How to buy BioNTech stocks in 2025

Biopharmaceutical New Technologies (BioNTech SE) is a German biotechnology company that develops immunotherapy drugs using mRNA to treat cancer and produces vaccines against infectious diseases. The four major classes of immunotherapy drugs produced by the company include mRNA therapeutics, cell therapies, antibodies, and small molecule immunomodulators.

In 2020, BioNTech partnered with the U.S biotech company Pfizer to jointly manufacture the anti-Covid-19 vaccine, conduct its clinical trials, and provide logistics support. The co-developed vaccine was marketed as Comirnaty and is commonly known as the “Pfizer-BioNTech COVID-19 vaccine”. As of July 2021, more than 1 billion doses of the vaccine have been shipped to more than 100 countries, while 2.2 billion more doses are to be delivered by the end of 2021, along with another 1 billion for 2022.

The article guides you on how you can buy BioNTech stock and provides important information about the company’s business and fundamental metrics.

How to Buy PFE Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in BioNTech

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About BioNTech

You should know the company’s history, strategy, revenue sources, recent performance, among other details, before investing in its stock to find out if it’s the right asset for your portfolio and strategy. The following sections mention important facts about the BioNTech company and its business.

BioNTech History

BioNTech was founded on the 2nd of June 2008. The company listed its ADSs (American Depositary Shares) on the Nasdaq Global Select Market on the 10th of October 2019 under the ticker BNTX at the price of $15 per share. The biotech company raised around $150 million from the offering.

In addition to its headquarters, the company has several sites in Mainz, Germany. The company’s North American headquarters are located in Cambridge, Massachusetts, which also serves as its research centre together with its San Diego office.

BioNTech SE has many subsidiary companies that are based in various locations and perform specialised tasks. BioNTech Innovative Manufacturing Services GmbH, BioNTech US Inc., BioNTech Small Molecules GmbH, BioNTech Delivery Technologies GmbH, BioNTech Cell & Gene Therapies GmbH, and BioNTech Diagnostics GmbH are some of its subsidiaries.

What Is BioNTech’s Strategy?

BioNTech makes strategic alliances and collaborations to develop vaccines and pharmaceutical products. BioNTech signed a Collaboration and License Agreement with Sanofi for developing intratumorally-administered mRNA-based therapeutics for treating solid tumours.

In addition, the company also entered into collaboration agreements with different biotech companies worldwide, such as Pfizer for Covid-19 and influenza vaccines, Fosun for Covid-19 vaccine in China, Genentech for iNeST mRNA drug, Genmab for checkpoint immunomodulator antibodies drug, and Genevant for rare disease protein replacement treatment.

The company also acquired in-licensed third-party patents and intellectual property licenses that synergise with the company's capabilities. Accordingly, the company has entered into in-licensing arrangements with TRON, Louisiana State University and MRT-CellScript. Due to the company's blockbuster revenues from the sale of its Covid-19 vaccine, the company intends to invest the cash into developing other therapeutic products.

How Does BioNTech Make Money?

BioNTech generates revenues from its research & development collaborations with other companies and commercial sales. Revenues from R&D collaborations entail product development through different approaches, such as revenue and/or cost-sharing, co-development and co-commercialization, or any other mutually agreed approach.

In Q2 2021, the company earned a total of €28 million from its R&D collaborations with other companies, which includes €13.3 million derived from collaboration with Genentech Inc, €14.3 million from Pfizer Inc., and €0.4 million from others.

The second source of revenue is commercial revenues, which include Covid-19 vaccine sales. In Q2 2021, the company generated a hefty €5.26 billion revenue from sales of its Covid-19 vaccine. Out of the €5.26 billion commercial revenues in Q2 2021, the company generated €4.09 billion from its share of collaboration partner's gross profit and sales milestones, whereas €1.03 billion of the revenue came from direct Covid-19 vaccine sales in Germany.

