How to buy Banco Inter stocks in 2024

Banco Inter is a Brazilian digital bank that offers numerous fee-free products and services, including a checking account, credit, insurance, financing, currency exchange, and digital shopping. The bank is headquartered in Belo Horizonte, Brazil, and operates digitally without physical branches other than its headquarters. The company is listed on Brazil’s B3 (Brasil, Bolsa, Balcão) stock exchange under script BIDI, with three subtypes: BIDI3 (common shares), BIDI4 (preferred shares), and BIDI11 (units). The bank has a total of nine subsidiaries that individually perform specialized functions; e.g., investment fund, insurance broker, collection, and resources manager. The company included those wholly-owned subsidiaries in its consolidated financial statements for the second quarter of 2021.

The article explains how you can buy Banco Inter stock and provides insights into the bank’s business and financials to help you make an informed investment decision.

How to Buy BIDI11 Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Banco Inter

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About Banco Inter

Understanding the history, business strategy, revenue sources, and recent performance of the company will enable you to make better investment decisions based on important information about the company. The following sections discuss the details about Banco Inter that you should know before investing in its stock.

Banco Inter’s History

The company was founded with the name Intermedium Financeira or Banco Intermedium in 1994, in Belo Horizonte, Brazil. Between 1999 until 2007, the company was involved in corporate credit, real estate credit, and payroll loan operations. The company acquired a multiple banking licence from the Central Bank of Brazil in 2008. In 2012, the bank created Inter Seguros, the insurance arm of the company, and became its parent company - Inter Group. In the following years, several other subsidiaries were also formed to carry out specialized functions.

In 2015, the bank entered retail banking and launched its first 100% free digital checking account that served as a complete and integrated financial services platform. In 2016, the bank expanded its digital account by launching foreign exchange operations, a digital app, and different cards under the Mastercard brand. In the same year, the company achieved a milestone of 80,000 digital customers.

In 2017, the company renamed its brand Banco Inter with a new vision to simplify the lives of its customers. In the same year, the company’s digital customer base saw a 4.6-fold increase from 2016 and reached 370,000. The company went public on April 30, 2018, on the B3 stock exchange, and the company closed the year with 1.4 million digital customers.

In 2019, the bank raised R$1.2 billion as SoftBank became a strategic partner by acquiring a 10% stake in the bank. In 2020, the bank acquired DLM Invista, an insurance company, to provide insurance services to its customers. The company internalized payment processing functionality and entered into partnership agreements with various big retailers to provide digital shopping facilities to its customers. The activity helped the bank achieve R$30 million in Gross Merchandise Value (GMV) in 24 hours of the campaign launch. The company also raised another R$1.2 billion in its secondary offering to fund potential mergers & acquisitions and launch new products. By the end of Q4 2020, the bank had 8.5 million digital customers.

What Is Banco Inter’s Strategy?

Banco Inter aims to change the banking industry by doing away with the traditional way of setting up physical branches, paperwork, long queues, and bureaucratic culture. For this purpose, the bank’s management focuses on innovation to continuously improve and optimize the digital platform for meeting the latest requirements of the customers. The management intends to focus on five major growth areas - daily banking, digital shopping, investments, insurance, and credit - which will promote growth in the bank’s customer base, service and financial intermediation revenues.

The digital setup places the bank at a competitive advantage in terms of low operating costs, which allows it to scale and have a high reach. The simplicity and the value-addition the company’s digital platform offers to its customers should help the bank acquire new customers and retain the existing ones.

In short, the management focuses on innovation, aims to provide complete solutions to customers, takes advantage of the low operational costs to scale the business, and strives to provide an excellent customer experience to make loyal clients.

How Does Banco Inter Make Money?

Banco Inter divides its operations into seven segments that contribute to its revenues. The segments include Banking, Marketable Securities Distribution, Insurance Brokerage, Marketplace, Asset Management, Service, and Investment Funds.

The banking services segment derives revenues from credit and debit cards, loans, advances to customers, and services provided through Inter's mobile application. The Marketable Securities Distribution and Asset Management segments generate revenues from commissions and management fees charges for handling investors' portfolios.

Revenues from the Insurance Brokerage segment include brokerage commissions on the sale of life, equity and vehicle insurance, consortia, pension funds, and others. The bank’s Marketplace segment generates commissions from sales through its online digital platform. The Service segment generates revenue from the development and licensing of customized and non-customized computer programs, technical support, maintenance, and other IT services.

How Has Banco Inter Performed in Recent Years?

Banco Inter’s common stock (BIDI3) generated an all-time return of around 110% as it rose from 9.66 BRL to 20.28 BRL between July 19, 2019, and September 24, 2021. The stock attained its highest point of 27.51 BRL on July 16, 2021.

