How to buy Santander stocks in 2026

This guide aims to introduce you to how to buy Santander stock and what factors you must consider while investing your hard-earned money in Santander. Before we move forward, let us first share some quick facts about the company.

Santander Group is a banking giant having a diverse product portfolio in retail and commercial banking. With 14,760 branches and over 193,000 employees, it serves more than 102 million customers worldwide. The company's success comes from customer care and a focused strategy for retail and commercial banking. Santander's sensible approach towards lending enables the bank to have a low-risk profile, making it a good fit for investment.

How to Buy BNC Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Best Reviewed Brokers to Buy Santander Stocks

1. eToro

eToro is one of the most prominent social investment networks, with a mission to improve investors' knowledge and activity regarding finance. Since its inception in 2007, eToro has become the premier investment platform for novice and experienced traders, with a user base of over 17 million. You can read our full eToro review here.

Security and Privacy

When choosing an investment platform, security is among the biggest factors to consider. Since eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), you can be assured that your funds and personal details are secure. Furthermore, eToro SSL encrypts all submissions to safeguard against hackers trying to intercept confidential information. Finally, the platform has two-factor authentication (2FA) to ensure the users’ accounts are safe.

Fees & Features

Both inexperienced and seasoned investors can take advantage of eToro's extensive library of cutting-edge trading methods. For instance, beginners in trading can take advantage of CopyTrading available on eToro as it allows them to mimic the actions of more experienced traders. Those with trading experience will be glad to find that eToro provides access to many markets, such as stocks, currencies, and cryptocurrency, all from one platform. Also, eToro is a commission-free service. However, the platform charges a monthly fee of £10 for inactivity to promote active trades on the platform.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

| Deposit Fee | £0 |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com, which originated in 2016, is an excellent multi-asset broker. With over 5 million users, it has established itself as a low-cost platform with low overnight fees, tight spreads, and 0% commission. You can read our full Capital.com review here.

Security and Privacy

Capital.com is an FCA, CySEC, ASIC, and NBRB-licensed corporation dedicated to providing the most effective trading experience in the world. It shows that users' data is secured and hidden on Capital.com, since the site follows stringent criteria to achieve this goal. Capital.com takes client data security seriously, and one way it does this is by complying with the PCI Data Security Standards.

Fees & Features

Capital.com offers a wide variety of no-cost brokerage services. Its financial policies are transparent. Any fees you incur will be made clear before you pay them. Capital.com's principal costs come from spread charges, which are often low compared to competitors. The broker's mobile trading app features an AI-powered tool that gives clients personalized trading information by employing a detection algorithm. In addition, Capital.com's multilingual customers can get in touch with a representative via email, phone, or live chat.

| Fee Type | Fee Amount |

| Deposit Fee | £0 |

| Commission Fee | 0% |

| Inactivity Fee | £0 |

| Withdrawal Fee | £0 |

Pros

- Efficient email and chat support

- MetaTrader integration

- Commission-free trading

Cons

- Majorly restricted to CFDs

3. Skilling

Skilling is a multi-asset broker with significant growth. The broker offers excellent trading conditions regarding platform features and products available to experienced traders. Skilling now provides Forex, CFD, Stock, and cryptocurrency trading six years after its inception to individual investors. You can read our full Skilling review here.

Security and Privacy

When looking for a broker like Skilling, it is essential to check the broker's regulatory standing. Skilling is administered by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). In addition, the money that traders deposit into their Skilling accounts is held in a completely independent financial institution. For maximum safety, Skilling only uses top-tier financial institutions for this purpose. Tier 1 capital is the industry benchmark for measuring a bank's soundness.

Fees & Features

Skilling does not charge commissions for trading equities, indices, or cryptocurrencies. The platform charges Spreads which vary based on the share, but are typically very reasonable. Skilling offers two distinct account options for FX and metals CFD trading. The Standard Skill account has significantly larger spreads but no commissions. The Premium account charges commissions on spot metal and FX CFD trades for decreased spreads. Additionally, Skilling provides a demo account, mobile applications, and a trade assistant.

| Fee Type | Fee Amount |

| Commission Fee | £0 |

| Withdrawal Fee | Varies |

| Inactivity Fee | £0 |

| Deposit Fee | £0 |

Pros

- Great platform choice

- Demo accounts

Cons

- High Spreads

- Service is unavailable in many countries, including the US and Canada.

