How to buy Vestas stocks in 2026

Vestas Wind Systems A/S is a Danish company that designs, manufactures, sells, installs, and services wind turbines in different parts of the world. The company was founded in 1945 and is headquartered in Aarhus, Denmark. It operates manufacturing plants in Denmark and many other countries in Europe, as well as in the US, Brazil, China, and a few others.

Vestas is a leading global partner in sustainable energy solutions, with more than 132 GW of wind turbines in 83 countries. The company went public in 1998, with its shares listed on the Copenhagen Stock Exchange. This guide tells you how you can buy Vestas stock with confidence, and why you might want to, taking various fundamental factors into account.

How to Buy VWSYF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

The Best Reviewed Brokers to Buy Vestas Shares

1. eToro

eToro was launched in 2007 and has since risen to be the most popular social trading platform with a user base of over 17 million worldwide. The platform makes trading accessible to anyone and anywhere by courting beginners and experts with its rich library of tools and resources. You can read our full eToro review here.

Security and Privacy

eToro is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) and has received its brokerage licenses to operate in Europe, USA, and Australia from several regulatory agencies.

eToro uses standard security features such as SSL encryption and 2FA, thereby protecting users' personal information and funds from a security breach.

Fees and Features

Firstly, eToro is a multi-asset platform, that is, users have access to more than 2,000 financial assets like stocks, ETFs, cryptocurrencies, indices, and more. Another great feature of eToro is the social trading feature which allows you to join and connect with a community of other traders worldwide to shape your trading decisions. The platform also has a CopyTrader feature that allows one to copy the trading strategies of more experienced traders. eToro also offers its users free insurance that protects them in case of insolvency or an event of misconduct.

eToro offers zero commission when you open a long, non-leveraged position on a stock or ETF. However, every withdrawal comes with a $5 fee. The platform also charges an inactivity fee of $10 every month if you don't trade for 12 months.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- SSL encryption to protect users' information

- Trading is commission-free

Cons

- Limited customer service

2. Capital.com

Capital.com is a multi-asset asset broker launched in 2016. The platform now has over 500,000 registered users with more than $5 billion in volume traded. Capital.com is built to help trading decisions with its Patented AI trade bias detection system. You can read our full Capital.com review here.

Security and Privacy

Capital.com is licensed and regulated by top regulatory bodies such as FCA, ASIC, NBRB, FSA, and CySEC. Users' information is secured and encrypted by Transport Layer Security, and users' funds are stored in a separate account.

Fees & Features

The brokerage's users can access 6100+ market options with CFD trading. It also provides educational materials to make a better trader out of its users. Capital.com also offers educational materials to assist customers in making more informed decisions. Customers can speculate on upward and downward movements in over 3000 markets. In its mobile trading app, the broker offers an AI-powered tool that provides individualized trading insights by utilizing a detection algorithm to uncover various cognitive biases.

Unlike many platforms, Capital.com operates a free service with no hidden charges, and it upholds its transparent fee policy.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- 24hrs email and chat support

- MetaTrader integration

- Commission-void trading

Cons

- Mostly limited to CFDs

3. Skilling

Skilling is a fast-growing multi-asset broker with awesome trading terms. At its inception in 2016, its main focus was on bond market investment, and since then, it has grown into creating a new model for the stock exchange. In addition, users can trade various financial assets, including CFDs, forex, and cryptocurrencies. You can read our full Skilling review here.

Security and Privacy

Skilling takes the privacy and security of its users' assets very seriously. All information entered into the platform is encrypted, and only authorized personnel can access the information. The platform also uses two-factor authentication to protect its users.

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA), which means customers can be assured about their assets' security.

Fees and Features

Skilling has four main platforms: Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, and Skilling Copy. Skilling Trader is intended for traders of all skill levels and provides access to all trading analysis tools. Skilling cTrader, on the other hand, is designed for more experienced traders, focusing on order execution and charting capabilities. MetaTrader 4 is a forex and CFD trading platform with a highly customizable interface. Finally, Skilling Copy is a trading platform that allows members to follow or copy the trading strategies of seasoned traders for a fee.

Skilling charges no fees for inactivity, deposits, or withdrawals. However, commissions on FX pairs and Spot Metals are charged on Premium accounts. These fees begin at $30 per million USD traded.

| Fee Type | Fee Amount |

| Commission Fee | Varies |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

Pros

- Flexibility and ease of use

- Access to Forex, CFDs, among many others

- Excellent customer service

- Highly secured and well regulated

Cons

- Single currency operation

- Not accessible in the US and Canada.