Banco Inter SA (Common Stock - BIDI3), Source: Google Finance

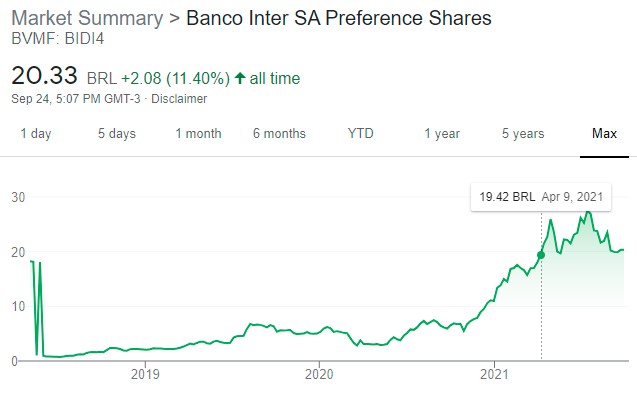

The company’s preferred stock also trades on the stock exchange and registered an all-time return of 11.4% since its inception on May 11, 2018, until September 24, 2021. The stock started from 18.25 BRL and is trading at 20.33 BRL at the time of writing.

Banco Inter SA (Preference shares - BIDI4) Source: Google Finance

Brazilian units (BIDI11) also trade on the stock exchange and have delivered a cumulative return of 329% since its inception. The per-unit price was 14.22 BRL on July 19, 2019, and the price has risen to 61.08 BRL at the time of writing.

Banco Inter SA (Brazilian Units - BIDI11) Source: Google Finance

Where Can You Buy Banco Inter Stock?

You can buy Banco Inter stocks by opening an account with a stockbroker. Other than the basic cash account, brokers also offer margin accounts, CFD accounts, and other specialized investment accounts. You need to have the full amount of cash in your account to initiate any trade. Margin accounts, on the other hand, allow you to open large positions using borrowed money from your broker. If you intend to hold stocks for the long term, you need to use your own cash to buy shares instead of using leverage.

Banco Inter Fundamental Analysis

Fundamental analysis involves interpreting various financial metrics of a company to determine the fair value of its stock. The most common factors that investors analyze include price-to-earnings ratio, revenue, earnings, earnings-per-share, dividend yield, and cash flow.

Banco Inter’s Revenue

Revenue denotes the value of goods or services a company sold during a particular period. Companies that register consistent growth in revenues can improve their profitability and raise their stocks. The revenue figure can be found on the Income Statement that comes as part of the periodic financial statements issued by the company.

Banco Inter reported total revenues of R$ 638.7 million for Q2 2021.

Banco Inter’s Earnings-per-Share

The earnings-per-share or EPS denotes the amount of earnings available for each share outstanding. The EPS can be calculated by first deducting the preferred stock dividends (if any) from the net profit, which will give us the net profit available for common stockholders. The resulting figure, when divided by the average number of outstanding common shares, gives us the earnings per share. If a company reports a net loss, the resultant figure would be negative and will represent loss per share. For example, if a company reported a net profit of $100 million and the average number of common shares outstanding were 10 million, the EPS would be $10.

In its Q2 2021 report, Banco Inter reported consolidated EPS of R$ 0.04494.

Banco Inter’s P/E Ratio

The price-to-earnings ratio or P/E ratio determines the price of a share in relation to its earnings per share. For example, a share that is trading at $50 and has EPS of $5 would have a P/E ratio of 10x, which means the stock is trading at 10 times its earnings per share. The P/E ratio is usually reported on a trailing 12-month (TTM) basis, which takes into account the earnings per share of the previous 12 months and uses the stock’s current market price for calculating the metric.

Banco Inter’s TTM P/E at the time of this writing is 1,736x.

Banco Inter’s Dividend Yield

Dividends represent the cash amount paid out to its shareholders by the company from its profit. The board of directors is authorized to declare the amount of dividends as they deem fit based on the dividend policy of the company. You need to hold the stock of the company before the ex-dividend date to be eligible for the dividends declared by the company.

Dividend yield can be calculated by dividing the annual dividends paid per share by the stock’s market price. For example, if a stock paid $10 annually as dividends and its current market price is $100, its dividend yield would be 10% ($10/$100).

Banco Inter paid R$ 0.013589821 and R$ 0.012084364 per share in March and June 2021. Banco Inter’s dividend yield at the time of writing is 0.22%.

Banco Inter’s Cash Flow

The free cash flow of a company shows the amount of free cash available after deducting operating and capital expenditures. Companies with high free cash flows generate high cash flows from their core activities and can spend cash on new projects. Free cash flow differs from the cash & cash equivalents figure that appears on the Cash Flow statement, and it denotes the amount of cash available at a particular time.

Banco Inter had cash & cash equivalents of R$5.69 billion as of 30 June 2021.

Why Buy Banco Inter Stocks?

Banco Inter has plenty of positive points that you should consider while analyzing the fundamentals of the stock:

- It operates digitally, has low operating costs, and shortens the service delivery time due to its excellent customer service. This puts the bank in a position to scale its services even further.

- The bank has been consistently registering growth in its revenue and gaining customers since 2015, which shows the customers’ trust in the bank’s services.

- The bank first paid dividends in 2018, and since then, has consistently been paying out dividends to its shareholders. The bank’s common stock and units (the equivalent of 3 common shares) generated healthy returns, which means that the stock can provide investors with long-term returns along with dividends.

