How to buy Coloplast stocks in 2024

Coloplast is a Denmark-based multinational company that develops, manufactures, and markets healthcare products and services worldwide. The company is a major supplier of ostomy care products, including SenSura Ostomy care solutions, SenSura Mio, which provides fit individual body shapes and optimal discretion for various types of ostomies, and the Brava ostomy accessories.

Coloplast is listed on the Copenhagen Stock Exchange, and for many years, it has been a component of the OMX Copenhagen Index, which is a market-cap-weighted index of the 20 most-traded stocks on the Copenhagen Stock Exchange. This guide shows you how to buy Coloplast stock with confidence, and why you might want to, after considering certain fundamental factors.

How to Buy CLPBY Stocks in 5 Easy Steps

-

1Visit eToro through the link below and sign up by entering your details in the required fields.

-

2Provide all your personal data and fill out a basic questionnaire for informational purposes.

-

3Click 'Deposit', choose your favourite payment method and follow the instructions to fund your account.

-

4Search for your favourite stock and see the main stats. Once you're ready to invest, click on 'Trade'.

-

5Enter the amount you want to invest and configure your trade to buy the stock.

Top 3 Brokers to Invest in Coloplast

1. eToro

There are several reasons why eToro has won a spot on our list and has been heralded as having a large market share of traders. Thanks to its consistency over the years, eToro has gained the trust and loyalty of over 17 million users. You can read our full eToro review here.

Security and Privacy

Security and privacy are arguably the most important factors that determine your choice of a brokerage platform. eToro takes the privacy and security of its users very seriously. The platform adopts a thorough security procedure with fewer odds of loss or leakage of information. eToro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). The platform also adopts the two-factor authentication (2FA) method and uses SSL encryption to prevent security breaches.

Fees & Features

eToro operates a no-commission policy for deposits. However, to promote active trades on the platform, users are charged a monthly fee of £10 for the inactivity fee.

eToro offers a wide scope of offering cuts across several markets, including forex, stocks, and cryptocurrency, aiding an all-in-one trading experience.

Being a beginner-friendly platform, it offers the copy trading feature to help beginner traders leverage the advanced trading strategies used by expert traders. The platform itself also offers winning strategies to guide trade.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £5 |

| Inactivity Fee | £10 (monthly) |

Pros

- Copy trading feature

- Ease of use for both new and experienced traders

- Operation across different financial markets

- No commission fee policy

Cons

- Customer service offerings are limited.

2. Capital.com

Capital.com is a reputable brokerage that supports trading on several financial markets. The provisions of its trading terms and the quality of innovation and efficiency of operation offered through the platform's features have granted it a market share of over 5 million users. Other benefits of the platform are no commission, low overnight fees, and tight spreads. You can read our full Capital.com review here.

Security and Privacy

Accredited by financial regulatory bodies including the FCA, CySEC, ASIC, and the FSA, Capital.com adheres to industry security guidelines in protecting its users. In addition, the platform complies with PCI Data Security Standards to safeguard customers’ information.

Fees & Features

Capital.com is popular for its offer of free brokerage services. With no hidden charges, inactivity charges, or withdrawal charges, Capital.com operates a transparent fee procedure. The bulk of the fees charged by Capital.com are Spread charges.

Capital.com’s mobile trading app has an AI-powered tool that provides clients with personalized transformation through its detection algorithm. In addition, the platform has an efficient and responsive customer support team serving multilingual customers via email, phone calls, and live chat channels round the clock.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

Pros

- Responsive customer support team

- Ease of use with the MetaTrader integration

- Commission-free trading policy

Cons

- CFDs restrictions.

3. Skilling

For a broker that originated in 2016, Skilling’s journey to the top has been impressive. The platform offers services across multiple asset trades, serves advanced trading strategies to experienced traders, and offers commission-free services. You can read our full Skilling review here.

Security and Privacy

Skilling is regulated and accountable to highly reputable financial regulatory bodies like the FSA and CySEC. In addition, the platform maintains a different bank account for monies paid by traders to enhance the security of funds.

Fees & Features

Skilling, like eToro and Capital.com, offers commission-free services. The fees are charged as Spreads and vary based on share type. Another upside to trading on Skilling is flexibility and choice. The platform offers two varieties of accounts for trading CFDs on forex and metals. The first is the Standard Skilling account with bigger spreads and no commissions. In contrast, the Premium account offers reduced spreads and charges commissions on spot metal and forex CFD trades. In addition, Skilling offers features such as a demo account, mobile apps, and a trade assistant.

| Fee Type | Cost |

| Commission Fee | 0% |

| Deposit Fee | £0 |

| Withdrawal Fee | No fixed cost |

| Inactivity Fee | £0 |

Pros

- No-commission fee policy

- Responsive support team

Cons

- Technical for novice traders

- Service unavailable in countries such as U.S and Canada.

