How to buy TeamViewer stocks in 2024

TeamViewer AG is a German multinational technology company that is known for its same-named “TeamViewer” remote access and support software. The company is headquartered in Göppingen, Germany, but it has other German offices as well as in Clearwater (FL, United States), Yerevan (Armenia), and Adelaide (Australia).

The company has gone beyond its remote access and support software to now offer a global cloud platform for connecting, monitoring, and controlling computers, machines, robots, and other “internet of things” (IoT) devices. Its global clientele includes companies of all sizes and from all industries.

TeamViewer stock is listed on the Frankfurt Stock Exchange and is a member of the MDAX and TecDAX indexes. In this guide, you will learn how to buy TeamViewer stock with confidence, and why you might want to, considering fundamental factors.

How to Buy TMVWY Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Best Reviewed Brokers to Buy TeamViewer Stocks

1. eToro

eToro is one of the most prominent social investment networks, with a mission to improve investors' knowledge and activity regarding finance. Since its inception in 2007, eToro has become the premier investment platform for novice and experienced traders, with a user base of over 17 million. You can read our full eToro review here.

Security and Privacy

When choosing an investment platform, security is among the biggest factors to consider. Since eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), you can be assured that your funds and personal details are secure. Furthermore, eToro SSL encrypts all submissions to safeguard against hackers trying to intercept confidential information. Finally, the platform has two-factor authentication (2FA) to ensure the users’ accounts are safe.

Fees & Features

Both inexperienced and seasoned investors can take advantage of eToro's extensive library of cutting-edge trading methods. For instance, beginners in trading can take advantage of CopyTrading available on eToro as it allows them to mimic the actions of more experienced traders. Those with trading experience will be glad to find that eToro provides access to many markets, such as stocks, currencies, and cryptocurrency, all from one platform. Also, eToro is a commission-free service. However, the platform charges a monthly fee of £10 for inactivity to promote active trades on the platform.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

| Deposit Fee | £0 |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com, which originated in 2016, is an excellent multi-asset broker. With over 5 million users, it has established itself as a low-cost platform with low overnight fees, tight spreads, and 0% commission. You can read our full Capital.com review here.

Security and Privacy

Capital.com is an FCA, CySEC, ASIC, and NBRB-licensed corporation dedicated to providing the most effective trading experience in the world. It shows that users' data is secured and hidden on Capital.com, since the site follows stringent criteria to achieve this goal. Capital.com takes client data security seriously, and one way it does this is by complying with the PCI Data Security Standards.

Fees & Features

Capital.com offers a wide variety of no-cost brokerage services. Its financial policies are transparent. Any fees you incur will be made clear before you pay them. Capital.com's principal costs come from spread charges, which are often low compared to competitors. The broker's mobile trading app features an AI-powered tool that gives clients personalized trading information by employing a detection algorithm. In addition, Capital.com's multilingual customers can get in touch with a representative via email, phone, or live chat.

| Fee Type | Fee Amount |

| Deposit Fee | £0 |

| Commission Fee | 0% |

| Inactivity Fee | £0 |

| Withdrawal Fee | £0 |

Pros

- Efficient email and chat support

- MetaTrader integration

- Commission-free trading

Cons

- Majorly restricted to CFDs

3. Skilling

Skilling is a multi-asset broker with significant growth. The broker offers excellent trading conditions regarding platform features and products available to experienced traders. Skilling now provides Forex, CFD, Stock, and cryptocurrency trading six years after its inception to individual investors. You can read our full Skilling review here.

Security and Privacy

When looking for a broker like Skilling, it is essential to check the broker's regulatory standing. Skilling is administered by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). In addition, the money that traders deposit into their Skilling accounts is held in a completely independent financial institution. For maximum safety, Skilling only uses top-tier financial institutions for this purpose. Tier 1 capital is the industry benchmark for measuring a bank's soundness.

Fees & Features

Skilling does not charge commissions for trading equities, indices, or cryptocurrencies. The platform charges Spreads which vary based on the share, but are typically very reasonable. Skilling offers two distinct account options for FX and metals CFD trading. The Standard Skill account has significantly larger spreads but no commissions. The Premium account charges commissions on spot metal and FX CFD trades for decreased spreads. Additionally, Skilling provides a demo account, mobile applications, and a trade assistant.

| Fee Type | Fee Amount |

| Commission Fee | £0 |

| Withdrawal Fee | Varies |

| Inactivity Fee | £0 |

| Deposit Fee | £0 |

Pros

- Great platform choice

- Demo accounts

Cons

- High Spreads

- Service is unavailable in many countries, including the US and Canada.

