How to buy Pfizer stocks in 2024

Pfizer is an American pharmaceutical and biotechnology company with a presence all over the world. Headquartered in Manhattan, New York City. Pfizer is known for researching, developing, and producing medicines and vaccines for all kinds of diseases, including infections, cancers, cardiovascular diseases, diabetes, metabolic syndrome, and neurological conditions. It’s the company that developed the famous sex drug Viagra (generic name Sildenafil) in the 1990s.

The company has entities all over the world and has produced many drugs and health products that individually generate over a billion dollars in annual revenues. Pfizer made its initial public offering on June 22, 1942, for $24.75 per share. It was a constituent of the Dow Jones Industrial Average (DJIA) stock index from 2004 to August 2020 before it was displaced by a bigger (higher capitalisation) stock.

This guide tells you how you can buy Pfizer stock, and why you might want to, taking into account certain fundamental factors.

How to Buy PFE Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Best Reviewed Brokers to Buy Pfizer Stocks

1. eToro

eToro is one of the most prominent social investment networks, with a mission to improve investors' knowledge and activity regarding finance. Since its inception in 2007, eToro has become the premier investment platform for novice and experienced traders, with a user base of over 17 million. You can read our full eToro review here.

Security and Privacy

When choosing an investment platform, security is among the biggest factors to consider. Since eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), you can be assured that your funds and personal details are secure. Furthermore, eToro SSL encrypts all submissions to safeguard against hackers trying to intercept confidential information. Finally, the platform has two-factor authentication (2FA) to ensure the users’ accounts are safe.

Fees & Features

Both inexperienced and seasoned investors can take advantage of eToro's extensive library of cutting-edge trading methods. For instance, beginners in trading can take advantage of CopyTrading available on eToro as it allows them to mimic the actions of more experienced traders. Those with trading experience will be glad to find that eToro provides access to many markets, such as stocks, currencies, and cryptocurrency, all from one platform. Also, eToro is a commission-free service. However, the platform charges a monthly fee of £10 for inactivity to promote active trades on the platform.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

| Deposit Fee | £0 |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com, which originated in 2016, is an excellent multi-asset broker. With over 5 million users, it has established itself as a low-cost platform with low overnight fees, tight spreads, and 0% commission. You can read our full Capital.com review here.

Security and Privacy

Capital.com is an FCA, CySEC, ASIC, and NBRB-licensed corporation dedicated to providing the most effective trading experience in the world. It shows that users' data is secured and hidden on Capital.com, since the site follows stringent criteria to achieve this goal. Capital.com takes client data security seriously, and one way it does this is by complying with the PCI Data Security Standards.

Fees & Features

Capital.com offers a wide variety of no-cost brokerage services. Its financial policies are transparent. Any fees you incur will be made clear before you pay them. Capital.com's principal costs come from spread charges, which are often low compared to competitors. The broker's mobile trading app features an AI-powered tool that gives clients personalized trading information by employing a detection algorithm. In addition, Capital.com's multilingual customers can get in touch with a representative via email, phone, or live chat.

| Fee Type | Fee Amount |

| Deposit Fee | £0 |

| Commission Fee | 0% |

| Inactivity Fee | £0 |

| Withdrawal Fee | £0 |

Pros

- Efficient email and chat support

- MetaTrader integration

- Commission-free trading

Cons

- Majorly restricted to CFDs

3. Skilling

Skilling is a multi-asset broker with significant growth. The broker offers excellent trading conditions regarding platform features and products available to experienced traders. Skilling now provides Forex, CFD, Stock, and cryptocurrency trading six years after its inception to individual investors. You can read our full Skilling review here.

Security and Privacy

When looking for a broker like Skilling, it is essential to check the broker's regulatory standing. Skilling is administered by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). In addition, the money that traders deposit into their Skilling accounts is held in a completely independent financial institution. For maximum safety, Skilling only uses top-tier financial institutions for this purpose. Tier 1 capital is the industry benchmark for measuring a bank's soundness.