Everything You Need To Know About Coloplast

Now, we take a detailed look at Coloplast, exploring its history and business strategy, as well as how it generates revenue and how it has performed in the last few years.

Coloplast History

Coloplast’s history began in 1954 when Nurse Elise Sorensen conceived the idea of the world’s first adhesive ostomy bag to help her sister, Thora, whose colon was removed after a cancer diagnosis. Fearing that her stoma might leak, Thora was afraid to leave the house. In a quest to help her sister, Elise met with Aage Louis-Hansen, a civil engineer and plastics manufacturer, to create an adhesive ostomy bag that could help Thora lead a normal life. This was how Coloplast was born and became incorporated in 1957.

It developed thousands of bags and distributed them to hospitals, and two years later, it was exporting two-thirds of the bags. Today, the company supplies the product to more than 53 countries around the world and has production facilities in Denmark, Hungary, France, China, and the US. While its global headquarters is in Humlebæk, Denmark, its headquarters in the United States & North America is based in Minneapolis, Minnesota.

The company became public in 1983, listed on the Copenhagen Stock Exchange. It has been a component of the OMX Copenhagen Index for many years. In 2010, the company acquired Mpathy Medical Devices. In November 2016, it acquired Comfort Medical, a direct-to-consumer medical supplier based in Florida, which had earlier acquired Medical Direct Club and Liberty Medical's urological business in 2015. Coloplast acquired Hope Medical and Rocky Medical Supply in 2020 and integrated them into Comfort Medical.

What Is Coloplast’s Strategy?

Coloplast focuses on developing, marketing, and selling products and services designed to treat various diseases related to urology, wound care, continence, and ostomy. It supplies these products to hospitals and other health institutions, as well as wholesalers and retail pharmacies.

The company’s strategy focuses on driving growth through efficiency, people, and sustainability. Coloplast plans to commit up to 2% of its annual revenue to incremental innovation and commercial initiatives. Its key strategic initiatives include innovation, chronic care, interventional urology, and sustainability, while the key geographic areas are the US and China.

How Does Coloplast Make Money?

Coloplast makes money from the sale of its products and services, categorised into four business segments: ostomy care, continence care, interventional urology, and wound & skincare. The ostomy care segment offers products for people whose intestinal outlet has been rerouted through the abdominal wall, while the continence care segment provides products for people who suffer from diseases of the urinary system.

The interventional urology segment offers products for people who suffer from diseases of the kidneys, the urinary system, or the male reproductive system. The wound & skincare segment provides products for the prevention and treatment of skin problems, including chronic wounds.

In terms of geographical areas, the company groups its markets into European markets, other developed markets, and emerging markets.

How Has Coloplast Performed in Recent Years?

The Coloplast stock has performed incredibly well in recent years. In fact, it has returned more than 7 times in profits in the last decade and over 15 times profits in the last 13 years — from DKK 73 (Danish Krone) in 2008 to its all-time high of DKK 1187 in August 2021.

At the time of writing, the stock is in a pullback, trading around 989 DKK — which is about 16.7% below its all-time high.

Source: Yahoo! Finance

Where Can You Buy Coloplast Stock?

Coloplast stock is listed on the Copenhagen Stock Exchange, so you can buy it through a stockbroker that is registered with the exchange, such as major international stockbrokers that have access to most big stock exchanges around the world. Many international stockbrokers offer just the standard trading accounts, but UK-based ones and those with UK offices also offer shares ISA and SIPP accounts, which are tax-friendly.

Buying shares through a stockbroker gives you part ownership of the company but spread betting and CFD trading does not offer you ownership rights to the company. However, some CFD platforms also offer real stocks. Another way you can buy the real stock is through the share dealing arm of any major international bank that offers Coloplast DR in your country of residence.

Coloplast Fundamental Analysis

Fundamental analysis is a way to evaluate a stock by studying the company’s business to know its real value and forecast how it might perform in the future. Unlike traders who use technical analysis, this method is used by long-term investors.

When performing fundamental analysis, investors consider certain financial factors, including the non-measurable ones like corporate management and goodwill. In this guide, however, we will focus on the measurable financial metrics, such as the company’s revenue, earnings-per-share, P/E ratio, dividend yield, and cash flow.