Everything You Need To Know About Vestas

Now, let’s take a more detailed look at Vestas by exploring its history and business strategy, how it makes money, and how it has performed in recent years.

Vestas History

Vestas traces its history to 1898 when a 22-year-old Smith Hansen bought a blacksmith shop in West Jutland and operated it as a family business under the name Dansk Staalvindue Industri — they were making steel window frames for industrial buildings. However, it was after the Second World War in 1945 that Vestas A/S (shortened from VEstjysk STålteknik A/S) was founded by Peder Hansen and a handful of colleagues, including his father, Smith Hansen.

The company initially started by manufacturing household appliances, but over the years, it experimented with many other products, including agricultural equipment in 1950, intercoolers in 1956, hydraulic cranes in 1968, and wind turbines in 1979. But it was in 1989 that it started producing wind turbines exclusively.

Vestas went public in 1998 by listing its shares on the Copenhagen Stock Exchange. Its merger with the Danish wind turbine manufacturer, NEG Micon, in 2003 gave rise to Vestas Wind Systems, which became the largest wind turbine manufacturing company in the world.

What Is Vestas’ Strategy?

Vestas offers wind energy solutions, designing, manufacturing, installing, and servicing wind turbines worldwide. The company tries to create solutions for both the world’s growing need for energy and climate change. Over the last 40 years, Vestas has installed more than 113 GW, preventing the release of 1.3 billion tonnes of CO2 into the atmosphere.

As a global leader in sustainable energy solutions that protect the environment, Vestas’ strategy is to maximise the value of its leading onshore wind energy position; continue growing faster than the market to further strengthen its global leadership; and ensure presence in key growth segments, while sustaining profitability and capital efficiency.

How Does Vestas Make Money?

Vestas Wind Systems A/S makes money from the development, manufacture, sale, and maintenance of wind power plants. The company operates through two segments — power solutions and service — and serves over 83 countries around the world.

The power solutions segment includes the sale of wind power plants, wind turbines, development sites, and so on, while the service segment engages in the sale of service contracts, spare parts, and related activities. In 2020, both segments earned the company about €14.82 billion in revenue.

How Has Vestas Performed in Recent Years?

The stock has performed remarkably well over the last decade, rising from a low of DKK 4.92 (Danish Krone) in July 2012 to its all-time high of DKK 321.00 in January 2021. During this period, it has only made a few pullbacks. In fact, from March 2020 to the end of 2020, the stock gained over 200%.

However, since January 2021, the stock has been in a prolonged pullback with consolidation, forming a pennant price pattern. As of the time of writing, the stock is trading at DKK 257.50, which is about 19.8% below its all-time high.

Source: Yahoo! Finance

Where Can You Buy Vestas Stock?

Unlike speculating on the price movement of a stock by placing a CFD trade or spread bet, buying the real stock gives you part ownership of the company. Vestas stock trades on the Copenhagen Stock Exchange. So, if you want to own Vestas shares, you buy the stock through a stockbroker that has access to that stock exchange, rather than trading it on popular CFD trading or spread betting platforms — however, some of those platforms also allow you to buy real stock.

Most international stockbrokers that can have access to the Copenhagen Stock Exchange usually offer only the standard share dealing accounts; however, UK-based stockbrokers also offer shares ISA and SIPP accounts, which are tax efficient. You can also buy Vestas DR through any major international bank in your country that has a share dealing arm.

Vestas Fundamental Analysis

Fundamental analysis is a stock evaluation method used by investors to determine the underlying health and intrinsic value of the company. When performing a fundamental analysis of a stock, investors consider many financial factors, such as corporate management (which is not measurable), company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow. In this guide, we will focus on the measurable metrics.

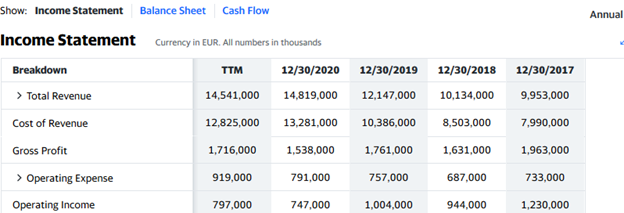

Vestas’ Revenue

A company’s revenue is the amount of money it makes from selling its products or services. You will see the revenue at the top of the company’s income statement, which is why it’s often referred to as the top line.