Everything You Need To Know About Santander

Let’s get to know Santander in more detail by exploring its history, strategy, and the ways it makes money.

Santander History

In 1857, Spanish Queen Isabella II signed a royal decree authorising the commencement of the sovereign bank, presently known as Santander. Initially, the bank used to facilitate trades between Santander ports in Northern Spain and Latin America. Over the years, it expanded its operations across the globe and witnessed massive growth at the start of the 19th century.

For instance, the company doubled its assets up to 10 million pesetas between 1900 and 1920. The bank managed to accumulate revenue worth 0.5 million pesetas in 1917 alone. Following multiple mergers and acquisitions between 1920 to 2020, the bank became one of the world's largest financial institutions with a market capitalisation of 56.02B.

What Is Santander’s Strategy?

Santander's customer-centric approach isolates it from many other high-street banks. The company follows the best social, environmental, and governance practices to make people prosper. The bank's business model has three core principles: customer focus, scalability, and diversification.

While the company serves nearly 6.1 million customers through the mobile banking app, it secures 44% of its revenue through online sales. With a balanced geographic diversification between emerging and mature markets, the company endeavours to operate efficiently and offer the best products and services to the masses.

How Does Santander Make Money?

Santander makes money by providing seamless financial services through the branch network, telephone and digital channels. The main areas of the business include retail banking, investment markets, asset management, and commercial & corporate banking. The group's major part of revenue comes from continental Europe, UK, Latin America, and the United States. The bank manages more than 660 billion euros in credit and 600 billion euros in deposits.

How Has Santander Performed in Recent Years?

The COVID-19 pandemic prompted the bank to announce its first loss. Its UK subsidiary contributed heavily to the loss. Not to mention, It was already struggling due to a price war on mortgages that wiped out margins. In late 2020, Santander’s (LON: BNC) shares traded at 138p on the London Stock Exchange.

Before the pandemic, Santander had been outperforming its competitors. While British banks were hit hard by the 2016 Brexit referendum, Santander only took a minor hit before bouncing back to 500p.

Since 2013, BNC's value has been stable at 400-500p, unable to break through that barrier. While the fundamentals are more complex, such changes may present an opportunity for investors who use technical analysis.

Where Can You Buy Santander Stock?

As opposed to trading CFDs or spread betting, buying a stock means holding a share of ownership in a company. You can buy Santander stock from a full-service stockbroker directly instead of placing an order using a trading platform. However, you can also use a trading platform since many modern age brokers allow you to go either way. You can also confirm with your bank if it deals in stock and permits you to buy shares of the company.

Santander Fundamental Analysis

The fundamental analysis enables clients to assess the security's intrinsic worth and gauge whether it is undervalued or overvalued. Fundamental analysts examine everything from macroeconomic factors like industry and economic conditions to microeconomic components like the efficiency and effectiveness of the company's management.

Typically, investors tend to find the values for variables, such as price-earnings ratio (P/E), revenue, dividend yield, earnings-per-share (EPS), cash flows, etc., before buying a stake in a company. Let us understand what these terms mean and how they hold valuable information for stakeholders.

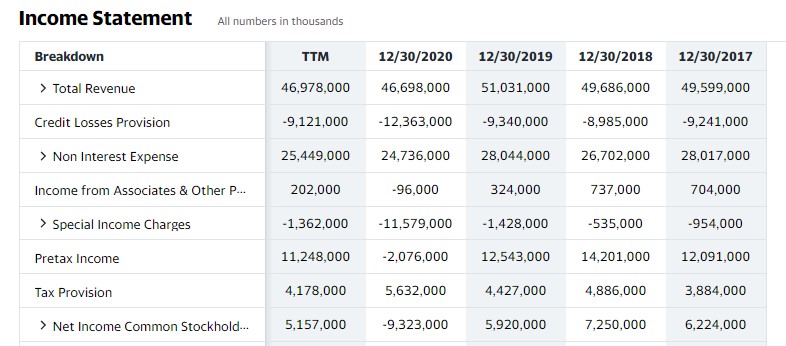

Santander's Revenue

Revenue is the amount of sale proceeds over a specific period, such as a month, quarter, half-year, or annual. It is an unadjusted income that includes all the expenses incurred for selling products and services. We deduct all the direct and indirect costs from the revenue figure to calculate the company's net profit. Given below is a table reflecting Santander's revenue for the past years.

