How to buy Valeo stocks in 2024

Valeo is a French multinational company that designs, produces, and sells a wide range of auto components and systems to automakers in France and other European countries, North America, South America, Asia, and Africa. The company also offers after-sale services. Together with its subsidiaries, the company employs 113,600 people in 33 countries worldwide.

Headquartered in France, the automotive supplier has over 186 production plants, 59 R&D centres, and 15 distribution platforms across the globe. It is listed on the Paris Stock Exchange and is a component of the CAC-40 Index. This guide tells you why you might want to buy Valeo stock and how you can invest in it, as well as the fundamental factors to consider before buying it.

How to Buy VLEEF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Valeo Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need To Know About Valeo

In this section, we take a deeper look at Valeo by exploring its history and strategy, how it makes money, and how it has performed in recent years.

Valeo History

The company was founded in Saint-Ouen in 1923, under the name Société Anonyme Française de Ferodo. It started as a distributor of brake linings and clutch facings under the license of Ferodo Ltd UK but later started producing clutches. In 1932, it was listed on the Paris Stock Exchange, and in the 1960s and 70s, it diversified into the production of braking systems, thermal systems, lighting systems, and electrical systems.

In the 1960s, the company started expanding outside France, establishing offices in Spain and Italy. It subsequently expanded to Brazil, the US, and the rest. As of 2018, it has a presence in 33 countries. The company changed its name to Valeo in May 1980. In 2015, it acquired German automotive suppliers Peiker and Spheros, and in 2017, it acquired FTE automotive.

What Is Valeo’s Strategy?

Valeo is a partner to automakers, designing innovative solutions for smart mobility. It operates through four segments - comfort & driving assistance systems, powertrain systems, thermal systems, and visibility systems. The company’s strategy is to grow through innovation and international development.

In the areas of innovation, the company invests 11.8% of its sales in research & development and has more than one-third of employees working in that department. Its innovation focuses on intuitive driving and the reduction of CO2 emissions. The company ranked as France’s leading patent filer in 2016 and 2017.

On the aspect of international development, the company wants to be near its automaker customers and new mobility companies. It focuses on high-growth potential regions, such as Asia, and emerging countries. It has a strong presence in China and Northern Africa (Egypt).

How Does Valeo Make Money?

Valeo makes money from the sale of its products and services, which include comfort & driving assistance systems, powertrain systems, thermal systems, and visibility systems, as well as aftermarket services.

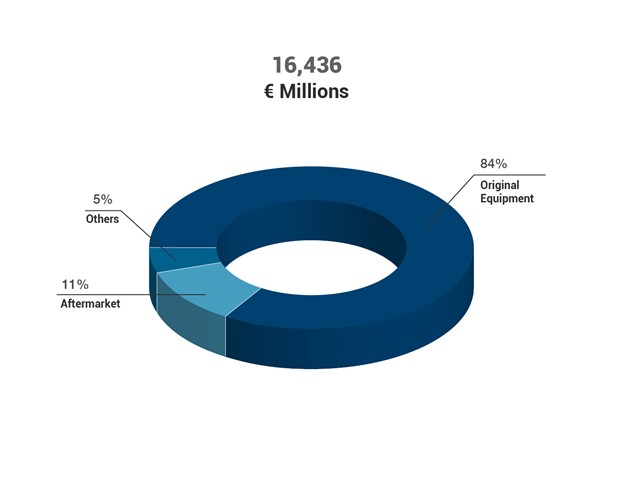

In its financial report, the company categorizes its offerings into original equipment, aftermarket, and others. In the 2020 fiscal year, which ended on December 30, 2020, the company reported €16.4 billion in sales (revenue), with original equipment sales contributing 84%, aftermarket 11%, and others 5%. See the picture below.