Year-on-year or quarter-for-quarter revenue growth may cause the stock price to rise, while a decline can have the opposite effect on the stock. For its 2020 fiscal year, Vestas’ revenue grew by 21.98% compared to the 2019 fiscal year.

Source: Yahoo! Finance

Vestas’ Earnings-per-Share

A company’s earnings are the profits it earns after all costs of doing business have been subtracted from the revenue for the accounting period under review. When you divide the total earnings (less the dividends paid to preferred stockholders) by the total number of outstanding shares of the company’s common stock, you get the earnings per share (EPS), which is what concerns you as a shareholder.

However, you don’t need to calculate the EPS yourself since you can get it from your stockbrokers’ website or any of the major financial websites. Vestas’ EPS for the 2020 fiscal year was €0.78, a bit higher than the 2019 value of €0.71.

Vestas’ P/E Ratio

A company’s price-earnings (P/E) ratio compares its share price to its earnings-per-share. You calculate it by dividing the company’s current share price by its EPS, but you can also see it on your stockbroker’s website or a major financial website.

Generally, a company’s P/E ratio is very high compared to those of its peers, it could be that the stock is overvalued but could also be that investors are expecting the company’s earnings to grow in the future. Likewise, when the P/E ratio is very low compared to those of its peers, it could be that the stock is undervalued or that investors don’t believe that the company can improve its earnings in the future. Thus, it’s better to also consider the PEG ratio, which is the growth-adjusted P/E value. But we cannot also get the PEG since we cannot get the P/E ratio. As of October 1, 2021, Vestas’ P/E ratio is 35.79.

Vestas’ Dividend Yield

Dividends are payments a company makes to its shareholders as a way of distributing its earnings. Companies can pay dividends quarterly, semi-annually, or annually. Vestas pays annual dividends. Generally, when a company declares dividends, its share price rises, as investors try to get their names in the company’s record before the ex-dividend date. However, from the ex-dividend date, the stock falls as the sellers have already secured the dividends.

Investors look beyond the dividend to consider the dividend yield, which is the total annual dividend expressed as a percentage of the company’s share price. For example, a company that pays out a total dividend of $0.40 in annual dividends per share when its share price is $20 would have a dividend yield of 2.0%.

You can see the dividend yield on your stockbroker’s website or any of the major financial websites. Vestas’ dividend yield for the 2020 FY’s dividends was 0.64%.

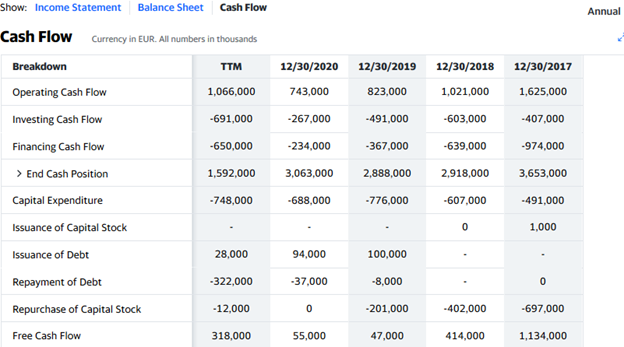

Vestas’ Cash Flow

The cash flow statement is a financial statement that shows how cash and cash equivalents are generated and expended by the company. You can see the cash flow statement beside the other financial statements in the financials section of the company’s information on your broker’s website or a major financial website like Yahoo Finance.

The metric that matters the most in the cash flow statement is the free cash flow, which shows the amount of cash or its equivalents the company has left after taking care of major expenses, such as the building and equipment. The free cash is what the company has to pay dividends, pay down debts, or fund expansion.

As you can see from Vestas’ cash flow statement below, the company had about €55 million in free cash at the end of 2020.

Source: Yahoo! Finance

Why Buy Vestas Stocks?

The truth is that renewable energy is no longer a niche industry. There are now many new entrants, both big and small, regional and global. These new entrants, including conglomerates like GE and Siemens, are seriously competing with Vestas for market share. However, with the world determined to transition to clean energy, the market is growing rapidly, especially in emerging economies like China and India.

Here are three reasons why you might want to buy Vestas stock:

- There is a growing need for the world to transition to clean energy;

- The demand for wind energy is increasing;

- Vestas is one of the biggest ESG stocks to own.