How Has BioNTech Performed in Recent Years?

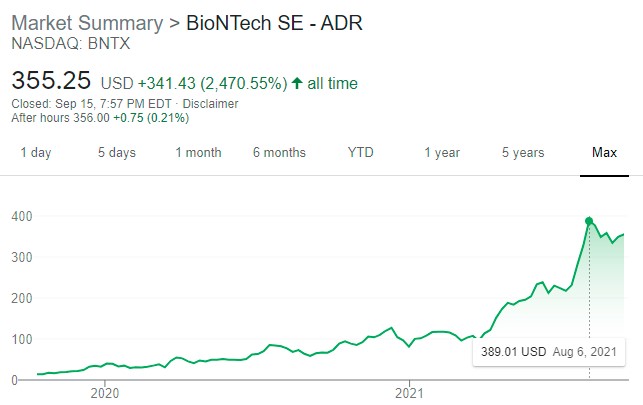

BioNTech initiated its foray into the stock market at $15 per share on the 10th of Oct 2019. It has been climbing since then to reach its highest mark of $389.01 on the 6th of August 2021. The shares have so far generated a cumulative return of 2,470% to date since its IPO.

Source: Google Finance

Where Can You Buy BioNTech Stock?

You need to open an equity account with a stockbroker to buy BioNTech stock, which is listed on the NASDAQ stock exchange. Brokers offer different types of accounts, such as cash account, margin account, CFDs account, and specialised investment accounts. The right one depends on your needs, experience, and skills.

BioNTech Fundamental Analysis

Fundamental analysis is used by savvy investors to determine the intrinsic value of the stock in relation to its market price. While you can analyse a stock more deeply, examining the most common fundamental metrics, such as price-to-earnings ratio, revenue growth, earnings per share, dividend yield, and free cash flow, can give you a reasonable idea about how the company is performing.

BioNTech’s Revenue

Revenue is the first or top-most item on the income statement and denotes the income generated from selling its goods or services during a given period. Revenue is also sometimes called the top-line.

Companies vie to increase their total revenue by increasing existing revenue sources or by diversifying their businesses to earn additional revenue. Investors often search for companies that consistently depict high revenue growth in each reporting period. A higher revenue can result in a higher net profit, provided the expenses are kept under control.

BioNTech reported revenue of €5.3 billion in Q2 2021, which is a meteoric rise of 12,630% in comparison with just €0.41 billion in Q2 2020. The hefty rise in revenue resulted from the company’s Covid-19 vaccine sale, from which it derived €5.2 billion during the quarter.

BioNTech’s Earnings-per-Share

The earnings per share of a company represent the amount of profit attributable to each outstanding share of common stock. The measure can be calculated by dividing the net profit and subtracting any dividends announced for preferred stockholders. The resulting figure is then divided by the average number of common shares to arrive at the EPS figure.

Earnings-per-share or EPS is reported in two forms: basic and diluted. The measures differ in the denominator calculation, which is the average number of common stock outstanding. When calculating the diluted EPS, the denominator is adjusted to include any convertible stocks, employee stock options, and warrants in the average number of common stocks, which reduces the EPS figure (dilutes EPS).

Typically, the EPS can be found at the bottom of the income statement. BioNTech reported basic and diluted EPS of €11.42 and €10.77, respectively, for Q2 2021.

BioNTech’s P/E Ratio

The price-to-earnings ratio or P/E ratio measures a stock’s market price in relation to its earnings-per-share. For example, a stock with a P/E ratio of 10 means that its market price is ten times the earnings or profit available for each share.

The P/E ratio can be used to determine whether a stock is trading at a premium or discount compared to its peers in the industry. However, investors should not solely base their buy or sell decision on the P/E metric alone and must use other metrics to corroborate their findings.

