How to buy Carrefour stocks in 2025

Carrefour is a multinational retail company based in Massy, France. It is the world's eighth-largest retail corporation with a market capitalisation of 12.63 billion as of 2021. Having a chain of hypermarkets, convenience, and grocery setups, the company ensures its global presence through more than 12,000 stores in 30 countries. The company's primary markets include Europe, South America, North Africa, Middle East, South and East Asia.

Revolutionising the consumption industry, the company aims to become the preferred choice of every household under the command of Alexandre Bompard (Chairman and CEO). Thus, it is not surprising that Carrefour can be the right pick if you aim to build a stable portfolio. The following sections introduce you to everything you need to know to make a well-informed decision.

How to Buy CRERF Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Carrefour

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About Carrefour Stock

Carrefour’s History

Carrefour's history traces back to the company's foundation in 1959. Marcel Fournier is the visionary man behind the opening of the first hypermarket in 1963 in France.

Since then, Carrefour has kept its pioneering spirit and reinvented itself. To enhance its operations and raise more funds, the company was listed on the domestic stock exchange in 1970. Over the next decade, the company launched a pass card in 1981, witnessing 200,000 clientele subscriptions and recording 4 million transactions.

Following multiple acquisitions, Carrefour continued expanding internationally and became the world's second-largest retail business by the end of the 20th century. Amid stagnant growth and increased competition, the company came up with a new concept of introducing Carrefour Planet in Western Europe and planned to invest $2.1 billion in May 2011.

After celebrating its 50 years of excellence in 2013, the group also stepped into the e-commerce industry in 2016. The company's board of directors appointed Alexandre Bompard as chairman and CEO of Carrefour on the 9th of June 2017.

Although the company's profit substantially dropped last year amid the pandemic crisis, it still performed pretty well in the retail sector and online sales.

What Is Carrefour’s Strategy?

Carrefour has been improving its business model to benefit all stakeholders, including customers, partners, producers, governments, and not-for-profit organisations. The group does its best to adapt to changing consumer and producer expectations.

The company intends to set up an ecosystem to provide consumers with locally produced healthy food at fair prices. It also aims to offer farmers justified compensation while providing workers with stable employment.

Carrefour focuses on four primary areas:

- Improvement of the organisation's agility while keeping end-users in mind;

- Progress regarding the quality of the food offering;

- Appraisement of productivity and competitiveness;

- Establishment of an industry-leading omnichannel ecosystem.

How Has Carrefour Performed in Recent Years?

With a reported EPS of €1.23, the company stock traded around €16.59 as of June 30, 2021. Compared to the stock price before the pandemic, the company witnessed a substantial decrease in its share value, dropping from €17.15 to €12.33 between September 2019 and March 2020.

However, despite this considerable reduction, the company performed pretty well in 2020. In addition to witnessing a significant increase in its revenues, it hit an all-time-high stock price of €17.75 as of 13th of January 2021.

With some volatility, the stock price kept hovering between €17.00 to €17.60 over the past eight months. In September, the stock price fell below €15.00. As of this writing, the stock price strengthens around €15.56. The firm anticipates multiple cost-saving programs and aims to generate an extra €1 billion this year.

Where Can You Buy Carrefour Stock?

Carrefour listed its shares on the Paris stock exchange under the ticker CA. You can buy the company's stock via an online brokerage firm. There are two types of brokerage firms available in the market: full-service brokers and discount brokers. Depending upon your preference, you can set up a live funded trading account with any of these brokers to get started.

While full-service brokers are a little more expensive than discount brokers, they are considered more competitive. Besides allowing you to buy the company's shares, they also act as financial advisors. Some companies like Carrefour also offer direct subscriptions. Instead of using a financial intermediary, you can buy shares directly from the company's authorised Société Générale Securities Services (SGSS). Alternatively, you can confirm from your bank whether it deals in company stocks.

Carrefour Fundamental Analysis

Fundamental analysis is a method of ascertaining a stock's fair value. Using multiple micro and macro factors, fundamental analysts tend to determine if the company's stock is overvalued or undervalued. Investors are mainly concerned with the return on equity and a company's potential to grow in the future. Therefore, they primarily look for revenue, earnings-per-share, dividend yield, and profit margins. Let's quickly go through each variable and understand how they offer valuable information to investors.

Carrefour's Revenue

Revenue is the sales proceeds of a business against the products and services. It is the unadjusted business income that includes all the relevant expenses incurred during the sales. Typically, it appears on the top of a company's income statement. To find out a company's gross profit, we need to deduct direct expenses. After that, we can subtract all the indirect costs to figure out a company's net profit or loss. Given below is a table showing Carrefour's revenue for the past years.