Coloplast’s Revenue

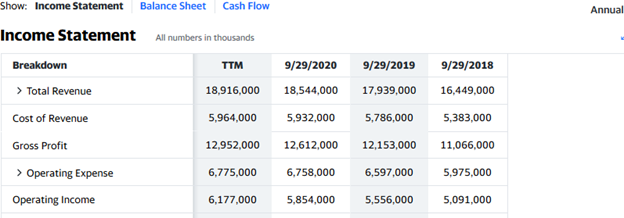

The revenue of a company is the amount of money it makes from the sales of its products or services. Revenues are reported at the top of the income statement, which you can see in the company’s quarterly or annual report and on the website of your broker or any major financial website.

Year-on-year and/or quarter-for-quarter revenue growth is good for any company’s stock performance. For its 2020 fiscal year, which ended on September 29, 2020, Coloplast reported revenue of DKK 18.54 billion, which represents a 3.4% increase from the 2019 revenue.

Source: Yahoo! Finance

Coloplast’s Earnings-per-Share

A company’s earnings are the profits left after all costs of doing business have been subtracted from the revenue for the accounting period. Since you only own some shares in the company and not the entire company, you should be more interested in earnings per share (EPS).

EPS is calculated by dividing the company’s total earnings (minus dividends paid to preferred shareholders) by the total number of outstanding shares of its common stock. However, you don’t need to calculate it yourself, as it can be found on your stockbrokers’ websites or any of the major financial websites. Coloplast’s EPS for the 2020 fiscal year is DKK 19.74.

Coloplast’s P/E Ratio

A company’s price-earnings (P/E) ratio compares its share price to the earnings-per-share. You can calculate it by dividing the current share price by the EPS, but you don’t need to since you can always find the ratio on major financial websites. Given Coloplast’s EPS of DKK 19.74 and share price as of this writing of DKK 989, its P/E ratio would be 50.1 (989/19.74).

Generally, a very high P/E ratio may mean that the stock is overvalued, while a low ratio may indicate that the stock is undervalued. But there is no specific cutoff to know a high or low P/E ratio, so investors usually compare it with those of peer stocks. Since the PEG ratio factors in the expected EPS growth in the future, it offers more information than the P/E ratio.

Coloplast’s Dividend Yield

Dividends are a portion of a company’s earnings distributed to its shareholders as a reward for investing in the stock. Companies pay dividends quarterly, semi-annually, or annually. Generally, a company’s share price rises when it declares dividends, but from the ex-dividend date, the stock starts to decline.

The dividend yield is the company’s dividend payment expressed as a percentage of its share price. For example, if a company pays out a dividend of $10 when its share price is $1000, its dividend yield would be 1%. You can see the dividend yield on your stockbroker’s website or any of the major financial websites.

Coloplast has a history of paying annual or semi-annual dividends. For the 2020 fiscal year, it paid dividends twice: DKK 187 (dividend yield: 1.82%) and DKK 18 (dividend yield: 1.77%).

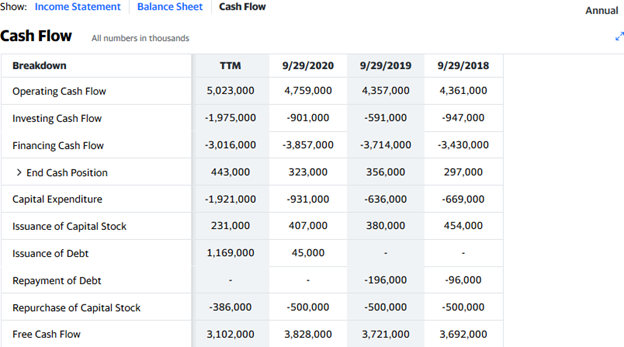

Coloplast’s Cash Flow

The cash flow statement shows a record of how cash and cash equivalents flow in and out of the business. You will see this statement beside the other financial statements in the financials section of the company’s information on a website like Yahoo Finance or even on your broker’s website.

In the cash flow statement, the most important figure is the free cash flow, as it shows the amount of cash or cash equivalents left for the company after taking care of major expenses, such as the rent, equipment, and other bills, necessary for running its business. It’s the free cash that the company can use to pay dividends. See Coloplast’s cash flow statement for the 2020 fiscal year in the picture below:

Source: Yahoo! Finance

Why Buy Coloplast Stocks?

The stock has been in a great bullish run for more than a decade, returning more than 1,500% in profits over a 13-year period. Although the momentum has waned a bit, as the stock has been in a pullback since august 2021, the stock still has more room to move. Moreover, the company management continues to innovate their products and services to improve growth — they already have a strategic growth plan for 2025.

Here are three reasons you might want to buy Coloplast stock:

The stock’s performance over the past 13 years has been incredible;

The company continues to innovate and improve its offerings;

In addition to capital gains, you can earn dividends.