Source: Yahoo! Finance

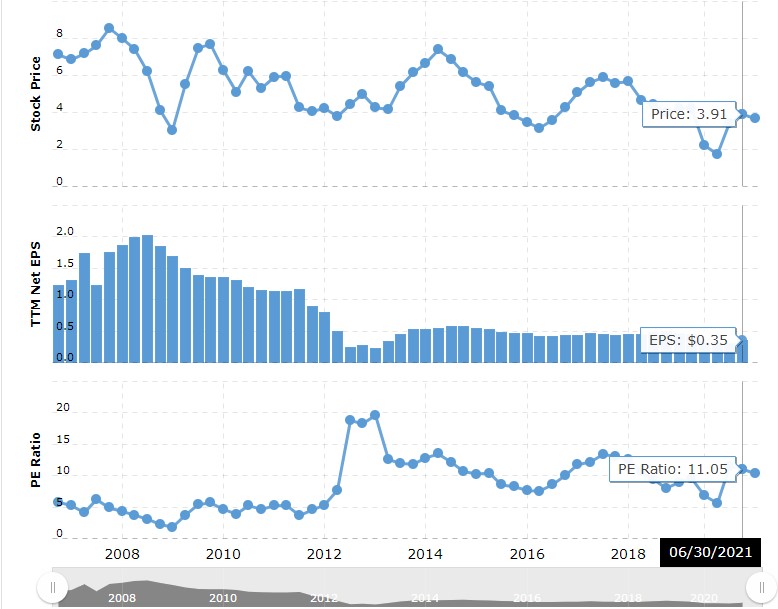

Santander’s Earnings-Per-Share (EPS)

Earnings Per Share (EPS) reflects the net profit allocated to each outstanding share of the company. Hence, EPS helps you find how much return you can have on each share in the company.

EPS is calculated by dividing net earnings available to common shareholders by the average number of outstanding shares over time. Not to mention, it is the most popular metric for estimating corporate value. Investors usually pay more for stocks having higher EPS value. Santander has reported €0.11 EPS for the second quarter of 2021.

Santander’s P/E Ratio

The P/E ratio allows investors to compare a stock's market value with its earnings. In simple terms, it helps you learn whether the price fairly reflects the company’s earning potential. The P/E ratio analysis is undoubtedly a simple way to assess whether the stock is overvalued or undervalued.

Investors can divide the market price of a stock by its EPS to calculate the P/E ratio. While the stock price of Santander was $3.91 and the EPS being 0.35, the P/E ratio stood around 11.05 as of June 2021. That means it will take Santander almost 11 years to pay back your investment. Generally, stocks having a P/E ratio below 15 are considered cheap.

Source: MacroTrends

Santander's Dividend Yield

A dividend yield is a percentage of a current share price of a company that it pays out as a dividend each year. Essentially, companies generating healthy profits do not appeal to investors unless they share the profit with investors by paying them dividends. Organisations can have different policies concerning dividend disbursement. Some pay annual dividends while others pay twice a year.

Growing companies usually pay lower dividends as compared to mature companies. However, a high dividend yield does not necessarily suggest an attractive investment opportunity. It could be the case that a company has opted to pay higher dividends amid its declining stock price to retain the interest of stakeholders.

If a corporation pays out annual dividends of 1 cent per share and its share price is $1, then the dividend yield would be 1%. As far as Santander's dividend yield is concerned, it paid an interim dividend of 2.75 euros per share despite booking a net loss of 8.77 billion euros for the year 2020. The company pays dividends twice a year.