Fees & Features

Skilling does not charge commissions for trading equities, indices, or cryptocurrencies. The platform charges Spreads which vary based on the share, but are typically very reasonable. Skilling offers two distinct account options for FX and metals CFD trading. The Standard Skill account has significantly larger spreads but no commissions. The Premium account charges commissions on spot metal and FX CFD trades for decreased spreads. Additionally, Skilling provides a demo account, mobile applications, and a trade assistant.

| Fee Type | Fee Amount |

| Commission Fee | £0 |

| Withdrawal Fee | Varies |

| Inactivity Fee | £0 |

| Deposit Fee | £0 |

Pros

- Great platform choice

- Demo accounts

Cons

- High Spreads

- Service is unavailable in many countries, including the US and Canada.

Everything You Need To Know About Pfizer

Let’s now take a more detailed look at Pfizer, exploring its history, business strategy, the way(s) it makes money, and how the stock has performed in recent years.

Pfizer History

Pfizer was founded in 1849 in New York by Charles Pfizer and his cousin Charles F. Erhart, who just immigrated to the US. Using a loan from Pfizer’s father, the two men set up a fine chemicals business in a Brooklyn factory, leveraging Pfizer’s skills as a chemist and Erhart’s training as a confectioner. Their first product was a palatable anti-parasitic drug that was made to taste like toffee. The product was a success, setting the stage for Pfizer’s future development.

The American Civil War, which broke out in 1862, propelled Pfizer’s expansion, with the company expanding its production and even doubling its revenue by 1868. The company continued to grow after the death of the founders (Erhart in 1891 and Pfizer in 1906).

Pfizer’s expertise was utilized by the US government during World War II, as they produced most of the penicillin used in the war. It was during this period, on June 22, 1942 (nearly a century after its founding), that Pfizer went public, selling close to 50% of its shares at $24.75.

On November 9, 2020, Pfizer became the first company to release the results of its phase 3 clinical trial for a COVID-19 vaccine, showing its safety, potency, and quality. It developed the vaccine in collaboration with BioNTech, a German biotechnology company. Following the announcement of the results, the US FDA authorized the vaccine for emergency use on December 9, 2020.

What Is Pfizer’s Strategy?

Pfizer is engaged in discovering, developing, and manufacturing healthcare products and it achieves this through two broad branches: Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). The company’s portfolio includes medicines, vaccines, medical devices, and consumer healthcare products.

Pfizer’s goal is to make the world a healthier place by improving access to medicines and healthcare in ways that improve Pfizer's standing among people and their governments. Some of its biopharmaceutical products include Lipitor, Sutent, and the Premarin family of products. Pfizer’s biotechnology products include BeneFIX, ReFacto, and Xyntha.

How Does Pfizer Make Money?

Pfizer makes money from the sale of its various biopharmaceutical and biotech products across the world. In terms of regions, in 2020, Pfizer made 50% of its revenues from the United States, 8% from each of China and Japan, and 36% from the rest of the world.

For Q4 of its 2020 fiscal year (FY), which ended Dec. 31, 2020, the company made $11.7 billion in revenue. Here is the breakdown across therapeutic fields: Oncology (26%) Internal Medicine (20%), Hospital (19%), Vaccines (17%), Inflammation & Immunology (11%), and Rare Disease (7%).

How Has Pfizer Performed in Recent Years?