Expert Tip on Buying Coloplast Stock

“ This is a great stock for momentum trading strategy, where you enter the position on a breakout. However, the stock is in a pullback as of October 2021, which presents an opportunity to buy such a growth stock on a dip. In this case, it is best to use an “at best” buy order rather than a buy limit order, which may not be triggered if the stock doesn’t fall lower. ”

5 Things to Consider Before You Buy Coloplast Stock

These are five things you must consider before you buy any stock:

1. Understand the Company

While it may be okay to invest in a company you are familiar with, that is not enough if you don’t carry out a fundamental analysis to be sure that the company is in a good financial state. Analyse the company’s business model, how it makes money, and the quality of its management and track record. This way, you know the quality of the stock you are buying so you don’t get swayed by minor market fluctuations.

2. Understand the Basics of Investing

You must understand the basics of investing before approaching the market so you don’t make avoidable mistakes. But, more importantly, learn about risk management, money management, and diversification techniques, which can help you protect your capital when investing. You may also “paper trade” with a demo account to understand how the market works and also learn how to place trade orders.

3. Carefully Choose Your Broker

Make sure you choose a broker that is regulated in your country of residence, as this can offer some form of protection. For example, your fund will be insured against brokerage insolvency.

Other factors you should also consider when choosing a broker include the asset offerings, supported order types, trading commissions, trading platforms (desktop, web, or mobile), payment methods, and customer support.

4. Decide How Much You Want to Invest

Be sure you know how much to budget for investment. Do not invest the money you need for your livelihood and never invest more than you can afford to lose. As a beginner, do not use the leverage offered by your broker — while leverage can increase potential profits, it can also amplify losses.

Also, when you have your capital, determine how to allocate funds to individual stocks. You may want to commit less than 5% of your capital to one stock and even make use of dollar-cost averaging to scale in gradually.

5. Decide on a Goal for Your Investment

Last but not the least, you must have an investment goal — what do you hope to achieve with the investment? It could be to raise money for your kid’s college or build your pension fund for retirement. Whatever the reason, it’s important to know how long you want to hold the investment and when to sell. You can sell when you (or your kid) reach a certain age, when the price gets to a particular level, or when the fundamentals are weak. You may also choose to buy and hold indefinitely and sell piece by piece whenever you need the money.

The Bottom Line on Buying Coloplast Stocks

Coloplast is a Denmark-based multinational company that manufactures and sells healthcare products and services worldwide. You may want to invest in the stock to profit from its incredible momentum, and you can do that through a broker that has access to the Copenhagen Stock Exchange where the stock is listed.

If you are ready to invest right now, sign up for a stockbroker’s share dealing account, look for Coloplast in its list of available stocks, and then hit the “buy” button to buy at a quoted price or place a limit order to buy at the maximum price you’re willing to pay.

If you’re not ready to invest right now, continue to read other guides on our website to learn more about investing. You may also “paper trade” on a demo account to learn how to place different order types in the market.

Frequently Asked Questions

-

In technical analysis, traders use historical price action, price patterns, and certain trading indicators to predict future price movement. Technical traders believe everything that can affect price movement is already manifested in the price, so by studying previous price movements, they can predict future movements. For example, a price in a trend is expected to continue in that trend.

-

It depends on the stockbroker you choose. There is a higher degree of safety if the broker is regulated, especially by the financial services authority in your country of residence because the broker would be forced to keep your fund and other clients’ funds in a separate account different from the broker’s operational funds. Also, clients’ funds may be insured against brokerage insolvency up to a certain amount. For example, in the UK, the Financial Services Compensation Scheme (FSCS) covers up to £85,000.

-

With a limit order, your trade is executed at the price you set for the order or a better price. If it’s a buy order, your trade would be executed at the pre-set price or a lower price. In the case of a sell order, your trade would be executed at the pre-set or a higher price.

-

Although using a limit order comes with many benefits (for example, it enables you to enter the market at your chosen price level or a better price), it also has some disadvantages. Your trade would not be executed immediately. In some cases, the price may not even get to your pre-set level before reversing, so your trade would not be executed at all.

-

When you practice dollar-cost averaging, you gradually scale into full position, instead of making a lump-sum investment at once and the price spiking up to get you in at a high price. This means that you divide your capital into equal portions and buy the stock at intervals. The average of your entry prices becomes your purchase price, which is better than a spiked-up entry price.

-

Since this aspect of fundamental analysis is not measurable, it is difficult to assess, but there are a few things you can use to get an idea about the capacity of the management team. Check the company’s mission statement to see the goals the management team has set for the company. Are the goals measurable? Another thing to check is the track record of each member of the team: find out whether they handled similar conditions in the past and what the results were.