Most investors find a stock’s P/E ratio on a trailing 12 months (TTM) basis, which takes into account the earnings of the previous 12 months and the stock’s current price. The TTM P/E ratio changes each day with the change in the stock’s market price. The BioNTech TTM P/E ratio as of 15th of September 2021 was 18.65x.

BioNTech’s Dividend Yield

Dividends are cash payouts made by the company to its shareholders. The company’s board of directors declare the cash amount of dividends per share or skip dividends altogether. This information is presented in the company’s dividend policy.

To be eligible for dividend payments, you need to own its shares before the ex-dividend date. On the ex-dividend date, the stock price falls by the amount of dividends paid to dissuade investors from getting an undue advantage by purchasing stock at the last moment just to get the dividends.

Dividend yield determines the annual dividends paid per share as a percentage of the stock’s price. For example, a stock pays $5 per share annually as dividends, and the stock’s price is $50. Its dividend yield would be 10%. In other words, the stock generated a 10% return as dividends based on its current market price of $50.

BioNTech stock is a growing company and has not paid any dividends to its shareholders since its listing in October 2019 until this writing in September 2021.

BioNTech’s Cash Flow

The cash flow shows the company's cash inflows and outflows based on operating, financing, and investing activities. If a company generates positive cash flows from operating activities, you can find the free cash flow by deducting capital expenditures from net cash flows from its operating activities.

The statement of cash flows allows you to find the current position of its cash & cash equivalents. Negative cash flows from operating activities would mean that the company does not generate sufficient cash from its operations, so it needs to borrow funds from external sources to cover its expenses.

As of June 30, 2021, the company had cash & cash equivalents of €914 million compared to €573 million on June 30, 2020.

Why Buy BioNTech Stocks?

BioNTech enjoyed tremendous success after it co-developed the Covid-19 vaccine, Comirnaty, with Pfizer. Here are some of the reasons why you might consider buying BioNTech stock:

- BioNTech is a growth company with over 20 product candidates in its pipeline that are at various stages of development. Successful approval of a product can improve its profitability and generate further lucrative business opportunities for the company that can lift its stock.

- Pfizer and BioNTech have already signed agreements to supply over 2.2 billion vaccine doses by the end of 2021 and another 1.1 billion by the end of 2022. The vaccine revenue will likely grow until the end of 2022, which can help the company invest in R&D to develop new products, leading to stock appreciation.

- The company’s strategy of targeted in-licensing, strategic collaborations, and mergers & acquisitions can expand and accelerate its immuno-oncology pipeline as it did by joint collaboration with Pfizer, which can be a positive for BioNTech stock.

Expert Tip on Buying BioNTech Stock

“ You may want to open a long-term position in the stock as the company has shown its capabilities and enjoyed immense success in developing the Covid-19 vaccine. You need to follow the company, watch the results of its product pipeline, and observe the company's strategic acquisitions or collaborations to predict the stock price movement. Although the stock doesn't provide dividends, you can have significant capital appreciation if you build your positions on the dips or by opening short-term positions at the time of any major development. ”

5 Things to Consider Before You Buy BioNTech Stock

You should consider the following important tips before buying BioNTech stock:

1. Understand the Company

A company’s business model, revenue sources, strengths, risks, and competitive environment are some of the important areas that you must understand to predict the outlook of a company. You should know the key drivers of the stock so that you can make correct and timely decisions on buying and selling the asset.

2. Understand the Basics of Investing

Understanding and applying the basic principles of investing before making investment decisions can drastically improve your returns. One of the core investing basics is to create a well-diversified portfolio that will lower your investment risk as well as provide you with a chance to generate significant returns. If you are into short-term trading, you should employ risk management techniques, such as putting a stop-loss order in each of your trades. By employing risk management strategies, you can protect your capital while giving yourself a chance to generate higher profits.

3. Carefully Choose Your Broker

Selecting the right broker can have a significant impact on your trading performance. A quality broker should provide you with the following features:

- Access to a robust and advanced trading platform

- The trading platform should provide you with a mobile trading app and work across all operating platforms and devices.

