How to buy Total stocks in 2024

TotalEnergies, formerly known as Total, is a French multinational oil and gas company and one of the biggest oil companies in the world. It operates as an integrated oil and gas company in different countries around the globe, covering the entire oil and gas chain — crude oil and natural gas exploration and production, international crude oil and product trading, refining, and petroleum product marketing. The company is also engaged in power generation and large-scale chemical manufacturing.

With its head office in Courbevoie, west of Paris, the company trades on Euronext and is a component of the Euro Stoxx 50 stock market index. It is also listed on the New York Stock Exchange (NYSE). This guide tells you how you can buy Total stock with confidence, and why you might want to, taking various fundamental factors into account.

How to Buy TTE Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Total Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need To Know About Total

Now, let’s get to know TotalEnergies in more detail by exploring its history and business strategy, the ways it makes money, and how it has performed in recent years.

Total History

TotalEnergies SE can trace its history to the establishment of Compagnie française des pétroles (CFP) on March 28, 1924. CPP, which literally translates to the "French Petroleum Company", was created to enable France to play a key role in the great oil and gas industry after World War I.

It was in 1954 that the company introduced its “Total” brand of gasoline in Europe and Africa. This downstream product was such a great success that the company was known by that brand name. In 1985, to build on the popularity of its gasoline brand, the company renamed itself Total CFP. The company later changed its name to Total in 1991, when it was listed on the New York Stock Exchange.

In 1999, Total merged with Petrofina, a Belgian oil company, and changed its name to Total Fina. After a merger with Elf Aquitaine in 2000, the changed its name to TotalFinaElf, but on 6 May 2003, it returned to its former name, Total. Finally, in May 2021, the company changed its name to TotalEnergies as a demonstration of its increasing investments in green electricity.

What Is Total’s Strategy?

TotalEnergies started as an integrated oil and gas company operating in the upstream, midstream, and downstream sectors of the oil industry but it is now transitioning to a broad energy company that produces and markets both non-renewable and renewable energies, such as oil and biofuels, natural gas and green gases, renewables and electricity.

With this integrated business model, the company discovers, produces, processes, and markets oil, gas, and electricity in different forms, adding value at every step in the chain. Over the last decade, the company has been increasing its investment in green energy sources. The company’s strategy is to transform itself into a broad energy company with profitable growth in energy production from LNG and renewable sources of electricity, which are the two fastest-growing energy markets.

How Does Total Make Money?

TotalEnergies makes money from the production and sale of its energy products, including crude oil, natural gas, gasoline, renewable energy solutions, and electricity, all over the world. The company categorises its business into these segments: exploration & production, gas, renewables & power, refining & chemicals, trading & shipping, and marketing & services.

In the second quarter of 2021, TotalEnergies reported revenue of $47.05 billion, up from the $25.73 billion in the corresponding quarter of 2020. Its adjusted net income for the quarter was $3.5 billion, a 15% increase compared to the first quarter of 2021.

How Has Total Performed in Recent Years?

After the ramp-up in the 2000s, peaking in 2008, the stock has not performed well again. In fact, in recent years, the stock has done quite poorly, trading below its share price from 5 years ago ($47 in the last week of September 2016 vs. $44 on Sept. 21, 2021). The coronavirus pandemic contributed to the stock’s woes in the last 20 months, as it hit a 21 year low in March 2020. While the stock is making a recovery, it is yet to hit the pre-pandemic levels.

Source: Yahoo! Finance

Where Can You Buy Total Stock?

Unlike CFD trading or spread betting which does not offer you ownership of the stock, buying stock from a stockbroker means that you actually hold the real assets (shares). So, if you want to own shares of TotalEnergies, you may buy the stock through a stockbroker that is registered with the NYSE or Euronext stock exchanges where it trades. While many stockbrokers offer only the standard dealing accounts, those with offices in the UK may also offer shares ISA and SIPP accounts, which are tax-efficient.

Furthermore, TotalEnergies have many foreign affiliates and subsidiaries which are listed on their various country’s stock exchanges — for example, TotalEnergies Nigeria is traded on the Nigerian Stock Exchange. You can buy the TotalEnergies subsidiary listed on your country’s stock exchange via your local broker.

Total Fundamental Analysis

Fundamental analysis is not like technical analysis in which historical price action is used to predict future price movements. Instead, it studies the company’s performance using certain metrics to determine its financial health and estimate the intrinsic value of the stock.

Some of the metrics investors consider include the company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow, which we are going to discuss next.

Total’s Revenue

A company’s revenue is the amount of money it made from the sale of its products or services during the accounting period under review. A year-on-year and quarter-to-quarter revenue growth tends to have positive effects on the stock price, while a decline does the opposite.