Expert Tip on Buying Vestas Stock

“ Vestas is a growth stock that has performed quite well in the past ten years. Considering its industry and the growing demand for clean energy, the stock still has a lot of room to rise. Moreover, as of October 1, 2021, the stock is a pullback and has formed a pennant pattern. While you can place a limit order, there’s no assurance that your order will be triggered, so it may be better to place a market order to ensure immediate execution. ”- willfenton

5 Things to Consider Before You Buy Vestas Stock

Before you buy any stock, including Vestas, consider these five factors:

1. Understand the Company

One thing you must do before you put your money on any company is to study it deeply. It is not enough for it to be a company you are familiar with or are using its products or services, as suggested by Warren Buffett. You must perform a fundamental analysis to be sure of the company’s financial health before investing. Be sure to analyse its business strategy and how it makes money.

2. Understand the Basics of Investing

Before approaching the market, you need to learn the basics of investing. It is necessary to understand what risk management, money management, and diversification are and how to use them to protect your capital. While risk and money management techniques enable you to control how much you can lose should the market go against your position, you use diversification techniques to spread your risk across several assets to reduce the impact of an anomaly in one market.

3. Carefully Choose Your Broker

There are many brokers to choose from. But it is important you choose a broker that is registered with the financial services regulator in your country of residence. This way, you get some form of protection from the financial compensation scheme in your country.

Apart from regulation status in your home country, other factors to consider before choosing a broker include trading commissions, the number of assets offered, payment methods, trading platforms and tools, and the promptness of the customer support team.

4. Decide How Much You Want to Invest

You need to determine the percentage of your capital you will allocate to one stock, as well as how you want to invest the money. It may make more sense to gradually scale into a full position (dollar-cost-averaging) than to invest all the money at once.

Another thing you should know is that no matter how good an opportunity looks, do not invest more than you can afford to lose and never ever invest with borrowed funds because anything can happen in the market at any time. Ensure you diversify your portfolio across different stocks and even different asset classes to avoid systemic risk.

5. Decide on a Goal for Your Investment

Finally, you need to consider your investment goal. Ask yourself why you are investing and how long you intend to hold your investment. Whether you’re investing to build your pension fund for retirement, save money for your kid’s college, or raise money for a future project, you must know when to sell. It could be at a specific time in the future, when the price reaches a certain level, or when the company’s fundamentals no longer look good. You may also hold the stock indefinitely and sell when you need money.

The Bottom Line on Buying Vestas Stocks

Vestas Wind Systems A/S is a Danish renewable energy company that manufactures, sells, installs, and services wind power plants all around the world. You might want to buy Vestas stock because of the growing demand for clean energy, and you can buy it through an international broker with access to the Copenhagen Stock Exchange or a major international bank.

To invest in Vestas shares right now, sign up for a share dealing account and fund it. Then, select Vestas from the broker’s categorized list of stocks and place an order to buy the stock.

If you’re not yet ready to invest right now, keep educating yourself by reading other guides on our website. You may also practice “paper trading” using a stockbroker’s demo account to familiarise yourself with the market and learn how to place orders.

Frequently Asked Questions

-

Also known as renewable energy, clean energy refers to energy from renewable, zero-emission sources that do not pollute the atmosphere when used. These include carbon-neutral sources like sunlight, wind, rain, tides, waves, and geothermal heat.

-

The effects of global warming and climate change are being felt in many cities across the world every year. The year 2021 was particularly eventful, with destructive floods seen in several European cities. There were also heat waves in many cities. Transitioning to clean energy is critical to reducing the effects of global warming and other extreme weather events.

-

Global warming refers to the phenomenon of increasing average air temperatures near the surface of Earth. This gradual increase in the overall temperature of the earth's atmosphere is generally attributed to the greenhouse effect caused by increased levels of carbon dioxide, CFCs, and other pollutants that come from the use of fossil fuels. In 2018, the Intergovernmental Panel on Climate Change (IPCC) estimated an average temperature increase of between 0.8 and 1.2 °C (1.4 and 2.2 °F) since preindustrial times.

-

Wind power plants are zero-emission energy sources and do not pollute the atmosphere with greenhouse gases. Moreover, they do not require water for cooling, so do not affect aquatic life. Additionally, energy from wind reduces dependency on fossil energy which adds C02 to the atmosphere, thereby reducing total atmospheric pollution.

-

Investors buy and hold their stocks for long enough to have their names in the company’s record books and qualify to receive any declared dividends. Traders, on the other hand, tend to hold stocks for a short time (long enough to make their gains from capital gain) and don’t like to tie their capital down waiting to qualify for dividends.

-

Apart from dividends, investors and traders make money from stocks through capital appreciation, which refers to the ability of stock prices to rise. For example, a stock purchased for £5.00 can rise to £15.25 by the time the buyer wants to sell.