- Charge low trading commissions and spreads, which will lower your trading costs.

- Be regulated by the local regulatory authorities to prevent yourself from getting defrauded.

- Provide you with popular deposit and withdrawal methods.

4. Decide How Much You Want to Invest

One of the basics of investing is to allocate the right amount of money into each investment option. Aim to create a balanced portfolio that will not only reduce your risk but also provide you with an opportunity to increase your gains. A portfolio tilted towards particular stock can give you higher returns but at the cost of exposing you to a higher risk. If you are a short-term trader, you should calculate your trade size to limit your risk and keep your profit and loss per tick at manageable levels.

5. Decide on a Goal for Your Investment

Your investment goal will set a direction for your investment strategy. Your investment goals should be realistic. Keep in view your current financial position, age, risk tolerance, investment horizon, and investment options. If you set an unreasonably high goal - say doubling your investment in a year - you will have to indulge in high-risk trading. On the other hand, aiming to generate market returns is much more reasonable and can be achieved by taking moderate risks.

The Bottom Line on Buying BioNTech Stocks

BioNTech has plenty of positives that have been pushing its stock upwards. The company generated hefty cash from the sale of its Covid-19 vaccine worldwide, which contributed to the massive rise in its stock price. The windfall funds it received from the vaccine sales will help its R&D endeavours by making collaboration agreements and acquisitions.

If you want to buy BioNTech stock, you should open an account with a stockbroker. Most brokers allow you to open your account online by filling out a form and uploading your identity documents, such as proof of identity and proof of residence. If there is no discrepancy in your documents, your account will be opened within three business days in most cases. You can then fund your account using any popular deposit method, such as Paypal, credit or debit card, and wire transfer.

If you want to explore other stocks for investment purposes, you can browse the extensive list of educational material on our website to find other interesting stocks.

Frequently Asked Questions

-

Apart from the Covid-19 vaccine that BioNTech co-developed with Pfizer, the company generates money from R&D collaborations with third parties. The massive revenues from the vaccine sales have dwarfed its gains from other products, and the company must develop new products to increase its low revenues from the collaborations. So far, the company has not been able to have a substantial or ground-breaking success other than the Covid-19 vaccine.

-

BioNTech company, like any other company, has its unique positive and negative points. It’s a growth company that has shown a promising start by generating massive revenues from Covid-19 vaccine sales in collaboration with Pfizer. The company and its investors have been rightly rewarded with around 2,500% cumulative return within two years of its IPO on the stock market. While you can invest in large and established biotech companies like Pfizer, BioNTech can give you a chance to ride its growth as interesting products are still in its pipeline.

-

BioNTech needs funds for carrying out R&D activities to roll out new products. Because the company is in its growth phase, it uses its revenues to make strategic acquisitions and develop new therapeutic products instead of paying out dividends to its shareholders. However, its shareholders can realise capital gains as the company’s stock rises.

-

BioNTech has more than 20 upcoming products in its pipeline in various development stages. Further, the company’s Covid-19 sales are likely to support its revenues until the end of 2022. Strategic acquisitions and collaborations, if proven successful like the Covid-19 vaccine, can drastically increase its revenues and open new business avenues that can lift its stock.

-

BioNTech stock can provide you with various short-term trading opportunities if you closely follow the company and industry-specific developments. You should keep yourself updated about the results of the clinical trials and development stages of the products, which can move its stock price. In the absence of any external or internal catalysts, trading the stock using technical analysis is always feasible.

-

Savvy investors hunt growth stocks that have strong fundamentals and have already shown initial success. BioNTech is one such company that has achieved early success in developing the Covid-19 vaccine that resulted in windfall profits for the company. The company is also fundamentally strong, with plenty of subsidiary companies carrying out specialised tasks, which can help investors realise long-term gains in the absence of dividends.