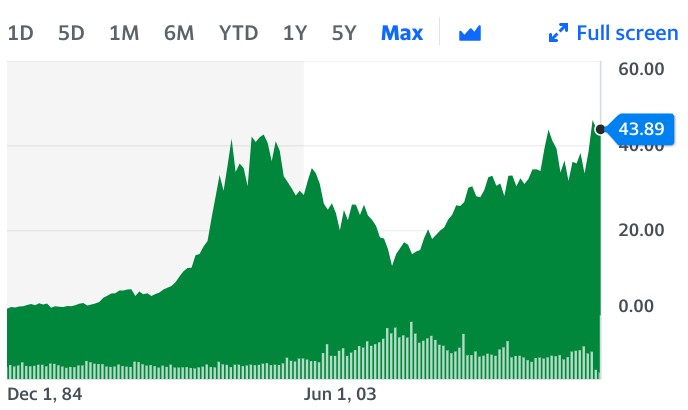

Despite all the billions of dollars the company makes every year, Pfizer’s stock performance has been relatively unimpressive in the last five years, after the massive growth it recorded in the late 1990s following the development of the impotence drug Viagra. During that period, the stock got as high as $47.47 (on September 5, 1999), and subsequently fell massively, reaching a low of $11 at the beginning of 2009. Since then, the stock has more than quadrupled.

In the last five years, the stock rose from below $30 per share in late 2016 to an all-time high of $51.86 on August 17, 2021. On September 17, 2021, the stock was trading 15.36% lower than its all-time high.

Source: Yahoo! Finance

Investors may not have gained so much from capital appreciation in the most recent years, but they get rewarded with regular income, as the company has a long history of paying quarterly dividends.

Where Can You Buy Pfizer Stock?

Pfizer trades on the New York Stock Exchange (NYSE), but most of its foreign subsidiaries are listed on the stock exchanges of the country of domicile; for example, Pfizer India is traded on the National Stock Exchange of India. You can buy the Pfizer affiliate company listed on your country’s stock exchange via your local broker. If you want to buy the parent Pfizer stock from the NYSE, you have to go through a US-based broker or one of the major International brokers that have access to the NYSE.

Alternatively, you can trade the stock via a spread betting or CFD trading platform, but this would not offer you ownership of the real stock.

Pfizer Fundamental Analysis

Fundamental analysis is a method of evaluating a stock by studying the company’s business to know the intrinsic value of the stock and the factors that can influence its growth in the future. Investors use certain financial metrics when performing the fundamental analysis of a stock. While some of them, such as the company’s management and goodwill, are not measurable, in this guide, we’ll focus on the measurable ones, such as the revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow.

Pfizer’s Revenue

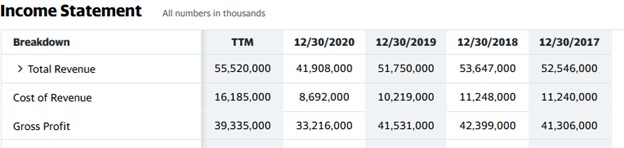

The revenue of any company is typically presented at the top of its income statement for the accounting period under review. It represents the amount of money the company makes from the sales of its products or services before any costs have been deducted.

Investors often compare the figures to that of a similar period in the preceding year to know whether the company is growing its revenue year-over-year (YoY). The higher the revenue growth, the better. For the 2020 fiscal year, which ended December 31, 2021. Pfizer’s revenue fell 19.0%, compared to the 2019 revenue, which might be attributed to the impact of the COVID-19 pandemic as people avoided visiting hospitals for other ailments thus lowering the demand for Pfizer drugs.

Source: Yahoo! Finance

Pfizer’s Earnings-per-Share

Earnings refer to the profit a company makes after all costs of doing business have been deducted from its revenues. Investors often refer to it as the “bottom line”. Since you only own some of the shares in the company, you should be more interested in earnings per share (EPS) than in the total earnings.

EPS is the amount a company earned for each outstanding share of its common stock during the period under review. For example, to get Pfizer’s EPS, you divide its net earnings (after subtracting dividends paid to preferred stockholders) by the number of common shares outstanding. Since EPS is readily available on your stockbroker’s website or any financial website, you don’t need to calculate it yourself. Pfizer’s EPS for the 2020 fiscal year is $0.42, which is lower than analysts’ expectations.