Everything You Need To Know About TeamViewer

In this section, we’ll take a more detailed look at TeamViewer AG and explore its history, business strategy, how it generates revenue, and its financial performance in the last five years to 2021.

TeamViewer History

The company traces its history to 2005 when the founder of Rossmanith GmbH developed the TeamViewer software and marketed it under the company, TeamViewer GmbH. The company offers the software free of charge to private users but sells it to corporate clients who have to purchase a paid license.

In 2010, a Malta-based IT firm, GFI Software, acquired TeamViewer GmbH, and in 2014, sold it to Permira, a British private equity firm for about $1 billion - thus making TeamViewer GmbH a unicorn (a privately held startup company valued at over $1 billion). Permira expanded the scope of the software and developed an international customer base for it.

In line with the general trend in the IT industry, TeamViewer GmbH changed its business model from selling licenses to allowing subscriptions in 2018. Before its IPO in 2019, the company created a new corporate structure, renaming itself TeamViewer Germany GmbH and establishing TeamViewer AG as its parent company. The company listed on the Frankfurt Stock Exchange in September 2019.

What Is TeamViewer’s Strategy?

The company offers the TeamViewer remote connectivity cloud platform, which enables secure remote access to any device, across platforms, from anywhere, and at any time. It connects computers, smartphones, servers, IoT devices, robots, and even commercial-grade machines, providing high-speed connections even in outer space or low bandwidth environments. The company also offers TeamViewer Assist AR for augmented reality.

Since 2018, TeamViewer’s business strategy has been to offer a subscription-based service, with monthly or annual subscriptions, rather than the sale of licenses it was using before. The company focuses on corporate clients who need its cloud platform to connect their machinery and digitalize their processes along the industrial value chain. These are more to maintain their subscription over the long term. Interestingly, TeamViewer's software can be used by companies of all sizes and from all industries, so it has a big market for its product.

How Does TeamViewer Make Money?

The company allows individuals to use the platform free of charge but limits connections to one person connecting to the computers of family and friends. It makes money from paid commercial use, which it categorizes into three levels:

- The business level costs $610.80 per year and allows one user with up to three devices to access up to 200 computers, with up to 10 meeting participants.

- The premium level allows up to 15 users to access up to 300 computers with up to 10 meeting participants. It costs $1,234.80 per year.

- The corporate level costs $2,482.80 per year and allows up to 30 users to access up to 500 computers with up to 10 meeting participants.

The company also offers paid add-on services, such as TeamViewer remote management add-ons that cost $22.92 per year each. TeamViewer Assist AR add-on with augmented reality costs $468.00 per technician per year, and support for mobile devices (iPad, iPhone, and Android) costs an additional $394.80 per year. It also offers Servicecamp Service Desk with ticket management for $118.80 per agent per year.

All prices are correct at the time of writing.

How Has TeamViewer Performed in Recent Years?

TeamViewer has had a mixed performance since it went public in September 2019. As with other companies that offer platforms for remote work and meetings, such as Zoom Video Communications Inc. (ZM), TeamViewer stock benefits from the coronavirus-pandemic-induced lockdown and social distancing policies in 2020.

After an initial dip in March 2020 when the pandemic emerged, TeamViewer stock rose steadily till the beginning of July 2020, making its all-time high of €54.86. However, since then, the stock has been on a decline. As of the time of writing (Sept. 20, 2021), the stock was trading around €27.62, which is 49.65% away from the all-time high.

Source: Yahoo Finance

Where Can You Buy TeamViewer Stock?

TeamViewer stock is listed on the Frankfurt Stock Exchange, so you can buy it from any stockbroker with access to that exchange. This can be a German-based broker or any international broker with access to that exchange. You may also be able to buy TeamViewer DR from the share dealing arm of any big commercial bank in your country.

If you only want to speculate on the price movement of the stock, without getting ownership rights to the company, you can trade the CFD or spread bets on online CFD or spread betting platforms. However, some of those platforms also allow you to buy real stocks.

TeamViewer Fundamental Analysis

Fundamental analysis is a way to evaluate stocks by looking at the factors that affect the company’s business. Investors use it to determine the underlying health and intrinsic value of the company. Some of the factors investors consider when evaluating a stock, such as corporate management, are not measurable. But in this guide, we will explore the measurable ones, such as the company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow.