You can find a dividend yield and other financial ratios of a respective company on the website of your stockbroker. Alternatively, the financials of a company may be accessible on its official web portal.

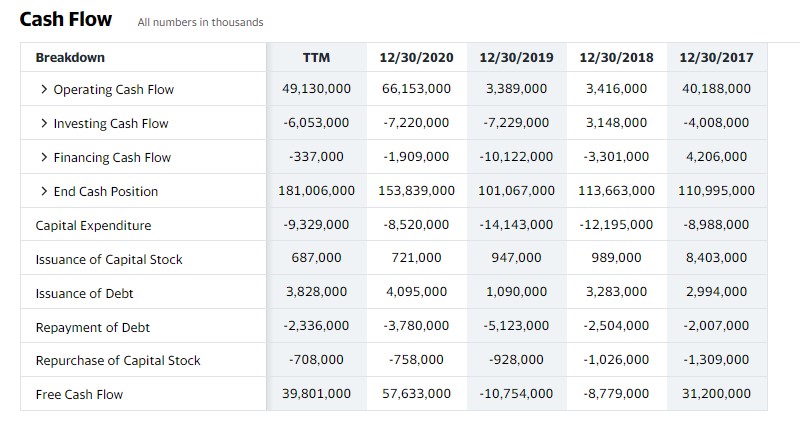

Santander’s Cash Flow

Cash flow is the net amount of cash and cash equivalents entering or leaving a business. The cash flow statement reflects a company's ability to remain liquid for paying off debt commitments and supporting operating expenses. It is one of the fundamental factors that are worth considering before you make a final decision.

After the company satisfies all current obligations, free cash flows become available. Corporations utilise free cash flows to expand business or pay out dividends.

You can find cash flows of a respective company under the financials section on its official website. It is likely to be available on your stock broker's website as well.

Santander's free cash flow improved from $31.2 billion in 2019 to $57.6 Billion in 2020.

Why Buy Santander’s Stocks?

After booking a net loss last year, the bank is set to beat its profitability goal. One of the reasons to invest in a professionally managed fund is Santander's competitive management. Their managers have the skills and resources to keep your assets on track regardless of geopolitical events.

For instance, the bank didn't stop dividend payments on account of pandemic turmoil. The bank doesn't have any intention to halt dividend payments in future as well. Short-term ups and downs might continue to hit the bank's profitability since the bank would take some time to be on the right track once again.

Being an investor, you must have a well-diversified investment portfolio that matches your specific goals, circumstances, and risk tolerance. While investing offers no certainties, mastering fundamentals can help you make the right decision.

Expert Tip on Buying Santander's Stock

“ As of this writing, Santander strengthens around $3.65. The technical bias remains bullish since the stock price printed a higher low in the recent downside move on monthly and yearly charts. It could be a great addition to your portfolio if it aligns with your investment objectives and risk appetite. ”

5 Things to Consider Before You Buy Santander Stock

There are at least five things to consider before buying Santander stock or staking your interest in any other company.

1. Understand the Company

Vesting enough time to research a company before buying its stock is crucial. Make sure that you understand the company. Ideally, you should invest in a company you generally use. However, based on your likings, a company can't be the best fit for investment purposes. You need to carefully examine different fundamental factors, such as business model, sources of revenue, turn-over ratio, growth potential, and past performance, etc.

2. Understand the Basics of Investing

Before diving into the stock market, learn the basics of investing. Having your goals defined clearly and a workable strategy is critically important for achieving your desired targets. Make sure to apply effective money management and portfolio diversification strategies. Start with little investment and spread it across different portfolios to diversify the risk. Ideally, you shouldn't invest more than 5% of your total capital in a single stock.

3. Carefully Choose Your Broker

Broker selection could be a challenging task, especially when you are new to stock trading. However, little guidance can make the process pretty easier. Below, you can find some factors that you should consider before choosing a broker.