Pfizer’s P/E Ratio

A company’s price-earnings (P/E) ratio compares its share price to its earnings-per-share. You get it by dividing the company’s current share price by its EPS. For example, with an EPS of $0.42 and a share price of $43.89 (Sept. 18, 2021), Pfizer’s P/E ratio would be about 104.52. In other words, investors are ready to pay $104.52 for every dollar Pfizer earns in profits or are ready to wait for more than 104 years to recoup their investment from earnings alone.

On a general note, if a company’s P/E ratio is very high, investors consider the stock overvalued. However, they may keep buying the stock if they expect the company to make higher earnings in the future.

Pfizer’s Dividend Yield

Some companies pay dividends quarterly, semi-annually, or annually. As of September 2021, Pfizer still pays quarterly dividends. Anytime dividends are declared, the share price rises until the ex-dividend date. After that date, it declines.

The dividend yield compares the total annual dividends a company pays to its share price; it expresses the dividend as a percentage of the stock price to get an idea of the returns. For example, Pfizer paid out a total annual dividend of $1.53 per share in the 2020 fiscal year. With its share price at $43.89 (Sept. 18, 2021), the dividend yield would be 3.5%. When you compare this yield to the interest rate that banks offer, you will know whether to invest in the stock or keep your money in the bank.

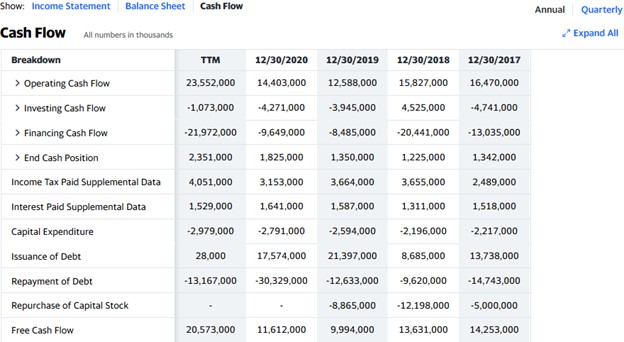

Pfizer’s Cash Flow

The cash flow statement is one of the three financial statements used in analyzing a company. It is usually placed alongside the other financial statements in the financial section of the company’s information on a broker’s website or any of the major financial websites.

You should focus on the free cash flow figure, which shows the amount of cash and cash equivalents a company generates after taking care of major expenses, such as buildings, equipment, and other bills necessary for running its business. The free cash flow tells you how much cash the company has to pay dividends, fund expansion, or pay down debts.

See Pfizer’s cash flow statement for the 2020 fiscal year below:

Source: Yahoo! Finance

Why Buy Pfizer Stocks?

As with most drug companies, Pfizer faces some risks. For example, patents for many of the company's drugs will start expiring after 2025, and that would mean diminished revenue for the company as those drugs would become cheaper to produce in generic versions. Also, on the subject of stock performance, Pfizer stock may not be suitable for momentum investors. However, if you are a value investor or a dividend hunter, you can still invest in the stock.

Here are some reasons to invest in the stock:

- Pfizer has been a very innovative company, always being among the first to develop important drugs for serious ailments; the company makes a lot of money from patents.

- The company is among those that profited immensely from making the COVID-19 vaccine.

- The company has a long history of paying dividends, which can earn you a regular income.

Expert Tip on Buying Pfizer Stock

“ Pfizer’s share price performance won’t appeal to momentum and growth investors. The stock is suitable for dividend-hunters who want to earn regular income through dividends. So, it is better to buy cheaper to improve your dividend yield. Also, the stock shows a cyclical pattern. Based on these, it is not the type of stock to buy on a breakout; you have to wait and buy on a dip. ”- willfenton

5 Things to Consider Before You Buy Pfizer Stock

You have to consider these five things before buying Pfizer stock:

1. Understand the Company

It makes sense to invest in a company you know. Some legendary investors, such as Peter Lynch and Warren Buffet, even suggest that you invest in companies whose products you use. But you should go beyond this and study the company’s fundamentals to be sure that it is in a good financial state. Surely, you must have been taking drugs and other health products made by Pfizer; however, that does not mean you should not first find out how the company is making money and its financial status.