Source: Valeo.com

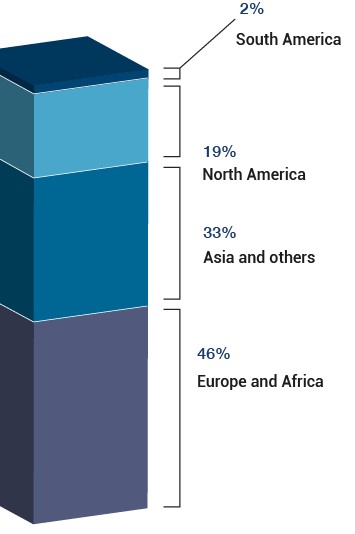

In terms of geographical areas, South America contributed 2% of the sales, North America 19%, Asia & others 33%, and Europe & Africa 46%.

Source: Valeo.com

How Has Valeo Performed in Recent Years?

After stagnating for most of the early 2000s, the stock embarked on a remarkable bull run from 2009. The stock surged from less than €3 at the beginning of 2009 to more than €65 by May 2017, reaching an all-time high of €67.80 — over 22 times factor.

However, the stock has been on a free fall since 2018. A muted attempt at recovery in the last half of 2019 was cut short by the emergence of the coronavirus pandemic in early 2020, which triggered another decline, hitting a low of €10.51 in March 2020.

For the rest of 2020, the stock attempted to recover but could not get beyond €33.73 before starting to fall again. It has been on a decline since the beginning of 2021, and as of Sept. 22, 2021, it’s trading at €21.55, which is about 68% below its all-time high.

Source: Yahoo! Finance

Where Can You Buy Valeo Stock?

Buying a stock from the stock exchange offers you part ownership of the company, unlike trading the CFD or spread bet, which is simply speculating on the share price movement. Thus, if you want to own Valeo shares, buy the stock via a stockbroker that is registered with the Paris Stock Exchange where it trades, rather than trading it on CFD trading or spread betting platforms — although some of those platforms also allow you to buy the real stock.

While you can only open the standard share dealing accounts with most international stockbrokers, UK-based stockbrokers may also offer tax-efficient accounts, such as shares ISA and SIPP accounts. You may also be able to buy Valeo DR from major banks in your country that have a share dealing arm.

Valeo Fundamental Analysis

Fundamental analysis is a sort of stock analysis where you study the details of the company’s business. Investors perform this analysis to determine the underlying health and intrinsic value of the company. Some of the metrics they use include the company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow.

Valeo’s Revenue

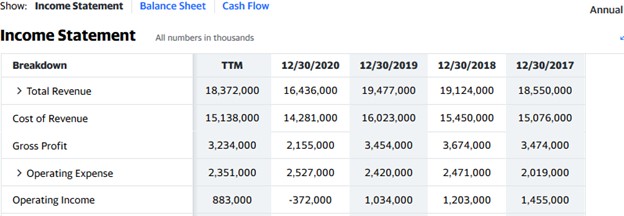

A company’s revenue, also known as sales, refers to how much money it generates from the sale of its products or services. When the revenue grows quarter to quarter or year on year, the stock price is likely to rise — the opposite happens when there’s a decline in revenue. Revenue is the first thing you see in an income statement, which is why it’s often called the top line. See the picture below:

Source: Yahoo! Finance

From the picture of the income statement above, you can see that Valeo made revenue of €16.44 billion in its 2020 fiscal year compared to €19.48 billion it made in 2019. This represents a 16% decline and may be attributed to the economic effects of the coronavirus pandemic in 2020.

Valeo’s Earnings-per-Share

A company’s earnings-per-share is the amount of profit the company earned for each outstanding share of its common stock. It is calculated by dividing the company’s total net profit (bottom line) divided by the number of common shares outstanding. You will have to subtract the dividends paid to preferred stockholders from the net profit before dividing by the number of common shares.

Note that you can get the EPS from your stockbrokers’ website or any of the major financial websites, so you don’t need to calculate it yourself. Valeo made a loss of €1.09 billion in the 2020 fiscal year; its EPS was -€4.55.

Valeo’s P/E Ratio

The price-earnings (P/E) ratio compares a company’s share price to its earnings-per-share. It is calculated by dividing the company’s current share price by its EPS. If a company’s P/E ratio is 50, for example, it means that investors are willing to pay €50 for each €1 the company earns in a year. To put it differently, investors are willing to wait for 50 years to recoup their investment from the company’s earnings, assuming the earnings remain the same every year.