TotalEnergies’ revenue for the 2020 fiscal year, which ended on December 30, 2021, declined by 32.1% compared to the 2019 value. See the income statement below. Notice that revenue is reported at the top of the income statement, which is why it’s often referred to as the top line.

Source: Yahoo! Finance

Total’s Earnings-per-Share

A company’s earnings per share (EPS) is the amount of profit earned attributed to each outstanding share of its common stock. To calculate it, you have to first get the net earnings, which is the profit left after all costs of doing business have been subtracted from the revenue for the accounting period. Then, you divide the net profit (less the dividends paid to preferred stockholders) by the number of common shares outstanding.

However, you don’t need to calculate the EPS yourself since you can get it from your stockbrokers’ website or any of the major financial websites. TotalEnergies’ EPS for the 2020 fiscal year was -$2.90; the firm was one of those that were affected by the COVID-19 pandemic.

Total’s P/E Ratio

The price-earnings (P/E) ratio of any stock compares the stock’s share price to its earnings-per-share. It is calculated by dividing the stock’s current share price by its EPS. TotalEnergies’ EPS for the 2020 fiscal year was negative; so, even though we know the share price, we cannot calculate the P/E ratio.

Generally, a very high P/E ratio may indicate that the stock may be overvalued, while a low ratio may indicate that the stock is undervalued. However, there is no standard cutoff to classify a P/E ratio as high or low; investors generally compare with those of similar stocks to have an idea about how the stock is trading relative to its EPS. Moreover, when investors are anticipating larger earnings in the future (growth stocks), they tend to price the stock higher. This is why you need the PEG ratio, which gives you the growth-adjusted P/E value.

Total’s Dividend Yield

Dividends are payments a company makes to its shareholders as a way of distributing some of its earnings for the period to the owners. Companies pay dividends quarterly, semi-annually, or annually. TotalEnergies pays quarterly dividends and even paid dividends for the 2020 fiscal year despite the poor earnings due to the coronavirus pandemic.

Most of the time, when dividends are declared, the share price rises (investors rush to buy the stock to get their names in the company’s record and qualify for the dividends). The share price tends to fall after the ex-dividend date to account for the extra payment, evening out the investors’ earnings.

A company’s dividend yield is its total annual dividends expressed as a percentage of its share price. For instance, a company that pays out a total annual dividend of $2 when its share price is $50 would have a dividend yield of 4.0%. Comparing the yield with the prevailing interest rate tells you how the yield compares with the interest you would receive if you keep the money in the bank.

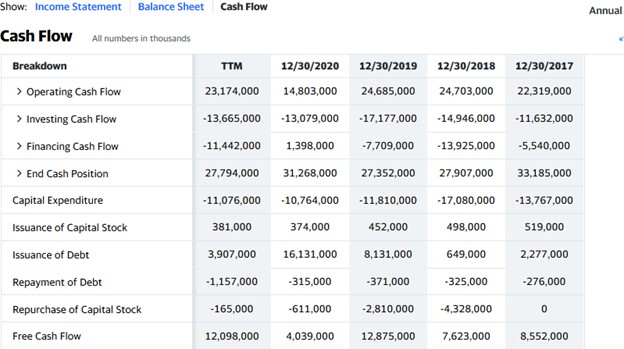

Total’s Cash Flow

The cash flow statement is a record of how a company generates and spends cash and cash equivalents. It can be seen beside the other financial statements in the financials section of the company’s information on your broker’s website or financial websites like Yahoo! Finance.

In the statement, focus on the free cash flow, which shows the amount of cash or its equivalents the company has left after taking care of major expenses, such as buildings, equipment, and other bills. The free cash flow shows how much the company has at hand to pay dividends or fund expansion projects.

From the TotalEnergies cash flow statement below, you can see that the company had about $4.04 billion in free cash flow as of the end of the 2020 fiscal year.

Source: Yahoo! Finance

Why Buy Total Stocks?

The stock may not have performed so well in recent years, but the company has a growth plan in place and is already making efforts to diversify into cleaner energies. It aims to meet the growing energy demand worldwide while moving to a lower-carbon global energy mix and more environmentally friendly operations.

According to the company’s projections, in the next decade, its energy production will grow by one-third - half from liquefied natural gas and the other half from electricity, mainly from renewables - while reducing oil products sales by almost 30%.

Here are three reasons why you might want to buy TotalEnergies stock:

- The company is transitioning into cleaner energy.

- It has a clear growth plan.

- It has a long history of paying quarterly dividends, which can be a source of regular income.