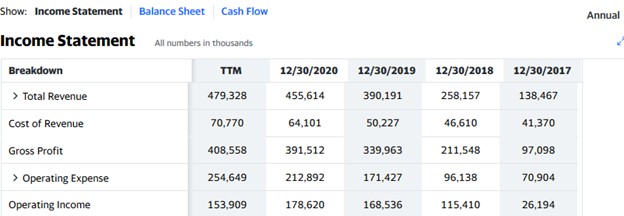

TeamViewer’s Revenue

Also known as gross sales, a company’s revenue is the total amount of money the company generates from the sale of its products or services. It is seen at the top of the income statement (top line) in any yearly or quarterly report, which is often displayed on the company’s website, major stockbrokers’ platforms, and websites of financial reporting firms, such as Yahoo Finance.

Investors love it when there is year-on-year revenue growth. For the 2020 financial year that ended Dec. 30, 2020, TeamViewer generated revenue of €455.6 million, which represents revenue growth of 16.8% from the €390.2 million realized in the 2019 financial year.

Source: Yahoo! Finance

TeamViewer’s Earnings-per-Share

Earnings-per-share is widely used by investors and analysts in evaluating a stock. It shows the amount the company earned for each outstanding share of its common stock during the financial period under review. It is calculated by dividing the total net income (minus dividends paid to preferred stockholders) by the number of common shares outstanding.

However, you don’t need to calculate it yourself because you can find it on your broker’s website or any of the financial websites. On Yahoo! Finance website, TeamViewer’s EPS for the 2020 fiscal year is €0.52 per share.

TeamViewer’s P/E Ratio

The price-to-earnings ratio (P/E) is another widely used metric for stock valuation. It compares a company’s stock price to its earnings per share (EPS). The ratio shows the expectations of the market about the stock. A high P/E typically suggests that a stock's price is high relative to earnings and may be overvalued. But it could be that investors are expecting higher earnings growth in the future, so they are willing to pay a higher share price today. Likewise, a low P/E might indicate that the current stock price is low relative to earnings and possibly undervalued or that investors are expecting earnings decline in the future.

To factor in growth expectations, analysts make use of the PEG ratio, which measures the relationship between the P/E ratio and earnings growth. Being a growth-adjusted P/E ratio, the PEG ratio normally provides a more complete story than the P/E alone.

TeamViewer’s Dividend Yield

Dividends are cash payments a company makes to its shareholders to reward them for investing in the company. Companies can pay dividends quarterly, half-yearly, or annually. Whenever dividends are declared, the stock price rises until the ex-dividend date and then starts to decline.

The dividend yield measures the annual dividends a company pays relative to its share price. A company with a high dividend yield is preferred by some investors because it offers them a regular income. Unlike investors, traders don’t usually focus on dividends because they are more interested in capital gains. As of September 2021, TeamViewer has not paid any dividends to shareholders.

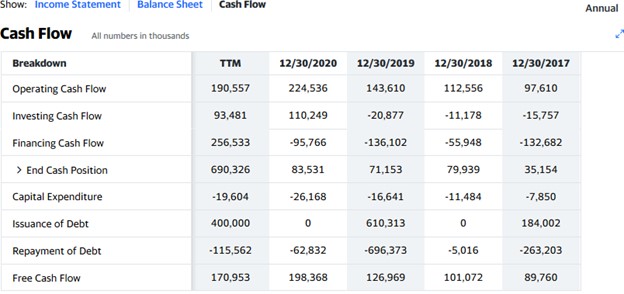

TeamViewer’s Cash Flow

Cash flow refers to how cash and its equivalents flow in and out of a business. It is recorded in the cash flow statement which can be seen alongside other financial statements in the “Financials” section of the company’s information on your broker’s website or that of any financial reporting firm.

The cash flow statement complements the balance sheet and income statement by showing where cash is coming from and how it is being spent. The most important element in the cash flow statement is the free cash flow, which shows how much cash left the company has after paying all the costs of staying in business, including capital expenses for buildings, machinery, and other bills. It tells investors how much cash the company has to finance other projects, pay dividends, or pay off debts. The following table shows that TeamViewer had about €198 million in free cash flow.

Source: Yahoo! Finance

Why Buy TeamViewer Stocks?

TeamViewer stock has performed poorly since July 2020. However, the company still has some growth potential as its services are very vital in today’s world. With the world shifting towards remote work, services such as TeamViewer’s are becoming more invaluable to businesses. Moreover, TeamViewer is making acquisitions (e.g., Ubimax and Xaleon) to pursue growth.

The company is also actively building partnerships and networking. In March 2021, the company signed a 5-year deal with Manchester United Football Club to not only become the club’s official sponsor but also use its technology to power the club’s setup, integrating the relationship between team and fans. Through the club’s huge fan base and networks, the company can gain more customers and improve sales.

