whether this company can continue to be successful. Put another way, if you’ve vowed never to use PayPal again due to some adverse event, other customers could have reached the same conclusion. This is what successful investor Peter Lynch means when he talks about investing in (or avoiding) companies based on your personal experiences.

However, since understanding a company as a consumer is subjective, you should also conduct an objective fundamental analysis as discussed earlier.

2. Understand the Basics of Investing

So, you’ve decided that PayPal stock would be a good investment. But do you know what investing actually entails - what it means to be a shareholder, how to use financial websites to research stocks, and how to operate a stockbroker’s online or mobile trading platform? This guide and our other guides on our website can help you understand the basics of investing.

3. Carefully Choose Your Broker

To buy shares of PayPal stock or any other stocks, you’ll need a stockbroker.

The most important thing to check is that the broker is properly regulated in your jurisdiction; e.g., regulated by the Financial Conduct Authority (FCA) in the UK. This means you might be protected against broker insolvency: up to £85,000 in the UK thanks to the Financial Services Compensation Scheme (FSCS). If you trade stocks via leveraged spread bets or contracts-for-difference (CFDs), regulation may also afford you negative balance protection, which means you can’t lose more money than you ever deposited into your brokerage account.

Other factors to consider include the rival brokers’ fee structures, customer support, and the range of markets on offer. Many brokers let you get to know them and their trading platforms by speculating with virtual money in a demo account for a period of time. This “paper trading” will help you learn the ropes but it won’t expose you to the emotional highs and lows of profits and losses that can affect your trading performance.

4. Decide How Much You Want to Invest

Two of the golden rules of investing are:

- Never invest money you can’t afford to lose or that you might need in the near term

- Never “bet the farm” on a single stock that could go bust; diversify your holdings instead

There is a third rule, which is “never borrow money to invest”, but this is exactly what traders do when they place leveraged trades.

If you have a lump sum to invest, decide on at least ten stocks or other assets to invest it in, with 10% of your funds in each one. Even better would be to choose more stocks, and to ensure that they’re uncorrelated (i.e., not all in the same sector such as banking).

If you can afford to invest only a small amount per month, this will allow you to diversify over time — rather than across assets — by practicing dollar-cost-averaging or pound-cost-averaging to average out your purchase price.

5. Decide on a Goal for Your Investment

Your investment timescale will determine the kinds of stocks you want to invest in; e.g., growth stocks for short-term speculation or dividend-paying value stocks for buy-and-hold investment. Your investment timescale will also determine whether you want to be trading via leveraged spread bets and CFDs or investing via a tax-efficient share dealing account such as the UK’s Stocks & Shares ISA or Self-Invested Personal Pension (SIPP).

So, are you saving for retirement, your child’s college education, or some short-term speculative fun?

The Bottom Line on Buying PayPal Stocks

Now it’s time to summarise what you’ve learned from this guide.

One of the early investors in disruptive payments processor PayPal was Elon Musk who then went on to disrupt other industries such as electric vehicles (as CEO of Tesla). Although it was the primary payment processor for eBay for many years, PayPal is now an independent company. PayPal has had increasing revenues and earnings per share, and a rising share price, for many years since its initial public offering. However, the company doesn’t pay dividends.

If you’re ready to invest in PayPal stock right now, you need to sign up for a stockbroker’s share dealing account, find PayPal in its categorised list of stocks, and place an order to buy at a quoted price (market order) or the maximum price you’re willing to pay (limit order).

If you’re not ready to invest right now, you can read other guides on our website to get more comfortable with investing, and maybe make a start by “paper trading” using a stockbroker’s demo account.

Frequently Asked Questions

-

PayPal Holdings has been listed on the Nasdaq exchange under ticker symbol PYPL since 2015.

-

Although PayPal has rewarded its shareholders with life-changing returns in terms of capital appreciation, it has never rewarded income investors with dividends. This is not unusual since nearly ninety percent of S&P 500 stocks don’t pay dividends. Consequently, PayPal is unlikely to initiate dividend payments any time soon.

-

One way to protect your PayPal investment is by placing a protective stop order below your entry price, to automatically sell your stake for a small loss before it becomes a big loss. Once your position is in profit, you can trail your stop order upwards to protect some of the profit. Be careful not to set your stop distance too tight on this volatile stock.

-

Diversification is key to protecting your portfolio as a whole. Taking stakes in ten different companies is less risky than putting all your money into a single stock. Diversify even more across other uncorrelated assets (such as gold) that should not go down at the same time as your stock holdings.

-

Technical analysis — which means looking for portent patterns on price charts — can be applied to any stock as a complement to fundamental analysis. Investors often use fundamental analysis to decide which stocks to buy, and technical analysis to decide when to buy them.

-

PayPal is considered to be a growth stock, which means its high P/E ratio is justified by the massive increase in earnings that investors expect in future years.