Source: Yahoo! Finance

Carrefour sales increased by 7.8% last year. According to the company, it was its best performance over the past two decades. With a revenue hitting €72.1 billion, the company witnessed massive growth in almost all markets and store formats worldwide.

Including the hypermarkets, Carrefour convenience stores and supermarkets did an outstanding job in the company's home country – France.

While the company grew by 8.3% in Belgium, the subsidiary in Spain witnessed a growth of 7.1%. However, the company's domains in Italy and Poland observed a decline in annual sales, which led to its overall profits falling by nearly 43%.

Not to mention, the company also enjoyed massive success in the e-commerce industry since its online sales amounted to €2.3 billion in 2020. With an impressive growth rate in sales of organic products, the company plans to hit €4.2 billion online sales by the end of 2022.

Carrefour's Earnings-Per-Share

Investors may also wish to calculate the company's earnings-per-share since it helps them know how much return the company can offer on each share. The formula is simple. You can divide the company's net income by the average number of total outstanding shares. The stock of companies with higher EPS values is likely to be more expensive since investors willingly pay higher prices anticipating higher returns. Carrefour's EPS stood around 0.34 as of the second quarter of 2021.

Carrefour's P/E Ratio

The price-to-earnings ratio enables investors to compare the market value of a company's stock to its earnings. It helps them know if the company's stock is reasonably worth its price. Finding the P/E ratio of a company is critical since it allows you to determine its performance over a given period.

Further, if the company seems to be underperforming, it can provide you with an idea of how long the company would take to pay back your investment. Investors can find the P/E ratio of a company by dividing the stock price by EPS. While the company's quoted share price is around 15.46, having a trailing 12-month EPS of 1.19, the firm P/E ratio is 12.96.

Carrefour Dividend’s Yield

A dividend yield is an annual payment made to shareholders expressed as a percentage of the company's current share price. For instance, if an organisation pays a $0.01 annual dividend and its stock price is $1, its dividend yield is 1%.

Companies can have different policies concerning dividend payments. While some companies pay interim and annual dividends, others distribute their profits every quarter. Not to mention, dividend disbursement is also subject to the company's profitability. An organisation can choose not to pay any dividend. However, the company putting dividend payments on halt can lose the interest of shareholders.

In general, established companies have a low dividend yield as compared to the companies in their struggling phase. Carrefour pays dividends once a year. The company paid a dividend of €0.48 per share for the fiscal year 2020 in May 2021. The firm has been consistent with dividend payments since 1998.

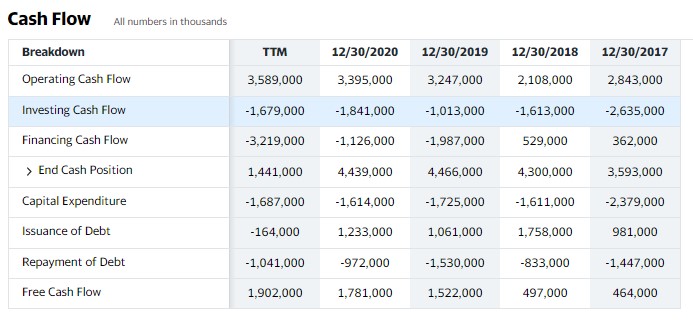

Carrefour’s Cash Flows

There is a financial statement that summarises all cash inflows from a company's both internal and external sources. It also reflects all cash outflows of a company that occurred for business and investment activities over a specific period. The cash flow statement helps investors to determine the liquidity of a company.

A business needs to be sufficiently liquid to meet immediate debt obligations and carry out operational activities. Once a company is done with its current obligations, it may use the available free cash flows for investment purposes or decide to pay dividends. Carrefour cash flows seem to have been consistently improving over the past five years.

Source: Yahoo! Finance

Why Buy Carrefour’s Stock?

One of the prime reasons investors should consider buying Carrefour's stock is its consistency regarding dividend payments. Secondly, the company's free cash flows have shown a steady increase despite the company's profit falling by 43% last year. That means the company still stands strong to meet its current liabilities.

Despite the pandemic, the company did exceptionally well in the retail sector and e-commerce. It also anticipates massive growth in its online sales by the end of 2022. The stock price of the company has been trading above €14 since the beginning of 2021. Analysts believe that the company's stock might continue to rise.

According to the world's most popular investment research firm Zack, Carrefour's VGM score is A that also shows the company is well-suited for value investors. However, before investing your money in Carrefour or any other company, you must do your own due diligence.