These are three reasons to buy TeamViewer stock:

- TeamViewer’s products and services are highly valued in today’s world.

- The company is actively pursuing growth.

- The stock is cheap (as of Sept. 20, 2021), which may offer some margin of safety.

Expert Tip on Buying TeamViewer Stock

“ The is a potential growth stock, considering the importance of its services in today’s world. Also, at the moment (Sept. 20, 2021), shares are trading more than 49% below their peak price. Thus, the stock can appeal to both growth investors and value investors. However, whether you’re a growth or value investor, you must have a long-term outlook when buying the stock. ”- willfenton

5 Things to Consider Before You Buy TeamViewer Stock

You need to consider these five things before buying any stock:

1. Understand the Company

As famous value investor Peter Lynch suggested, it’s good to invest in companies you are familiar with, and if possible, whose products you are already using. While that is good to an extent, it is not enough if you don’t also consider certain fundamental factors that can tell you the financial health of the company. You must find out the company’s business model, how it is making money, whether its revenue is growing, and a lot more.

2. Understand the Basics of Investing

It is important to understand the basic elements of investing before putting your money in the market. This can save you from making silly mistakes and losing your capital. You need to know how to execute orders properly so that you don’t fill a bigger position size than you intend to. Also, you must learn money management, risk management, and diversification as ways to minimize risks.

3. Carefully Choose Your Broker

There are factors you must consider before choosing a broker. Some of them include the regulation status, trading fees, ease of deposit and withdrawals, trading platforms and apps, customer service, supported order types (market, limit, stop, and trailing stop), and the available stocks. The most important one is the regulatory status, especially in your country of residence. It makes it less likely for you to lose your money if the broker becomes bankrupt if there’s a compensation scheme in your country, like the UK’s financial services compensation scheme (FSCS).

4. Decide How Much You Want to Invest

Determine how much you want to invest and how to allocate your funds to each stock. Also, plan how you want to buy the stocks: do you make a lump-sum investment at one go or use a dollar-cost-averaging method and gradually scale in?

One more thing. Anything can happen in the market at any time, so only invest with an amount you can genuinely afford to lose, but don’t make this a reason to become complacent about losing that money. Above all, do not invest with borrowed funds (i.e., leverage) unless you really understand it.

5. Decide on a Goal for Your Investment

It is not enough to buy the stocks you want. You need to have a goal for the investment. It could be to build your pension fund for retirement, raise money for kids’ college, or finance a future project. Whatever the goal, you need to plan how long to hold the investment and when to sell. You can sell when the price gets to a specific level, when the company’s fundamentals are weak, or when you need the money.

The Bottom Line on Buying TeamViewer Stocks

TeamViewer is a German technology company that offers remote access and support software. The company has enormous growth prospects, and you can buy it via any stockbroker with access to the Frankfurt Stock Exchange.

If you’re ready to invest in the stock right now, just sign up for a stockbroker’s share dealing account, find TeamViewer in the list of stocks on its platform, and place an order to buy the stock.

But if you’re not ready to invest right now, you can read many other guides on our website to get more information about investing. You can also start “paper trading” using a stockbroker’s demo account to get used to the platform.

Frequently Asked Questions

-

A “unicorn” is a term used in the financial world to describe a private company (not yet listed on the stock exchange) that is worth at least one billion US dollars. Venture capitalists use it to indicate the value of a startup. Examples of former unicorns are Facebook, Airbnb, and Robinhood.

-

A market order is an order to buy or sell a stock at the current best available price in the market. While a market order ensures immediate execution, it does not guarantee a specified price. You use this order type when you want your trade executed immediately.

-

A limit order is an order to buy or sell a stock when the price reaches a specified price or better. Buy limit orders are placed below the current market price, and the order is executed only at the limit price or a lower one. Sell limit orders are placed above the current market order, and the order is executed only at the limit price or a higher one.

-

A stop-loss order is placed with a broker to sell or buy a stock when the price reaches a certain level against your position. You can use it to limit losses when the market moves unfavorably in your absence.

-

A trailing stop is an order type traders use to lock in their profits or limit losses as a market moves in a favorable direction. The order moves along with the price when it is moving in a favorable direction, and when the price reverses, it stays at the last level it reached, to lock in profits or limit losses.

-

One of the major causes of raging emotions is investing above your means (investing more than you can afford to lose). So, to manage your trading emotions, invest only what you can afford to lose and do not commit more than a small fraction of your capital to each trade. Another thing you can do is to always set a stop-loss order so that you don’t lose more than you can stand. It’s also good to build a diversified portfolio of different assets: stocks, bonds, commodities, and others.