Start with checking the regulation status of a broker since it is one of the most critical elements to check before making a final move. Confirm if the broker is registered with the regulatory authority in your country. Regulation of a broker ensures the safety of your funds. For example, brokers in the UK offer indemnity insurance to their clients in registration with Financial Services Compensation Scheme (FSCS). That means even if a broker becomes insolvent or bankrupt, your funds stay unharmed.

You might also want to check the cost to buy and sell shares through your prospective broker. It should be competitive compared to the average industry standards.

A reliable broker offers efficient customer support. Try communicating with your prospective broker to confirm if it resolves your concerns on a timely basis.

Besides offering multiple trading platforms across different channels, including web, PC and mobile, your prospective broker should have a wide range of stocks available. At least, you would like it to be listing the shares of your prefered company.

Finally, check the technical aspects of trading and investment with your broker. For example, whether your prospective brokers allow free access to charts and indicators. You might also want to confirm the supported order types, such as stop, limit, trailing stops, etc.

4. Decide How Much You Want to Invest

There is no need to buy a certain number of shares or fill your entire portfolio with one stock. Successful investors do not keep all eggs in the same basket. For example, instead of buying $25,000 worth of shares in just one company, you can diversify your risk and invest an equal amount to buy your hold in five different stocks.

You can also start by just buying one share to get a feel for what it's like to own individual stocks and whether you have the stamina to ride out the turbulence. You can increase your share in the company when the price per share drops.

5. Decide on a Goal for Your Investment

Carefully analyse the reasons for investment and pick the pressing ones to establish the timeline and your risk tolerance level. For example, if you plan to save for your retirement, you might wish to go for a long-term investment.

Holding your stake in a company for years shouldn't be an issue for you. Besides receiving dividends, you can have your wealth maximised over the years with the increase in the value of your holdings. However, buying shares with your cash for daily needs will likely put you in a rush to sell your stake when the market might be down. Consequently, you will incur a loss instead of making profits.

Remember, do not invest the money you can't afford to lose. Also, do not ever think of buying shares with the borrowed money unless you have a sound understanding of how leverage works.

The Bottom Line on Buying Santander’s Stocks

Santander is the largest bank in Spain. It offers personal and business banking, including leasing, factoring, stockbroking, and mutual fund services. Although banks are known to be a solid choice for investment, natural disasters such as the pandemic can still impact them adversely.

The bank reported its first-ever annual loss following provisions for bad debts and impairment of assets amid the pandemic in 2020. However, compared to the 2008 financial crisis, Santander is more capitalised now, and its global spread can help it stay protected against localised economic shocks. The bank might halt paying dividends for some time, but it is likely to remain an attractive investment opportunity in the foreseeable future.

Now, if you think you'd like to buy Santander's stock, the process is simple. Follow the guidelines listed above to find a suitable broker and sign up with it. Search the broker's product portfolio to find Santander's stock and go ahead with full confidence.

If you still need some time before proceeding further, then there is no rush. Take your time reading our expert opinions on Santander's stock and explore various other resources. You can also use a demo account to practice some trading skills if you wish to do so.

Frequently Asked Questions

-

Santander has a listing on Spain, Mexico, Warsaw, New York and London stock exchanges. The company is listed under different symbols: Spain: SAN, Warsaw: SAN, London: BNC, New York): SAN, Buenos Aires: STD.

-

This depends on the profit per share (net profit divided by the number of shares) and the bank's dividend policy, which determine future payouts on the purchased stock.

-

Santander stockholders having their shares deposited at a Santander Group bank are exempt from dividend fees (except Openbank). Not to mention, some depository institutions do charge a fee for receiving dividends.

-

Santander had several stock splits in its history. It did not affect the value of holdings in the company, but investors' number of shares got changed. However, the new reduced share price may have damaged the market's appetite for Santander stock, affecting the stock price.

-

Although fundamental analysis provides you with critical information, the significance of technical analysis before buying a stock can't be overlooked either. Choosing one over the other depends on your investment period as technical analysis is often associated with shorter periods, while fundamental analysis is often associated with long-term investments.

-

You can employ a stop-loss feature while placing your order. If the share price falls below your risk tolerance level, then the stop-loss order gets executed, and your position will be closed automatically, saving you from incurring losses beyond a certain level.