Expert Tip on Buying Carrefour's Stock

“ Carrefour provides many consumer staple products and has expanded in many countries around the globe. This stock could be seen as extra protection during crises, as its performance is bound to remain high even during economic downturns. This is because the hypermarkets provide supplies and food for daily necessities. Thus, Carrefour can be a relatively safe asset, especially when coupled with risk and money management techniques, and its revenue is more diversified than a domestic company. ”

5 Things to Consider Before You Buy Carrefour Stock

1. Understand the Company

Understanding the company is probably the most crucial element before investing your stake in it. You ought to consider various external and internal factors to make a decision. Always commit sufficient time to research the company. Learn about its business model and explore the company's plans for the future. It will help you assess how the company might perform over the months and years to come. Looking for any competitive advantage that the company may have over its rivals may also help. Ideally, your investment decision should come from thorough technical or fundamental analysis. Essentially, picking a stock based on your likings or social media trends can't be a wise decision.

2. Understand the Basics of Investing

Getting yourself familiarised with the basics of investment is also essential. Remember, stock investment is different from trading or saving. Stocks are relatively less volatile than other investment vehicles, but can sometimes appreciate or lose their value all of a sudden for various reasons, including price manipulations. Therefore, avoid investing too much in a single stock. Always have a workable trading strategy at hand, and do not forget to employ various risk management tools.

3. Carefully Choose Your Broker

Broker selection is yet another significant element of investment. Start with checking the regulatory status of your prospective broker. It should hold a license from the regulatory authority in your region, such as ASIC, CySEC or FCA. Regulated brokers are generally more reliable than others since they employ increased security measures and are likely to remain fair in all aspects amid compliance with regulations.

Choose a broker that offers a user-friendly platform. Undoubtedly, making the correct transactions could become problematic with a complex interface, especially for newbies. Also, make sure that the broker provides all the basic and advanced trading tools needed for a meaningful experience. Not to mention, your prospective brokerage firm should be offering round the clock customer support.

4. Decide How Much You Want to Invest

It is essential to determine your risk tolerance level accompanying the maximum funds you could spare for investment purposes. Based on the availability of funds and your risk appetite, you can decide which stock to buy. However, avoid investing a large portion of your capital in a single stock. To decrease your risk exposure, you can create a portfolio containing Carrefour stock, along with other stocks and various asset classes, such as bonds.

5. Decide on Goal For Your Investment

Usually, investment is associated with achieving long term financial goals instead of merely looking for short-term profits. Therefore, you must understand the risk and reward that comes in either case. For example, if you wish to save for your retirement, you should be willing to invest in a company's stock for extended years. Besides receiving dividend payments, you can expect an increase in your wealth over time due to capital appreciation.

The Bottom Line on Buying Carrefour Stocks

Carrefour seems to put more effort into improving the company's performance, and results so far have been satisfactory. While the firm's free cash flows are on the rise, it plans to buy back nearly 5% of its outstanding stock this year. Not to mention, the company is considering re-investing in itself.

The retailer also anticipates cutting costs of around €2.4 billion, which might further help the company stabilise and compensate for the loss incurred amid the pandemic. In short, the company can be a good choice for investment provided its long-term strategy turns successful.

If you think carrefour stock can be a good fit for your investment portfolio, buying it is pretty straightforward. Open an account with a broker of your choice and initiate the trade.

However, if you still need more time to decide, that's fine as well. Do plenty of research and read through expert analysis on the company. You can also check out many other guides about investing on our website.

Frequently Asked Questions

-

Opening an account with most brokers doesn't take more than a couple of minutes. However, the KYC (Know Your Customer) process could take between a day or two as you need to upload your ID and proof of address for verification. Once your account is verified, you can deposit your funds instantly and buy Carrefour stock.

-

This depends on your strategy and objectives. While technical analysis helps investors examine a security's price movement to predict short-term price movements, fundamental analysis enables clients to explore the economic and financial factors that could affect a company over a long period. As a result, short-term traders opt for technical analysis, while long-term investors use fundamental analysis to identify opportunities.

-

It depends upon the type of broker you choose for buying Carrefour stock. Discount brokers are known to have low charges compared to full-service brokerage firms. It’s recommended to check the cost structure of your chosen broker before signing up with them to see a full breakdown of all charges.

-

Yes, the company split its stock in 1999 using a ratio of 6:1. In other words, for each share owned before the split, stockholders got six shares, but at the same value. Share split doesn't affect the overall shareholder's wealth or position in the company. However, the stock price per share falls, which makes the stock more attractive to small investors.

-

Carrefour shares are listed on Euronext Paris under the ticker CA. The stock also trades in the OTC markets under the ticker CRRFY.

-

The company dividend payments depend upon its financial performance. For instance, Carrefour reported its dividend yield as 3.11% for the first quarter of 2021.