2. Understand the Basics of Investing

You need to learn the basics of investing first before approaching the market. This way, you reduce your chances of making a mistake and losing your money. You should learn about risk management, money management, and diversification. You practice risk management and money management to control how much you lose if the market goes against your position. With diversification, you spread your risk across several stocks.

3. Carefully Choose Your Broker

Choose a broker that charges low commission fees. Also, consider the broker’s trading platform and apps, trading tools, supported order types (limit order, market order), payment methods, and customer support service. But most importantly, be sure that the broker is licensed by the financial services regulator in your country of residence. You should benefit from any financial compensation scheme in your country if the broker becomes insolvent.

4. Decide How Much You Want to Invest

You should never invest more than you can afford to lose, and don’t ever invest with borrowed money (leverage) no matter how well you think a stock will perform. Leverage is a double-edged sword; you can lose your shirt.

When you have determined the amount you want to invest, specify the percentage of the capital you will allocate to each stock and how you want to invest the money. While you can invest a lump sum at once, it may be preferable to practice dollar-cost-averaging and scale in gradually. It helps you to use market volatility to your advantage.

5. Decide on a Goal for Your Investment

Last but not the least, what is your investment goal? You should know why you are investing and how long you intend to hold your investment. For some people, it is to build their pension fund for retirement, and for others, it is to save for your kids’ college education. Whatever your reason, you should know when to sell. You can sell at a specific time in the future, when the price gets to a particular level, or when the company’s fundamentals no longer look good. You can even hold the stock indefinitely if you want and sell when you need money. Whichever way, just make sure you write down your investment goal and plan.

The Bottom Line on Buying Pfizer Stocks

Pfizer is an American multinational pharmaceutical and biotechnology company with affiliate firms all over the world. You can buy the stock through a broker that has access to the NYSE or buy the local affiliate company in your country. The company has a history of paying quarterly dividends.

If you want to invest in Pfizer stock right now, just sign up for a stockbroker’s stock trading account and fund it. Then, select Pfizer from the list of stocks on the broker’s platform and place an order to buy the stock.

If you’re not yet ready right now, continue to educate yourself by reading other guides on our website until you are ready to invest. You may also try “paper trading” using your stockbroker’s demo account to familiarize yourself with how the market works.

Frequently Asked Questions

-

Retained earnings are earnings that were not paid out to shareholders as dividends but were instead retained by the company. For a dividend-paying company, it is that portion of a company’s net income that is left after it has paid out dividends to its shareholders.

-

Companies retain their earnings for many different reasons. Some use their retained earnings to finance other projects and expand their businesses, while some use it to pay off debts to reduce or eliminate interests.

-

Paper trading is simulated trading using a demo account that is funded with virtual currency. Beginners can use it to practice how to trade in the market, while experienced traders can use it to test their trading strategies before implementing them in the market. However, paper trading does not allow traders to experience the emotional aspect of trading and develop trading psychology because real money is not on the line.

-

Trading psychology is a term used to explain the mental skills required in mastering trading emotions. The ability to handle trading emotions can determine success or failure in trading. A trader’s trading psychology can influence their trading actions.

-

When a company declares dividends, investors rush to buy the stock to qualify to receive the declared dividend. This increases the demand for that stock, pushing the share price up. Since buying the stock after the ex-dividend date disqualifies one from receiving the dividends, the demand for the stock falls from that date, thereby driving the share price down.

-

Diversifying your portfolio across different stocks or even different asset classes helps you to avoid systemic risks. That is, if one stock is performing poorly, the gains from the other stocks will offset the loss. Thus, spreading your capital across different stocks not only protects it but may also improve earnings.