- The bank has been rapidly diversifying its services to different areas, which reduces the volatility in its revenues as it makes the bank less reliant on revenues from one segment.

Expert Tip on Buying Banco Inter Stock

“ Banco Inter stock provides you with an opportunity to earn dividends in addition to capital appreciation. The bank is still in its early stages of growth with a promising start, and you can consider including high-growth stocks such as Banco Inter in your portfolio to accelerate your returns. However, you should allocate only a portion of your total funds in the stock as buying large quantities of the stock at once can expose you to high risk. If you want to open a short-term position, you should look at the price action, note down any short-term triggers, and secure your trade by employing risk management principles. However, you can potentially earn higher returns by holding the stock for the long term and become a part of the growth story of the bank. ”

5 Things to Consider Before You Buy Banco Inter Stock

Analyzing the company’s fundamentals can provide you with useful insights into its financial health. But if you complement your analysis with the following 5 tips, you will become more confident with your investment decisions.

1. Understand the Company

You should begin your investment proposition with a thorough understanding of the company’s business model, revenue sources, competitive environment, fundamentals, key price drivers, and other factors. The knowledge of these factors will drastically improve your investment prowess and help you select the right stocks for your portfolio.

2. Understand the Basics of Investing

The basics of investing and stock trading are critical to your success as an investor or trader. You should be familiar with the concept of creating a well-diversified portfolio of stocks that reduces your investment risk. In other words, you should not put all your money in a single stock but, instead, spread your investments across different stocks - preferably from different or unrelated sectors. If you are into short-term trading, you should always employ risk management techniques to protect your capital.

3. Carefully Choose Your Broker

Choosing the right broker can make a huge difference to your trading performance. Your broker should provide you with the following features that will aid you in your investment and trading decisions and improve your performance.

- Should be registered with and regulated by the local authorities, which will ensure that your capital remains safe.

- Should charge low commissions, fees, or spreads, which will lower your trading costs.

- Should provide you access to an advanced online trading platform that can be used across all operating platforms and mobile devices.

- Should provide easy and fast deposit and withdrawal methods.

4. Decide How Much You Want to Invest

If you find a lucrative investment opportunity, it is important not to get carried away by your emotions. A more sensible approach is to buy the stock in small quantities periodically to lower your average cost of holding the asset. If you are using leverage to buy stocks for short-term gains, you should ensure that you don’t open a trade big enough to wipe your account even with the minor market moves against you. Instead, you should calculate the optimal trade size so that you only risk 1% or 2% of your account on a single trade and your gain/loss per tick is at manageable levels.

5. Decide on a Goal for Your Investment

Your investment strategy depends on your investment goal. An aggressive goal that requires you to achieve high returns in less time needs an aggressive and high-risk strategy, whereas a conservative goal with modest returns in a reasonable time can be relatively easier to achieve and may require a less-riskier investment strategy. An investment goal should be realistic and practicable so that it could be achieved by assuming risk within the tolerable levels.

The Bottom Line on Buying Banco Inter Stocks

Banco Inter is a digital bank that has been registering a consistent rise in customers since 2015. The company is focusing on multiple revenue sources, for which it has made strategic acquisitions and intends to acquire more businesses that can have a positive impact on its revenues. The company’s business model entails low operational costs, provides one-stop digital banking and non-banking solutions, which makes it better suited for scalability and growth.

If you want to buy Banco Inter stock, you need to open an account with a stockbroker. Most brokers allow you to open an account remotely by filling out an online form and uploading your identity documents, such as proof of residence and proof of identity. Most brokers usually take two to three business days to open your account after verifying your credentials. After your account is created successfully, you can fund your account using any of the popular deposit or withdrawal methods.

If you want to explore other exciting companies and stocks, you can read more articles on our websites that cover hundreds of interesting and successful companies and provide in-depth information about the companies to facilitate your investment decision.

Frequently Asked Questions

-

A conventional bank has physical branches and involves plenty of paperwork just to open an account, and other bureaucratic procedures. In contrast, Banco Inter is a digital bank that aims to simplify banking, eliminate the need for physical branches, and provide banking and non-banking services to its customers in a more convenient way.

-

Banco Inter stock is a growth stock with its revenue and customer base rising significantly for the past years. The bank has diversified sources of revenue as it has expanded to other businesses to provide a one-stop digital solution to its customers. The robust and aggressive business model of the bank can drive further growth in the stock.

-

As an investor, you might realize long-term returns as the bank continues to generate healthy growth in revenues, its customer base, and make new strategic acquisitions. The stock also pays regular dividends, so you can possibly generate capital gains, along with cash dividends by investing in Banco Inter stock.

-

To determine whether Banco Inter stock is cheap or expensive, you need to analyze different fundamental metrics, such as the P/E ratio, PEG ratio, and compare the ratios with other stocks in the industry.

-

Banco Inter has three types of stocks with different scrip symbols: BIDI3 (Common shares), BIDI4 (Preference shares), and BIDI11 (Units- the equivalent of three common stocks). All three types of stocks trade on the B3 stock exchange, and you can buy any of them.

-

Yes, Banco Inter is regulated by the Central Bank of Brazil.