Generally, a very high P/E ratio may indicate that the stock is overvalued, while a low ratio may indicate that the stock is undervalued. However, there is no cutoff figure for the P/E ratio to know a high value or a low value. Investors simply compare with those of similar stocks to have an idea.

Sometimes, investors may be anticipating higher earnings in the future and tend to price that in. This is why you need the PEG ratio (growth-adjusted P/E value) to account for the growth factor. Since Valeo’s EPS for its 2020 fiscal year was negative, we cannot calculate both the P/E ratio and the PEG ratio, even though we know the share price.

Valeo’s Dividend Yield

Dividends are a portion of a company’s earnings it distributes to its shareholders. They may be paid quarterly, semi-annually, or annually. Valeo has been paying annual dividends for many decades. Whenever dividends are declared, the share price rises until the ex-dividend date and then falls.

A company’s dividend yield is its total annual dividends expressed as a percentage of its share price. It is calculated by dividing the annual dividend by the share price and multiplying it by 100. So, a company that pays out a total annual dividend of €1.50 when its share price is €30 would have a dividend yield of 5.0%. Long-term investors like good dividend yields because dividends are one of the ways they make money from their stockholding.

Despite the impact of the COVID-19 pandemic in 2020, Valeo paid an annual dividend of €0.30 for the 2020 fiscal year.

Valeo’s Cash Flow

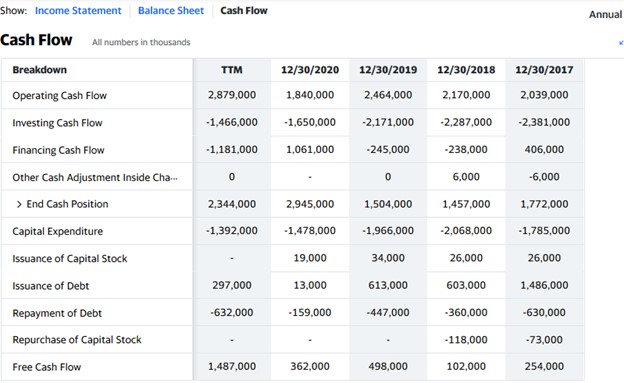

The cash flow statement is one of the financial statements you need to study when analysing a stock. It is simply a record of how cash and cash equivalents are generated and spent by a company. You can see it beside the other financial statements in the financials section of the company’s information on any financial websites (eg., Yahoo Finance) or even your broker’s website. See Valeo’s cash flow statement below:

Source: Yahoo! Finance

The most important figure in the cash flow statement is the free cash flow, which tells you how much cash or its equivalents the company has left after taking care of major expenses, such as building and equipment. Notice that Valeo had €362 million in free cash flow at the end of the 2020 fiscal year. That’s the cash available to the company then, which it could use to fund new projects, pay down debts, or pay dividends.

Why Buy Valeo Stock?

Valeo stock has not really performed well since May 2017, and the company has a high level of debt. However, Valeo is a highly innovative company and has been creating superior products in the automotive industry. The company leads the world in parking assistance systems that use ultrasonic sensors. It is working on a low-voltage electric vehicle and presented the prototype at the 2017 Consumer Electronics Show in Las Vegas.

Here are three reasons you might want to buy Valeo stock:

- The company is very innovative and focuses a lot on research and development while expanding into emerging economies with high-growth potential.

- It has a long history of paying dividends, though the yield is quite low.

- The stock is cheap, trading far below its all-time high (as of Sept. 22, 2021).

Expert Tip on Buying Valeo Stock

“ While the stock has long-term growth potential, it is quite volatile in the short term. So, you might want to buy on the dip to gain some margin of safety and increase profit potential. Also, it’s better to use a limit order, which gets filled at your specified price or a better price rather than an out-of-hours “at best” order that could execute at a spiked-up price when the market opens. ”- willfenton

5 Things to Consider Before You Buy Valeo Stock

These are five things you must consider before you buy any stock, including Valeo stock.