Expert Tip on Buying Total Stock

“ Most investors buying this stock do so to get regular income from dividend payments. Dividend stocks, such as this one, are best bought when they are in a dip to get them cheap, which improves the dividend yield. Also, since the stock can be volatile, it is better to buy with a limit order so that your trade gets executed at your desired price level. ”- willfenton

5 Things to Consider Before You Buy Total Stock

You need to consider these five things before you buy any stock.

1. Understand the Company

Both Warren Buffett and Peter Lynch suggested that it’s good to invest in a company that one knows very well, in terms of their products and services. While this is not a bad idea, it is not sufficient without also taking into account the fundamental factors that can tell you more about the financial health of the company.

2. Understand the Basics of Investing

Don’t start investing without first learning the basics, otherwise, you would expose yourself to unknown levels of risk. This would help you avoid losing money unnecessarily. For instance, if you learn how to use your chosen trading platform, you can avoid mistakes, such as entering 500 shares instead of paying $500 for your asset. This could mean risking some or all your capital in the trade instead of the 5% that you intended.

Other investing basics you need to learn include money management and risk management techniques, as well as diversification.

3. Carefully Choose Your Broker

There are many brokers out there; you have to choose the one that is most suitable to you based on your location and investing style. Some of the things to consider when choosing a broker include trading fees and commissions, payment methods, customer support service, access channels (mobile, web, telephone), and supported order types (market order or limit order). The broker’s regulatory status in your country of residence is also important. Be sure you choose a broker that is regulated by the financial authority of your country to ensure the safety of your funds and also benefit from any available insurance scheme against broker insolvency.

4. Decide How Much You Want to Invest

It is important you invest with only disposable income. Also, if you decide to use margin or leverage, make sure you know how to use these risky features before committing your hard-earned cash. Opting for a demo account first could help you better understand how they work. However, you can gradually save up some disposable funds by cutting down on non-essential spending and reinvest all the earnings in the beginning, no matter how small they are.

5. Decide on a Goal for Your Investment

Finally, determine your investment goal. You should know why you are investing — to raise money for a future project, save for your kid’s college, or build a retirement fund. Your investment goal may guide you when you sell the stocks. You may want to sell when your kid reaches a particular age, or when the stock’s fundamentals are weak, or when the price reaches a particular level. If you want, you can also hold the stock indefinitely and sell gradually as the need for liquidity arises.

The Bottom Line on Buying Total Stocks

TotalEnergies (NYSE & Euronext: TTE) is an integrated oil and gas company. The company is rapidly diversifying into renewable energy. You can buy the stock through a stockbroker with access to the NYSE or Euronext. You may also buy its local subsidiary in your country.

If you’re ready to invest in TTE shares right now, simply sign up for a stockbroker’s share dealing account and fund it. Then, select TTE from the broker’s categorised list of stocks and place your buy order.

If you’re not yet ready to invest right now, educate yourself more by reading other guides on our website. In addition, you may also “paper trade” using a stockbroker’s demo account to learn how to place orders in the market.

Frequently Asked Questions

-

Climate change may be described as long-term shifts in temperatures and weather patterns driven by human-induced emissions of greenhouse gases. The effects of climate change can be seen in severe heatwaves and dangerous flooding experienced in various cities around the world.

-

Net-zero emission, sometimes referred to as carbon-neutral, is achieving a balance between the amount of greenhouse gas released into the atmosphere and the amount taken out. The net-zero state is reached when the amount we add is equal to the amount taken away via natural carbon sinks (forests, wetlands, etc.) and CCUS (carbon capture, use, and storage) processes.

-

Renewable energy, often referred to as clean energy, is energy from natural sources, which are constantly replenished on a human timescale. Examples include carbon-neutral sources, such as sunlight, wind, ocean currents, rain, waves, geothermal heat, and biomass.

-

Investors love dividends for many reasons. One of them is that dividends increase their gains, and if the stock is performing poorly, dividends can help reduce their losses. Another one is that they can reinvest the dividends and compound their income. For those who don’t want to reinvest, dividends offer them additional income for solving their financial problems.

-

It is an investing strategy in which you spread out your stock purchases, investing similar amounts at regular intervals over a certain period. Your entry price becomes the average of those purchase prices. The aim is to reduce the impact of volatility so you don’t get to buy at the market top.

-

Go to the website of your chosen stockbroker and click on the “Open an Account” button. Fill in the registration form, providing your full name, email address, postal address, and phone number. You may also need to provide a means of identification (a government-issued ID) and proof of residence (a utility bill that is not more than three months old) for the broker to verify your account.