1. Understand the Company

To assess its full potential, you need to conduct research on your chosen company, Valeo. In this case, you may want to get all the information on their previous products, future plans, and business strategy. You need to check the company’s management team and their track record, as well as analyse the company’s financial ratios, such as the EPS, P/E ratio, PEG ratio, dividend yield, and others; these can help you estimate the worth of the company.

2. Understand the Basics of Investing

Don’t ever start investing money in the market without taking some time to learn how the market works and what you can do to protect your investment. For example, you need to learn how orders are executed, the type of order to place, and when to place it. Other things you need to learn include money management, risk management, and diversification.

3. Carefully Choose Your Broker

Choosing the most suitable broker is a difficult process, but if you know what to look for, it makes things a lot easier. The first thing is to check the broker’s regulation status in your country of residence. A broker that is registered with the financial services regulator in your country is safer than a broker that does not comply with current legislation. Moreover, in the event that the broker becomes insolvent, you would be covered by the compensation scheme in your country.

Apart from regulation, you should also consider the broker’s trading commissions and other fees, customer service, payment methods, trading channels (mobile, web, telephone), and supported order types (market order or limit order).

4. Decide How Much You Want to Invest

How do you source the fund to invest? Make sure it’s not borrowed money because nothing is guaranteed in the market; you can lose everything. The best thing is to invest your disposable income. You may take some time to save it up to a sizable amount. When you do, you have to determine how to allocate the funds to different stocks and how you want to enter the market: it may be better to scale in at intervals than to make a lump-sum purchase at one go.

5. Decide on a Goal for Your Investment

You must have a goal for your investment: it could be that you want to build a retirement fund or want to raise money for a future project. Whatever your goal is, create a plan for it. You don’t just invest in stock; you must have a strategy for getting out of the market. Your strategy could be to sell when the price reaches a particular level or on a specific date in the future.

The Bottom Line on Buying Valeo Stocks

Valeo is a French multinational company that supplies auto components to automakers around the world. You might want to invest in this innovative company to benefit from its long-term growth potential, and you can do that through a stockbroker with access to the Paris Stock Exchange.

To invest in Valeo shares right now, register with the right stockbroker, fund your account, select Valeo from the broker’s list of stocks, and then place an order to buy the stock.

However, if you’re not yet ready to invest right now, keep educating yourself by reading other guides on our website. In addition, practice “paper trading” using a stockbroker’s demo account to get used to the process.

Frequently Asked Questions

-

The ex-dividend date marks the cutoff for a buyer’s name to appear in the company’s register and qualify to receive the declared dividend. Investors rush to buy the stock before the ex-dividend date, increasing demand for the stock; as a result, the stock rises. The demand for the stock drops drastically from the ex-dividend date because those buying at that time would not qualify for the dividend.

-

Investors tend to hold a stock for a long period, even several years, so they hold over the period dividends are declared. Short-term traders, on the other hand, may sell the stock before dividends are declared, so they focus more on capital gain and care less about dividends. Also, long-term investors may want to reinvest the dividends to compound their income.

-

No! A stock can lose its entire market value and fall to zero; at this stage, investors lose all their investment in the stock (-100% return). However, a stock can never fall below zero. But this does not mean that you cannot lose more than you invested: if you are using leverage and the broker doesn’t offer negative balance protection, you can lose more than 100% of your invested capital even before the stock falls to zero.

-

If a stock price drops to zero, investors lose all their money in the stock as the stock has become worthless. When this happens, the stock exchange delists the stock and it would no longer be available for trading. In fact, most major exchanges have a minimum price that, if a stock falls below it, it gets automatically delisted.

-

In the context of trading, money management refers to a strategy to protect your investing capital. It refers to how much of your capital you commit in one trade, which in turn determines your position size (the number of shares) for that trade. Experts advise that you commit no more than a small fraction of your capital in each trade.

-

Risk management is a strategy to limit your potential loss in each trade to an amount you are comfortable with. It refers to the use of a stop-loss order to limit the amount of loss you can take if the market goes against your position.